This Startup Is Using NFTs to Give Black Dance Artists Credit for Their Creations

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

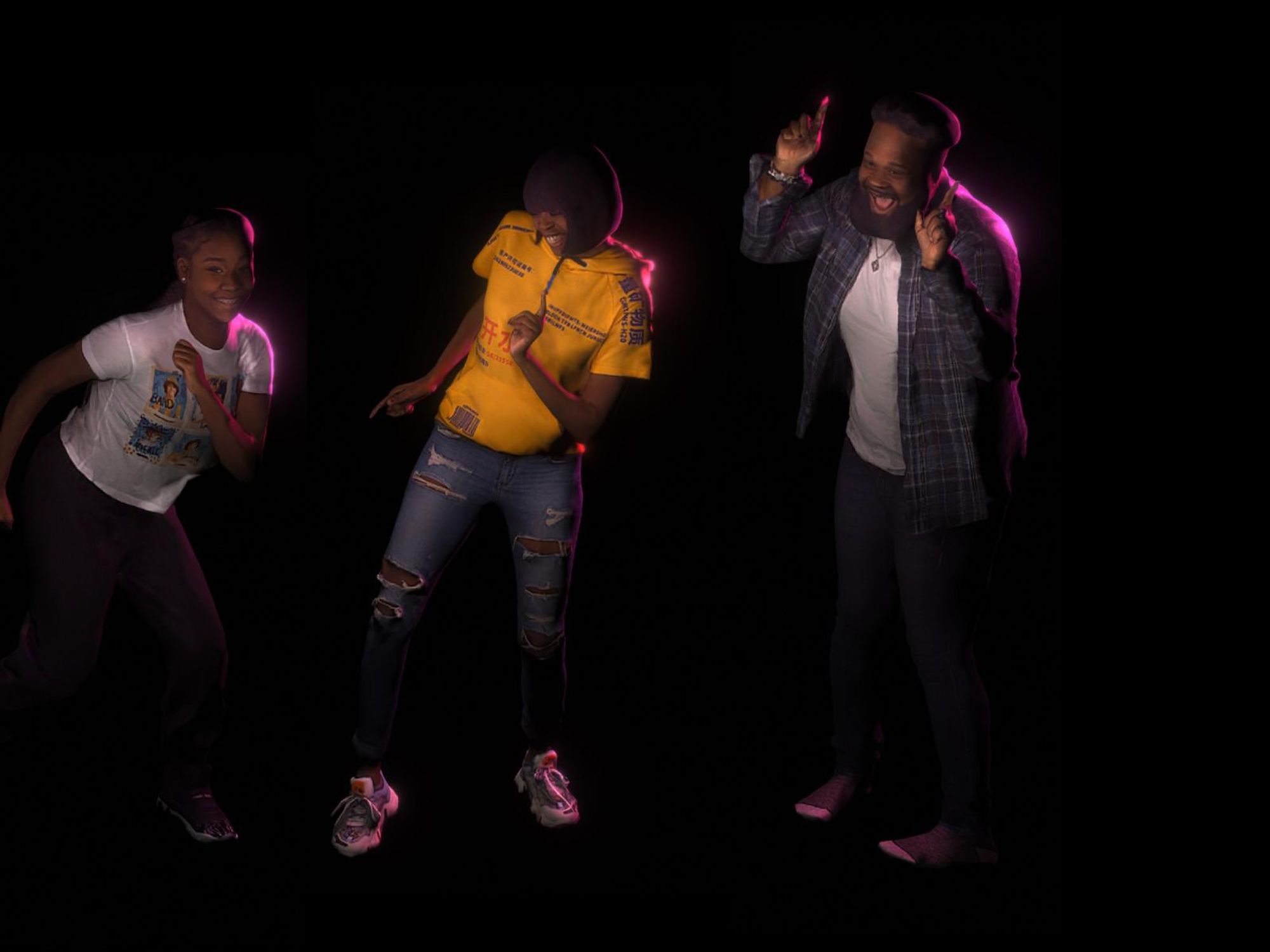

Three Black creators are offering NFTs tied to holograms of themselves performing the iconic dance moves they pioneered that spread through social media and sparked discussion over how to compensate digital performers.

The "Renegade" took social media by storm in 2020. TikTok's biggest stars and millions of others uploaded videos of themselves performing the dance. But the routine's then-14-year-old creator, Jalaiah Harmon, told the New York Times she didn't get credit for the dance nor any income that could have come with it. Later her viral dance became a Fortnite emote that players could buy for their characters to perform, but any licensing arrangement made with Harmon was not made public.

As of today, Harmon's dance, along with Cookie Kawaii's "Throw it Back" and Blanco Brown's "The Git Up," have collectively been viewed on TikTok over 10 billion times, but monetizing their creations has been challenging.

Working with La Cañada-based AR production house Jadu, and their Culver City-based studio partner Metastage, the three creators have each made a hologram of themselves performing their dances. These will be sold at auction as NFTs on Juneteenth on NFT marketplace OpenSea,.

One NFT has been minted for each of the three holograms. The creators will receive a majority percentage of the auction sale, along with a percentage of any secondary sales. Jadu will receive minority percentages.

Black creators not getting properly compensated has sparked controversy over how to properly give credit in the fragmented, copycat world of user-generated media. NFTs present one way forward, and doing so was a big motive for Jadu.

NFTs allow creators to retain an ongoing stake in a digital asset. Smart contracts can automatically reroute a percentage of any secondary sale to a creator's account.

"We were really looking to find artists that have been either overlooked or have not received the appropriate cultural and financial compensation," said Jadu chief operating officer Jake Sally. "Everyone should know who Jalaiah, Blanco Brown, and Cookie Kawaii are."

The three holograms will be available for use on the Jadu app, which allows users to interact with holographic celebrities and create free videos that can be shared across social media. Owners of the three NFTs will be displayed on the app.

Sally said enabling people to use these holograms should help the value of their associated NFTs increase over time – value that the creators can capture through their perpetual stake in any secondary sales.

- BallerTV Launches NFTs for High School Athletes - dot.LA ›

- Brud Founder Trevor McFedries on Lil Miquela and Artist NFTs - dot ... ›

- Mythical Games Hopes to Pioneer Blockchain Gaming - dot.LA ›

- NFTs Could Change the Game for Artists and Creators - dot.LA ›

- More Than $1.5K for 52 Seconds: How Young Influencers Are ... ›

- Jadu Aims to Kick Off a New Era of Artist-Fan Engagement ›

- Most Shittiest NFT Aims to Raise Funds for Autism Research - dot.LA ›

- Dibbs Raises $13M for Their Fractional NFT Marketplace - dot.LA ›

- How ARHT Media's Holograms Work - dot.LA ›

- TikTok Stars Are Earning More Than Many S&P 500 CEOs - dot.LA ›

- Are NFTs a Good Investment? We Asked Local VCs - dot.LA ›

- Folio Wants to Streamline the World of Digital Art - dot.LA ›

- TikTok Launches Animated Avatars - dot.LA ›

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

Image Source: Skyryse

Image Source: Skyryse