The electric car company Canoo made a weak Wall Street debut on Tuesday after completing a reverse merger with Hennessy Capital Acquisition.

The Torrance-based startup, trading on the Nasdaq under the ticker symbol GOEV, closed the session down 3.1%, falling from $22.75 a share.

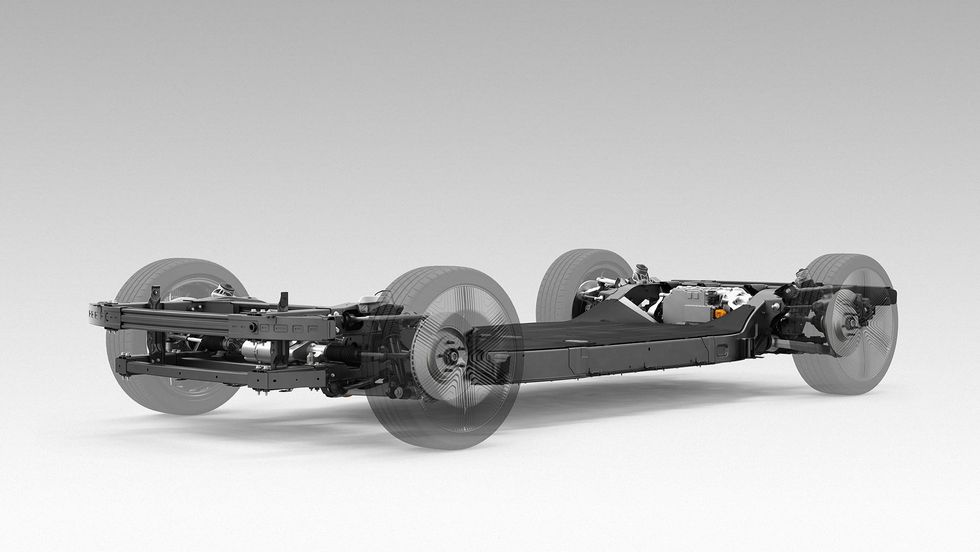

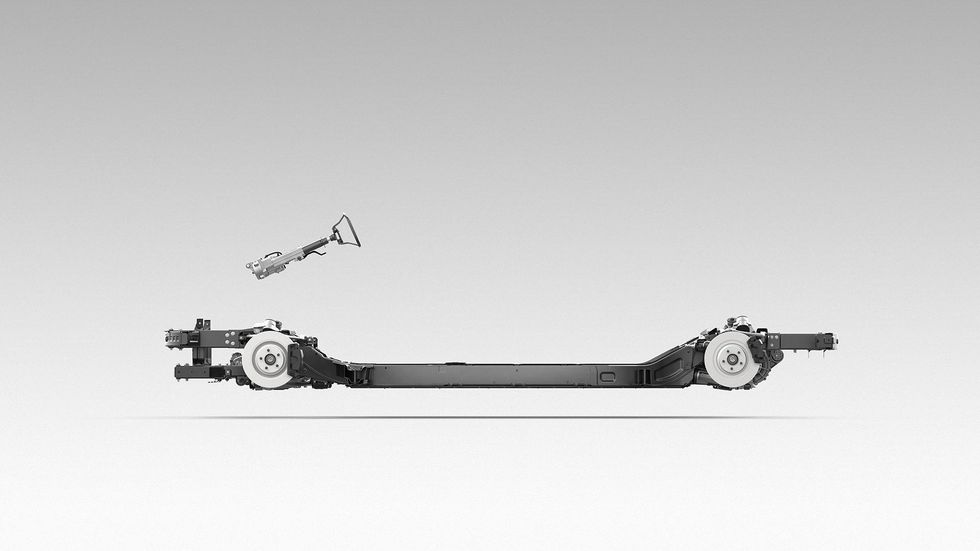

The company offers a subscription electric car that is slated for release in 2022 and has touted its "skateboard platform" design. Last week, Canoo unveiled its second vehicle, a delivery van that starts at $33,000.

The startup inked a deal earlier this year with Hyundai Motor Group to build its futuristic modular minivan that consumers can rent through a subscription service.

Canoo's move is the latest in a string of electric vehicles going public via a SPAC. In October, Fisker went public following a similar merger that valued the company at around $3 billion.

The EV market is red hot. Shares for Tesla were down after its first day in the S&P 500 Monday, but its stock soared this year, making Elon Musk the second richest person in the world.

Hennessy shareholders approved the deal with Canoo on Monday. In a statement released then, Canoo CEO Tony Aquila said that "the next chapter is a very important one" as the company gears up for 2023 production.

- Canoo Unveils Electric Delivery Van a Week Before IPO - dot.LA ›

- Canoo Is Set to Go Public - dot.LA ›

- Canoo to Go Public After Shareholders Approve Merger - dot.LA ›

- LA's Xos Electric Truck-Maker Will Go Public Through SPAC - dot.LA ›

- Canoo Introduces Its New Electric Truck - dot.LA ›

- Canoo Opens Reservations for Electric Vehicles - dot.LA ›

- Canoo Will Build Its Electric Vehicles At Two New Plants In 2022 - dot.LA ›