How a Scrappy Startup Is Using the Pandemic to Take on a Big Competitor in the Valley

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Los Angeles in general — and the San Fernando Valley specifically — are not exactly known for being hotbeds of enterprise software competition, but two of the world's leading providers of a niche type of accounting software are duking it out for market share and the competition is escalating during the coronavirus pandemic.

One is a startup that has raised $90 million in venture funding and the other is a publicly traded corporation with a market capitalization of $3.4 billion. Their headquarters are about five miles apart, the incumbent in Woodland Hills and the startup in Sherman Oaks.

"This is nuts to me," said Mike Whitmire, co-founder and CEO of FloQast. "It's the weirdest battle that you would never expect L.A. to have, with just the 405 between us."

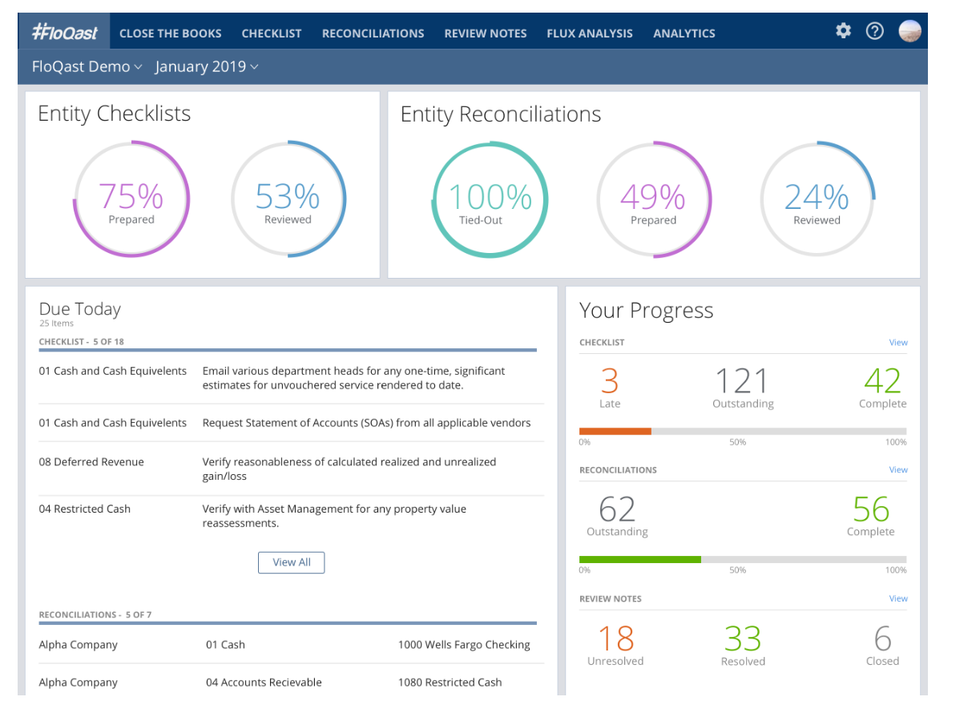

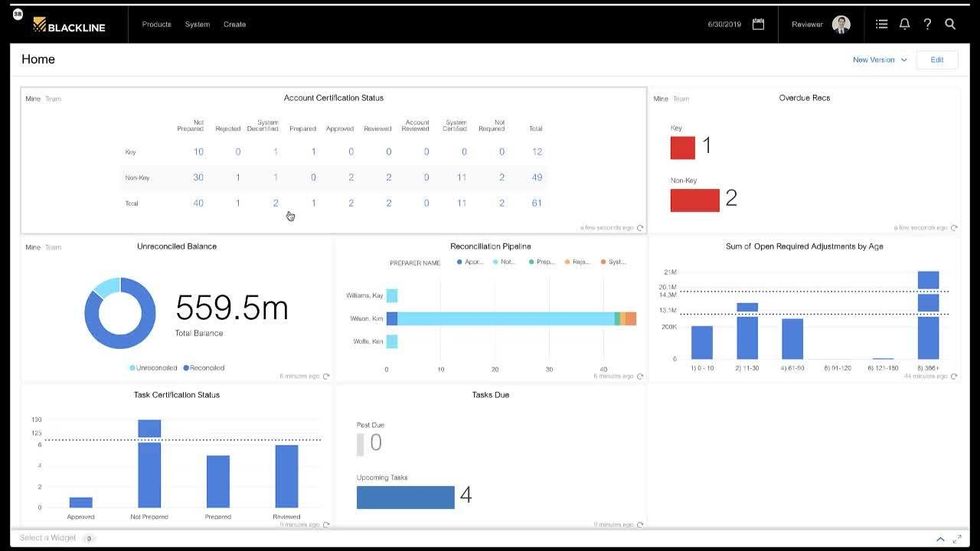

FloQast, with 150 employees, closed a $40 million Series C round led by Norwest Venture Partners earlier this year at a $250 million valuation, according to Pitchbook. It is trying to nip away market share from Blackline, which was founded in 2001, and has 1,005 employees. They compete in an esoteric realm only accountants would know about: close management software. It helps companies automate the normally tedious process of closing their books every month to be able to generate more timely and accurate financial statements.

Blackline declined to make anyone available for this story.

While many companies are hunkering down just trying to make it through to the other side of the pandemic, FloQast is using the crisis as an opportunity to raise the stakes against Blackline. Starting Wednesday, FloQast is giving the implementation of its software away for free to any Blackline customer through July, promising that once they sample FloQast they will never go back to Blackline.

"It's definitely an opportunity that has presented itself because of COVID-19," said Whitmire. "During good times people are happy to reimplement and will spend more money. Now that budgets are getting tighter people are looking more closely at what better options are being deployed."

Whitmire started FloQast in 2015 with $50,000 in pre-seed funding from the Amplify.LA accelerator after seeing the limitations of accounting software when he was an early employee at Cornerstone OnDemand, joining a year before it went public in 2011. He spoke to dot.LA this week on Zoom call with a virtual background of Kirk Gibson celebrating after his famous walk-off homerun the last time the Los Angeles Dodgers won the World Series in 1988. Whitmire loves sports and relishes playing a scrappy David to Blackline's slow-footed Goliath.

"I'm super competitive," he said. "We poach clients from them, we've taken 25 to date."

FloQast has had considerable success selling its services to sports teams, who he says often have relatively complicated accounting practices. An early contract with the Golden State Warriors led to deals with the Los Angeles Lakers, Boston Celtics, Milwaukee Bucks, Washington Wizards, San Francisco 49ers, Philadelphia Eagles, and Chicago Cubs.

The company also has deals with around 900 other companies, including well-known names like Zoom, Yelp, Zillow, Grubhub, and Lyft.

FloQast charges anywhere from $10,000 to $100,000 a year for a subscription, not an insignificant amount for companies trying to trim expenses in an uncertain environment. Whitmire makes the argument that his software saves substantial amounts of money in the long run. If that is not enough of a selling point, he is willing to offer struggling clients discounts or deferred payment until the crisis is over, which he says he can afford to do thanks to January's $40 million cash infusion.

"At times like these you need to be accommodating," said Whitmire. "We're in a position to do that. If a client needs a break in their billing, we can make that happen because of our balance sheet."

Of course, Blackline has a much bigger balance sheet, with $607 million cash on hand at the end of last year, but if Whitmire is nervous about so aggressively taking on such a bigger foe, he does not show it.

"It's been a lot of fun competing with them." said Whitmire. "They have a bullseye on us internally and I don't expect much to change."

Whitmire hopes that the competitor across the 405 will decide to set its sights more on big companies who employ hundreds or even thousands of accountants. "We are good at mid market," he said. "They are good at enterprise. They have bigger fish to fry."

- Startups - dot.LA ›

- FloQast Takes on Close Management Software Firm Blackline - dot.LA ›

- Cornerstone OnDemand's CEO Adam Miller Steps Down - dot.LA ›

- FloQast Raises a $110M Series D and Becomes a Unicorn - dot.LA ›

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Northwood Space

Image Source: Northwood Space

Image Source: JetZero

Image Source: JetZero