LA's Most Impressive Founders, According to the City's VCs

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Los Angeles is home to thousands of founders working day and often night to create a startup that's the next breakout hit.

Who are the most impressive L.A. founders? To find out, we asked our cohort of dozens of L.A.'s to VCs top weigh in.

In somewhat of a surprise, given he has less high-profile than many other founders, Andrew Peterson, co-founder of the cybersecurity platform Signal Sciences, topped the list. Last year, he sold his company for $825 million to Fastly, which he joined during the transaction. He now leads the cloud computing giant's security practice.

Unfortunately, the list is lacking in diversity and does not include any females, which is emblematic of problems that continue to plague the industry.

A mere 1% of venture-backed companies are led by Black entrepreneurs. Last year, only a quarter of venture dollars nationwide went to companies with a female founder and L.A. fares especially poorly, ranking fourth for capital invested with female teams.

The complete list is below, in alphabetical order, except for Peterson, who received the most votes. The others were all tied.

Andrew Peterson

Andrew Peterson is the co-founder and former chief executive of Signal Sciences, a web application security platform that he founded in 2014 and was acquired in 2020 by Fastly in a $775 million deal. Signal Sciences protects web applications from attacks and data breaches for clients like Duo Security, Under Armor and DoorDash.

Prior to starting Signal Sciences, Peterson worked at Etsy, helping the online marketplace with international growth as a group project manager. Etsy reportedly became one of Signal Sciences's first customers. Peterson has also served stints as health information management officer at the Clinton Foundation and as a senior product specialist at Google.

Ara Mahdessian

Ara Mahdessian is the co-founder of ServiceTitan, a SaaS product for managing a home services business.

The inspiration for ServiceTitan, Mahdessian's first company, came from watching his parents start their own businesses in building and plumbing, only to struggle with the logistics behind keeping them running, he told Inc in 2019. Mahdessian and his co-founder Vahe Kuzoyan met while in college, and worked on several consulting projects before starting ServiceTitan, in hopes of aiding small business owners like their parents.

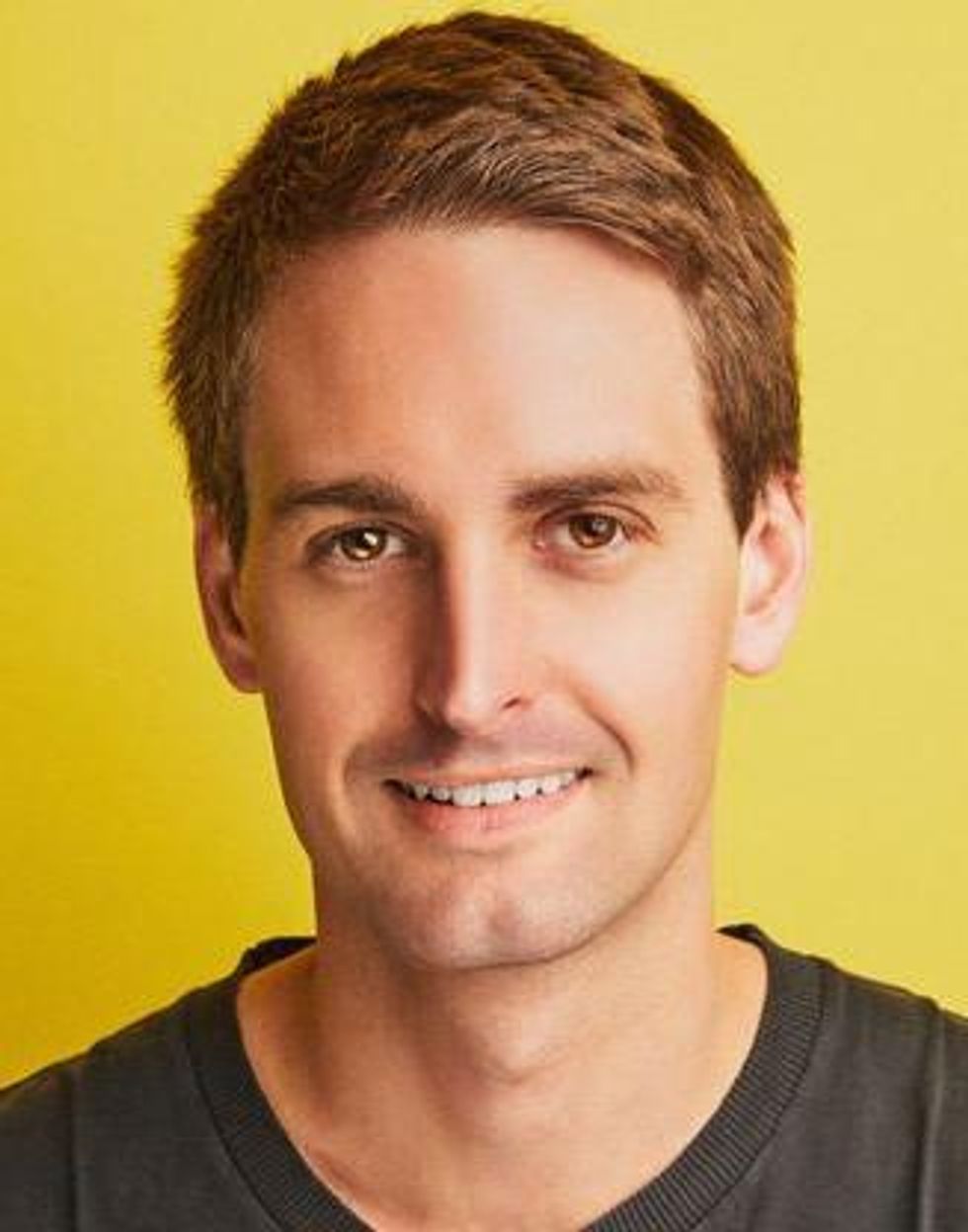

Evan Spiegel

Evan Spiegel is the co-founder and chief executive officer of Snap Inc., the Venice-based company known for its app Snapchat. He's also one of the youngest billionaires in the world, launching Snapchat while still an undergraduate at Stanford.

SnapChat, the company's app, has recently been taking on rival TikTok with a new feature and a program meant to attract creators to its platform. And it is been at the center of a larger national debate on the power of big tech.

Spencer Rascoff

Spencer Rascoff is the founder of several companies, including dot.LA. He started his career as an investment banker at Goldman Sachs, later leaving to co-found travel website Hotwire. After serving as vice president of lodging at Expedia, he went on to found Zillow, an online real estate marketplace that went public in 2011.

Rascoff's most recent project is Pacaso, a marketplace for buying, selling and co-owning a second home.

Tim Ellis

Tim Ellis is the co-founder and chief executive of Relativity Space, an autonomous rocket factory and launch services leader for satellite constellations. He is the youngest member on the National Space Council Users Advisory Group and serves on the World Economic Forum as a "technology pioneer."

Before founding Relativity Space, Ellis studied aerospace engineering at the University of Southern California and interned at Masten Space Systems and Blue Origin, where he worked after graduation. He was a propulsion engineer and brought metal 3D printing in-house to the company.

Travis Schneider

Travis Schneider is the co-founder and co-chief executive of PatientPop, a practice growth platform for healthcare providers. He founded the company with Luke Kervin in 2014.

The two have founded three companies together, including ShopNation, a fashion shopping engine that was later acquired by the Meredith Commerce Network.

Luke Kervin

Luke Kervin is the other co-founder and co-chief of PatientPop. He is a serial entrepreneur — his first venture was Starbrand Media, which was acquired by Popsugar in May 2008.

Kervin and Schneider then founded ShopNation, and when it was acquired in 2012, Kervin served as the general manager and vice president at the Meredith Commerce Network for a few years before leaving to found PatientPop.

Kervin had the idea for PatientPop when he and his wife were expecting their first child, he told VoyageLA. They were frustrated with how the healthcare system wasn't focused on the consumers it was meant to serve. So in 2014, he and Schneider created PatientPop.

- The Angelenos in Pharrell Williams and Jay-Z's 'Entrepreneur' - dot.LA ›

- Entrepreneur of the Year: Shivani Siroya - dot.LA ›

- Los Angeles' Tech and Startup Scene is Growing. - dot.LA ›

- Former Zillow CEO Spenser Rascoff Advises LA tech week - dot.LA ›

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Blackbird

Image Source: Blackbird