Get in the KNOW

on LA Startups & Tech

XMeet the 10 Startups in Techstars' 2021 Space Accelerator Class

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

Techstars' Space Accelerator took off this week with its third class of space-related companies that make everything from AI-powered smart cameras to technology that can anticipate celestial collisions.

The 10 startups selected for the competitive four-month program are based across the U.S. and Australia and will work with Techstars on a mostly remote basis.

All are developing technology with multiple uses in space and will receive a $120,000 investment in addition to access to Techstars' expanding network of mentors.

That network includes aerospace experts at the Pasadena-based NASA Jet Propulsion Laboratory. Participating companies include Lockheed Martin, Arrow Electronics, SAIC and Israel Aerospace Industries.

"Alumni from our previous cohorts are launching space systems and infrastructure, raising tens of millions of dollars in venture capital as well as receiving lucrative contracts from both government and commercial customers," said Jonathan Fentzke, the program's managing director.

The program will culminate in a demo day on Sept. 2 where the startups will show off their work in hopes of winning potential investors or clients.

Fentzke noted that while no companies in this year's cohort are based in LA, Techstars still has partners mentors and investors based here.

"As it turns out the four companies in California out of 10 are not based in L.A. today, but will likely have a presence over time," Fentzke told dot.LA.

Here's a look at the 10 companies selected for this year's Techstars Space Accelerator.

Hyperkelp

LOCATION: San Clemente, Ca.

CEO: Graeme Rae

Founded by maritime engineer Dr. Graeme Rae, Hyperkelp is building buoys that aren't your average fishing bobber. Its tech can collect and transmit data about the surrounding ocean and incoming payloads from space. The company says its goal is to create a network of the buoys around the ocean to help aerospace launch companies stream data from anywhere around the world.

Hyperspec.ai

LOCATION: San Francisco, CA. and Tel Aviv, Israel

CEO: Ohad Levi

Hyperspec.ai makes smart cameras that run on artificial intelligence. The company's CEO Sravan Puttagunta previously worked in HP's engineering department. In a nutshell, Hyperspec's cameras are made to create accurate mapping and object tracking in real time, with the goal of being used on self-driving cars and other autonomous vehicles.

Nicslab

LOCATION: Sydney, Australia

CEO: Dr. Andri Mahendra

Nicslab develops technology called the "source measurement system" that uses quantum computing to help organizations optimize their internet speeds and make them faster. Its current clients include the University of Oxford, HP Labs and Mitsubishi Electric.

Pierce Aerospace

LOCATION: Indianapolis, In.

CEO: Aaron Pierce

Pierce Aerospace makes software that helps autonomous drones identify objects and payloads. It argues that this software is critical to the development of the drone industry -- after all, it can be pretty scary if a drone goes rogue because it can't see where it's going. In 2019 the company received a roughly $50,000 grant from the U.S. Department of Defense to continue work on its flagship product, the Flight Portal ID system, which the DoD wants to use on its Unmanned Aircraft Systems.

Pixspan

LOCATION: Rockville, MD.

CEO: Michael Rowny

Pixspan develops a system that lets large files be transferred from different storage locations (like hardware or the cloud) at rapid speeds -- sometimes up to 5 times faster than average, it reports. It's compatible with several app programming interfaces, the main one being Amazon Web Services.

QuSecure

LOCATION: San Mateo, Ca.

CEO: Dave Krauthamer

QuSecure is a security company that focuses on protecting government and corporate systems from hacks. Specifically, its software works to keep encrypted data from being stolen and decrypted by quantum computers, which can steal and read valuable information at rapid speed. Its customers include Google and Amazon.

SCOUT

LOCATION: Alexandria, Va.

CEO: Eric Ingram

Scout -- also known as Scout Space -- develops software that helps spacefaring companies visualize what's going on in the great beyond and avoid casualties, like crashes with other spacecraft, satellites or debris. The company was founded in 2019 and says its name is an acronym for helping Spacecraft Observe and Understand Things around them.

SeaSatellites

LOCATION: San Diego, CA.

CEO: Mike Flanigan

As the name suggests, SeaSatellites is building unmanned vessels that work as satellites for the ocean and have a wide array of potential uses, from environmental data collection to communications. Similar to their skyward counterparts, SeaSatellites' tech can be controlled from anywhere and are designed to carry payloads on long missions.

Xairos

LOCATION: Denver, CO.

CEO: David Mitlyng

This company's name is Greek to us -- literally. A nod to the Greek god of opportune time, Kairos, is an appropriate name for this startup using quantum mechanics to bring GPS-type technology to areas of the globe without internet access.

Thermexit

LOCATION: Boston, MA.

CEO: Katie Willgoos

Thermexit is the only company in this year's Space Accelerator cohort that's led by a woman. CEO Katie Willgoos joined the company in March and helps the company create and sell its main product, Theremexit Pads, which are tiny thermal sensing sticky pads that can be placed on circuit boards and inside computers.

Correction: An earlier version of this post stated this is Techstars' second space accelerator cohort. It's the accelerator's third such class. It also, misnamed the CEO of Hyperspec.ai.

From Your Site Articles

- Techstars Starburst Space Accelerator Demo Day is Wednesday ... ›

- New Techstars Anywhere Accelerator Class has LA Company - dot.LA ›

- Here is Techstars' Starburst Space Accelerator Class - dot.LA ›

- Event: Demo Day For The Long Beach Accelerator's 2nd Cohort - dot.LA ›

- Techstars Gears Up for Its 2021 Los Angeles Startup Showcase - dot.LA ›

- Kairos Ventures’ Alex Andrianopoulos on Investing in Academia - dot.LA ›

- These SoCal Startups Get Ahead of the Game Via Comcast’s Sports Tech Accelerator - dot.LA ›

- Long Beach Accelerator Set to Welcome Fourth Group of New Companies - dot.LA ›

- NASA’s Space Accelerator Program Lifts Off - dot.LA ›

Related Articles Around the Web

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

https://twitter.com/samsonamore

samsonamore@dot.la

'These Things Happen Too Often': How an Encounter with Police Launched an App to Hold Cops Accountable

06:47 AM | April 30, 2021

Photo by James Eades on Unsplash

Tony Rice II was just a 17-year-old kid living in the Dallas-Fort Worth area when an officer approached his car with his gun drawn, saying he suspected the car was stolen.

"He pulled me over, came up to my car, and actually pulled a gun on me," said Rice. In the end, the officer still gave Rice a traffic ticket. It was only later he said he discovered there had been no corresponding reports of a stolen vehicle.

Rice and his family never filed a complaint about the interaction. "I think we were all just glad that it didn't result in a fatal encounter," said Rice, now 36, whose father grew up in the segregated South and whose mother is an immigrant from Haiti. "Unfortunately in my community, these things happen too often."

Unarmed founder Tony Rice II

Systemic racism was something that Rice couldn't avoid over the next two decades, even as he was building his career at Google and Deloitte and eventually with his own consulting firm, which helped cities launch tech projects with vendors such as Oracle. He said he was "just not sure how I could help address it."

Then, in 2020, George Floyd and Breonna Taylor were killed by police. It dawned on Rice that he could leverage his personal and professional experience to address police violence in a meaningful way. "Knowing that could have been me," he said, "I thought I was uniquely positioned to create a technology project that could potentially help resolve this disparity."

He began developing Unarmed, an online platform that allows city government agencies to easily gather and manage civilian feedback about law enforcement, including cases involving use of force. The public often doesn't know that they can give feedback about police, he said, and even when they do, they don't know how to do so. He hopes streamlining the process will increase both access and awareness about these options.

So far, Rice has self-funded the company, and he plans to hold a family-and-friends funding round at the end of the second quarter. Though the launch of the completed product is slated for the end of this year, Rice points out that its major functionality is already finalized. "We could deploy tomorrow," he said, adding that the platform can be implemented quickly because it can be installed remotely rather than onsite.

Mock-up videos on the Unarmed website show a streamlined online platform where a user can select to file a "complaint" or a "compliment." Subsequent pages give civilians the option to either provide personal information or file anonymously, and to provide information about the incident, officers involved, details about witnesses and any photo or video evidence. Cases are submitted to a city's oversight officers and labeled with a tracking number, which allows users to check for updates.

Unarmed might seem like an obvious solution, but in many cities there are relatively few avenues for civilians to file complaints about police. While some cities have robust citizen complaint review boards (also known as civilian oversight agencies) that are external to police, most police departments log and review complaints internally.

Even though some departments have "very independent complaint review processes," said Jack Glaser, an expert on policing and racial justice at UC Berkeley's Goldman School of Public Policy, "it is very difficult to get a complaint 'sustained.'" Sustainment occurs when a complaint is found to be supported by sufficient factual evidence and deemed a policy violation. He said complaints about racial profiling in particular are almost never sustained.

Worse yet, Rice has found that while a few cities offer fillable PDFs or forms that can be printed out and submitted, many do not offer any online options and instead require civilians to manually log complaints at the police department, "which is obviously counterintuitive," he said. Further, he notes, many of these services are offered only in English and Spanish, excluding Americans who primarily speak different languages.

Designed with access in mind, Unarmed is geared toward cities that have stated their commitment to police reform. As the Black Lives Matter movement continues to gain traction, the number of such places appears to be growing. Last July in Kansas City, Mayor Quinton Lucas and city council members called on the police to provide data in order to create a publicly available use-of-force database. This still hasn't materialized, however, and the city's police chief is currently under fire for failing to deliver on these demands. With Unarmed, willing cities can organize and manage such databases so that they're positioned to have the biggest impact on police reform.

The platform isn't just for citizens; Rice said it can also be useful for police departments because it allows them to log and organize data that they are legally required to report. For instance, in Los Angeles, where Rice is based, police must submit race- and identity-related details of every person that an officer detains or searches — known as "stop" data — to the California attorney general every year. "There's a checklist of different items you need to include," said Rice, "so even including that also makes it more enticing to police departments." Currently, the Callifornia government recommends police use notebooks, mobile data terminals or mobile digital computers for this data collection but doesn't provide any tools.

Rice is "hopeful" that both cities and police departments will show interest in his product. "All I can do is do the outreach, and try to show the problems that exist today and the benefits of being on the platform," he said.

Cameron McEllhiney, director of training and education at the National Association for Civilian Oversight of Law Enforcement, notes a major obstacle to Rice's project: Many cities have limitations regarding the investigation of third-party complaints, an issue that platforms similar to Unarmed have faced in the past. Nevertheless, she adds, "the adoption and implementation of effective, sustainable civilian oversight mechanisms is what we should be striving for."

Glaser sees promise in Unarmed, noting that "anything that standardizes and streamlines these processes will be a step in the right direction." But the real challenge will be ensuring that civilian feedback is registered and meaningfully adjudicated. "It's one thing to collect, categorize and store this information; it's another, and harder, thing to act on it," he said.

Optimistic about the future of Unarmed, Rice is likewise encouraged by the ongoing conversations about diversity in tech, which has led many companies to hire more diverse workers. "There's not a lot of us," he said. "I think it's not only about funding Black founders but Black founders that are making an impact, that can drastically impact people's lives."

Read moreShow less

Yasmin Tayag

Yasmin Tayag is a science editor and writer. She was previously the lead editor of the Medium Coronavirus Blog and founding editor of Future Human, a publication about science and the future. She was also a senior editor at the health website Elemental and the tech website OneZero. Before that, she was the senior science editor at Inverse. She is most interested in biology, health, the future of food, and the intersection of science with racial and social justice.

https://twitter.com/yeahyeahyasmin

Watch: Exploring Relativity Space With Tim Ellis and Spencer Rascoff

05:00 PM | April 28, 2020

dot.LA Co-founder and Executive Chairman Spencer Rascoff speaks with Relativity Space Co-Founder and CEO Tim Ellis about 3D printing in manufacturing, going to Mars, and the future of the new space race in the latest Strategy Session.

Strategy Session: Exploring Relativity Space With Tim Ellis and Spencer Rascoffwww.youtube.com

Tim Ellis

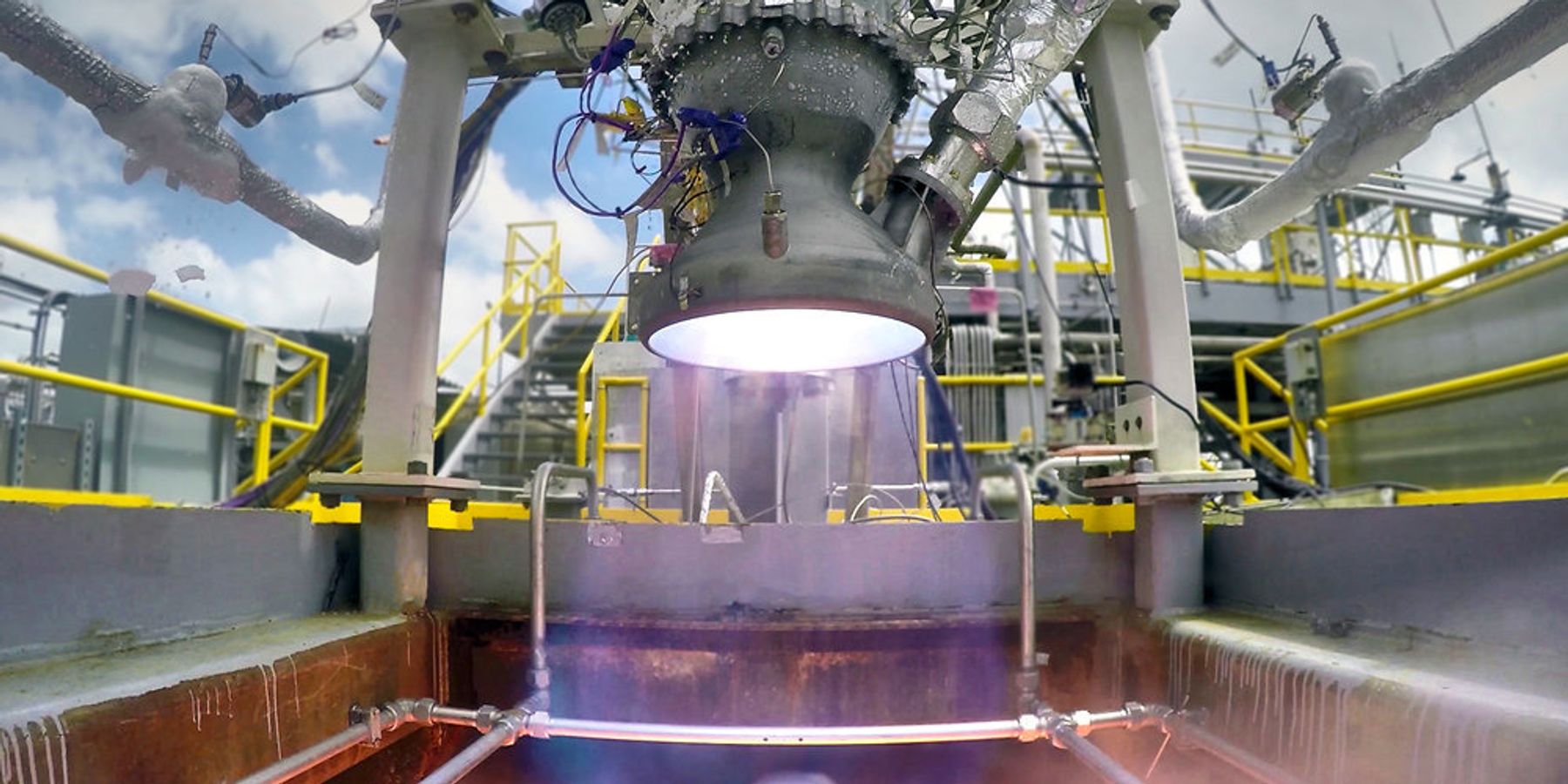

Tim Ellis is the co-founder and CEO of Relativity, the first autonomous factory and launch service for rockets. Relativity recently created the largest robotic metal 3D printer in the world and has tested our entirely 3D printed Aeon rocket engine over 180 times. Previously responsible for bringing metal 3D printing into Jeff Bezos' Blue Origin, and a propulsion development engineer on Crew Capsule RCS thrusters, BE-4, and New Glenn. Alumni of USC and played a leadership role in launching the first student designed and built rocket into near space. Testified to the US Senate on commercial space policy and is the youngest member on the National Space Council UAG by nearly 2 decades, and directly advises the United States White House on all space policy. Has spoken at numerous conferences including CBInsights Aha! and TEDx. Relativity is backed by Playground Global, Social Capital, Y Combinator, Mark Cuban, USC, and Stanford.

Spencer Rascoff

Spencer Rascoff is an entrepreneur and company leader who co-founded Zillow, Hotwire and dot.LA, and who served as Zillow's CEO for a decade. He is currently executive chairman of dot.LA and a board member at TripAdvisor. In the fall of 2019 Spencer was a Visiting Executive Professor at Harvard Business School where he co-taught the "Managing Tech Ventures" course. In 2015, Spencer co-wrote and published his first book, the New York Times' Best Seller "Zillow Talk: Rewriting the Rules of Real Estate." Spencer is the host of "Office Hours," a monthly podcast on dot.LA featuring candid conversations between prominent executives on leadership, diversity and inclusion, and startups.

From Your Site Articles

- Long Beach is Becoming Home to the Aerospace Industry Once ... ›

- Relativity Space CEO: 20K Satellites Will Launch in the Next Five ... ›

- relativity-space - dot.LA ›

- Relativity Space CEO Tim Ellis On 3-D Printing Rockets - dot.LA ›

- Relativity Space Will Have a Launch Site in California - dot.LA ›

- Relativity Space Co-Founder Jordan Noone Steps Down, Hints at 'Next Venture' - dot.LA ›

- Relativity Space Soars, Lands $500M Investment - dot.LA ›

- Relativity Space to Launch 3-D Rocket Mission with TriSept - dot.LA ›

- Relativity Space Is Planning a Reusable Rocket - dot.LA ›

- Relativity Space Scores Department of Defense Contract - dot.LA ›

Related Articles Around the Web

Read moreShow less

Annie Burford

Annie Burford is dot.LA's director of events. She's an event marketing pro with over ten years of experience producing innovative corporate events, activations and summits for tech startups to Fortune 500 companies. Annie has produced over 200 programs in Los Angeles, San Francisco and New York City working most recently for a China-based investment bank heading the CEC Capital Tech & Media Summit, formally the Siemer Summit.

http://www.linkedin.com/in/annieburford

annie@dot.la

RELATEDTRENDING

LA TECH JOBS