Get in the KNOW

on LA Startups & Tech

X

Image courtesy of Lime

Lime Is Bringing Its New, More Eco-Friendly Scooters to LA

Maylin Tu

Maylin Tu is a freelance writer who lives in L.A. She writes about scooters, bikes and micro-mobility. Find her hovering by the cheese at your next local tech mixer.

The first Lime electric scooters hit the streets of Los Angeles in June 2018, some nine months after rival e-scooter startup Bird first took flight in Santa Monica. In the years since, Lime has battled Bird and a wave of other micromobility operators for market dominance—seeking to transform the urban transportation landscape while facing losses, regulatory backlash and even destructive anti-scooter sentiment.

Now, Lime is upping the ante in the great e-scooter wars once again by bringing its latest e-scooter model—the Lime Gen4—to the streets of Los Angeles, with the goal of replacing all 7,000-plus vehicles in its L.A. fleet by this summer. Lime has already rolled out the Gen4 globally in markets from Denver to London.

The San Francisco-based company told dot.LA that it designed the Gen4 to be more eco- and user-friendly—with a swappable battery, bigger wheels, a lower center of gravity and swept-back handlebars akin to a bicycle.

“As of [the week of April 17], you'll start to see them in Hollywood, West Hollywood and in some of the Hills area,” said Alyssa Edelen, Lime’s general manager for the southwest region.

The Next Generation

Originally a bike-sharing company, Lime launched its e-scooter fleet in 2017 with the Segway Ninebot, a popular choice for operators at the time. However, early e-scooters were not built for the harsh conditions of shared use. One 2018 study by Quartz of Bird scooters in Louisville, Ky., found that the vehicles lasted less than 29 days on average before breaking down or falling prey to vandalism or theft.

The next Lime generation to hit L.A. streets in 2018 was the Gen2.5, a hardier model built to last 18-to-24 months. Then last year, the company swapped out the Gen2.5 for Okai scooters inherited through its 2020 acquisition of Uber’s micromobility business, Jump. Instead of recycling the Jump scooters, Lime wanted to deploy them in select markets.

Now, Lime says that its latest model—designed and manufactured completely in-house—is built to last for up to five years. In comparison, competitor Bird’s latest model, the Bird Three, has an estimated shelf life of two years.

Lime didn’t share details on how much the company invested in R&D for the Gen4. The scooter was initially developed by Jump, with Lime continuing the work after acquiring the former Uber subsidiary.

How Eco-Friendly Are E-Scooters?

The lifespan of an e-scooter doesn’t only affect a company’s bottom line—it also has a significant impact on sustainability.

In a 2019 study conducted at North Carolina State University, researchers calculated the life-cycle emissions of shared e-scooters. The study found that although riding one was better for the environment than driving a car, it was not as green as riding an electric bike or even taking a gasoline-powered bus.

And that’s not just because of the energy required to charge e-scooters, which represented only 5% of their total emissions. According to the study, most of the greenhouse gas emissions from shared micromobility comes from manufacturing a device’s parts, as well as the logistics of collecting and charging the vehicles. In other words: the longer a scooter’s lifespan and the easier it is to charge it, the lower its carbon footprint will be

To address the environmental impact of charging scooters and returning them to the streets, Lime and other micromobility operators are now embracing models that feature swappable batteries. According to Lime, the Gen4’s swappable battery makes the charging process more streamlined and energy-efficient; vehicles no longer need to be transported to a warehouse for charging. Lime’s new Gen4 e-bike model is also using the same swappable battery.

While some competitors, like Bird and Superpedestrian, have called into question the environmental benefits of swappable batteries, the industry at large seems to be trending in their favor. Veo CEO Candice Xie told dot.LA earlier this year that the micromobility firm is using its Cosmo seated scooter to tow trailers filled with batteries that are swapped into its vehicles in Santa Monica.

“We don't need to collect all the devices back to the warehouse to charge and then roll [them] out again,” Xie said. “All we need to do is swap the battery on site, and that increases our efficiency and reduces our operations by 40-to-50% compared to other vendors.”

West Hollywood-based Wheels is testing out a similar strategy in Austin, Texas, where it’s using its own electric seated scooter to swap batteries and service its vehicles, with plans to implement this method in L.A. Meanwhile, a Lyft spokesperson said many of the company’s maintenance teams are using electric golf carts and e-cargo tricycles to swap batteries on its own micromobility vehicles.

Lime has yet to use electric vehicles in L.A. for charging and maintenance operations, but said it’s in the process of acquiring and implementing them.

The Adoption Issue

Lime’s more eco-friendly approach comes as Angelenos are increasingly turning to shared transit options to avoid record-high gas prices. As of mid-April, Lime had seen its ridership in L.A. grow “about 35%” in the preceding two-to-three weeks, Edelen said. The company’s Lime Access equity program, which provides discounted rides to underserved Angelenos, logged 12,000 rides in March, the highest number since its inception.

But despite the lofty environmental goals of micromobility companies—Lime is aiming to have a zero-emissions operations fleet by 2030—some experts note that their impact on the greater transportation sector is limited.

In a study released in February, researchers at Carnegie Mellon University examined the environmental impact of replacing short car trips with micromobility vehicles during peak travel hours. For context, in the U.S., almost 50% of car rides are three miles or less—a sweet spot for bicycles, e-bikes and scooters. Using the city of Seattle as a model and factoring in weather conditions, trip type and user demographics, the study found that only 18% of short car trips could be replaced, leading to just a 2% reduction in overall emissions.

Carnegie Mellon assistant professor Corey Harper, a co-author of the study, noted that most carbon emissions come from long-distance travel. “We have a lot more work to do if you really want to reduce emissions in our transportation sector,” Harper told dot.LA. “Because even if we were able to fulfill every single trip that could be done by bike or scooter, 98% of emissions would still be there.”

The study suggests that e-scooters have the most impact when combined with public transit as a first- and last-mile option. Choosing to take an e-scooter instead of driving a car has other benefits as well, such as reducing traffic congestion. Ultimately, Harper believes that for people to choose more eco-friendly transportation options, companies and cities have to make those modes more appealing to riders.

Lime is gambling that its redesigned e-scooter—with its bigger wheels, swept-back handlebars and improved suspension—will attract even more riders, and not just because it’s the more eco-friendly option.

In a promising sign, Edelen said that L.A. users are riding the Gen4 longer and rating it higher compared to the previous model.

“Ridership is up compared to last year and previous years,” she noted. “Comparing this model to our Okai, we are seeing close to double the utilization.”

From Your Site Articles

- Can WeHo-Based Wheels Get More Underserved Angelenos to ... ›

- Move Slow and Fix Things: E-Scooter Startup Superpedestrian ... ›

- Here's How Bird Laid Off 406 People in Two Minutes - dot.LA ›

- Lime Piloting New Motorbike - dot.LA ›

- Veo Expands Into the City of LA - dot.LA ›

- LA’s E-Scooter Winners Now Clear as Cities Ratchet Up Regulations - dot.LA ›

Related Articles Around the Web

Maylin Tu

Maylin Tu is a freelance writer who lives in L.A. She writes about scooters, bikes and micro-mobility. Find her hovering by the cheese at your next local tech mixer.

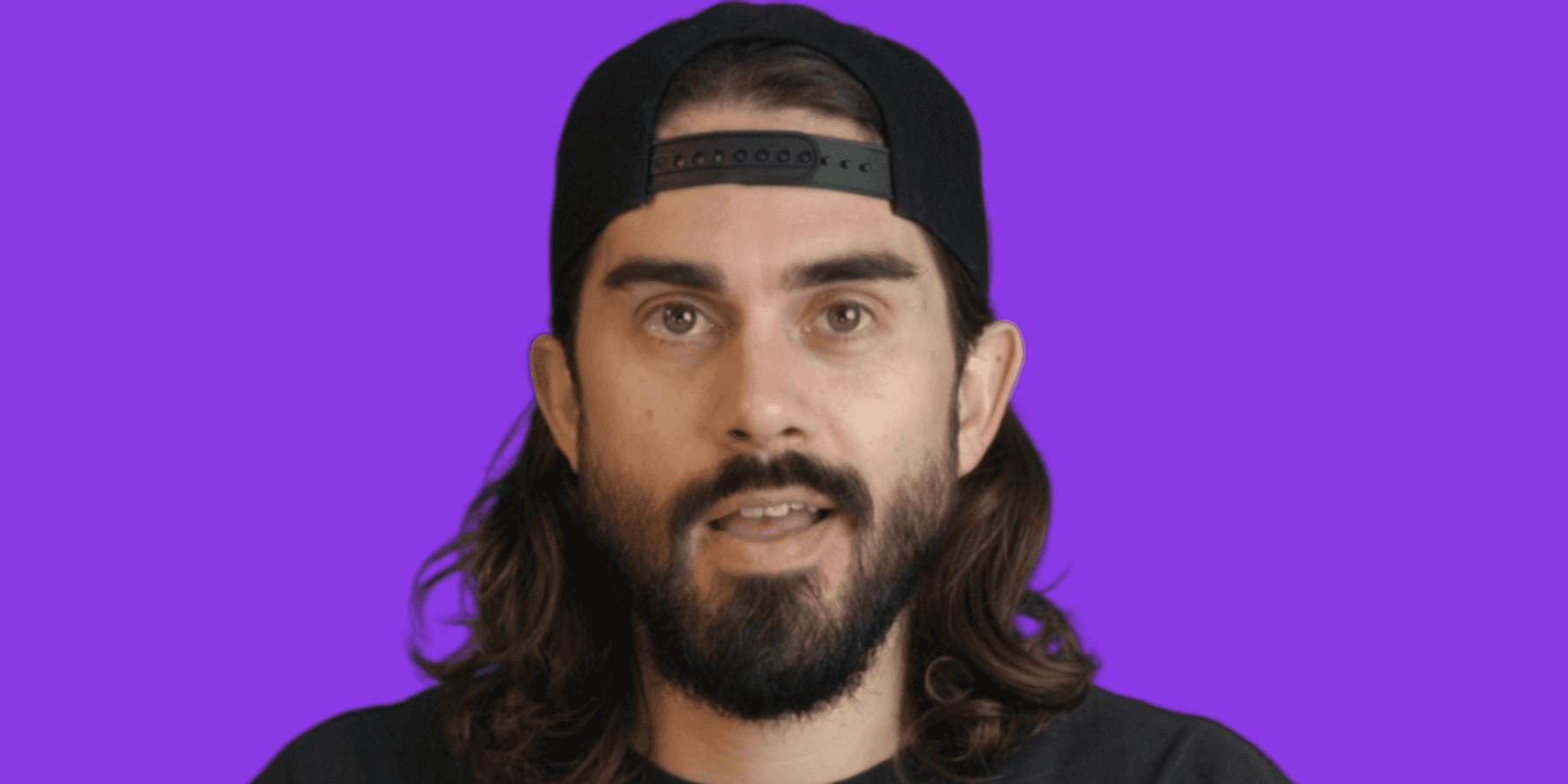

OpenView’s Blake Bartlett on How Product-Led Growth Can Break the 'Fundamental Physics' for Startups

02:59 PM | September 07, 2022

Courtesy of OpenView

Investor Blake Bartlett spent high school exploring different passions, from skateboarding to photography.

He now sees himself as the “song and dance man” at OpenView Venture Capital, a growth-stage venture capital firm. On this episode of the LA Venture podcast, the L.A.-based VC talks about coining the term “product-led growth” and building companies in the “end user age.”

OpenView is currently investing from its sixth fund. Focused on B2B software, the firm invests in companies that are actively scaling up, usually around the Series A or Series B, Bartlett said. Based in Boston, the firm has led investments in startups including Calendly, Expensify and Highspot, among others.

OpenView’s “value-add,” he said, is its 75- to 80-member expansion team, which focuses on helping its portfolio companies grow.

While many investors have a reputation for being interested mainly in metrics and math, Bartlett prides himself on bringing imagination to his investing approach.

“I'm much more wired like a creative,” Bartlett said. “Creativity means lots of different things. Creative problem solving, and how do we sort of really have a unique angle to diligence and this investment thesis like that is creativity, and that certainly comes to bear, but also having other outlets.”

Currently, he also uses that vision through his YouTube series, “PLG123,” and his podcast, “Build.” Both allow him to explore finding his voice and presenting a unique perspective to a wider audience by discussing topics relevant to the VC community.

That creativity came into play in 2016, when he noticed more companies were using product development—rather than sales or marketing—to grow. These companies were different both in operation and performance, Bartlett said, and were expanding quickly without burning capital.

“These businesses were growing incredibly fast on the top line, and then also being capital efficient, if not profitable on the bottom line,” Bartlett said. “For me, that kind of broke the fundamental rules of physics of startups, because I had heard and been taught that there's a fundamental trade off more times than not—almost all the time—between growth and profitability.”

Where a traditional business might invest heavily in its sales and marketing teams in order to expand, Bartlett said, a product-led organization looks first at tactical problems and seemingly small details like signup processes, paywalls and other features. These types of startups were building their product to serve the end user, rather than the division lead who might be purchasing software for a large company, for instance.

“So it's a difference first and foremost, the building for the user, not for the buyer. And then you distribute it to the user, not to the buyer.”

Bartlett said one of the benefits of this model is that companies can build a user base before dealing with administrative issues that software companies have to deal with when selling to much larger companies. Instead, product-led companies can focus on how to turn individual users’ love for a product into revenue, and then scale it from there.

“What is the business case and how do we take all this user love and this thing that people say they can't live without, how do we articulate that into ROI in dollars and cents for this organization that's considering [purchasing in] six figures, seven figures or something of that nature?” Bartlett said.

dot.LA editorial intern Kristin Snyder contributed to this post.

Click the link above to hear the full episode, and subscribe to LA Venture on Apple Podcasts, Stitcher, Spotify or wherever you get your podcasts.

From Your Site Articles

- Real Ways to Increase Diversity in the Workplace - dot.LA ›

- Product Science Lands $18M, Preveta Gains $6.2M - dot.LA ›

Related Articles Around the Web

Read moreShow less

Minnie Ingersoll

Minnie Ingersoll is a partner at TenOneTen and host of the LA Venture podcast. Prior to TenOneTen, Minnie was the COO and co-founder of $100M+ Shift.com, an online marketplace for used cars. Minnie started her career as an early product manager at Google. Minnie studied Computer Science at Stanford and has an MBA from HBS. She recently moved back to L.A. after 20+ years in the Bay Area and is excited to be a part of the growing tech ecosystem of Southern California. In her space time, Minnie surfs baby waves and raises baby people.

What Are LA’s Hottest Startups of 2021? We Asked Top VCs to Rank Them

07:28 AM | January 04, 2021

Despite — or in many cases because of — the raging pandemic, 2020 was a great year for many tech startups. It turned out to be an ideal time to be in the video game business, developing a streaming ecommerce platform for Gen Z, or helping restaurants with their online ordering.

But which companies in Southern California had the best year? That is highly subjective of course. But in an attempt to highlight who's hot, we asked dozens of the region's top VCs to weigh in.

We wanted to know what companies they wish they would have invested in if they could go back and do it all over again.

Startups were ranked by how many votes each received. In the case of a tie, companies were listed in order of capital raised. The list illustrates how rapidly things move in startup land. One of the hottest startups had not even started when 2020 began. A number doubled or even 16x'd their valuation in the span of a few short months.

To divvy things up, we delineated between companies that have raised Series A funding or later and younger pre-seed or seed startups.

Not surprisingly, many of the hottest companies have been big beneficiaries of the stay-at-home economy.

PopShop Live, a red-hot QVC for Gen Z headquartered out of a WeWork on San Vicente Boulevard, got the most votes. Interestingly, the streaming ecommerce platform barely made it onto the Series A list because it raised its Series A only last month. Top Sand Hill Road firms Andreessen Horowitz and Lightspeed Venture Partners reportedly competed ferociously for who would lead the round but lost out to Benchmark, which was an early investor in eBay and Uber. The round valued PopShop Live at $100 million, way up from the $6 million valuation it raised at only five months prior.

Scopely, now one of the most valuable tech companies in Los Angeles, was also a top vote getter.

The Culver City mobile gaming unicorn raised $340 million in Series E funding in October at a $3.3 billion valuation, which nearly doubled the company's $1.7 billion post-money valuation from March. It is no coincidence that that was the same month stay-at-home orders began as Scopely has benefited from bored consumers staying on their couch and playing ScrabbleGo or Marvel Strike Force.

The company's success is especially welcome news to seed investors Greycroft, The Chernin Group and TenOneTen ventures, who got in at a $40 million post valuation in 2012. Upfront Ventures, BAM Ventures and M13 joined the 2018 Series C at a $710 post-money valuation.

Softbank-backed Ordermark, which flew more under the radar, also topped the list. The company's online ordering platform became a necessity for restaurants forced to close their dining rooms during the pandemic and raised $120 million in Series C funding in October.

On the seed side, two very different startups stood out. There was Pipe, which enables companies with recurring revenues to tap into their deferred cash flows with an instant cash advance, and Clash App, Inc., a TikTok alternative launched by a former employee of the social network in August.

We will have the list of Southern California's top seed startups out tomorrow.

Hottest

PopShop Live ($100 million)

The live-streaming shopping channel created by Danielle Lin reportedly found itself in the middle of a venture capital bidding war this year. Benchmark eventually won out leading a Series A round, vaulting the app at a $100 million valuation. The Los Angeles-based platform has been likened to QVC for Gen Z and it's part of a new wave of ecommerce that has found broader appeal during the pandemic. Google, Amazon and YouTube have launched live shopping features and other venture-backed startups like Los Angeles-based NTWRK have popped up.

Boiling

Scopely ($3.3 billion)

One of the most valuable Southern California tech startups with a $3.3 billion valuation, the Culver City mobile game unicorn has benefitted from a booming gaming market that has flourished in this stay-at-home economy. Scopely offers free mobile games and its roster includes "Marvel Strike Force," "Star Trek Fleet Command" and "Yahtzee with Buddies." In October the company raised a $340 million Series E round backed by Wellington Management, NewView Capital and TSG Consumer Partners, among others fueling speculation that it was on its road to an IPO. Co-CEO Walter Driver has said that he doesn't have immediate plans to go public.

Ordermark ($70 million)

The coronavirus has forced the closure of many dining rooms, making Ordermark all the more sought after by restaurants needing a way to handle online orders. Co-founder and CEO Alex Canter started the business in 2017, which recently rang in more than $1 billion in sales. Ordermark secured $120 million in Series C funding by Softbank Vision Fund 2 in October that it will use to bring more restaurants online. The company's Nextbite, a virtual restaurant business that allows kitchens to add delivery-only brands such as HotBox from rapper Wiz Khalifa to their existing space through Ordermark, is also gaining traction.

Simmering

Cameo ($300 million)

Cameo, which launched three years ago, had its breakout year in 2020 as C-list celebrities like Brian Baumgartner banked over a million dollars from creating customized videos for fans. In the sincerest form of flattery, Facebook is reportedly launching a feature that sounds a lot like Cameo. Even though the company is still technically headquartered in Chicago, we included Cameo because CEO Steven Galanis and much of the senior team moved to L.A. during the pandemic and say they plan to continue running the company from here for the foreseeable future.

Mothership ($64 million)

Co-founded by CEO Aaron Peck, Mothership provides freight forwarding services intended to streamline the shipping experience. The company's tracking technologies connect shippers with nearby truck drivers to speed up the delivery process. It raised $16 million in Series A venture funding last year, driving the platform to a $48 million pre-money valuation.

Nacelle ($6.7 million)

Founded in 2019, Nacelle's ecommerce platform helps retailers improve conversion rates and decrease loading speeds for their sites. The software integrates with Shopify and other services, offering payment platforms and analytics integration, among dozens of services. Nacelle raised about $4.8 million earlier this year with angel investors that included Shopify's Jamie Sutton, Klaviyo CEO Andrew Bialecki and Attentive CEO Brian Long.

Boulevard ($30 million)

Matt Danna and Sean Stavropoulos came up with Boulevard when an impatient Stavropoulos was frustrated wasting hours to book a hair appointment. Their four-year-old salon booking and payment service is now used by some of Los Angeles' best-known hairdressers. Last month, the two secured a $27 million Series B round co-led by Index Ventures and Toba Capital. Other investors include VMG Partners, Bonfire Ventures, Ludlow Ventures and BoxGroup.

CloudKitchens ($5.3 billion)

Uber co-founder Travis Kalanick CloudKitchens rents out commissary space to prepare food for delivery. And as the pandemic has fueled at-home delivery, the company has been gobbling up real estate. The commissaries operate akin to WeWork for the culinary world and allow drivers to easily park and pick-up orders as the delivery market has soared during pandemic. Last year, it raised $400 million from Saudi Arabia's colossal sovereign wealth fund.

GOAT ($1.5 billion)

Founded by college buddies five years ago, GOAT tapped into the massive sneaker resale market with a platform that "authenticates" shoes. The Culver City-based company has since expanded into apparel and accessories and states that it has 20 million members. Last year, Foot Locker sunk a $100 million minority investment into 1661 Inc., better known as Goat. And this fall it landed another $100 million Series E round bankrolled by Dan Sundeheim's D1 Capital Partners.

Savage X Fenty

The lingerie company co-founded by pop singer Rihanna in 2018 is noted for its inclusivity of body shapes and sizes. It has raised over $70 million, but The New York Times' DealBook newsletter recently reported that it's been on the hunt for $100 million in funds to expand into active wear. The company generates about $150 million in revenue, but is not yet profitable, according to the report. It became the focus of a consumer watchdog investigation after being accused of "deceptive marketing" for a monthly membership program.

Warming Up

FabFitFun ($930 million)

The lifestyle company provides customized personal subscription box services every three months with full size products. Started in 2010 by Daniel Broukhim, Michael Broukhim, Sam Teller and Katie Rosen Kitchens, it now boasts more than one million members. Last year, the company raised $80 million in a Series A round led by Kleiner Perkins last year and appears to be preparing for an eventual IPO as it slims down costs and refocuses on its high value products.

Dave ($1 billion)

Launched in 2016, the finance management tool helps consumers to avoid overdrafts, provides paycheck advances and assists in budgeting. Last year, it began to roll out a digital bank account that was so popular that two million users signed up for a spot on the waitlist. The company, run by co-founder Jason Wilk, has raised $186 million in venture capital and counts billionaire Mark Cuban as an early investor and board member. Other backers include Playa Vista-based Chernin Group.

Sure ($59 million)

SURE offers multiple technology products to major insurance brands — its platform can host everything from renter's insurance to covering baggage, so customers never have to leave an agency's website. It also offers its platform to ecommerce marketplaces, embedding third-party insurance protections for customers to purchase all on the same webpage. Founded in 2014, the Santa Monica-based startup last raised an $8 million Series A round led by IA Capital in 2017.

Zest AI ($90 million)

Founded in 2009 by former Google CIO Douglas Merrill and ex-Sears executive Shawn Budde, Zest AI provides AI-powered credit underwriting. It helps banks and other lenders identify borrowers looking beyond traditional credit scores. It claims to improve approval rates while decreasing chargeoffs. The company uses models that aim to make the lending more transparent and less biased. This fall the company raised $15 million from Insight Partners, MicroVentures and other undisclosed investors, putting its pre-money valuation at $75 million, according to PItchbook.

PlayVS

Santa Monica-based PlayVS provides the technological and organizational infrastructure for high school esports leagues. The pandemic has helped the company further raise its profile as traditional sports teams have been benched. Founded in early 2018, PlayVS employs 46 people and has raised over $100 million. In addition to partnering with key educational institutions, it also has partnerships with major game publishers such as Riot and Epic Games.

Tapcart ($40 million)

A SaaS platform helps Shopify brands create mobile shopping apps. The marketing software saw shopping activity jump 50% over 90 days as the pandemic walloped traditional retailers. Founded by Eric Netsch and Sina Mobasser, the company raised a $10 million Series A round led by SignalFire, bringing the total raise to $15 million.

Papaya ($31.8 million)

Papaya lets customers pay any bill from their mobile devices just by taking a picture of it. The mobile app touts the app's ease-of-use as a way to cut down on inbound bill calls and increase customer payments. Founded by Patrick Kann and Jason Metzler, the company has raised $25 million, most recently a S10 million round of convertible debt financing from Fika Ventures, Idealab and F-Prime Capital Partners.

Floqast ($250 million)

FloQast is a management software that integrates enterprise resource planning software with checklists and Excel to manage bookkeeping. The cloud-based software company claims its system helps close the books up to three days faster. It is used by accounting departments at Lyft, Twilio, Zoom and The Golden State Warriors. In January, it raised $40 million in Series C funding led by Norwest Venture Partners to bring the total raise to $92.8 million.

Brainbase ($26.5 million)

The company's rights management platform expedites licensing payments and tracks partnership and sponsorship agreements. It counts BuzzFeed, the Vincent Van Gogh Museum and Sanrio (of Hello Kitty and friends fame) among its clients. In May it announced $8 million in Series A financing led by Bessemer Venture Partners and Nosara Capital, bringing the total raised to $12 million.

OpenPath ($28 million)

The Los Angeles-based company provides a touchless entry system that uses individuals cell phones to help with identification instead of a key card. The company offers a subscription for the cloud-enabled software that allows companies to help implement safety measures and it said demand has grown amid the pandemic. Founded by James Segil and Alex Kazerani the company raised $36 million led by Greycroft earlier this year, bringing its total funding to $63 million.

FightCamp ($2.5 million)

FightCamp is an interactive home workout system that turns your space into a boxing ring with a free standing bag, boxing gloves and punch trackers. The company is riding the wave of at-home fitness offerings including Peloton, Mirror and Zwift that have taken off during the pandemic as gyms closed. The company has raised $4.3 million to date.

Numerade

The Santa Monica-based company provides video and interactive content for education in math, science, economics and standardized test prep. Founded in 2018 by Nhon Ma and Alex Lee, who previously founded Tutorcast, an online tutoring service, the company gathers post-graduate educated instructors to create video lessons for online learning.

Our Place ($32.5 million)

The creator of a pan with a cult following on social media, this Los Angeles-based startup designs and retails cookware and dinnerware. Founded by Amir Tehrani, Zach Rosner and Shiza Shahid, the company completed its Series A funding earlier this year, bringing its total raised to date to $10 million.

Tala ($560 million)

For customers that have no formal credit or banking history, this company's application promises more financial access, choice and control. It gathers data to create a credit score that can be used to instantly underwrite and disburse loans ranging from $10 to $500. Co-founded by Shivani Siroya and Jonathan Blackwell, Tala has raised $217.2 million to date. Its investors include PayPal Ventures, Lowercase Capital and Data Collective.

ServiceTitan ($2.25 billion)

Founded in 2007 by chief executive Ara Mahdessian and president Vahe Kuzoyan, ServiceTitan operates software that helps residential home contractors grow their businesses. It provides businesses tools like customer relationship management and accounting integration to streamline operations. The company closed a $73.82 million Series E funding round from undisclosed investors earlier this year.

100 Thieves ($160 million)

Founded in 2017 by former professional "Call of Duty" player Matthew Haag, 100 Thieves manages esports competitions in major titles including "Counter Strike Global Offensive" and "League of Legends." The company also produces apparel and merchandise, opening a physical store and training ground called the "Cash App Compound" in collaboration with Fortnite earlier this year. The company has raised $60 million to date, from investors including Salesforce CEO Marc Benioff and Aubrey Graham, better known as the rapper Drake.

Emotive ($16.5 million)

This AI-powered customer service platform automates text conversations between customers and businesses to increase sales. Emotive uses their sales team to verify questions, distinguishing it from other bot-driven marketing services, according to the company. The company was founded in 2018 by Brian Zatulove and Zachary Wise, who serve as the chief executive and the chief operating officer, respectively. It has raised $6.65 million to date, from Floodgate Fund and TenOneTen Ventures.

Everytable ($33 million)

Created by former hedge fund trader Sam Polk, the Los Angeles-based startup wants to be a healthy fast food chain. It prices its healthy pre-packaged meals around $5 in underserved communities while costing more in other neighborhoods with the goal of reducing so-called food deserts in low-income neighborhoods. It also offers a subscription delivery service. The company recently closed a $16 million Series B round led by Creadev along with Kaiser Permanente Ventures.

Lead art by Candice Navi.

From Your Site Articles

- Los Angeles' Tech and Startup Scene is Growing. - dot.LA ›

- The dot.LA/ Pitchbook Top 50 LA Startups for 2020 Q2 - dot.LA ›

- dot.LA/Pitchbook 50 Hottest Los Angeles Companies - dot.LA ›

- Venture Capitalist Invested $69 Billion into Startups in Q1 - dot.LA ›

- Is NextBite Creating or Solving Problems for Restaurants? - dot.LA ›

- Top LA Angel Investors 2021: McInerney, Rascoff and Lee - dot.LA ›

- LA Startup Jobs Site Interchange.LA Re-Launches - dot.LA ›

- Thankful Raises $12 Million To Boost Customer Service - dot.LA ›

- Young LA Startups Saw Their Valuations Surge in 2021 - dot.LA ›

- VCs Are Flush, But Funding Mostly Male-Led Startups - dot.LA ›

- Largest Raises in Los Angeles in 2021 - dot.LA ›

- Los Anegeles’ Hottest Startups of 2022 - dot.LA ›

- LA Is The Third-Largest Startup Ecosystem in the U.S. - dot.LA ›

- Here Are LA’s Hottest Startups for 2023 - dot.LA ›

Related Articles Around the Web

Read moreShow less

popshop livescopelyordermarkcameoboulevardcloudkitchensgoatfabfitfundavesuresavage x fentyplayvszest aitapcartpapayafloqastbrainbaseopenpathfightcampnumeradeour placetalaservicetitan100 thievesemotiveeverytablelos angeles startupsvc sentiment survey

Ben Bergman

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

https://twitter.com/thebenbergman

ben@dot.la

RELATEDTRENDING

LA TECH JOBS