Fintech startup Superjoi, which lets fans fund creators’ content projects, has raised $2.5 million in pre-seed funding.

Superjoi raised the funding from fintech-focused investors including Ascension Ventures, QED Investors, Systema VC, Tomahawk and Modern Venture Partners. The round also included participation from senior leadership at e-commerce platform Shopify, fintech firm Revolut and Los Angeles-based live-in accelerator Launch House.

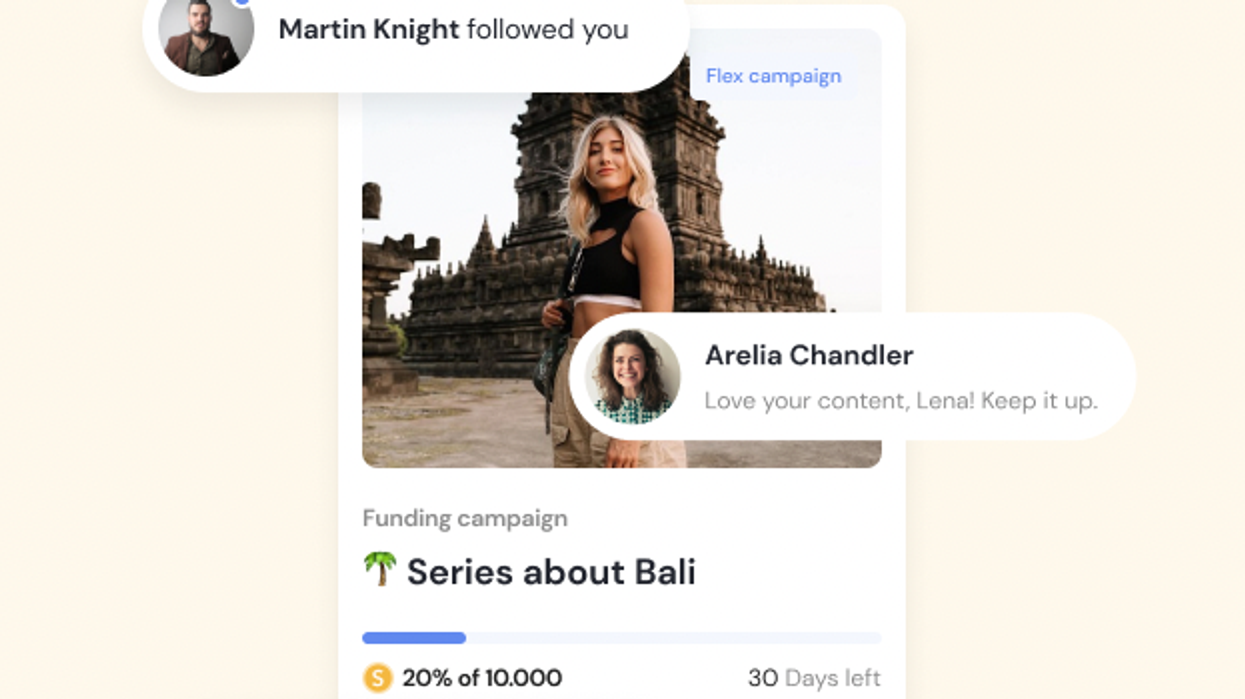

Based in West Hollywood, Superjoi’s platform allows creators to run Kickstarter-like campaigns to raise capital for projects, while giving fans the chance to suggest ideas for new content. Creators can also reward fans who chip in by giving them event tickets, merchandise or a personal video call. Later this year, Superjoi plans to help fans reap financial rewards, too—such as a share of advertising revenues generated from projects that they backed.

Major online platforms like Facebook and YouTube have increasingly monetized the relationship between creators and fans, targeting users with ads and sharing some of the revenues with creators. But Superjoi’s founders contend that fans have been completely cut out of the equation despite driving creators’ successes. In September, the startup began building a platform that would give fans a share of the financial upside, co-founder and CEO Chris Knight told dot.LA.

“Superjoi, as we position it, is liquidity with love,” Knight said. “The reason why we call it that is, for somebody who's creative, there's no better funding source for their creativity than the people who love them—and that’s their fans.”

Knight learned a lot about what he calls “superfans” after helping to build Fantom, a fan-focused smartwatch launched with England’s Manchester City Football Club. The Premier League team consults its fans on decisions relating to its stadium and sponsorships, he noted. “I see huge opportunities in the future for creators to actually have a deeper engagement with their audience and actually mobilize their audience to a new level,” Knight said.

Fans will initially fund projects on Superjoi by buying “supercoins,” an in-platform currency that is worth $1 each. While supercoins are not technically crypto tokens at this stage, the startup envisions letting fans invest in creators, earn a financial return and receive ownership in their content based on tokenization. Superjoi collects a 10% cut of a creator’s fundraising goal.

The platform plans to launch in mid-May with about 25 U.S.-based creators with larger audiences, and will onboard more creators on a waitlisted basis, Knight said. A full public launch is expected later this summer.

Superjoi, which has 14 employees, plans to use the new funds on growing its team, acquiring creators and marketing the platform.

- JibJab CEO Paul Hanges on How to Create Viral Joy - dot.LA ›

- Prism Lands $26M, Wellth Stacks Up $20 - dot.LA ›

- How House of Pitch is Helping Connect VC's and Journalists - dot.LA ›