Subscribe for free to finish this article!

Join tens of thousands of other founders, investors, and operators who subscribe to dot.LA for the most important tech news in their inbox 2x a week.

Get access to

Get in the KNOW

on LA Startups & Tech

XJoin tens of thousands of other founders, investors, and operators who subscribe to dot.LA for the most important tech news in their inbox 2x a week.

Get access to

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

Apparently unshaken by the ongoing pandemic, the venture capital world plowed unprecedented amounts of money into startups in 2021, shattering plenty of records in the process.

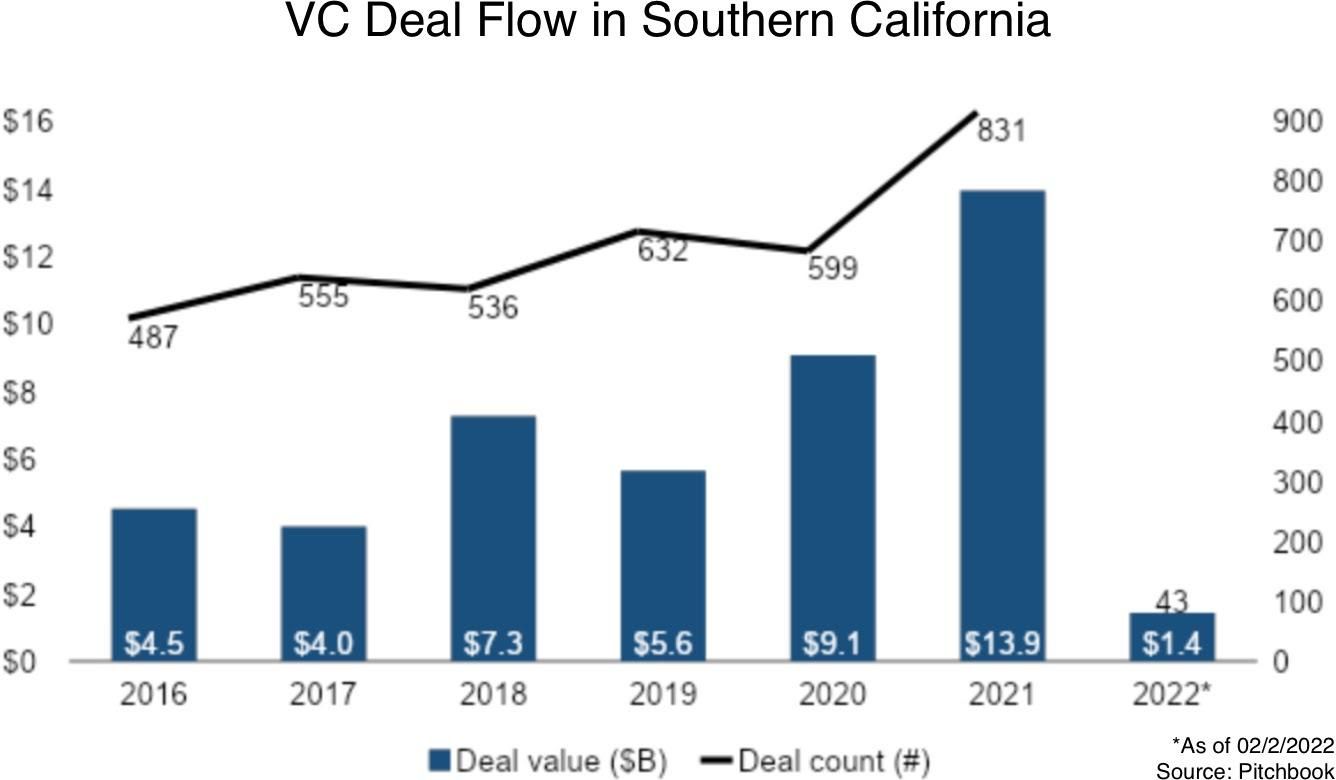

Southern California was no exception, with last year proving a major growth period for startups and venture investors alike throughout the region, according to data provided to dot.LA by PitchBook. In 2021, SoCal ventures raised nearly $14 billion across more than 800 deals, while VC exits also soared. (PitchBook’s definition of Southern California covers the following counties: Imperial, Kern, Los Angeles, Orange, Riverside, San Bernardino, San Diego, San Luis Obispo, Santa Barbara and Ventura. Curiously, it excludes select municipalities including Long Beach, Santa Ana, Irvine, Glendale and Pasadena, which are not factored in these statistics.)

Here are some key takeaways from what was a historic year for Southern California’s ever-growing startup environment—including one metric in which the region actually lagged behind the rest of the nation.

Southern California startups closed a record 831 venture deals in 2021. That was up nearly 39% from the previous year, and represented the single-biggest jump in the region’s deal count since at least 2016 (the earliest year for which PitchBook provided regional funding data).

The growth rate mirrored a national pattern: Last year, the U.S. saw about 40% more venture capital deals than in 2020, according to a joint report from PitchBook and the National Venture Capital Association.

SoCal’s 2021 deal spike was a strong rebound after a down year in 2020, when the region’s total deal count slipped 5.2% (to 599, from 632 in 2019).

Venture capitalists poured a record $13.9 billion into Southern California businesses in 2021, representing a 52.7% increase from $9.1 billion in 2020.

While the region’s total deal value hit an all-time high, the growth rate of venture capital dollars flowing to companies actually slowed down from the previous year, when SoCal’s total deal value climbed by 62.5% between 2019 and 2020.

Southern California’s rate of venture funding growth also lagged behind the national trend. VC-backed companies in the U.S. raised an eye-watering $329.6 billion in 2021, up nearly 98% from the prior year.

In that light, what was a spectacular year for SoCal’s venture scene was relatively unremarkable by national standards. The trend speaks to the sheer volume of cash that VCs across the U.S. are deploying lately.

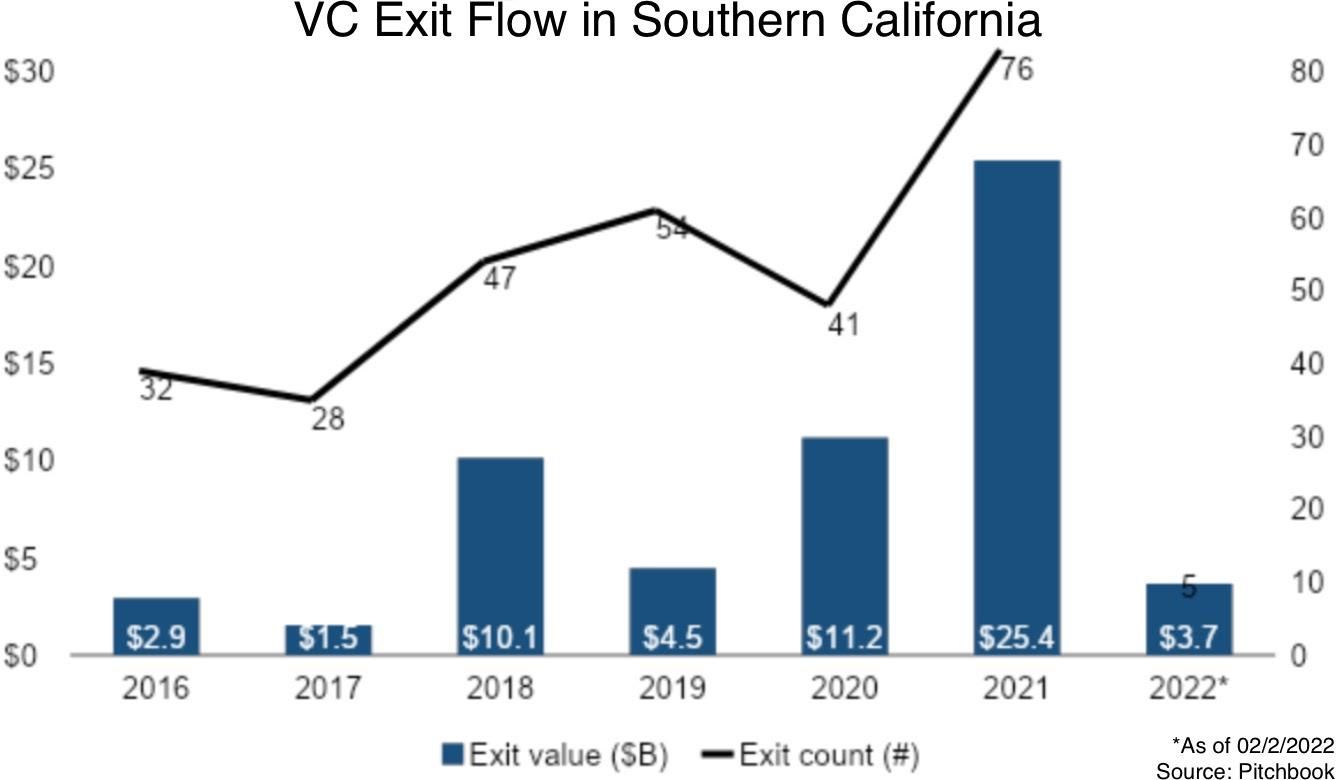

A record amount of capital flowed back to investors in 2021 thanks to a flurry of acquisitions, SPAC mergers and IPOs.

PitchBook recorded 76 venture-backed company exits in Southern California last year, up 85% from 41 in 2020. More impressively, the value of those exits more than doubled between 2020 and 2021—climbing to $25.4 billion, from $11.2 billion the previous year.

It’s early days, but so far 2022 is on track to eclipse last year’s exit total; PitchBook has already tracked $3.7 billion worth of SoCal exits between January 1 and February 2 of this year.

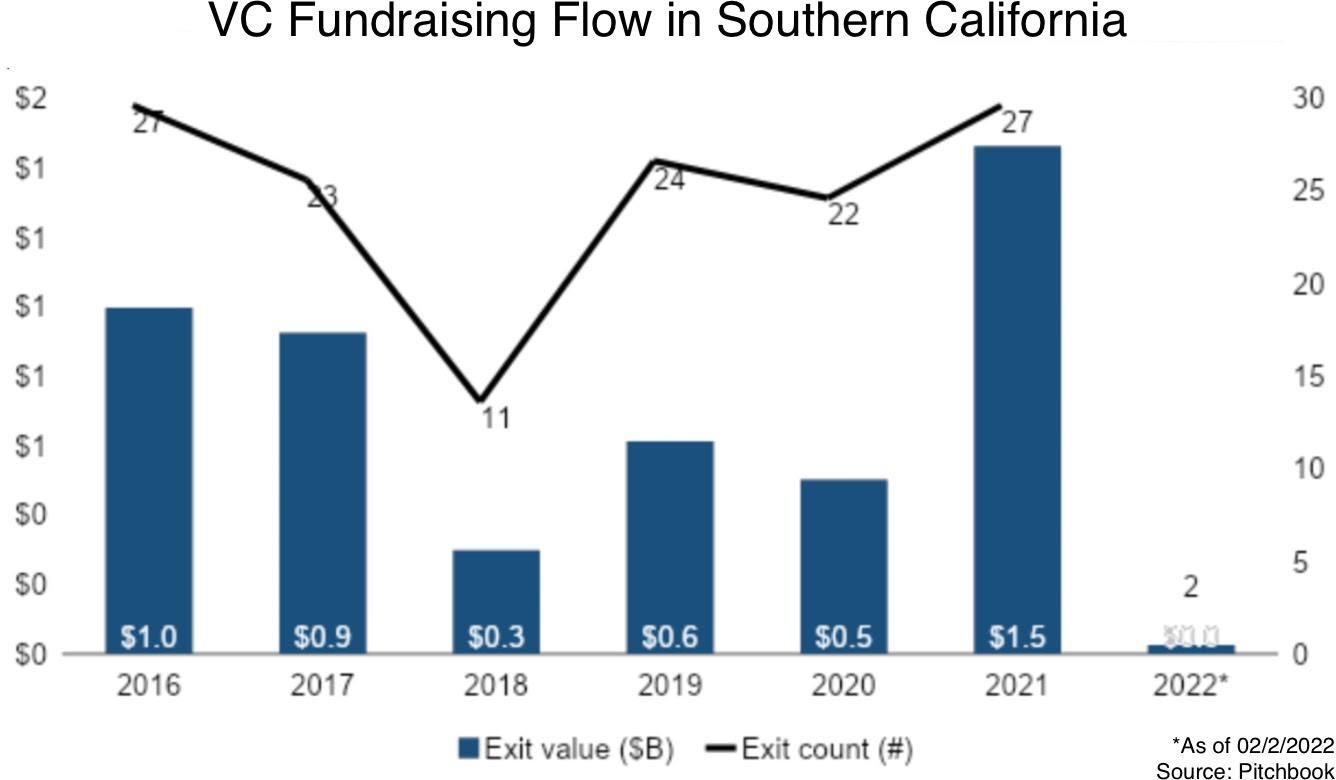

While Southern California startups lured investors from around the world, venture capital firms based here had a bumper 2021, as well: SoCal-based VCs raised an unprecedented $1.5 billion across 27 separate funds last year, per Pitchbook data.

While the 27 funds were on par for the region, the $1.5 billion figure tripled the amount raised in the previous year—indicating that SoCal venture capitalists raised atypically large funds to funnel into startups both within and beyond the region.

While Southern California startups secured more capital than ever from investors last year, individual deals from previous years still overshadowed the region’s largest raises of 2021.

Among the top 10 deals involving VC-backed SoCal companies since 2016, only two from 2021 made it onto the leaderboard: a $420 million raise announced by L.A.-based accelerator Black Unicorn Factory, and a $400 million round by San Diego-based project management software developer ClickUp. Otherwise, deals in recent years involving the likes of Faraday Future, Quibi and CloudKitchens still lead the pack.

Update, Feb. 14: This article has been updated to specify the areas in Southern California that PitchBook includes in its statistics.

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

According to a Forbes report last April, both the viewership and dollars behind women’s sports at a collegiate and professional level are growing.

In 2022, the first 32 games of the NCAA tournament had record attendance levels, breaking records set back in 2004, and largely driven by the new and rapidly growing women’s NCAA tournament. WNBA openers this year saw a 21% spike in attendance, with some teams including the LA Sparks reporting triple-digit ticket sales growth, about 121% over 2022’s total. In 2023, the average size of an LA Sparks crowd swelled to 10,396 people, up from 4,701 people.

Women make up half the population, but “also 50% of the folks that are walking into the stadium at Dodger Stadium, or your NFL fans are just about 50% women,” noted Erin Storck, a panelist and senior analyst at Los Angeles-based Elysian Park Ventures.

Storck added that in heterosexual households, women generally manage most of the family’s money, giving them huge purchasing power, a potential advantage for female-run leagues. “There's an untapped revenue opportunity,” she noted.

In the soccer world, Los Angeles-based women’s soccer team Angel City FC has put in the work to become a household name, not just in LA County but across the nation. At an LA Tech Week panel hosted by Athlete Strategies about investing in sports, Angel City head of strategy and chief of staff Kari Fleischauer said that years before launching the women’s National Women’s Soccer League team, Angel City FC was pounding the pavement letting people know about the excitement ladies soccer can bring. She noted community is key, and that fostering a sense of engagement and safety at the team’s home venue, BMO stadium (formerly Banc of California Stadium), is one reason fans keep coming back.

Adding free metro rides to BMO stadium and private rooms for nursing fans to breastfeed or fans on the spectrum to avoid sensory overload, were just some of the ways ACFC tried to include its community in the concept of its stadium, Fleischauer said. She noted, though, that roughly 46% of Angel City fans are “straight white dudes hanging out with their bros.”

“Particularly [on] the woman's side, I'd like to think we do a better job of making sure that there's spaces for everyone,” Fleischauer told the audience. “One thing we realize is accessibility is a huge thing.”

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

L.A. Tech Week has brought venture capitalists, founders and entrepreneurs from around the world to the California coast. With so many tech nerds in one place, it's easy to laugh, joke and reminisce about the future of tech in SoCal.

Here's what people are saying about the fifth day of L.A. Tech Week on social:

#LATechWeek has been on 🔥🔥🔥. Yes the events are super cool at amazing venues. But, I’m blown away by the people. I’ve met so many founders building generative AI companies from the ground up. I’m so bullish on LA right now🥳. LA is for builders #longLA

Thanks @rpnickson 📸 pic.twitter.com/B6rT2jJYIs

— Dr. Kelly O'Brien (@Kvo2013) June 8, 2023

Successful LatinxVC Avanza Summit 2023 in LA! It’s been an amazing few days near the beach w great company. Thank you to our panelists & participants.

Huge thanks to our incredible sponsors SVB, Chavez Family Foundation, Annenberg Foundation, PledgeLA, Fenwick & West, Countsy! pic.twitter.com/oVuGIgFurk

— LatinxVC (@LatinxVCs) June 9, 2023

30+ gaming startups presented at the A16z Speedrun Demo Day in LA yesterday. Great thanks to the @a16zGames team for an awesome day of events! #LATechWeek pic.twitter.com/DKq8IFo5QZ

— Grace Zhou (@graceminzhou) June 9, 2023

📣🤩 What’s the buzz? It’s #LATechWeek from @TechstarsLA & @TechstarsHealth joint demo day with the #Techstar HC team where our @fyelabs founder/CEO Suvojit Ghosh mentored both cohorts! #TechStars demo day highlighted 12 amazing emerging #startups in #healthtech #innovation. 🩺 pic.twitter.com/0RXClCtfDQ

— FYELABS (@fyelabs) June 9, 2023

Another successful Coffee On Slauson in the books for #LATechWeek.

Special thanks to the good people at Pledge LA, SVB and @GundersonLaw for the ongoing support and the @findyourhilltop staff for providing the space, eats & vibes. ♻️ pic.twitter.com/51cMDoEn30

— Slauson & Co. (@SlausonAndCo) June 9, 2023

The perfect combo to start #LATechWeek Day 5: pastries, coffee, and great convos with industry founders ✨

Fireside chats with @enriquealle, @wp, and @robynpark pic.twitter.com/booYPdekVV

— Tech Week (@Techweek_) June 9, 2023

Of course @designerfund has the most amazing pastries at their event. #LATechWeek pic.twitter.com/PjyWlGTQI4

— Jesse Pickard (@jessepickard) June 9, 2023

My favorite event from @Techweek_ has to be "Modern Storytelling & Business Building." Hosted by @STHoward #LATechWeek pic.twitter.com/SV1eexMJ4k

— JonnyZeller (@JonnyZeller) June 9, 2023

And the finale of the night was courtesy of the one and only @zedd for an unforgettable end to the "City of Games" party! Hosted by @a16zGames and @100Thieves #LATechWeek pic.twitter.com/hliI9yLKse

— Tech Week (@Techweek_) June 9, 2023

Excited to be at the @a16zGames Speedrun Demo Day! Loved the energy and excitement from the companies that pitched there. It was also great to see @Tocelot and @ndrewlee at this amazing #LATechWeek event pic.twitter.com/NfLQO5lR27

— Andy Lee | andypwlee.bit (@andypwlee) June 9, 2023

Thank you to everyone who joined the Sony Venture Fund US team at #LATechWeek for our screening of Spider-Man: Across the Spider-Verse. Last summer, we started building a presence in LA. Today, it's exciting to host such an event with the @Sony family and the LA VC community. pic.twitter.com/wdDm6qtHdL

— Sony Innovation Fund (@Sony_Innov_Fund) June 9, 2023

Time to eat, connect and build while @remi_rodney provided the vibes. 🙏🏽#LATechWeek @BuildOnBase @developer_dao @WeAreRazorfish pic.twitter.com/QIPh1gjvoA

— Hola Metaverso-Blockchain & New Web Tech Events 🎪 (@holametaverso) June 9, 2023

@Lux_Capital at #LATechWeek advancing the impossible to inevitable, from..

..defense primes partnering with cutting edge defense tech startups, to..

..hardware x LLMs improving mental health.

From the rich and diverse LA ecosystem stems generational companies: pic.twitter.com/v5S5r8JtbU

— Shahin Farshchi (@Farshchi) June 9, 2023

LA Tech Week has been a blast! Met some amazing creators, founders and investors from all over the world! #LATechWeek pic.twitter.com/AAh9JFELhe

— Chris Germano (@netslayer) June 9, 2023

Had such a blast at LA Tech Week and hosting events for @brexHQ

Top highlights were collabing with @pulley on an Emerging Managers / Founder mixer at the @poplco House, rooftop event in Venice, creator panel with @thechangj & proper Korean food with in KTown.

Exhausted is an… pic.twitter.com/mGQnSYGPdg

— Τyler Robinson (@TyyRob3) June 9, 2023

Did you have fun at @sophiaamoruso’s launch party for @trustfundvc? #LATechWeek pic.twitter.com/gbrbXRQ9Xx

— Kay (@KaySnels) June 9, 2023

y00tilty in every city with @KaylaLor3n & @cryptochrisg813.

Welcome to the LA @y00tsNFT fam! #LATechWeek #3XP week. pic.twitter.com/6wWKlsTacx

— VanG0xH (@CryptoVanGoghs) June 9, 2023

Really enjoyed #LATechWeek. Here are some observations I made 👇

— s.personal.ai (Suman Kanuganti) (@SumanPersonalAI) June 9, 2023

Thank you @TheKofiAmpadu for including me in #demoday with the latest @a16ztxo cohort! It was a real full circle moment to witness the brilliance of both @ChrisLyons & @ZMuse_ & #PledgeLA very own. She’s why we’re #LongLA 🚀💕 #LAtechweek pic.twitter.com/itkKXMxQRb

— Qiana Qiana! (@Q_i_a_n_a) June 9, 2023

@upfrontvc Gaming Founders Podcast #iLOVELA #LATechWeek @Techweek_ @KatiaAmeri @mucker @fikavc @bonfire_vc @TenOne10 @WatertowerGroup @ganasvc @IAmRobRyan @john_at_stonks @eva_ho @dereknorton pic.twitter.com/LCbaGXCoW7

— Sean Goldfaden (@seangoldfaden) June 9, 2023

Hosts Kevin Zhang, Partner at @upfrontvc, and Eden Chen, CEO of @pragmaplatform, interviewed two special guests from @raidbaseinc Stephen Lim, Co-Founder & Product Director, and Trevor Romleski, Co-Founder & Game Director. 🎙 #LATechWeek pic.twitter.com/hxHEAoELZ6

— Tech Week (@Techweek_) June 9, 2023

Kicking off @a16zGames @100Thieves City of Games party at #LATechWeek 🔥🔥🔥 pic.twitter.com/zQcZedG15f

— Jon Lai (@Tocelot) June 9, 2023

Yesterday at @socinnovation I got to have this AWESOME conversation with @iamwill — musician, producer, technology entrepreneur, and Founder & CEO of https://t.co/D60y1e2JOu #LATechWeek pic.twitter.com/KBxK6rXyTG

— Anna Barber (@annawbarber) June 9, 2023

I absolutely love this game. Proud moment for the team @investwithatlas. #LATechWeek pic.twitter.com/fPZvKXU7TC

— Tobias Francis (@TobiasFrancis) June 9, 2023

Had a blast at LA Tech Week this year with @brexHQ

From hosting & moderating my first creator panel featuring @BlakeMichael14, to a fun rooftop night in Venice, and to attending some amazing events such as Watertower’s emerging manager panel and a VC/founder tennis tournament pic.twitter.com/udjfmLHE0L

— Jonathan Chang (@thechangj) June 8, 2023

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

At Lowercarbon Capital’s LA Tech Week event Thursday, the synergy between the region’s aerospace industry and greentech startups was clear.

The event sponsored by Lowercarbon, Climate Draft (and the defunct Silicon Valley Bank’s Climate Technology & Sustainability team) brought together a handful of local startups in Hawthorne not far from LAX, and many of the companies shared DNA with arguably the region’s most famous tech resident: SpaceX.

Here’s a look at the greentech startups that pitched during the Tech Week event, and how they think what they’re building could help solve the climate crisis.

Arbor: Based in El Segundo, this year-old startup is working to convert organic waste into energy and fresh water. At the same time, it also uses biomass carbon removal and storage to remove carbon from the atmosphere and sequester it in an attempt to avoid further damaging the earth’s ozone layer. At the Tech Week event Thursday, Arbor CEO Brad Hartwig told a stunned crowd that Arbor aims to remove about five billion tons of organic waste from landfills and turn that into about 6 PWh, or a quarter of the global electricity need, each year. Hartwig is an alumni of SpaceX; he was a manufacturing engineer on the Crew Dragon engines from 2016-2018 and later a flight test engineer at Kitty Hawk.

Antora: Sunnyvale-based Antora Energy was founded in 2017, making it one of the oldest companies on the pitching block during the event. Backed by investors including the National Science Foundation and Los Angeles-based Overture VC, Antora has raised roughly $57 million to date, most recently a $50 million round last February. Chief operating officer Justin Briggs said Antora’s goal is to modernize and popularize thermal energy storage using ultra-hot carbon. Massive heated carbon blocks can give off thermal energy, which Antora’s proprietary batteries then absorb and store as energy. It’s an ambitious goal, but one the world needs at scale to green its energy footprint. According to Briggs, “the biggest challenge is how can we turn back variable intermittent renewable electricity into something that's reliable and on demand, so we can use it to provide energy to everything we need.”

Arc: Hosting the panel was Arc, an electric boating company that’s gained surprising momentum, moving from design to delivering its first e-boats in just two years of existence. Founded in 2021, the company’s already 70 employees strong and has already sold some of its first e-boats to customers willing to pay the luxury price tag, CTO Ryan Cook said Thursday. Cook said that to meet the power needs of a battery-powered speedboat, the Arc team designed the vehicle around the battery pack with the goal of it being competitive with gas boats when compared to range and cost of gas. But on the pricing side, it’s not cheap. Arc’s flagship vessel, the Arc One is expected to cost roughly $300,000. During the panel, Cook compared the boat to being “like an early Tesla Roadster.” To date Arc Boats has raised just over $35 million, according to PitchBook, from investors including Kevin Durant, Will Smith and Sean “Diddy” Combs.

Clarity Technology: Carbon removal startup Clarity is based in LA and was founded by Yale graduate and CEO Glen Meyerowitz last year. Clarity is working to make “gigaton solutions for gigaton problems.” Their aim? To remove up to 2,000 billion pounds of carbon from the atmosphere through direct air capture, a process which uses massive fans to move chemicals that capture CO2. But the challenge, Meyerowitz noted in his speech, is doing this at scale in a way that makes an actual dent in the planet’s emissions while also efficiently using the electricity needed to do so. Meyerowitz spent nearly five years working as an engineer for SpaceX in Texas, and added he’s looking to transfer those learnings into Clarity.

Parallel Systems: Based in Downtown LA’s Arts District, this startup is building zero-emission rail vehicles that are capable of long-haul journeys otherwise done by a trucking company. The estimated $700 billion trucking industry, Parallel Systems CEO Matt Soule said, is ripe for an overhaul and could benefit from moving some of its goods off-road to electric railcars. According to Soule, Parallel’s electric battery-powered rail vehicles use 25% of the energy a semi truck uses, and at a competitive cost. Funded in part by a February 2022 grant from the U.S. Department of Energy, Parallel Systems has raised about $57 million to date. Its most recent venture funding round was a $49 million Series A led by Santa Monica-based VC Anthos Capital. Local VCs including Riot Ventures and Santa Monica-based Embark Ventures are also backers of Parallel.

Terra Talent: Unlike the rest of the startups pitching at the Tech Week event, Terra Talent was focused on building teams rather than technology. Founder Dolly Singh worked at SpaceX, Oculus and Citadel as a headhunter, and now runs Terra, a talent and advisory firm that helps companies recruit top talent in the greentech space. But, she said, she’s concerned that all the work these startups are doing won’t matter unless we very quickly turn around the current trendlines. “Earth will shake us off like and she will do just fine in 10,000 years,” she said. “It’s our way of living, everything we love is actually here on earth… there’s nothing I love on Mars,” adding that she’s hopeful the startups that pitched during the event will be instrumental in making sure the planet stays habitable for a little while longer.

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.