The Climate Crisis Is Changing How LA VCs Invest — Here's How

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

Many leading venture capitalists in Los Angeles say they've altered their investment strategy because of climate change, and some are responding to the crisis by pouring more cash into clean-tech startups.

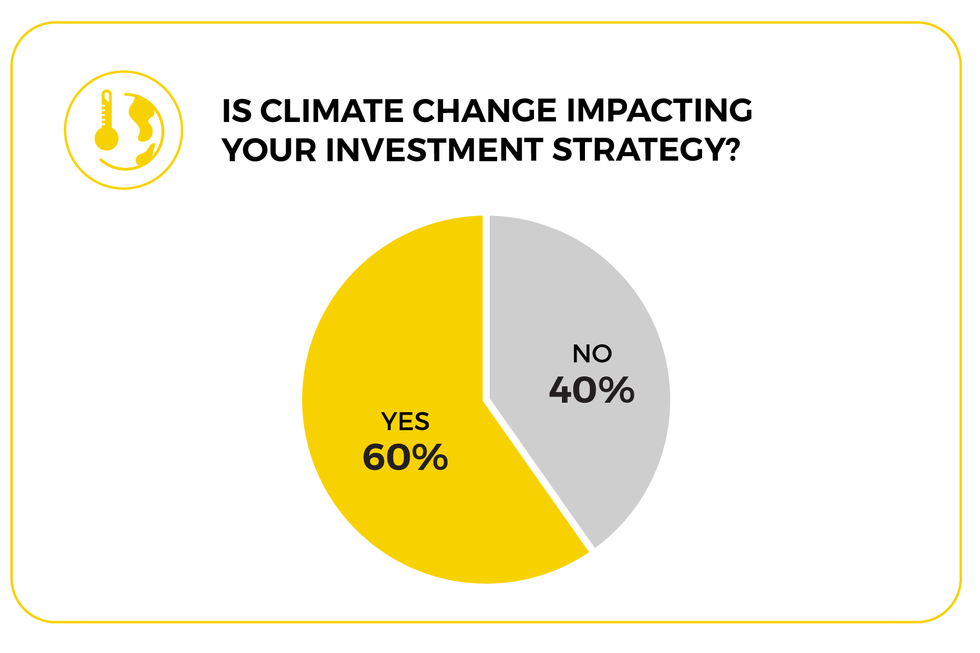

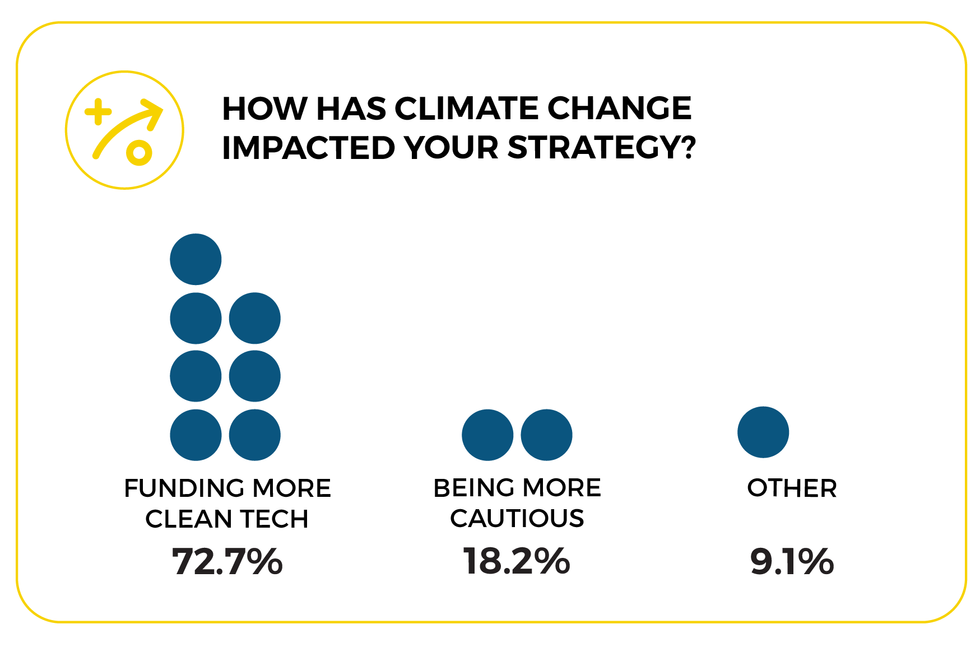

A majority, or 60%, of the more than two dozen investors polled by dot.LA said climate change is affecting how they invest.

The trend is fueling a record-setting year for the sector, as investors put billions behind Southern California-based companies such as electric vehicle maker Rivian and home energy storage firm Swell.

As of late October, Pitchbook tracked $6.4 billion in Southern California "climate tech" deals this year — nearly twice as much as in the entirety of 2020. The expansive sector, as mapped out by the data firm, includes everything from clean-energy generation and electric transportation to the development of plant-based proteins (a.k.a fake meat).

By deal size, Rivian and Faraday Future led the pack in SoCal, followed by Swell, nuclear fusion firm TAE Technologies and Bird, the scooter company that just debuted on the New York Stock Exchange.

"I've been actively investing in the space," Thomas McInerney, L.A.-based angel investor and World Wildlife Fund national council member, told dot.LA. "I think venture can change the world. Its role is crucial," he added, and pointed to several investments in startups such as carbon-removal company Charm Industrial and battery-swapping startup Ample.

Most of the venture capitalists polled said the climate crisis has prompted them to fund more clean-tech startups. One investor noted they were on the lookout for "more novel solutions to these problems."

Globally, climate investments have skyrocketed. In the third quarter of 2021 alone, Pitchbook tracked a record $30.8 billion in related deals. "The industry could give rise to 500 to 1,000 unicorns in the coming years," Pitchbook added in its recent climate report.

What Can't Tech Do?

The promising fundraising trend comes as the White House argues that yet-to-be developed tech will play a critical role in the response to the climate crisis.

"I am told by scientists that 50% of the reductions we have to make to get to net zero are going to come from technologies that we don't yet have. That's just a reality," U.S. Climate Envoy and former Senator John Kerry said in May.

But like others skeptical of Kerry's optimism, Dr. Deepak Rajagopal, professor at UCLA's Institute of the Environment and Sustainability, views the environmental problem as less a "technological one but more socio-political at an aggregate level and behavioral at an individual level."

For years experts have warned that tech alone cannot solve the crisis, and emerging tech often yields unexpected outcomes.

"My research on life cycle assessment of technologies always has shown every technology has unintended consequences and it is an ethical question whether the unintended consequences are worth it. You cannot find a solution which does not have some type of negative impacts," Rajagopal told dot.LA

Dr. Greys Sošić of the University of Southern California, whose research includes supply chain sustainability, called the rise in clean tech investments "commendable," but urged a holistic approach.

"I am wondering what is happening with the rest of their investments? Are there any trends toward reducing investments in "dirty" startups? Until this happens, we cannot make a lot of progress," said Sošić. "Just adding some clean tech startups in one's portfolio, without doing additional changes, looks more like greenwashing than a serious effort to help the environment."

Largest Southern California Clean Tech Deals by Size

Data from Pitchbook.

Lead image and infographics by Candice Navi.

- Fifth Wall Ventures Lands $116.8 Million Climate Fund - dot.LA ›

- Are We In a Tech Bubble? Majority of Top LA VCs Say 'Yes' ›

- Los Angeles Clean Tech Startup News - dot.LA ›

- Thin Line Capital's Aaron Fyke on Clean Tech Investing - dot.LA ›

- King River Capital's Megan Guy on Clean Tech Investing - dot.LA ›

- FullCycle’s Kyle Adkins On Addressing the Climate Crisis - dot.LA ›

- Top Los Angeles Clean Tech Companies of 2021 - dot.LA ›

- MCJ Collective’s Cody Simms on Climate Change Tech ›

- LA Now Gets 60% of Its Energy From Carbon-Free Sources ›

- Diablo Canyon Nuclear Power Plant Will Reman Operational - dot.LA ›

- Nuclear Fusion Ignition! We Did it! So What? - dot.LA ›

- SoCal Cleantech Still Buzzing Despite Gloomy VC Environments - dot.LA ›

- How XPRIZE Plans to Combat Wildfires Through Competition - dot.LA ›

- Captura Plants to Use Oil Barges As a Carbon Removal System - dot.LA ›

- LA Tech Week: UCLA Panelists on the Future of Climate Tech - dot.LA ›

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

Image Source: Revel

Image Source: Revel