Event: Verizon 5G Is 'Changing the Game' for the Tech Industry

By now, everyone has heard about 5G but Verizon says the wireless network technology goes far beyond faster web surfing and streaming.

Tech industry leaders and venture capitalists gathered for a final dot.LA 2021 Summer Series event at the Verizon 5G Labs in Playa Vista on Thursday to get a first-hand look at the technological promises of the new generation of wireless. The event was sponsored by Compass real estate agents Ari Afshar of Voyage Real Estate, Lauren Forbes and Jen Winston.

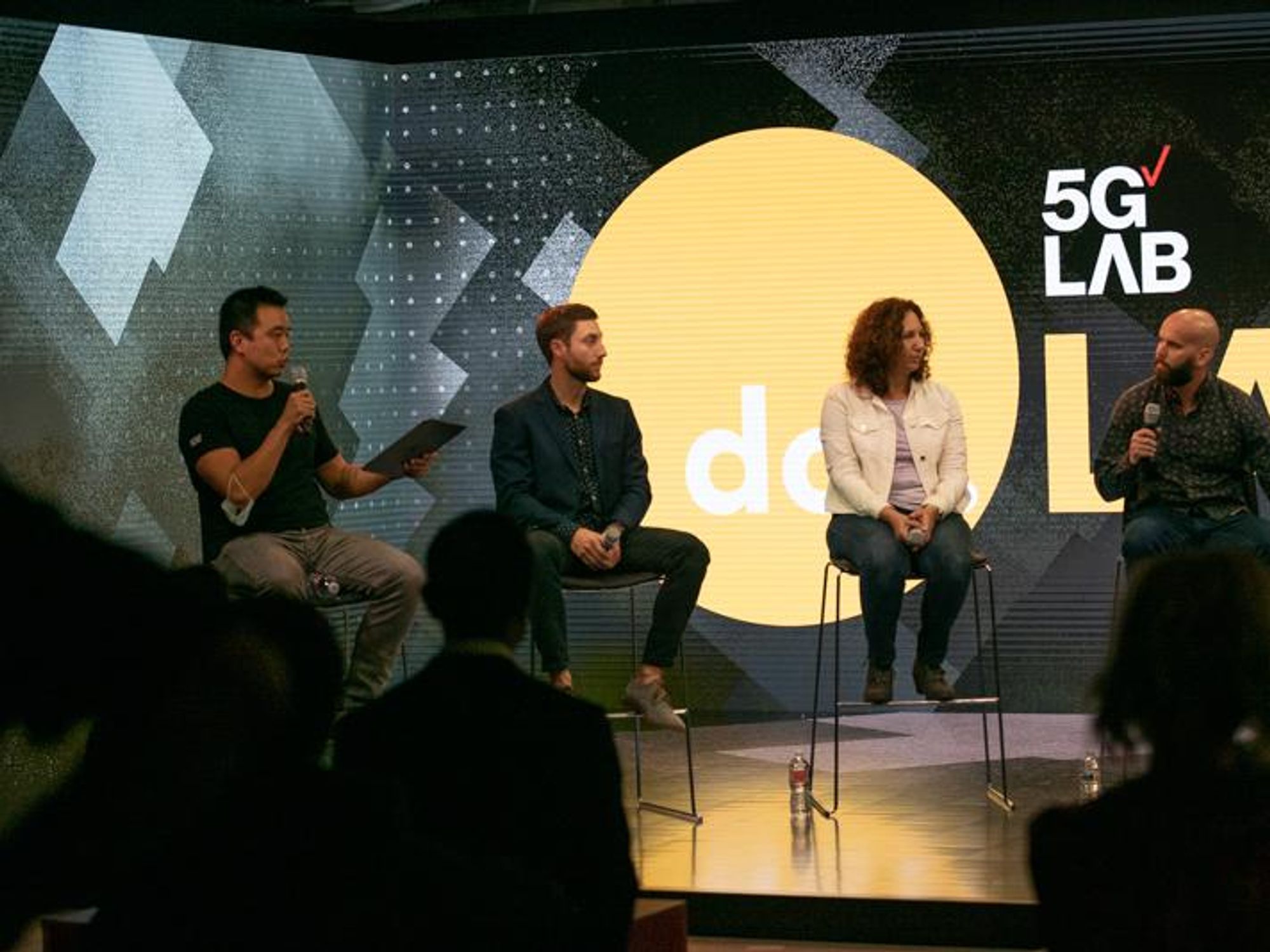

Luke Wang, 5G Labs lead for Verizon, moderated a speaker panel featuring Pam Allison, head of 5G Labs strategy and partnerships, Ian Nelson, senior manager of business development of Ryot, and Corey Laplante, chief operating officer of Mixhalo.

Verizon 5G Labs co-hosted the event with dot.LA.

"L.A. is at the very intersection of tech media entertainment, and 5G is completely changing the game for all kinds of use cases across the super industry," said Sam Adams, CEO of dot.LA, in his introductory remarks at the event.

Nelson, who works on technology that relies on fast wireless speeds, said 5G has been greatly beneficial in his line of work.

"I tend to think about 5G as an accelerant to degree, right? It does enable quite a bit of features and ways to interact with content and products, but it really does benefit when you tie it to other technologies," said Nelson.

Allison talked about the accessibility of 5G for people with newer phones.

"The first is nationwide 5G and that you know, if you have a 5G phone, it means you get 5G almost anywhere that you can typically get 4G," said Allison.

Laplante lauded Verizon for what the company has been doing outside of being just a mobile carrier and entering the entertainment space.

"Look at the NFL deal that they just struck two or three weeks ago. It's a 10-year deal. They're in all these stadiums, the opportunity and scale, there's like nothing we could achieve with another mobile carrier," said Laplante.

Image Source: Revel

Image Source: Revel