Get in the KNOW

on LA Startups & Tech

X

Design, Bitches

Looking to Build a Granny Flat in Your Backyard? Meet the Firms and Designs Pre-Approved in LA

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Adding a backyard home in Los Angeles is now nearly as easy as buying a barbecue.

Homeowners who for years have wanted to build a granny flat in their backyard, but dreaded the red tape, can now choose from 20 pre-designed homes that the city has already approved for use.

The shift, made official last week, will speed up a weeks-long process and bring more badly needed units to an overpriced market. It also has the potential to elevate the 14 startups and firms building the next generation of homes.

The designs for the stand-alone residences range from a 200-square-foot studio to a 1,200-square foot, two-story, two-bedroom unit. And many of the homes are filled with design flourishes, reflecting the diverse architecture of the city, from a house in the silhouette of a flower to one with a spiral outdoor staircase leading to the roof.

It's no surprise. The program was spearheaded by Christopher Hawthorne, a former architecture critic at the Los Angeles Times and now the city's chief design officer.

The firms are primarily local and startup architecture and design firms, while others are well-known with a history of building granny flats, also know as accessory dwelling units, or ADUs.

The standard plans avoid the Los Angeles Department of Building and Safety's typical four-to six-week review process and can allow approvals to be completed in as quickly as one day.

Some aspects of the plans can be modified to fit a homeowner's preferences. Eight other designs are pending approval.

Mayor Eric Garcetti believes by adding more such units, the city can diversify its housing supply and tackle the housing crisis. Recent state legislation made it easier to build the small homes on the lot of single-family residences. Since then, ADUs have made up nearly a quarter of Los Angeles' newly permitted housing units.

Because construction costs are relatively low for the granny flats – the pre-approved homes start at $144,000 and can go beyond $300,000 – the housing is generally more affordable. The median home price in L.A. County in January was $690,000.

Here's a quick look at the designs approved so far:

Abodu

Abodu

Abodu, based in Redwood City in the Bay Area, exclusively designs backyard homes. In 2019, it worked with the city of San Jose on a program similar to the one Los Angeles is undertaking.

In October, it closed a seed funding round of $3.5 million led by Initialized Capital.

It has been approved for a one-story 340-square-foot studio, a one-story one-bedroom at 500 square feet, and a one-story, 610-square-foot two-bedroom.

The pricing for the studio is $189,900, while the one-bedroom costs $199,900 and the two-bedroom is $259,900.

Amunátegui Valdés Architects

Led by Cristobal Amunátegui and Alejandro Valdés, the firm was founded in 2011 and has offices in Los Angeles and Santiago, Chile. Amunátegui is an assistant professor at the Department of Architecture and Urban Design at UCLA.

The firm designs work in various scales and mediums, including buildings, furniture and exhibitions.

Its one-story, two-bedroom with a covered roof deck 934-square-foot unit is pending approval from the city.

Connect Homes

Connect Homes has a 100,000-square foot factory in San Bernardino and an architecture studio in Downtown L.A.

It specializes in glass and steel homes and has completed 80 homes in California. Its designs have an aesthetic of mid-century modern California residential architecture.

It has two one-bedroom models pre-approved by the city, one is 460 square feet, which costs $144,500 with a total average project cost of $205,000. The other is 640 square feet, which costs $195,200 with a total project cost of $280,000.

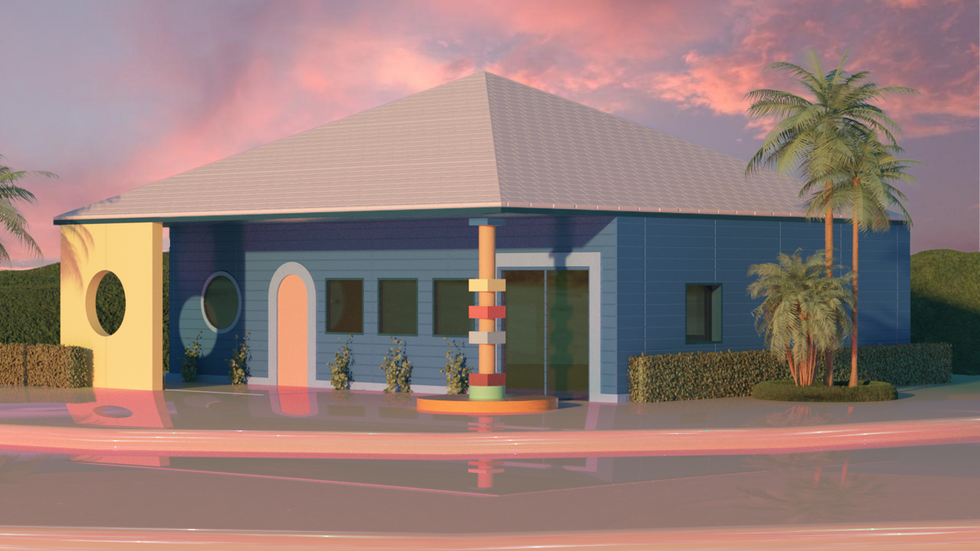

Design, Bitches

The Los Angeles-based architectural firm founded in 2010 describes itself as having a "bold and irreverent vision." Its projects include urban infill ground-up offices to single-family homes, adaptive re-use of derelict commercial buildings and renovations of historic landmarks.

Its pre-approved design, named "Midnight Room," is a guest house/ studio. Its bedroom can be left open for a loft feel or enclosed as a separate room. The design is a one-story, one-bedroom at 454 square feet.

Escher GuneWardena Architecture

Founded in Los Angeles in 1996, Escher GuneWardena Architecture has received international recognition and has collaborated with contemporary artists, worked on historical preservation projects and more.

The company has been approved for two different one-story, one- or two-bedroom units, one at 532 square feet with an estimated cost of $200,000 and another at 784 square feet with an estimated cost of $300,000. The firm noted the costs depend on site conditions and do not include soft costs. Those could add 10% to 12% to the total construction costs.

First Office

First Office is an architecture firm based in Downtown Los Angeles. Its approved ADUs will be built using prefabricated structural insulated panels, which allow for expedited construction schedules and high environmental ratings.

The interior finishes include concrete floors, stainless steel counters and an occasional element of conduit.

There are five options:

- A one-story studio, 309 to 589 square feet

- A one-story one-bedroom, 534 to 794 square feet

- And a one-story two-bedroom, 1,200 square feet

Fung + Blatt Architects

Fung + Blatt Architects is a Los Angeles-based firm founded in 1990.

The city has approved its 795-square-foot, one-story, one-bedroom unit with a roof deck. It estimates the construction cost to be $240,000 to $300,000, excluding landscape, site work and the solar array. Homeowners can also expect other additional costs.

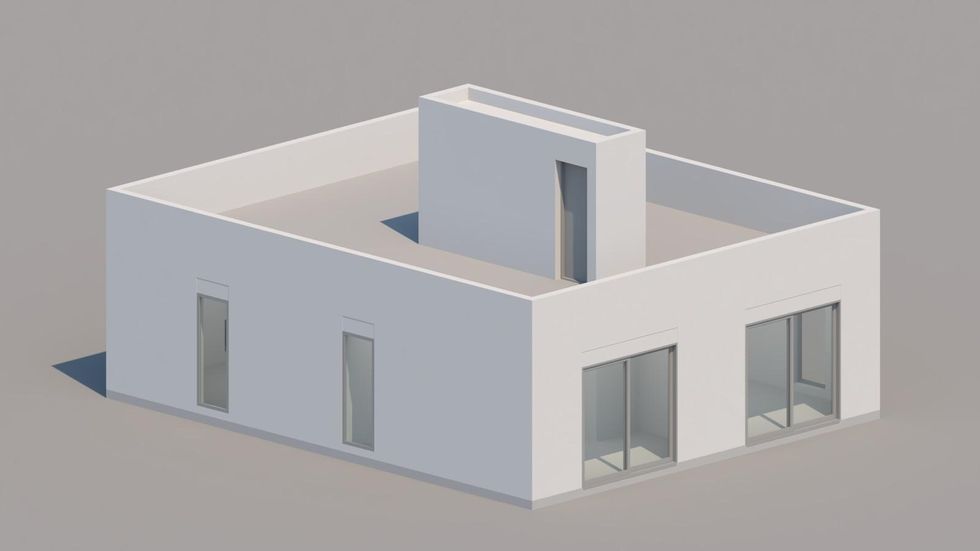

Taalman Architecture/ IT House Inc.

The design team behind "IT House" is Los Angeles-based studio Taalman Architecture. Over the past 15 years, IT House has built more than 20 homes throughout California and the U.S.

The IT House ADU standard plans include the tower, bar, box, cube, pod and court.

The city has approved four options, including:

- A two-story including mechanical room, 660 square feet

- A two-story including mechanical room, 430 square feet

- A one-story studio, 200 square feet

- A one-story including mechanical room, 700 square feet

The firm also has another two projects pending approval: a 360-square-foot one-story studio and a one-story, three-bedroom at 1,149 square feet.

LA Más

LA Más is a nonprofit based in Northeast Los Angeles that designs and builds initiatives promoting neighborhood resilience and elevating the agency of working-class communities of color. Homeowners who are considering their design must commit to renting to Section 8 tenants.

The city has approved two of LA Más' designs: a one-story, one-bedroom, 528 square feet unit and a one-story, two-bedroom, 768 square feet unit. The firm has another design for a one-story studio pending approval. That design would be the first 3D-printed ADU design in the city's program.

Jennifer Bonner/MALL

Massachusetts-based Jennifer Bonner/MALL designed a "Lean-to ADU" project, reinterpreting the stucco box and exaggerated false front, both Los Angeles architectural mainstays.

The design has been approved for a 525-square-foot one-story, one-bedroom unit with a 125-square-foot roof deck.

sekou cooke STUDIO

New York-based sekou cooke STUDIO is the sole Black-owned architectural firm on the project.

"The twisted forms of this ADU recalls the spin and scratch of a DJ's records" from the early 90s, the firm said.

Its design, still pending approval, is for a 1,200-square-foot, two bedroom and two bathroom can be adapted to a smaller one-bedroom unit or to include an additional half bath.

SO-IL

New York-based SO-IL was founded in 2008. It has completed projects in Leon, Seoul, Lisbon and Brooklyn.

Its one-story, one-bedroom 693-square-foot unit is pending approval. It is estimated the construction cost will be between $200,000 and $250,000.

WELCOME PROJECTS

Los Angeles-based Welcome Projects has worked on projects ranging from buildings, houses and interiors to handbags, games and toys.

Its ADU is nicknamed The Breadbox "for its curved topped walls and slight resemblance to that vintage counter accessory."

It has been approved for a one-story, one-bedroom 560-square-foot unit.

wHY Architecture

Founded in 2004, wHY is based in Los Angeles and New York City. It has taken on a landmark affordable housing and historic renovation initiative in Watts.

Its one-story, one- or two-bedroom 480 to 800-square-foot unit is pending approval.

Firms that want to participate in the program can learn more here . Angelenos interested in building a standard ADU plan can learn more the approved projects here.

From Your Site Articles

- United Dwelling Raises $10M to Address the Housing Shortage ... ›

- Plant Prefab Raises An Additional $30 Million - dot.LA ›

- How 3D Printing Could Help Tackle Homelessness in LA - dot.LA ›

- New Bills, New Startups Address Housing in California - dot.LA ›

- LA's ADU Culture Still Faces Financial Barriers - dot.LA ›

- What Will Take To Make Modular Homes Mainstream? - dot.LA ›

Related Articles Around the Web

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Skyryse Raised $300M+ to Do What Most Startups Can’t

09:26 AM | February 06, 2026

🔦 Spotlight

Hello Los Angeles

LA just minted another aviation unicorn, and it is not because someone built a prettier helicopter demo. It's because Skyryse is trying to do the rarest thing in tech: turn software into something regulators will sign their name to, and that pilots will trust when conditions are at their worst.

El Segundo’s newest unicorn is simplifying the cockpit

Skyryse raised $300M+ in a Series C at a $1.15B valuation. The round was led by Autopilot Ventures and returning investor Fidelity Management & Research Company, with participation from Qatar Investment Authority, ArrowMark Partners, Atreides, BAM Elevate, Baron Capital Group, Durable Capital Partners, Positive Sum, Rokos (RCM Private Markets Fund), and Woodline Partners, among others.

The pitch is bold and deceptively simple. Skyryse is building a “universal operating system for flight,” SkyOS, designed to replace the cockpit’s maze of mechanical controls with a computer-driven system that makes routine flight easier and emergency situations more manageable. The bigger claim is standardization: if you can make the interface and controls feel consistent across aircraft, you reduce training friction, lower pilot workload, and create fewer opportunities for human error when the stakes spike.

The real work starts after the press release

Skyryse says the funding will be used to accelerate FAA certification and scale SkyOS across additional aircraft platforms, including the Black Hawk. That is the hard part, and also the part most startups never reach. Aviation is where software has to prove itself in edge cases, repeatedly, with zero tolerance for surprises, because “mostly works” is another way of saying “eventually fails.”

The bet hiding inside the headlines

If Skyryse clears certification and can port SkyOS across aircraft types the way software ports across devices, it could unlock a new category of safety automation for fleets that cannot afford downtime, confusion, or long training cycles. Emergency response, defense modernization, and industrial aviation are all markets where reliability is the product, and simplicity is the differentiator. In a world obsessed with shipping faster, Skyryse is playing a different game: getting permission to ship at all.

Keep scrolling for the latest LA venture rounds, fund news and acquisitions.

🤝 Venture Deals

LA Companies

- Accrual announced it has raised $75M in new funding led by General Catalyst, with participation from Go Global Ventures, Pruven Capital, Edward Jones Ventures, and a group of founders and industry executives. The company says the raise supports its official launch and continued buildout, alongside early partner firms, investors, and advisors. - learn more

- Morpheus Space secured a $15M strategic investment led by Alpine Space Ventures and the European Investment Fund, with continued support from existing investors, to fuel its next phase of growth. The company says it will use the capital to expand mass-production capacity and its team at its Dresden “Reloaded” facility, helping industrialize its GO-2 electric propulsion systems and meet rising demand from large satellite constellations. - learn more

- Machina Labs raised a $124M Series C to build its first large-scale “Intelligent Factory,” a U.S.-based production site aimed at rapidly manufacturing complex metal structures for defense, aerospace, and advanced mobility. The company says the funding, backed by investors including Woven Capital, Lockheed Martin Ventures, Balerion Space Ventures, and Strategic Development Fund, will help it scale its AI-and-robotics “software-defined” manufacturing approach from breakthrough tech into high-throughput production infrastructure. - learn more

- Midi Health raised a $100M Series D led by Goodwater Capital, with new investors Foresite Capital and Serena Ventures joining and existing backers including GV, Emerson Collective, and others returning, valuing the company at over $1B. The women’s telehealth provider says it will use the funding to scale beyond menopause care into a broader, AI-enabled women’s health platform, expanding access and using AI to personalize care and streamline clinical operations. - learn more

- Mitra EV raised $27M in financing, combining equity led by Ultra Capital with a credit facility from S2G Investments, to expand its “no upfront capital” fleet electrification model. The Los Angeles-based company says it will use the money to grow its shared charging network, roll out additional fleet solutions, and expand into new markets, positioning itself as a fully managed package that bundles EV leasing, overnight charging, and access to shared fast-charging hubs. - learn more

- Plug raised a $20M Series A to scale its EV-first marketplace, following $60M in used EV sales since launching in 2024. The round was led by Lightspeed with participation from Galvanize and existing investors including Autotech Ventures, Leap Forward Ventures, and Renn Global, as Plug positions itself as infrastructure for the coming wave of off-lease EV inventory with EV-native pricing, battery health insights, and faster dealer transactions. - learn more

- Breezy, a Los Angeles-based AI operating system for residential real estate professionals, raised an oversubscribed $10M pre-seed round led by Ribbit Capital, with participation from Fifth Wall, DST Global, Liquid 2 Ventures, O.G. Venture Partners, and others. The company says it will use the funding to strengthen its product and data platform, grow engineering and design, invest in security, and prepare for broader U.S. and international rollout. - learn more

LA Venture Funds

- Upfront Ventures participated in Daytona’s $24M Series A, a round led by FirstMark Capital with participation from Pace Capital and existing investors E2VC and Darkmode, plus strategic checks from Datadog and Figma Ventures. Daytona is building “composable computers” for AI agents, essentially programmatic, stateful sandboxes that can be spun up, paused, and snapshotted on demand so agents can safely run code and explore many paths in parallel at scale. - learn more

- Second Sight Ventures participated in Willie’s Remedy+’s $15M Series A, a round led by Left Lane Capital to fuel national retail expansion and continued product development for its hemp-derived THC beverages positioned as an alcohol alternative. The company says it has already sold 400,000+ bottles in under a year and claims the top spot for online THC beverage sales as it gears up for broader distribution in 2026. - learn more

- Navitas Capital led Cadastral’s $9.5M funding round, with participation from JLL Spark Global Ventures, AvalonBay, Equity Residential, and 1Sharpe. Cadastral says it will use the capital to accelerate product development and expand go-to-market for its vertical AI platform, positioning the product as an “AI analyst in a box” that automates core commercial real estate workflows like underwriting and due diligence. - learn more

- B Capital participated in Lunar Energy’s $232M raise, which the company disclosed as two rounds: a $102M Series D led by B Capital and Prelude Ventures, and a previously unannounced $130M Series C led by Activate Capital. The startup says it will use the capital to rapidly scale home-battery manufacturing and deployments, turning those distributed systems into a grid-supporting virtual power plant as electricity demand surges. - learn more

- B Capital participated in Goodfire’s $150M Series B at a $1.25B valuation, a round that also included investors like Juniper Ventures, DFJ Growth, Salesforce Ventures, Menlo Ventures, Lightspeed, South Park Commons, Wing, and Eric Schmidt. Goodfire says it will use the funding to scale its interpretability-driven “model design environment,” aimed at helping teams understand, debug, and deliberately shape how AI models behave in high-stakes settings. - learn more

- Helena participated in Positron AI’s oversubscribed $230M Series B at a post-money valuation above $1B, alongside strategic investors including Qatar Investment Authority and Arm. The round was co-led by ARENA Private Wealth, Jump Trading, and Unless, and the company says it will use the capital to scale energy-efficient AI inference now and accelerate its next-generation “Asimov” silicon roadmap. - learn more

- Smash Capital participated in ElevenLabs’ $500M Series D, which values the company at $11B as it scales its voice and conversational AI products for enterprise use. The round was led by Sequoia Capital with support from existing backers like Andreessen Horowitz and ICONIQ Capital, plus additional participation including Lightspeed Venture Partners. - learn more

- MTech Capital participated in Pasito’s $21M Series A, a round led by Insight Partners with additional participation from Y Combinator. Pasito says it’s building an AI-native workspace for group health, life, and retirement benefits that turns messy, unstructured plan and census data into a unified layer so carriers and brokers can automate workflows end-to-end, from quoting and enrollment to support and claims. - learn more

- Rebel Fund participated in Ruvo’s $4.6M seed round, led by 1confirmation with participation from Coinbase Ventures and others, as the Y Combinator-backed fintech expands its cross-border payments infrastructure between Brazil and the U.S. Ruvo says it operates like a U.S. dollar account for Brazilians, combining Pix, stablecoins, ACH/wire transfers, and a Visa card in one app to speed up remittances by reducing intermediaries. - learn more

- Rainfall Ventures participated in a seed funding round for Deft Robotics alongside Spring Camp, backing the company’s push to build AI-driven automation tools for manufacturers. The round amount wasn’t disclosed in the announcement, but the funding is positioned to help Deft scale product development and customer deployments in industrial settings. - learn more

- Trousdale Ventures participated in CesiumAstro’s Series C by leading the $270M equity portion of a $470M total growth-capital raise, alongside investors including Woven Capital, Janus Henderson Investors, and Airbus Ventures. CesiumAstro says the broader financing also includes $200M from Export-Import Bank of the United States and J.P. Morgan, and will fund a major U.S. scale-up including a new 270,000-square-foot HQ and expanded manufacturing to accelerate deployment of its software-defined, AI-enabled space communications platforms. - learn more

- Mucker Capital participated in Linq’s $20M Series A, which was led by TQ Ventures to help the company become infrastructure for AI assistants that run directly inside messaging apps. Linq’s platform lets developers and businesses deploy assistants through channels like iMessage, RCS, and SMS, and the company says the funding will go toward expanding the team, building a go-to-market motion, and continuing to develop the product. - learn more

- Sound Ventures participated in Day AI’s $20M Series A, which was led by Sequoia Capital with additional participation from Greenoaks, Conviction, and Permanent Capital. Day AI says the funding will help scale its AI-native CRM platform and support its move into general availability, positioning “CRMx” as a faster, context-driven alternative to legacy systems that turn simple questions into slow projects. - learn more

- Chaac Ventures participated in Arbor’s $6.3M seed round, which was led by 645 Ventures with additional backing from Next Play Ventures, Comma Capital, and angel investors. Arbor is building an AI interview and research platform that captures frontline employee and customer conversations and turns that qualitative “ground truth” into structured operational intelligence leaders can act on quickly, without slow surveys or pricey consultants. - learn more

- B Capital participated in When’s $10.2M Series A, a round co-led by ManchesterStory and 7wire, with new investor Mairs & Power Venture Capital and returning backers Enfield Capital Partners, TTV Capital, and Alumni Ventures. When says it helps employers and departing or transitioning employees navigate health coverage changes by steering people to more affordable alternatives to COBRA through an AI-powered marketplace and targeted reimbursements, with the new capital going toward team growth and expanding into more transition scenarios like Medicare eligibility and early retirements. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS