Watch: Film, Music Execs on What the Future of Streaming Means for Artists

Annie Burford is dot.LA's director of events. She's an event marketing pro with over ten years of experience producing innovative corporate events, activations and summits for tech startups to Fortune 500 companies. Annie has produced over 200 programs in Los Angeles, San Francisco and New York City working most recently for a China-based investment bank heading the CEC Capital Tech & Media Summit, formally the Siemer Summit.

Streaming has dramatically changed how consumers view Hollywood and hear music as theatrical release windows shrink and social media replaces radio and television as a source of music discovery.

In our latest Strategy Session, dot.LA spoke with three talent representatives about how new platforms, models and the pandemic are shifting the ways artists reach their audiences, and what might be in store for the future.

Q&A co-founder Troy Carter has worked on providing new tools that allow musicians to gauge the future success of their songs, and to take care of back-office needs once provided by record labels. UTA Independent Film Group partners Rena Ronson and Jim Meenaghan bring new directors and filmmakers to light and help them get financing and distribution deals for their films. Each plays a role in helping artists navigate bringing their work to market.

Carter said where once record companies and radio stations, MTV and BET picked who would be played and who wouldn't, now a whole new world has opened up to artists on social media, streaming apps, as well as entire new industries such as gaming and streaming video.

What hasn't much changed, Carter said, is the way that artists are compensated. Those who own the music copyright are paid well by streaming services such as Spotify, but that money often doesn't trickle down as quickly to artists. "And that's where, you know, things need to be fixed," he said.

"If an artist is releasing music independently, they still run a label, essentially. So they should be organized with the same tools," he said. "Everybody's a label, essentially."

The question for artists has become 'how do you cut through the noise'. His goal is to give them — as well as record labels and agents — the tools to reach listeners.

"The idea is to, you know, can we make the music industry run more efficiently, and be able to allow labels and artists to make smarter and more informed decisions?"

For filmmakers, the marketplace is getting to be more difficult, especially for those who — like many independent directors — would like to see their films on the traditional big screen, Ronson and Meenaghan said. The pandemic has accelerated trends within the industry that favor streaming services, which were already able to offer larger sums for films.

"Everybody in our ecosystem still wants there to be theatrical releases," Meenaghan said. "COVID has just put a pause on theatrical releasing during the pandemic, but I don't think any of us believe that theatrical releasing is going away."

Much of that may depend on whether the pandemic has created new habits for audiences, who are now used to watching movies on demand and at home. Meenaghan said he's also heard questions about whether theater chains will consolidate or become part of large studios such as Netflix or Disney.

"That was the speculation," he said. "The studios would buy out the exhibition chains, take the real estate, presumably, and then use the theaters for captive marketing and releasing venues."

Ronson said viewers can probably expect the 'theatrical window' — the time when films are available only in theaters, before they're released online — to shrink.

"The big question is going to be 'how is the windowing going to look? Will people stay, you know, continue to go to the theaters?'," she said.

Watch the full discussion above and sign up for our newsletter to get updates on upcoming dot.LA events.

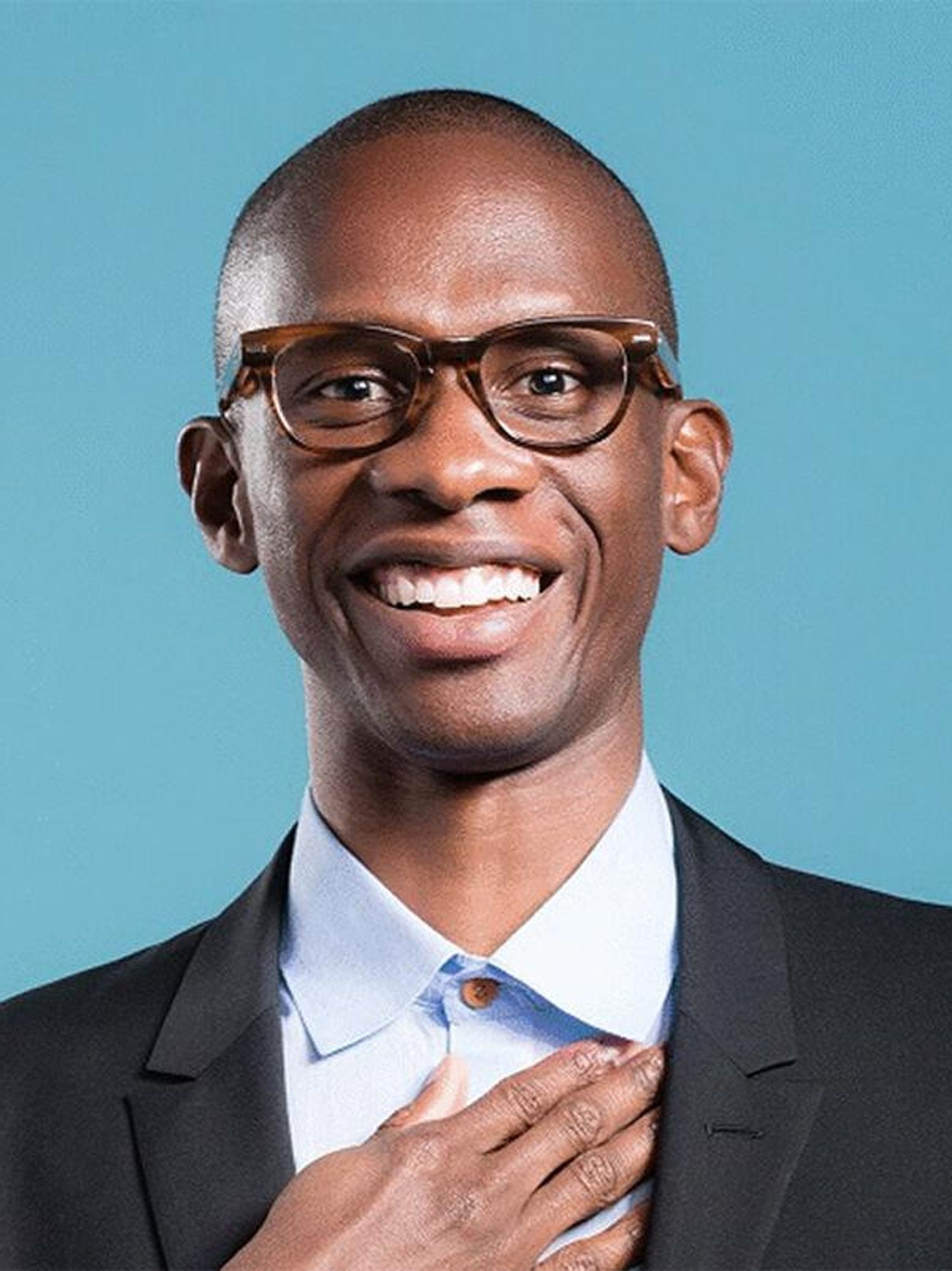

Troy Carter, Founder and CEO of Q&A

Troy Carter, Founder and CEO of Q&A

Troy Carter is the founder and CEO of Q&A, a technology and media company focused on powering the business of music through distribution, services, and data analytics. Formerly, Troy was the founder and CEO of Atom Factory, where he rose to prominence, nurturing the careers of global superstars including Lady Gaga and John Legend. He most recently served at Spotify as its global head of creator services, overseeing the company's growth strategy for artists and record labels. In 2017, Carter was also named entertainment advisor to the Prince Estate.

His interest in the intersection of technology and culture resulted in the formation of AF Square Investments. Early investments include Uber, Lyft, Dropbox, Spotify, Warby Parker, theSkimm, Blavity, Gimlet Media, Thrive Market, PlayVs, and FazeClan. Troy currently serves as a trustee for The Aspen Institute, Los Angeles County Museum of Art, and CalArts.

Jim Meenaghan, Co-Head of the Independent Film Group and Head of Business Affairs - Motion Pictures

Jim Meenaghan, Co-Head of Independent Film Group and Head of Business Affairs, Motion Pictures

As co-head of UTA Independent Film Group, Meenaghan is actively involved in structuring and negotiating film financing and distribution deals for independent films across all media. Meenaghan also oversees day-to-day business affairs operations for the motion picture departments across the agency and works closely with many of UTA's high-profile clients including Wes Anderson, Joel and Ethan Coen, Drew Goddard and Noah Baumbach.

Prior to joining UTA, Meenaghan served as executive vice president of Anschutz Film Group/Walden Media ("The Chronicles of Narnia," "Charlotte's Web," "Ray") and was in charge of all aspects of the company's business and legal affairs. Prior to that, he was senior vice president, business affairs at Icon Productions ("What Women Want," "We Were Soldiers," "Passion of the Christ").

Rena Ronson, Partner and the Co-Head of the Independent Film Group

Rena Ronson, Partner and Co-Head of the Independent Film Group

Rena Ronson is a partner and the co-head of the Independent Film Group at leading global talent and entertainment company United Talent Agency (UTA). One of the industry's pre-eminent packaging and finance executives, Ronson specializes in global film finance, distribution and marketing strategies for independent and co-financed features, helping the world's most acclaimed independent filmmakers see their work reach global audiences.

Throughout her career, Ronson has helped package, structure financing for, and sell numerous high profile films, including Oscar-winning "I, Tonya," "Room" and "Icarus," and Oscar-nominated films, "Hidden Figures," "The Big Sick," "Lady Bird," and "Call Me By Your Name," among many others. She is also known for working with acclaimed filmmakers on their directorial debuts, including Greta Gerwig's "Lady Bird," Haifaa al-Mansour's "Wadjda," Don Cheadle's "Miles Ahead," Marielle Heller's "Diary of a Teenage Girl," Jill Soloway's "Afternoon Delight," Crystal Moselle's "Skate Kitchen," and Emerald Fennell's "Promising Young Woman." Additional upcoming films include "The Father" starring Anthony Hopkins and "The Mauritanian" starring Tahar Rahim, Jodie Foster, and Benedict Cumberbatch.

Kelly O'Grady, Chief Host and Correspondent

Kelly O'Grady, Chief Host and Correspondent

Kelly O'Grady is dot.LA's chief host & correspondent. Kelly serves as dot.LA's on-air talent, and is responsible for designing and executing all video efforts. A former management consultant for McKinsey, and TV reporter for NESN, she also served on Disney's Corporate Strategy team, focusing on M&A and the company's direct-to-consumer streaming efforts. Kelly holds a bachelor's degree from Harvard College and an MBA from Harvard Business School. A Boston native, Kelly spent a year as Miss Massachusetts USA, and can be found supporting her beloved Patriots every Sunday come football season.

Sam Blake, dot.LA Entertainment Reporter

Sam Blake, dot.LA Entertainment Reporter

Sam Blake is dot.LA's entertainment reporter. Prior to joining dot.LA, he had a writing fellowship with The Economist, where he wrote primarily for the business and finance sections of the print edition. Sam previously interned at KCRW and hosted a podcast at UCLA's college radio station while completing his dual-degree MBA and Master's in Public Policy. A native of Detroit, Sam previously lived in Madison, Wisconsin and New York City. He studied history at the University of Michigan and speaks four languages.

- Are Livestream Concerts Music's Future or a Pandemic Fad? - dot.LA ›

- Q&A CEO Troy Carter on Predicting Hits and Music's Future - dot.LA ›

- Can a Niche Streaming Service Survive the Streaming Wars? - dot.LA ›

- United Talent Agency’s Gaming SPAC Lands on the Nasdaq - dot.LA ›

- UTA.VC Launches to Invest in Creator Economy, Web3 Startups - dot.LA ›

Annie Burford is dot.LA's director of events. She's an event marketing pro with over ten years of experience producing innovative corporate events, activations and summits for tech startups to Fortune 500 companies. Annie has produced over 200 programs in Los Angeles, San Francisco and New York City working most recently for a China-based investment bank heading the CEC Capital Tech & Media Summit, formally the Siemer Summit.

Image Source: Revel

Image Source: Revel