Two VCs See Trading Cards as a Great Investment and are Starting a Fund to Trade Them

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

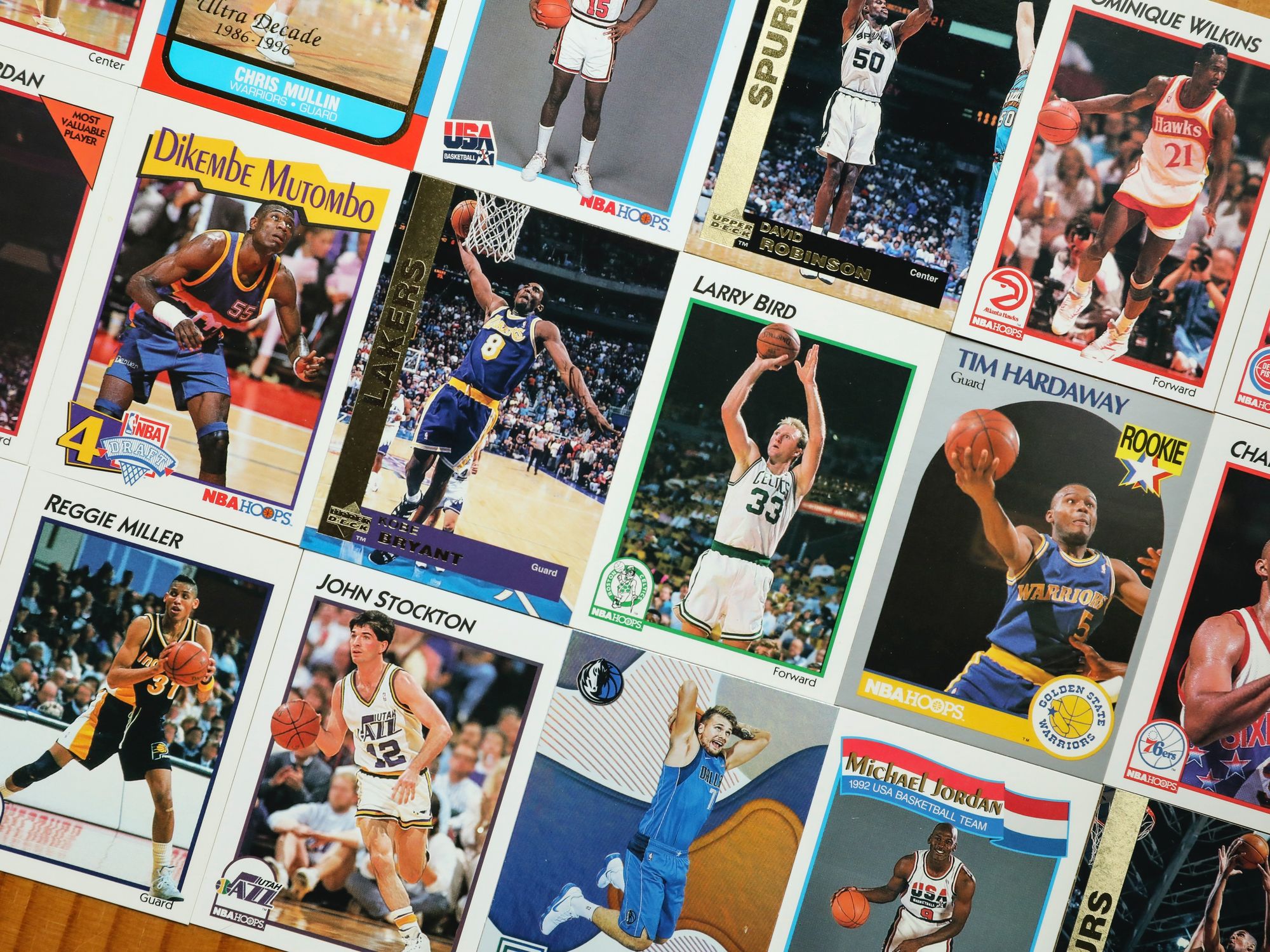

As early investors in buzzy startups like Lyft, SpaceX, Pinterest and Ring, Courtney and Carter Reum have gained a reputation as successful venture investors. Now they are devoting some of their attention and dollars to a decidedly lower tech investment: trading cards. After dabbling in cards as a hobby since they were kids growing up in the Midwest, the brothers want to use what they have learned as VCs to start a fund to procure undervalued cards they hope will someday score big returns.

"Applying that kind of rigor to something that has usually been done by young kids or emotion...I think that's how you get unfair advantages and outlier results," explained Courtney Reum. "I don't want to just dabble a couple hours a week. I want to be with people who really want to actually do this in an analytical way."

The Reums are making what they describe as a "meaningful" contribution to a multimillion dollar fund called Mint 10. They view it as a way to diversify their holdings away from illiquid shares in startups that won't pay off for years – if they're lucky – and equities, which they see as overvalued.

"I see this as a great alternative class, somewhere closer to a stock, albeit a little less liquid but more so than my venture and private equity stuff," said Courtney Reum. "To me, there's not much to find in the stock market that's a good deal."

A study last year showed baseball cards had a far superior return to stocks over the previous decade. The pandemic has triggered a frenzy in the card market, with huge spikes in trading and new records for coveted NBA rookie cards fetching more than a million dollars apiece.

The Reum brothers founded their Santa Monica-based early-stage consumer technology venture firm, M13, in 2016, after they sold their spirits business, Veev, for a hefty multiple to a St. Louis beverage conglomerate. M13 is now deploying its $175 million second fund backed by Virgin Group founder Richard Branson.

Reum thinks the still stodgy card industry is ripe for a shake up, eyeing big potential in influencers and creating content around the practice of "case breaking," the act of opening card boxes, which can draw big audiences on streaming platforms.

Reum, who remembers his mother driving him to card shows when he was 14 years old, views trading cards as similar to art, sports teams, Bitcoin or gold, which he's "bought a bunch of lately." What do all those assets have in common? There's a finite supply, which Reum believes inevitably drives the price up over time.

"I generally believe that something like gold or baseball cards, depending who you are, could be a couple percent of your allocation, up to like 10 percent," Reum said. "I think this is just as viable as gold or bitcoin or any of that."

Mint 10 will hedge its bets by buying a mix of cards from the three major sports that are both old and new.

"It's no different than how a long/short fund does their allocations," Reum said. "We have LP [limited partner] interest coming out of our ears."

Reum would not specify how large the fund will be or what his and brother's contribution is, owing to the fact that they are still fundraising. "It will be a multi-million dollar fund but we haven't finalized the amount yet," he explained. "We have a lot of interest but we want the strategy to dictate the raise vs the inverse, which is sometimes the case."

The Reums are not alone in their newfound enthusiasm for trading cards. Just as people bored at home with extra cash in their pockets drove a wave of day trading, card sales have been on a tear during the pandemic.

During the first few months of the coronavirus outbreak, sales of basketball cards on eBay spiked more than 130%. Baseball cards saw a 50% spike while football cards had a 47% increase.

In July, a LeBron James rookie card shattered the record for a modern day NBA card, going for $1.8 million. But the record stood for only a few months as last month a card of Milwaukee Bucks forward Giannis Antetokounmpo fetched $1.812 million. (The card previously sold for $7,000 on eBay, but the buyer reportedly returned it because of a yellow stain.)

"I think you're going to see sales records over the next 12 to 16 months that shock the world," said Scott Keeney, a DJ, entrepreneur, and trading card expert who the Reums brought in to run the new fund. "I've seen more VC activity in the last four-to-six weeks around the card space than I would have ever dreamed."

Keeney compares Mint 10 to funds trading fine art, but he sees a much bigger upside in cards because of people like Reum, who have traded them since they were kids.

"This generation who grew up in the Junk Wax Era now has disposable income to spend," Keeney said. "Would they rather spend all this money on a piece of art that hangs on the wall that they might not be that tied to? Or do they want to own Magic Johnson's rookie card if they're a Lakers fan?"

Though most trading is done online these days, Keeney, along with fellow DJ, Steve Aoki, opened a brick and mortar card card shop last month in Hollywood, Cards and Coffee, featuring over $2 million worth of inventory.

With a widely accepted grading system and limited supply, the trading card market has come a long way from the scandals that scared away collectors in the 20th century. But the industry still has problems. Last year, the FBI launched a criminal investigation into the world of baseball card collecting that included the largest seller of cards on eBay.

"This doesn't sour us on the market one bit," Reum said. We are obviously aware of this process of attempting to cheat the system, and are diligent in research to avoid this scenario. However, we actually are glad this incident came to light and was taken seriously by the FBI."

The Card Reum Will Never Sell

On a recent Zoom video call conducted just after he had returned from a business trip to Austin, Reum excused himself and said there was something he wanted to show. He darted off screen and returned holding up a framed oversized 1985 Michael Jordan Interlake card.

He pointed to the bottom right hand corner where the words "Interlake Youth Incentive Program" were printed in small lettering. The card holds a great deal of significance for Reum because his father, W. Robert Reum, was an executive at The Interlake Corporation before becoming president and CEO in 1990.

The company signed on as a corporate sponsor of the Bulls in 1984. As someone who now spends a lot of time thinking about how consumer-focused startups should market themselves, the move still baffles him.

"Given they were a B2B diversified industrials company, whomever was running their marketing probably should have been fired for such a sponsorship," Reum laughs. "The Bulls were the worst team in the league, there was no internet for people to discover the company, and it was hard to see how the sponsorship would help sales of Interlake products. However, the sponsorship did come with eight floor seats. The year following the deal, the Bulls drafted Michael Jordan and the rest is history."

W. Robert Reum died two years ago at the age of 74 from complications from cancer and Reum has a hard time not getting choked up looking at the card.

"To me, it is a really personal way to honor my dad," he said.

The card is worth around $20,000 and could soar in value to half a million dollars if it is seen as Jordan's rookie card, according to Keeney. But this is one card Reum will never sell. He wants to acquire more of them.

- Investing in Uncertain Times: How VCs and COVID-19 - dot.LA ›

- Venture Capital Firm M13 Is Still Looking For Deals - dot.LA ›

- Are Sports Cards the New Currency? - dot.LA ›

- Collectors Raises $100 Million, Rolls Out Rebrand - dot.LA ›

- Trump and the Art of the Poorly-Timed Celebrity NFT - dot.LA ›

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Skyryse

Image Source: Skyryse

Image Source: Northwood Space

Image Source: Northwood Space