Riding the NFT Hype Wave, Curio Sells Digital Collectibles. Credit Accepted.

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

Even Rikin Mantri, whose company launched an NFT exchange on Friday, admits the eye-popping sums being paid for digital artwork, NBA highlights and even Tweets are being fueled by hype.

Mantri, co-founder of Curio, which launched last month, expanded his platform to let fans trade their digital collectibles directly. It will be competing with a bevy of blockchain-backed collectible exchanges including Rarible and OpenSea, which just raised $23 million.

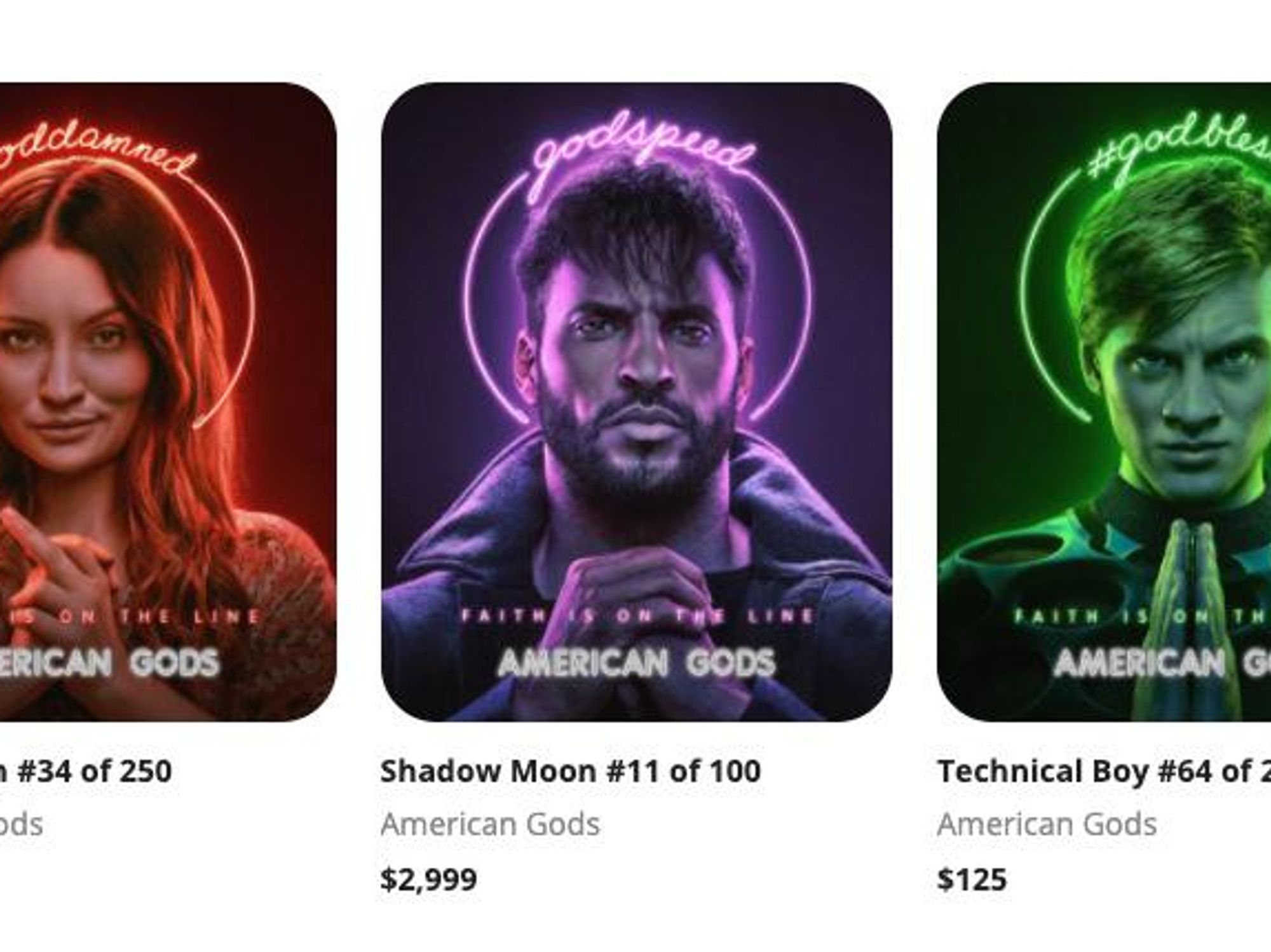

But Curio plans to appeal to the average consumer by targeting dedicated fan bases and partnering with well known entertainment brands. Already, it's struck a deal with Fremantle, which owns the television drama "American Gods" franchise, based on the graphic novel by Neil Gaiman.

"We're definitely seeing a hype cycle," Mantri said. "If you see who's placing the bids, it's based on crypto enthusiasts who've made a lot of money investing early on."

But he still sees a big business in targeting dedicated fans. "We think about (NFTs) as a passport to prove your fandom and also unlock VIP experiences."

So-called "smart contract" technology that underpins NFTs can give the owners of these tokens special access to experiences, like celebrity meet-and-greets.

Mantri thinks most people won't care about the underlying technology of NFTs in the same way they care little about how credit cards work. To appeal to a non-cryptophile audience, Curio accepts payments in normal currency – in contrast to many NFT platforms that require crypto – and also offers a "gallery" feature and enables sharing on social media to allow collectors to "flex" their items.

"Collection is a human condition," Mantri said, noting his old pet rock, trading card and watch collections that have been gathering dust.

Mantri and co-founder Juan Hernandez met in the computer science program at Northwestern University. Hernandez went on to build a blockchain-based financial exchange as founder of OpenFinance Network. Mantri entered the world of entertainment, first at William Morris and later at ABC. Along with Ben Arnon — an early employee at tech startup Wildfire that was later acquired by Google — the two began the company last year to capitalize on their experience across crypto and entertainment. They wanted to ride the tailwind created by NBA TopShot, which first launched in July 2019.

Curio has so far sold 2,350 NFTs connected to seven different American Gods characters. The tokens have been priced between $50 and $100, depending on their rarity, and have in total yielded $130,000 since sales began in late February. Collectors who purchase all seven types unlock one of two bonus items.

Mantri said every NFT "drop" has been sold out within two hours, and some in as little as 90 seconds.

One NFT that was sold originally for $100 later traded for $1,800. Numerous others have traded for six- or seven-times their sales price, Mantri said.

Curio makes its money by taking a percentage from the primary purchase and from any secondary-market trades – which it now enables on its own platform. The intellectual property rights holders receive the remainder.

With Fremantle, Curio is working with its merchandising division, which manages the distribution of earnings to the proper rights holders.

"It's all boats rise; a completely new incremental revenue stream," said Mantri.

The company also plans to offer a service that allows IP owners to create their own NFT platforms.

Earlier this month, Curio announced a $1.2 million raise that it closed in late 2020. It is currently pursuing another round.

Since Hernandez built Curio's platform eight months ago, the company has grown to 12 employees, and plans to expand to 20 next month.

The timing of Curio's future NFT "drops" will largely be determined by its partners' overall marketing strategies – for example, in between show seasons, or to boost one-off content releases.

"It's about fitting into the space in between a fan's experiences," Mantri said.

He thinks these partnerships and a selective strategy of what to offer will help Curio stand out.

"Open Sea and Rarible are more like YouTube and user-generated content; we're more of a Netflix model," Mantri said.

- A TikTok Mansion for Startup Founders - dot.LA ›

- NFTs Could Change the Game for Artists and Creators ›

- 'Owning Things Matters':NFTs Change the Game for Creators - dot.LA ›

- Can Blockchain Technology Revolutionize Health Care? - dot.LA ›

- NFTs Rise, and What's Could Be Coming Next - dot.LA ›

- OneOf Raises $63M for an Artist-Focused, Green NFT Platform - dot.LA ›

- Most Shittiest NFT Aims to Raise Funds for Autism Research - dot.LA ›

- E-commerce Trends in 2021 Here to Stay - dot.LA ›

- Tom Brady’s NFT platform Autograph Raises $170 Million - dot.LA ›

- Ethernity Raises $20M to Build a Celebrity NFT Platform ›

- NFT Gallery With Art By Julie Pacino - dot.LA ›

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

Image Source: Tinder

Image Source: Tinder Image Source: Apple

Image Source: Apple