Robot Bartenders, Space Construction and a Weight Loss App: Highlights From Techstars’ LA Demo Day

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

On Wednesday, Techstars’ fall 2022 class gathered in Downtown Los Angeles to pitch their products to potential investors in hopes of securing their next big funding round. dot.LA co-sponsored the demo day presentation alongside Venice-based space news website Payload.

Managing director Matt Kozlov explained that unlike previous years, this year Techstars combined two cohorts, merging its space accelerator program and Los Angeles program into one demo day. The result was a comprehensive pitch day where investors, founders and press could hear from 12 creative and intriguing companies working across a variety of industries.

What’s New In Space Startups

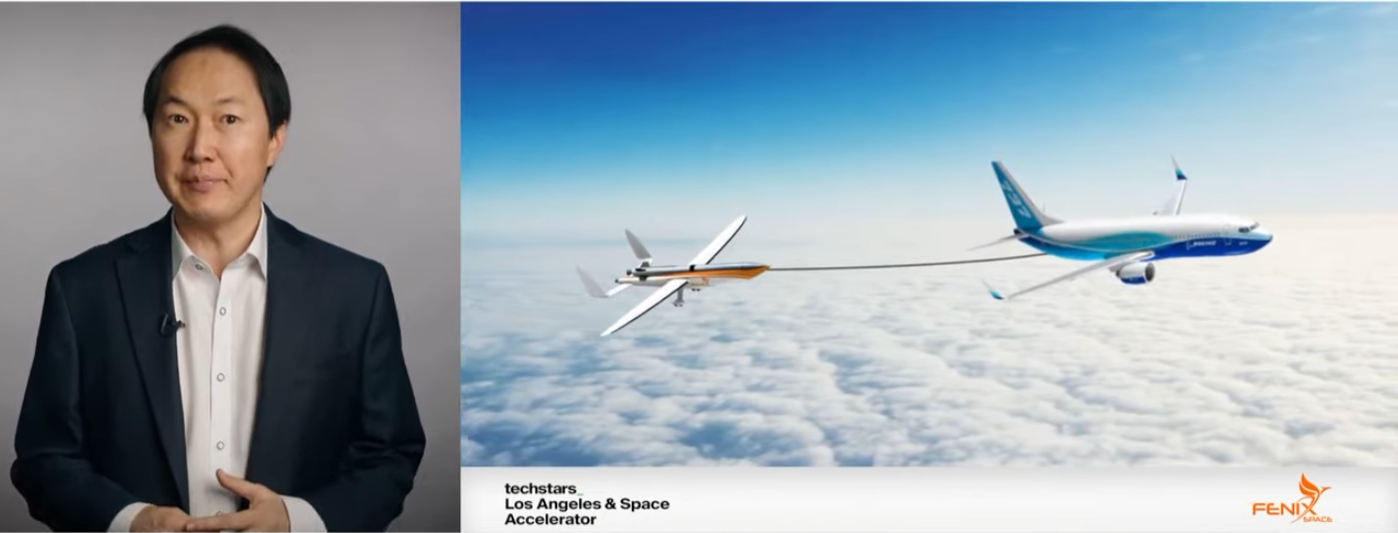

On the space side, two local firms were introduced, including Fenix Space, a San Bernardino startup that got off the ground in 2017 and is looking to wrestle control of the commercial air launch market away from local rival Virgin Orbit.

Fenix Space has a different model of air launching rockets than Virgin; instead of strapping the rockets to a large plane like Virgin does, it plans to tow them through the air. During the Techstars demo day Fenix CEO Jason Lee told Payload co-founder Ari Lewis that Fenix conducted one sub-orbital test flight last year, and is working on making a second craft that will be tested at New Mexico’s White Sands Missile Range by second quarter of next year.

During his pitch Lee said, he sees a wide variety of tow launch applications including terrestrial logistics (think an alternative to ground shipping for e-commerce, as one example) but noted, “we're starting with space because corporations and governments looking to put assets into space are relying on ground launch operations from only five orbital space points in the United States… . As a result, the wait time to launch is up to two years, customers are subject to fixed schedules, are being delivered to limited orbital destinations, and are often delayed weeks or even months.”

Lee said Fenix’s crafts can carry 75 times more payload per launch and can launch payloads to orbit 1000 times faster than its competitors. The company has raised $9 million in funding over five years, said Lee and has memorandums of understanding with “major commercial customers” that account for at least $32 million in potential revenue. He also noted Fenix has existing partnerships with the Air Force Research Lab and commercial space operations support agreement with Vandenberg Space Force Base.

Fenix also has a Space Act Agreement with NASA to develop its tow-glider launch platform and an exclusive license agreement with the agency.

In Orbit Aerospace CEO Ryan Elliot was clearly passionate about the company’s mission to make manufacturing in space as easy as possible. “Today, the only way to manufacture in space and recover products back on Earth is through the International Space Station,” Elliot said. Elliot is betting that In Orbit can help reduce the high wait times and correspondingly spiking costs of space manufacturing by helping customers set up their own space factories.

All of which is a tall order, but not as far-fetched as it might seem. In Orbit developed a custom orbital satellite it calls the Haven Shepherd to launch customers’ cargo to space for manufacturing. Once the mini-factory is operational, In Orbit’s second module, a capsule called the Haven Retriever, will bring raw materials to the factory and swap that payload for the new, finished product to return it back to earth.

Elliot also noted the company is the only one trying to tackle the challenge of building a permanent orbital station that can interface with Earth, and has some $180 million in potential contracts in the pipeline. Adding that In Orbital has a Space Act Agreement with NASA and is planning a test mission as soon as 2024.

Apps Focused on Food and Drink

One overarching theme of this year’s Techstars LA cohort was a focus on the food and beverage industries, as well as the intersection those industries have with the healthcare market.

Rotender was one of the splashier startups in this Techstars cohort, because, well, who doesn’t think the phrase “robot bartender” sounds cool. Sure, this robot won’t listen to you gripe about your partner during happy hour, but it will pour you a G&T in under 30 seconds. At least, that’s the gist pitched by CEO Ben Winston.

Rotender could work a large private event, but Winston said the company’s focused on getting into sports stadiums and entertainment venues. Capitalizing on the one thing all fans hate – long lines for concessions – Rotender is aiming to convince venues that spending $35,000 annually on a robot to pour drinks is worth the spend. “One Rotender unit operating 18 or more hours a week will earn a venue over $700,000 a year in drink revenue,” Winston said, adding that it could also save a venue over 175,000 annually in spillage fees.

On the business-to-business side, Techstars-backed app Bevz is trying to “save your local convenience store,” as CEO Jason Vego put it. Bevz is basically an order management system for bodegas that helps them avoid running out of top-selling products. The app syncs with the store’s custom point of sale system and sends users notifications to purchase more products before it runs out. It also consolidates input from various delivery apps to give the store a clear picture of what is sold and how frequently.

“These stores are constantly running out of products that their customers want to buy, leading to $50 billion in lost revenue every year,” Vego said. “Most stores don't have any technology… this [platform] is a game-changer.

Startups Targeting Mental and Physical Wellness

While a number of local startups backed by TechStars are looking to innovate in the food and beverage market, two in particular were focused on fitness coaching.

Founded by Liz Dickinson in 2020, San Diego-based wellness app Relish Life is an app-based clinic that connects people with clinicians for medication-assisted weight loss therapy supplemented by mental health treatment. Dickinson said during her pitch that Relish participants reported “11% body weight lost by six months compared to only 5% in 12 months, twice the weight in half the time of our competitor and we've clinically validated that the weight stays off,” Dickinson said. “Anything that stress triggers, we can treat,” she added, noting the platform could be used to help modify other unhealthy behaviors like smoking or even possibly addiction.

Another wellness-focused app pitching at the demo day was Liberate, a Brentwood-based coaching app focused on mental fitness. CEO Olivia Bowser said during her pitch that she quit her “dream job” six years ago after quickly burning out. The experience prompted her to found Liberate, which companies can choose as a benefit for their workers.

The platform works by connecting people with counselors and guided stress management and wellness exercises to complete throughout the day. There’s also a Slack channel for team-wide guided wellness exercises and morale boosting. “At less than two years old, we've serviced hundreds of companies through monthly and annual contracts… [and] helped nearly 5,000 employees feel happier and more productive at work,” Bowser said.

Clarification: This story has been updated to reflect that Rotender's CEO said its technology could "earn a venue over $700,000 a year in drink revenue."

- Meet TechStars LA's 2021 Accelerator Cohort ›

- Slingshot Aerospace Raises $40M To Expand Space Object Sensor Network ›

- Techstars LA Unveils Health Care-Heavy Spring 2022 Accelerator Class ›

- Gitai's Robots Will Build Future Space Stations for Humans - dot.LA ›

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

Image Source: Revel

Image Source: Revel