Farmer Fintech ProducePay Is Getting Into the Carbon-Trading Game

David Shultz reports on clean technology and electric vehicles, among other industries, for dot.LA. His writing has appeared in The Atlantic, Outside, Nautilus and many other publications.

It’s not exactly easy to understand what ProducePay does, so let’s get that out of the way first.

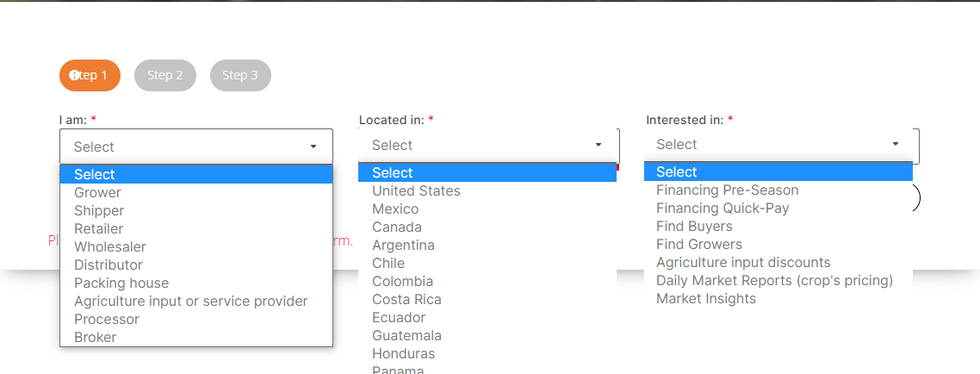

The Los Angeles-based fintech company essentially functions as a digital marketplace for produce that connects farmers to distributors and sellers.

“We go to your farm. We understand what your production capability is. If you need capital to achieve that, we help get that set up for you,” explains CEO Pablo Schwarzbeck. “Ultimately, we help you find the buyers—or for the buyers, help them find the sellers.”

To enable the trade of perishable goods like fruits and vegetables, ProducePay has had to become an underwriter for more than 1,500 farms across the Americas. Those farms can range in size from a few acres all the way up to multinational giants that supply hundreds or thousands of grocery stores. And the only way to figure out who to trust and how to lend money is by getting boots in the dirt. Schwarzbeck, who grew up on a fourth-generation farm in Northwest Mexico, spent nearly 100 days visiting farms during the pandemic last year.

“Do these people know what they're doing? Do they have any experience farming? Do they have the infrastructure to support it? Do they have accountants? Do they have a proper staff of people beyond farming that will ultimately be able to run this like a business? Do they have the partners to buy produce? Do we trust their partners?” asks Schwarzbeck.

ProducePay makes its money by taking a small percentage of each transaction completed on their site. It also lends capital to farmers and distributors it feels will be able to pay it back . And of course they’re also collecting and selling data on the cost and distribution of crops, among other industry insights.

“Our job really is to create transparency and trust that allows both parties to feel comfortable,” says Schwarzbeck.

The amount the company charges per transaction ranges from .5% to 10% and depends on the amount of value that ProducePay can generate for the client.

“We try to take about no more than one out of every four points that we get back,” says Schwarzbeck, meaning if ProducePay can help a farmer sell 40% more produce, it’ll take 10%. If it can only help them sell 2% more, the company takes 0.5%.

This sort of clinical approach to fintech underwriting has remained the core of ProducePay’s strategy since its inception. But this summer the company added a new pillar to their underwriting model: climate pricing.

With consumer demand for sustainably grown, low-carbon foods increasing, ProducePay is adding economic incentives to its platform to encourage farmers to lower their carbon footprint.

Through a partnership with ALLCOT, a company specializing in greenhouse gas emission offsetting, the fintech company is offering a way for farmers to access the carbon market.

Schwarzbeck says that many of the growers he works with were already practicing a variety of sustainable farming techniques. With ProducePay, they can now sell carbon credits on voluntary carbon markets, meaning they get paid to grow more sustainably. The specifics of how this plays out and which carbon markets are used can vary, but the idea is that ProducePay evaluates a farm, establishes how much carbon it’s using, and then recommends Climate-Smart Agriculture practices as outlined by the United Nations. Farmers can then practice strategies like crop rotation, minimum tillage and cover crops usage to reduce their carbon footprint. Once the carbon savings are calculated and confirmed by an external audit, they can be converted into credits and sold.

When used as a way for corporations to buy their way out of causing climate damage, carbon offsets remain dubious for a large variety of legitimate reasons. However, following sustainable farming practices can actually make a difference in the Earth’s carbon budget: Rather than buying a bandage for the damage a company is doing, selling credits incentivize farmers to do less damage to begin with. And Schwarzbeck says with consumer demand for sustainable produce constantly rising, adding the environmental pillar to their underwriting model has fundamentally changed how the company is doing business.

“Consumers are really starting to vote with their wallets,” he says. “That has been such a palpable movement in the market that has literally shifted how we underwrite the farmers right now.”

David Shultz reports on clean technology and electric vehicles, among other industries, for dot.LA. His writing has appeared in The Atlantic, Outside, Nautilus and many other publications.

Image Source: Skyryse

Image Source: Skyryse