Santa Monica's Tapcart is Surging As Retail Stores Scramble to Mobile

Rachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

Every month 10 million shoppers scroll through Tapcart, a little-known software that translates the $95 billion ecommerce giant Shopify's platform to mobile.

The marketing software has seen shopping activity jump 50% over the past 90 days as the pandemic wallops traditional retailers. And chief executive Eric Netsch is aiming to process $1 billion in sales over the next year. In May alone, the company is expected to hit $71 million of online retail sales through its mobile app.

But the Santa Monica-based company's biggest get may have happened a few days before California Gov. Gavin Newsom's stay-at-home order came down. Founders Netsch and Sina Mobasser had been pitching venture capitalist for a Series A round when they scored with SignalFire, which committed to lead the $10 million round. The nation's economy was about to go into free-fall.

"We didn't know companies were going to have a hard time getting funded, we didn't know that the economy was going to collapse. We didn't know about the stay-at-home order at the time," he said. "The timing was impeccable and we're happy that we found the right partner."

Flush with funds, Tapcart is planning a marketing and expansion blitz in an effort to grow the business software company as it looks to grow its offerings. Since it was founded in 2017, Tapcart has raised a total of $15 million.

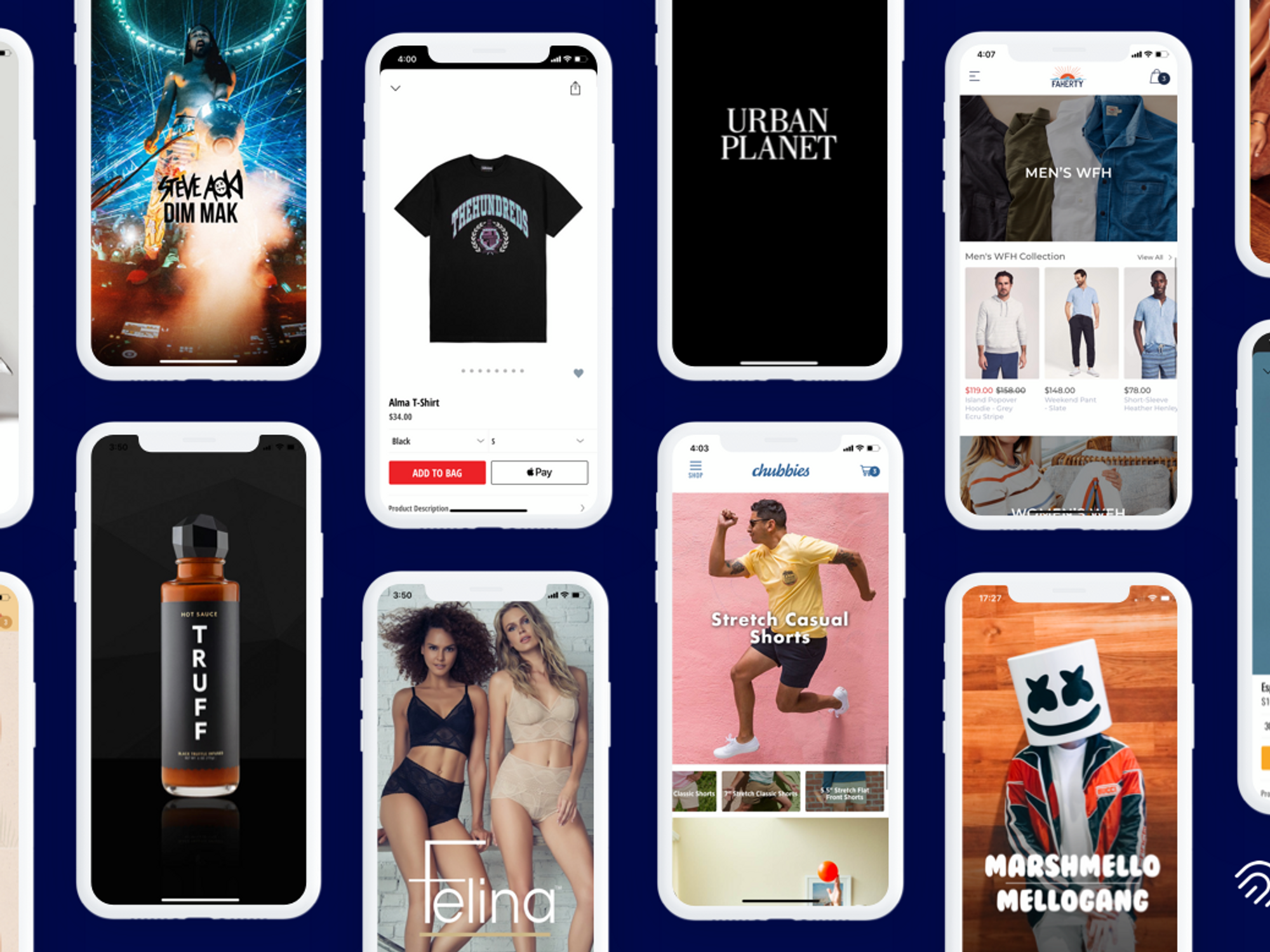

Like a lot of ecommerce products, Tapcart — whose clients include fast-fashion seller Fashion Nova, Chubbies and other brands — has benefited from the pivot to online shopping. The largest growth has been among smaller and medium size businesses that haven't had to deal with some of tough logistical issues facing larger companies. It's also seen a jump in food and beverage along with retailers selling sports apparel and supplements, as people were forced to remake their workout routines at home.

"The behavior will be permanent because people are realizing they can get everything on their mobile app on their phone," he said.

In April, consumer spending nosedived 16%, but online sellers — which make up a smaller share of the market — saw sales increase 8.4%.

The surge in store closings has toppled already ailing retail giants like Pier1 Imports and JCPenny, and walloped other retailers facing mounting debts.

"We have traditional retailers who have closed a lot of their retail stores and shifted all of their traffic onto their apps in their website," he said.

Among them is New Jersey-based DressBarn which recently launched a mobile app as it, like other retailers, go into survival mode.

Until now, Tapcart has relied solely on Shopify, a popular sales platform that has made it easier for small and mid-size businesses to create online stores, to distribute its product.

Tapcart, which sells monthly subscriptions ranging from $99 to $999, has only about 1,000 paying customers in a sea of over one million merchants using Canada-based Shopify's platform. But it plans to offer a decoupled version of its mobile applications to customers. Its pitch is that it helps with customer retention, an expensive proposition in the online world.

"We have a lot of room to grow," he said. "Part of our expansion plan is that we want to start working with Fortune 1000 brands like the JC Penny's and Nordstroms to start using our technology in their own custom built solution."

Chris Farmer, the managing director of SignalFire, said the company had "massive opportunity to also help retailers get back on their feet with mobile and offline commerce."

- As Retail Struggles, Mobile E-Commerce Platform Tapcart Soars ›

- COVID-19 crisis sparks 'inflection point' for online grocery — and ... ›

- Ecommerce Startups Are the Focus of Our Next Pitch Showcase ... ›

- How Ecommerce Will Grow After the Pandemic - dot.LA ›

- Tapcart Raises $50 Million to Help Brands Expand on Mobile - dot.LA ›

Rachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

Image Source: Tinder

Image Source: Tinder Image Source: Apple

Image Source: Apple