dot.LA VC Sentiment Survey: Investors See Lots of Deals and Hiring Despite Long Return to Normal

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Welcome to the first edition of the dot.LA VC Sentiment Survey. Every quarter we're going to be surveying the top VCs in Los Angeles. We asked dozens of partners and top level investors who they thought were the hottest companies and best VCs right now and we will be sharing their opinions in the coming days and weeks.

But we first wanted to know how they are feeling about the startup world and the larger economy at the end of the most tumultuous year of our lifetimes.

Our survey found a considerable amount of optimism, especially considering that coronavirus hospitalizations and deaths continue to skyrocket in California and the U.S.

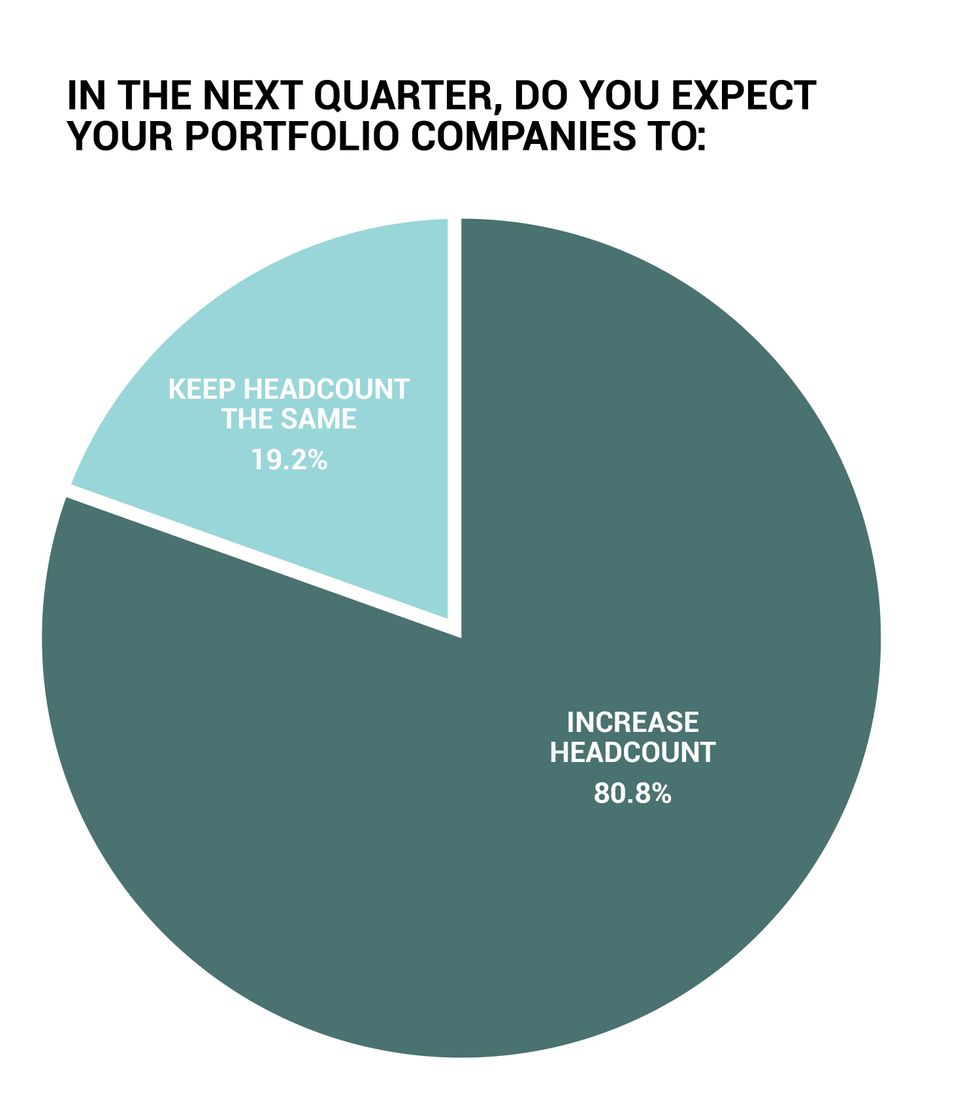

Of the 28 respondents, 82% expected their portfolio companies to hire more staff in the next quarter, with over half saying they had also added employees in the last quarter. None said they had seen reduced staffing or expected to do layoffs in the next quarter.

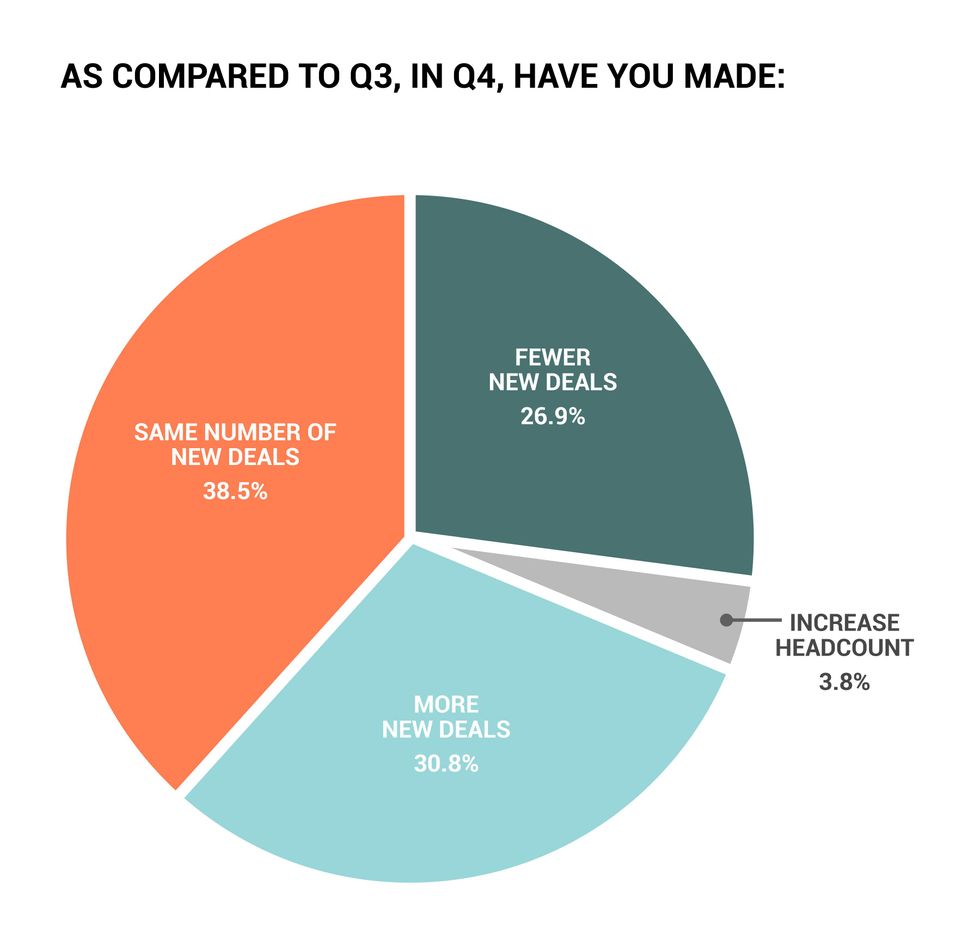

Dealmaking among our cohort remained robust. Slightly under half said they made the same number of deals in the past quarter compared to Q3, while 35% said they made more deals and only 25% said they made fewer deals. Most saw valuations hold steady while 35% saw them go up.

For comparison, when Pitchbook surveyed 102 VC's last month, 51% said they were investing at the same pace as before the pandemic, and only 3.9% said they had significantly pulled back.

It can seem a bit incongruous to see such robust dealmaking amidst a recession, but if we've learned anything this year it's that the pandemic and ailing broader economy has little effect on most tech companies and in many cases has been a benefit by accelerating the shift to digital.

Graphics by Candice Navi

Most of our VCs don't think the U.S. economy will start to recover for another year. A third think the recession will last all the way until the second half of 2022 and even stretch into 2023. That's slightly more pessimistic than a recent survey of economists, which found 73% expect the U.S. economy to recover to pre-pandemic GDP by the second half of 2021.

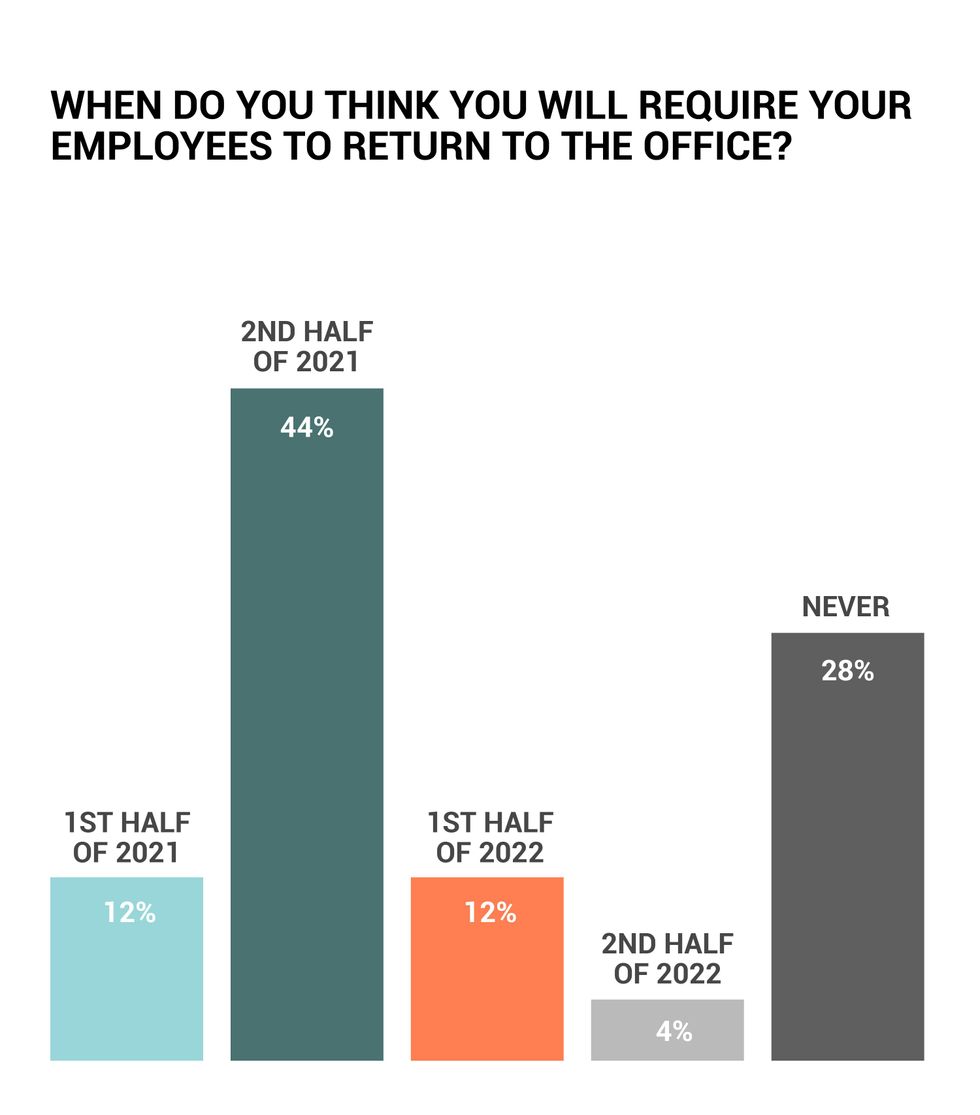

And the pandemic is likely to have lasting impact on the workplace. If you've gotten used to Zoom meetings and yoga pants, do not expect a return to the office anytime soon. Most respondents don't expect to require their employees to go back until the second half of 2021. Notably, a quarter of our VCs do not expect employees to ever go back.

Lead image and graphics by Candice Navi.

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: JetZero

Image Source: JetZero