A New LA Company Aims to Give Fans a Way to Invest, Literally, in the Musicians They Love

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

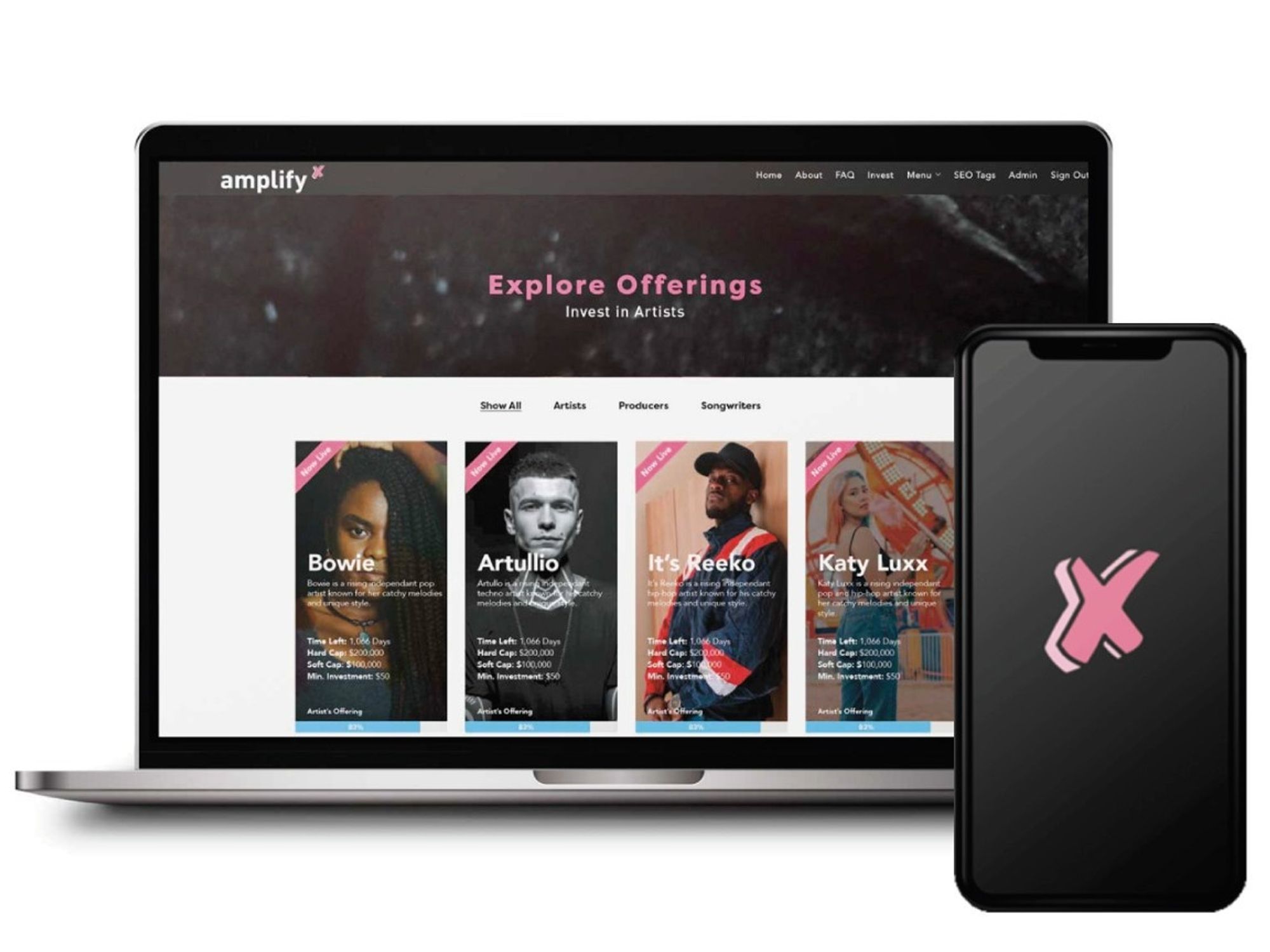

- AmplifyX launches next week to offer shares in musicians' future royalty income

- Its first tranche is two Detroit-based musicians, each of whom are offering 20% of future royalties for $10,000 at an effective $25 share price

- In the future, Amplify plans to build out a secondary trading market and hopes to expand beyond music and into the broader creator economy

Rising Detroit rapper and singer Rocky Badd has always been about the street, but soon she and her manager Curtis McKinnon will be going public.

Next week, they'll be selling shares worth 20% of Rocky's future royalty income for $10,000. In doing so, they're also hoping to gain a legion of super fans financially and emotionally invested in her success.

The exchange will be powered by L.A.-based AmplifyX, one of a growing number of online investment platforms made possible by 2015 regulatory changes around crowdfunding. An extension of President Obama's 2012 JOBS Act, the new rules eased restrictions on fundraising and investing, enabling the budding democratization of fractional ownership. Non-accredited investors can now add to their portfolios shares of vintage cars, collectibles like sneakers and trading cards, famous artworks and more.

"Music hasn't really changed from a financing perspective in decades," said Adam Cowherd, Amplify's co-founder and chief executive. His platform aims to address that.

Detroit rapper and singer Rocky Badd, aka September Briyonna-Michelle.

Badd, whose real name is September Briyonna-Michelle, is using Amplify to offer 400 shares tied to her upcoming album, "Respect the Writer 2," for $25 each. Each share is effectively a claim on 0.25% of the streaming and digital download royalties generated by the new release and a few additional songs. Jay Vinchi, another musician from Detroit, is also putting up shares for his upcoming album as part of Amplify's first tranche of offerings.

In L.A., Cowherd has been hard at work. A former physicist turned investment banker, he and his small team had built the infrastructure to run a securities exchange by the end of last year. They waited, though, to complete what would be an 8-month gauntlet to gain regulatory authorization from FINRA, a private financial regulator, and the SEC, its public sector counterpart. The company finished that process in August, and is now awaiting final approval to open its first offering, which Cowherd expects to arrive early next week.

He thinks the wait for that regulatory compliance will pay off by helping Amplify to compete with other platforms that offer similar services, such as Royalty Exchange and Vezt, which also allow fans to buy shares of artist royalty streams.

This first fundraise will be open for 60 days and royalty payments will be distributed to shareholders annually; eventually that could shift to quarterly, Cowherd said.

For artists like Rocky Badd and Jay Vinchi, one obvious appeal to selling shares in their future royalties is earning instant cash – not exactly easy to come by for a musician today.

Rocky Badd's deep connection to her fanbase gives her manager McKinnon and Cowherd confidence she'll have no trouble raising the $10,000. In May, she hosted a livestream concert on Zoom that sold over 1,000 tickets. The YouTube video for her song "Vindictive" has over 8 million views.

With the money raised, McKinnon will look to further spread Rocky Badd fever.

"Rocky can post something and easily get thousands of streams and likes, but now we're trying to get to the millions," he said.

The Amplify offering also has the potential to inspire a squadron of fans to become a de-facto marketing department.

"If we get multiple fans [to buy shares], we now have promoters for a lifetime, because the better that album does, the more revenue share for them," said McKinnon, who — in addition to managing Briyonna-Michelle — runs CrowdFreak, an online platform that helps up-and-coming artists find performance and exposure opportunities.

A rising number of artists are eschewing record labels in favor of ad-hoc, artist-support services, many of which are enabled by technology. Cowherd sees AmplifyX one day building further on that trend, morphing into an entire "record label á la carte."

"Long term, it would basically be a record label in your pocket. We'd like to build that into the native mobile app from the artist perspective, where not only do they have their investor data, and their streaming and social data, but they could also say, 'I'm looking for PR', and we give them three options that have already been vetted through us, and they can make those connections and bookings right through the application," Cowherd said.

Even if Amplify remains solely a financing platform, he sees expansion opportunities in working with more artists and eventually selling shares in legacy catalogs.

"How cool would it be for somebody who's part of the KISS Army to actually own a fractional piece of 'Detroit Rock City' or something like that?"

The company also plans to build a secondary market for trading shares, he said.

For investors, getting in on the streaming market could be attractive. From 2014 - 2019, revenue from streaming saw a 43% compound annual growth rate, and Goldman Sachs projects the $11 billion market to quadruple by 2030. And since streaming royalties are generally uncorrelated with investment returns elsewhere, they provide a means for investors to reduce risk across their investment portfolio.

Given these factors, Cowherd expects investment to come from cryptocurrency investors and the growing crowd of young traders, along with artists' super fans.

"There's a growing demand among Gen Z for investing," Cowherd said. "My uncle is the principal of a school in Michigan, and he actually had to ban Robinhood because so many kids were day-trading."

Down the road, Cowherd expects to see a lot of engagement from that younger generation. They may have the chance to invest not only in musical projects but also in other content creators as well, and the businesses those creators and influencers may start.

"I really want to power the entire creator and influencer economy," Cowherd said.

Amplify has raised about $250,000 in pre-seed funding and plans to raise a $2-3 million seed round in Q1 or Q2 next year.

For now, it'll generate revenue by taking a percentage of the capital raised from the revenue-share offering. Later, it plans to take an affiliate fee for its record label á la carte service, and a small fee for transactions through its secondary market. It may also offer debt financing, such as for underwriting concert tours.

Other companies will be competing to provide innovative forms of artist financing. L.A.-based Stem, for example, recently opened a $100 million debt-financing arm to loan artists advances against their future royalty income. Kobalt, a London-based firm, is also in the competitive mix.

Hipgnosis, which has been on a spending spree of late to allow investors to buy rights to songs and musical IP, represents the broader bubbling activity in the acquisition of music publishing rights.

Cowherd said one key way he aims to differentiate Amplify is by facilitating direct connections between fans and artists.

For Briyonna-Michelle, that connection is about more than a financial transaction.

"For a lot of people, especially people in my city, we don't really invest in nothing. You buy jewelry, you buy clothes, you buy cars or whatever and you just keep up, but it's like, at some point, when we get older, you're just gonna say you had it," she said. "I feel like no matter what the album does, it's still, like, at least you tried to invest in something, whether it worked or it didn't. I feel like it motivates people to start putting some money behind something where later on in life you can get something out of it."

Come next week, a new set of fans will begin hoping one day to get something out of their investment in her.

---

Sam Blake primarily covers entertainment and media for dot.LA. Find him on Twitter @hisamblake and email him at dot.LA

- Spotify Introduces its Podcast Producers to its Music Empire - dot.LA ›

- TikTok Says it Will Pay Creators— and Universal Music Group - dot.LA ›

- The EU's Article 17 Is Already Changing Digital Music Deals - dot.LA ›

- SoundCloud Will Experiment With a New Way To Pay Artists - dot.LA ›

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

Image Source: SpinLaunch

Image Source: SpinLaunch

Image Source : Locket

Image Source : Locket Image Source: Meta

Image Source: Meta