Latinx-Owned Small Businesses Showing Signs of Recovery from the Pandemic Crisis, Survey Finds

Latinx-owned small businesses are proving resilient in their recovery from the coronavirus crisis. Most were forced to shut down, but over three-fourths have reopened their doors.

So says a new national report from L.A.-based fintech firm Camino Financial that looked at the impact of the pandemic on these businesses.

"The Latino business market continues to be resilient," Camino CEO Sean Salas said, but "access to capital is drastically needed to enable Latino entrepreneurs to drive a quicker economic recovery."

The study examined nearly 35,000 Camino loan applications over the last two years and surveyed 368 of those small-business applicants. Nearly half of those initially saw their revenues decline over 30% after the pandemic hit. Most were forced to shut down, but 78% have reopened, and 44% reported revenues returning to pre-pandemic levels.

Coupled with this resilience, the surveyed businesses are feeling optimistic; 70% reported they think business will be as good as or better than before the pandemic.

The report also found a 14% quarterly increase in loan applications among Latinx-owned sole proprietorships, which Camino called a "leading indicator of recovery." Another encouraging sign is that loan applications among Latinx-owned businesses in operation for two years or fewer have returned to pre-pandemic levels.

These businesses face obstacles to a rebound, however. Sixty percent of those surveyed have less than four months' worth of operating capital, for instance, and 21% have less than three weeks'.

Access to capital and financial education continues to be an issue for these companies. Camino found that businesses with a pre-existing relationship with a lender were nearly seven times more likely to receive PPP relief funds compared to those going it alone.

What's the Remedy?

"What is needed is more access to capital, coupled with education and technical support from lenders focused on lending to underbanked communities," Salas told dot.LA.

He pointed to Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs) as steps in the right direction. But there's more to be done, he said.

"We can't just invite CDFIs and MDIs to participate; we also need to give them access to low-cost liquidity to enable the flow of capital into underserved markets," Salas said, noting that CDFIs were shut out of the first phase of the PPP process.

Salas called for a "rethink and redesign" of the next round of PPP, suggesting a more finely tuned approach. "We need to recognize the nuances of a microbusiness vs. a small business vs. a mainstreet business," he said.

Salas also advocates for including undocumented folks in such programs, noting that population contributes over $30 billion in federal and state taxes.

"We need to see capitalizing Latino entrepreneurs as part of the solution," Salas concluded. "A hand-up, not a hand-down."

- Pension Funds Could Be Key to Adding Diversity to VCs - dot.LA ›

- Ten Venture Capital Firms Commit to 'Diversity' Rider' - dot.LA ›

- Minority-Owned Businesses Were Hit Hard by COVID-19 - dot.LA ›

- Latino Entrepreneurs Account for 2% of all Venture Funding - dot.LA ›

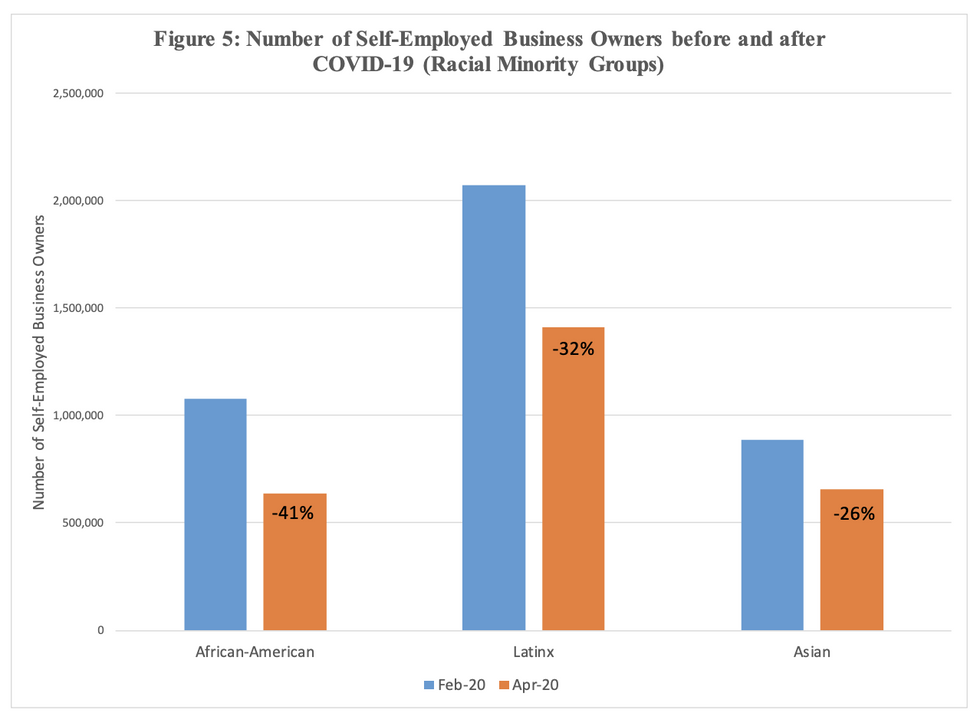

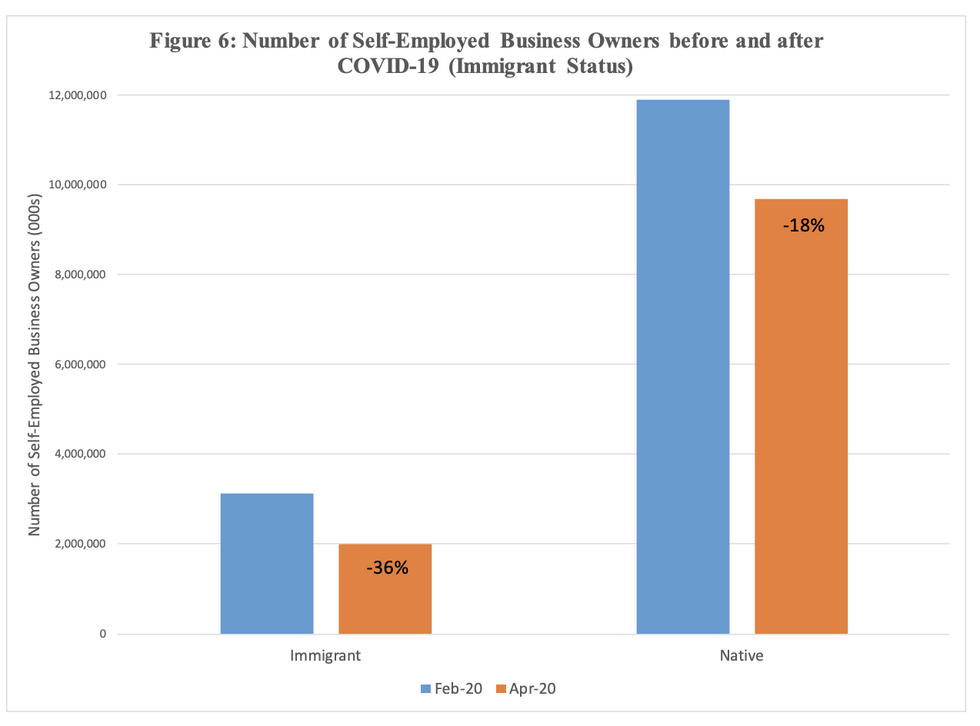

Data from the National Bureau of Economic Research

Data from the National Bureau of Economic Research Data from the National Bureau of Economic Research

Data from the National Bureau of Economic Research