Meet the 24-Year-Old Trying to Disrupt the Intellectual Property Industry

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

Nate Cavanaugh has a penchant for prophecy. The 24-year-old founder of Venice-based Brainbase wrote a letter to his future self when he was 13 in which he presciently asked, "Do you still want to start your own computer company?" At 18, in a high school assignment describing his role model, he chose Mark Zuckerberg, and proclaimed that "I, too, plan on starting my own technology company in college... (and) plan to drop out of college once I can comfortably support myself."

According to plan, he enrolled at Indiana University and promptly founded Guuf, an esports tournament platform, before leaving school and selling the company shortly thereafter. Inspired by a talk on the problem of patent trolls from Union Square Ventures' co-founder Fred Wilson and a blog post on the subject by Elon Musk, at 19 Cavanaugh formed Brainbase, a technology company meant to simplify and streamline the management of intellectual property (for example, trademarks, patents, copyright).

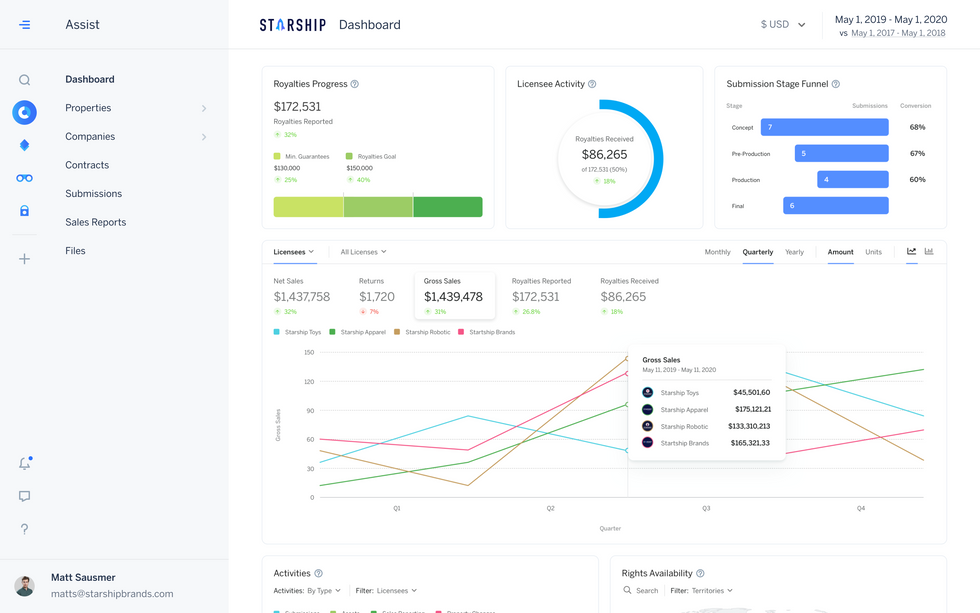

Five years later, the company has around 40 employees and its customers include BuzzFeed, the Vincent Van Gogh Museum, and Sanrio (of Hello Kitty and friends fame). Its flagship product is called Assist, which includes a dashboard for tracking royalty payments and schedules; analytical tools for comparing IP asset performance by property, territory, partner, category and distribution channel; automated invoice generation and contract management; and artificial intelligence tools to identify potential opportunities for exploiting IP.

Now, fresh off an $8 million Series A led by Bessemer Ventures with participation from L.A.-based Struck Capital, Alpha Edison, Bonfire Ventures, and Tera Ventures, Brainbase is expanding its product suite with a marketplace to facilitate IP-oriented transactions and a tool to enable IP filing and renewal. In a statement about the investment, Kent Bennett of Bessemer described Brainbase as bringing "the archaic, paper-shuffling world of IP management into the 21st century."

Cavanaugh has long been interested in business and tech. His dad is a serial entrepreneur himself whose current venture, Ready Nutrition, recently signed brand partnerships with NBA superstar Giannis Antetokounmpo and L.A. Rams pro-bowler Aaron Donald. As a 10-year-old kid he remembers marveling at videos of Steve Jobs, which he often rewatches now that he, too, runs a business. "The reality is it's in my genes," he says.

dot.LA caught up with Cavanaugh to ask about his journey so far and what motivates him to keep going, sometimes in the face of skepticism around his youth. His latest prediction? He says the next stage for Brainbase is going to be hard, but he's up for the challenge.

dot.LA: Tell me about your background and how that led to the company you sold after dropping out of college.

I'm originally from Pittsburgh and I grew up in an entrepreneurial family. My dad had been starting companies since I was born, so I was essentially interning at startups from the time I was eight years old. In my junior year of high school I started a website design and services business, and I was making enough money from it that I didn't want or need to go to college.

But I went to Indiana, largely because of Mark Cuban – he's from Pittsburgh, too, and he went there. I knew I didn't want to finish, but I don't think I had the risk tolerance to just not go; I wasn't ready to be a full-time founder yet. I didn't want to keep doing my website business so I decided I'd go, and try to start a startup with the intention of leaving early.

I'd been interested in gaming and esports, and as I kept learning about venture capital I thought a services business would be interesting. There was a company called Major League Gaming that was doing well at the time and my freshman year I formed a company that was basically a platform to facilitate esports tournaments. That was really before esports took off and frankly I think we sold it a bit too early.

Nate Cavanaugh is the founder of Brainbase

You're now on your third company and you raised over $12 million before turning 24. Have you had any pushback along the way because of your age?

Of course. There's a lot of negative press about young founders who aren't ready to run companies at scale. Until you sign that first set of impressive customers or raise money, you get doubted. I was 21 when Brainbase first raised VC funding and I didn't have traditional domain expertise in intellectual property. I was basically self-taught, and there were a lot of people that questioned our story.

What kept you going?

I'm extremely competitive. When I commit to something I have a will to succeed. And dropping out of college to start something makes you want it to succeed extra badly and do whatever it takes to make it work.

What would you consider some of your biggest personal achievements so far?

I'm a big believer that raising money is not necessarily a successful milestone – you need a strong outcome from that, so there's still a lot of work to do. But the fact that we were able to get a round done with Bessemer during COVID-19 was certainly not easy and I'm proud of that. We also recently did a deal with a big university for trademark licensing; I applied there for undergrad and was denied, so getting rejected and then getting them as a customer is kind of a a funny accomplishment.

And the customers we've been able to get, like Sanrio; they're one of the biggest licensors in the world and we got them as a customer within 12 months of starting.

Also one of our first investors was the founder of Duolingo, a unicorn, and they're from Pittsburgh, so I was proud of that too.

How did your dad's business experience impact you?

He had two businesses when I was growing up that got up to a fairly impressive scale, and then he wound them both down to start Ready Nutrition when I was in high school. So he was starting a clean-slate startup when I was a junior. I saw that grow from a one-person business to making nine figures in revenue. I worked as an unpaid intern and I saw how he ran meetings, interacted with employees, how he closed deals. That gave me a lot of valuable experience early on. It's one thing I don't talk about too much when I'm fundraising – as a founder you want your merits to live separately from that – but I was fortunate to be able to grow up with that.

How has your relationship with your dad evolved as you've had your own success?

We have an interesting dynamic. My family is still in Pittsburgh – when he and I talk it's almost all about work; it's the nature of our relationship. It's interesting to be able to talk about different ways we've done things. His business is bootstrapped, whereas we just closed a Series A. It's been really cool to be able to bring my experience with tech, VC and startups and to hear about his side of things in consumer goods. It's fun to be able to talk about and learn from the challenges he and I are going through.

Who else do you consider your role models?

Of the people in my network, I spend a fair amount of time with Adam Struck, the founder of Struck Capital; he's been a helpful mentor and is on our Board. Severin Hacker (co-founder and CTO at Duolingo) and Kent Bennett (Partner at Bessemer Ventures) have also been helpful. It's been great being able to go to them for function-specific questions.

I've been a fan of Steve Jobs and how elegantly Apple markets their products. I still go back and watch his interviews with Kara Swisher. I'd watch those when I was 10 years old.

I also admire Ben Horowitz; his book The Hard Thing About Hard Things is excellent. Andy Grove (former CEO of Intel), too. And I'm also interested in Peter Thiel, who often provides a contrarian view compared to the mainstream tech narrative.

What's your impression of the L.A. tech scene?

I've been really impressed, on a couple of levels. There's sufficient seed-stage capital from funders and the Series A market is maturing. I still think for Series B and beyond most founders think you need to go to NYC or San Francisco to raise, or at least to make the process competitive. And from a recruiting standpoint, there are so many impressive companies here and the region has a ton of engineering talent. So from the capital and recruiting standpoint it's only maturing and I expect that'll keep growing.

This interview has been edited for clarity and brevity.

---

Sam Blake primarily covers entertainment and media for dot.LA. Find him on Twitter @hisamblake and email him at samblake@dot.LA- Headspace Adds Former Quickbook Exec as Audience Grows - dot.LA ›

- Bonfire Ventures Raises $100M Fund II - dot.LA ›

- Brainbase Launches Two New Trademark Tracking Products - dot.LA ›

- Meta Software Moves Its Data SaaS Operations to LA - dot.LA ›

- Will AI Kill the Student Essay? These Professors Say 'No' - dot.LA ›

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake