Part Pixar, Part Roomba: Meet Moxie, the Pasadena-Built Learning Robot for Children

Rachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

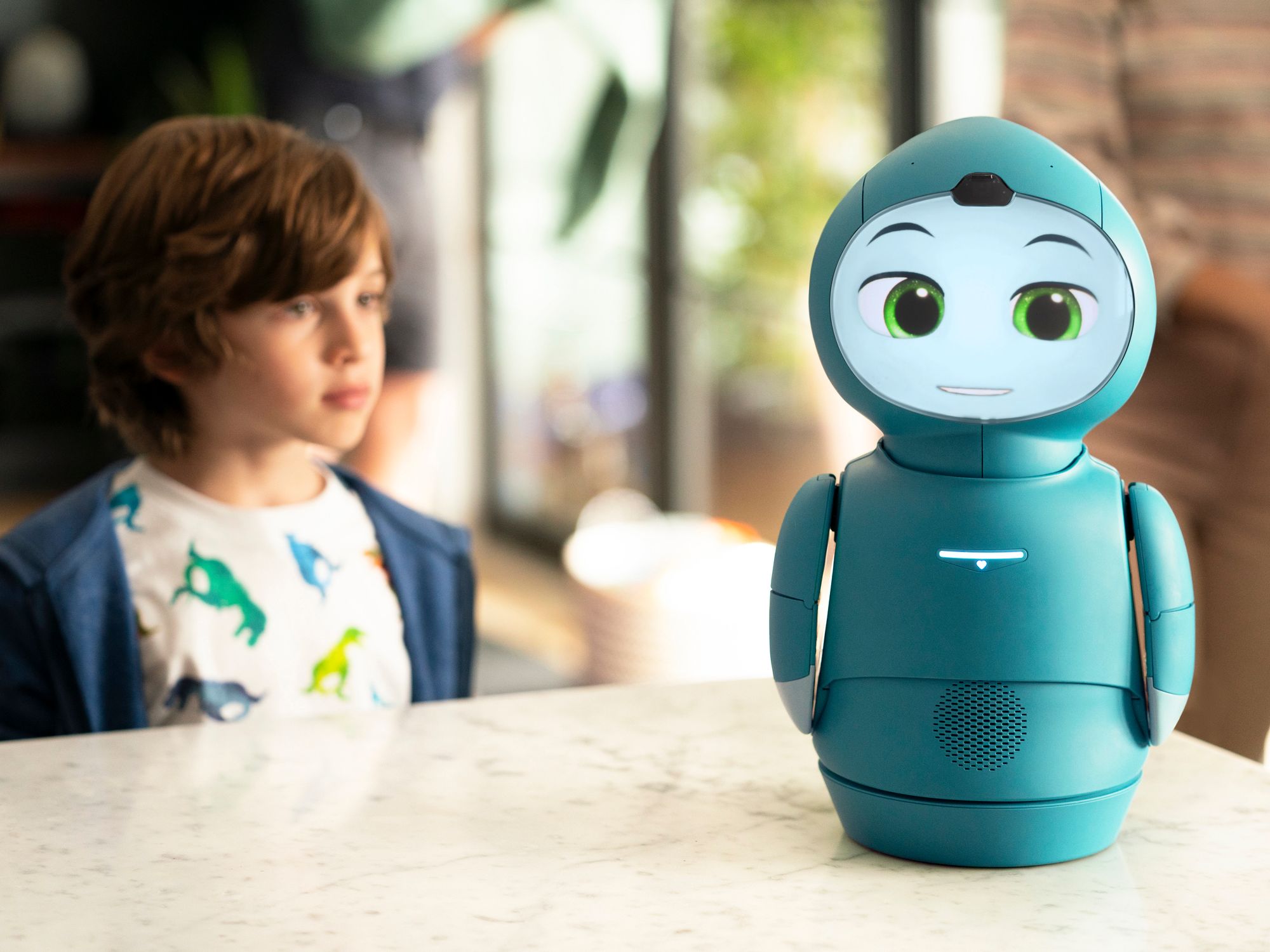

Wide-eyed and sweet, meet Moxie, the $1,500 robot for children.

The creators of the one-foot tall emotive machine want Moxie to become your child's newest companion. Geared toward autistic children, the company believes Moxie embodies "the very best of humanity" in a form of technology that fuels learning.

"What we are trying to do with this product is to amp up the benefit of social or, if you like, emotional intelligence," said its creator Paolo Pirjanian. "I want every child to be able to access this."

Over the last four years, Pirjanian, the former chief technology officer at iRobot, and his team of therapists, designers and engineers at Pasadena-based Embodied built a battery-powered creature that makes eye contact, reads facial expressions and converses with children. Pirjanian eventually hopes to develop these robots for older adults in isolation or those with Alzheimer's or dementia.

The venture-backed company has raised $34 million in the process, securing money from the funds of big name companies looking to bring artificial intelligence into our everyday lives including Amazon, Intel and Toyota.

"What Paolo has built with the team at Embodied is a new way for humans and machines to interact that involves emotional intelligence, emotional awareness and really tries to infuse humanity into a field of machines," said Jason Schoettler an investor and co-founder of Calibrate Ventures. "This is not an evolution in my view, this is a revolutionary step forward."

The robot looks less like Stars Wars C-3PO than a character out of a Pixar movie with giant green eyes, rosy cheeks and a round head. It's pre-programed lessons are intended to guide children through development with discussions about feelings and relationships- difficult areas for children with autism to navigate.

The U.S. Centers for Disease Control and Prevention estimates that one in 54 U.S. children have autism spectrum disorder, a neurodevelopmental disorder that makes interaction and communication challenging.

Researchers have become increasingly interested in the use of so-called social robots to help children with autism develop social skills.

"The robot actually does personalize its interactions for that particular child over time using machine learning," Pirjanian said. "The data that we are collecting will potentially help the healthcare community to have better insights into what techniques work for what kind of a child, because it has to be individualized for every single child."

But such personal data can become prey for hackers. Pirjanian said there's sufficient protections. The robot's information is encrypted and can only be unlocked by a parent's unique key. It's also audited by Privo for compliance with regulations governing children's online protection.

In a six-week study conducted by Embodied, their researchers found Moxie improved eye contact, self-esteem and emotional regulations for school-aged children with autism after regularly interacting with the robot. But, the company's study is of a small sample size and may not actually reflect real life outcomes.

Moxie the Robot: AI for Autistic Childrenwww.youtube.com

Other companies have sought to jump into the market.

SoftBank Robotics has bankrolled NAO, an educational robot that sells a version aimed at autistic children for about $17,000. RoboKind, a Texas-based robotics company built Milo, a $6,500 robot for autistic children that includes plus a $3,500 subscription fee. Both have versions that are aimed at the wider $3.9 billion educational robotics market that includes bots that teach STEM. But the market has yet to really take hold.

Moxie could change that and it could shake up the $20.4 billion consumer robotics market. The company opened up its site for pre-orders this week and will give customers access to a full-year subscription which includes so-called behavioral analytics and new content that includes "missions," which are often task or challenges that Moxie presents to children.

John Lee, a partner at JAZZ Ventures and investor in the company, said that he found the technology intriguing because it really improved people's lives. Parents with autistic children often struggle with diagnosis and learning how to guide their children toward resources.

"Embodied's mission is to build socially and emotionally intelligent companions that promote positive social skill building in children," he said in an email. "This might open up people's minds to how technology can be used in a positive way and, perhaps, that opens up new products that address other markets."

Maja Mataric is a pioneer in the field of social robotics who was one of Embodied's original co-founders but is no longer associated with the company. Mataric, who holds shares in the company, declined to state why the two parted ways.

But, she said one of the biggest challenges that companies like Embodied face is having the ability to test the robot fully to see if it offers true therapeutic benefits to children.

"Companies usually need to spin out a product in just a couple to three years. That's the startup money that they have. A clinical study altogether will take two to three years just to conduct. So there's no time," she said.

Still, she said robots hold promise. Earlier this year Mataric, the founding director of University of Southern California's Robotics and Autonomous Systems Center was a co-author on a study looking at the ability of robots to improve development for autistic children using the technology at home. In the study, Mataric and her team at USC left Kiwi, a social robot that gauges child interest and tailors response, at the homes of 17 autistic children for a month. The bot played space-themed math games and offered personal feedback. At the end of intervention, all improved math skills while 92% improved social skills.

Still, she said there hasn't been wide scale studies on the use of robotics in the home.

"Robots are not aspirin," she said. "What happens in the worst case scenario? What happens in the best case scenario?"

"Sometimes the best case scenario could be the worst case scenario, right? What if the robot is so effective that the child adores it, but they adore it so much that they don't play with anyone else," she said. "Those are the kinds of things, one has to worry about."

The idea for the company can be traced back to Pirjanin's own experiences. Born in Iran, the Armenian Christian fled to Denmark after the Revolution as a teenager. Feeling lost and behind in his studies, Pirjanin eventually bought a computer and became enthralled with its possibilities after seeing a documentary on Pixar Animation Studios.

"I was fascinated. 'How can a computer this simple create something so lifelike?'" he said to himself. "It drew me into technology. I followed that curiosity."

He got a PhD there and moved to California to help develop robots for exploration on Mars at NASA's Jet Propulsion Laboratory. From there, he went on to work with Idealab founder Bill Gross where he eventually helped develop a visual navigation technology that was the foundation of his company Evolution Robotics.

That company was bought in 2012 by iRobot, maker of the self-driven Roomba vacuum, for $74 million and he became the company's chief technology officer. iRobot, which last year recorded selling its 30 millionth robot, is arguably one of the few companies that has successfully mass marketed robots, a useful background for somebody attempting to convince parents that their children need robots to develop emotional skills.

Pirjanian said he left the company because he felt he hadn't been doing the work that had originally sparked his imagination. Embodied, he said, was a way to bring all the skills he had learned as a roboticist from machine learning to natural language processing to life. At first he eyed building a robot for the elderly, but learned about the benefits it was having on children.

Children who have social emotional and cognitive challenges were seeing benefits from a robot companion that improved their chances in society, he said.

"I knew very well this was a complete moonshot," Pirjanian said. "It's been a challenge but we are finally ready to launch."

Do you have a story that needs to be told? My DMs are open on Twitter @racheluranga. You can also email me.

- artificial-intelligence - dot.LA ›

- Moxie the Robot Helps Children With Autism Through AI - dot.LA ›

- Moxie, Embedded's New Robot, Aims To Teach Kids Emotions - dot.LA ›

- Moxie, Embedded's New Robot, Aims To Teach Kids Emotions - dot.LA ›

- dot.LA Strategy Session: The Rise of Robotics - dot.LA ›

- How Curative Inc. Plans to Test the U.S. for Coronavirus - dot.LA ›

- How Curative Inc. Plans to Test the U.S. for Coronavirus - dot.LA ›

- Behind Her Empire Podcast: AI Trailblazer Rana el Kaliouby On Defying Expectations ›

- OK Play Says It's a Kids App Parents Won't Feel Guilty About - dot.LA ›

- Capsida Biotherapeutics Raises $140M for Its Gene Therapies - dot.LA ›

- Capsida Biotherapeutics Raises $140M for Its Gene Therapies - dot.LA ›

- Auticon Raises $4M to Grow Tech Jobs for Autistic Adults - dot.LA ›

- Graze Unveils an Autonomous Electric Lawn Mower - dot.LA ›

- How the CHLA Is Using Robots To Monitor Babies - dot.LA ›

Rachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

Image Source: Skyryse

Image Source: Skyryse