Why Streaming Services Are Joining Forces and Consolidating

This is the web version of dot.LA’s daily newsletter. Sign up to get the latest news on Southern California’s tech, startup and venture capital scene.

As of Tuesday, it’s official: Warner Bros. Discovery’s (WBD) two major streaming platforms – HBO Max and Discovery+ – have merged into the unified “Max” service. For most current subscribers, the shift will happen automatically in the background; their HBO Max interface will simply update to the new Max service on its own. Some others may be prompted to download the latest version of the app.

Price-wise, everything’s remaining the same; Max is $9.99 per month with ads or $15.99 per month without. WBD is adding one new tier, with 4K Ultra HD streams, the ability to download content for offline viewing, and immersive Dolby Atmos audio on selected titles. That’s going to run $19.99 per month.

The biggest immediate change users will likely note upon moving from HBO Max to just Max is a significant expansion of the platform’s streaming library. Max launches with around 35,000 hours of content, more than double the catalog depth of its predecessor.

Something Akin to Cable 2.0

More than a decade after the massive explosion in the popularity of streaming platforms as an alternative to cable and satellite TV, a period of consolidation is now underway. Next month, on June 27, Paramount Global will formally abandon the Showtime standalone streaming service in favor of the “Paramount+ with Showtime” offering. (Showtime content is already available as a premium add-on with a Paramount+ subscription. The changeover in June will just formalize the connection and eliminate the option to stream Showtime without Paramount+.)

AMC Networks has followed a similar trajectory. While the company’s streaming strategy was initially built around small, lower-cost, niche streaming services – like British TV-focused Acorn TV and horror movie-centric Shudder – a subscription to the flagship AMC+ service now folds in content from across the company’s offerings, as an added inducement for sign-ups.

Speaking at a media conference last week, Warner Bros. Discovery chief David Zaslav suggested that this is just the beginning. He argued that media and entertainment companies should begin joining forces to offer bundles or package deals including even more services. That doesn’t mean merging, as WarnerMedia and Discovery Networks did in order to form Warner Bros. Discovery in the first place. This is something more akin to Cable 2.0, line-ups of multiple streaming services that are all accessed through one monthly subscription, featuring a wide assortment of entertainment styles and genres for the whole family.

Zaslav suggests that, if companies like WBD, Disney, and Comcast’s NBCUniversal don’t make these kinds of arrangements on their own, it will be done for them, potentially by the streaming hubs that already exist. During his presentation, he specifically namechecked Amazon, Apple TV+, and Roku, which of course offer a variety of third-party subscriptions through their own central streaming platforms.

Still, this is a curious argument, mainly because platforms like Roku and Amazon Prime Video Channels are entirely opt-in. If Warner Bros Discovery didn’t want consumers to have the ability to package together Max alongside Paramount+ and Peacock on Amazon’s platform, they could just decline Amazon’s offer. In fact, HBO Max was unavailable via Amazon Prime Channels from mid-2021 through the end of 2022, when they made a new deal with Amazon to return. (That agreement extends through the end of 2024.) Amazon couldn’t force Zaslav’s hand if he wasn’t interested in bundling Max. Perhaps he simply meant such a package offering would be so tantalizing for consumers, there’s no rational way Warner Bros. Discovery could decline to participate.

Cable TV is a Flat Circle

What’s perhaps most intriguing about Zaslav’s suggestion – and the idea that consolidation will completely alter the streaming landscape in such a major way – is how thoroughly his new proposal mirrors the old cable TV system. Streaming, after all, was conceptually promoted to consumers as an improvement to cable television, not just a recreation of the same model but online.

Whereas one cable subscription signs you up for all the content at once, streaming services are a la carte, giving viewers more options and increasing competition, which theoretically leads to not just better deals but higher-quality programming. These individual streamers would also be cheaper than an all-inclusive cable package, allowing TV fans to save money by just selecting the content they most wanted to see. Bundling multiple services together basically eradicates these changes; we’re once again paying one big bill each month for all the content together.

Beyond just historical revisionism, there are some potential complications to Zaslav’s proposed scheme. One of the big sticking points between platforms like Amazon and Roku and content providers like Apple, Warner Bros Discovery, and YouTube owners Google has been around sharing data. If a new customer signs up for Max via Amazon, which company owns that customer and their information? Who gets access to the demographics that allow them to customize their advertising experience?

Consolidation of this sort provides some clear benefits to the studios, streamers, and the tech and telecom companies that own them. Currently, each new fiscal quarter brings fresh scrutiny to subscriber numbers and churn rates. Bundling all the streaming services together takes some of the individual load off. Even if interest in Disney+ dips in Q2, well, maybe a new season of “House of the Dragon” on Max makes up for it, and the overall subscriber picture doesn’t change.

Consumers may ultimately prefer this kind of system as well. It would cut down on the confusion about what shows and films are available to stream on which platforms and would make the entire streaming experience more consistent and reliable. No more wanting to watch a “Harry Potter” film, only to find that they’ve jumped from Peacock to Max. Bundles would likely also be cost-savers for heavy streaming users who are already signed up for five or more individual platforms, which accounts for around 10% of all subscribers in the US.

So if consumers really are willing to go along with a scheme that turns streamers back into cable, studios and platforms may be all too willing to comply. No more complaining about your monthly cable bill though… we’d all have to acknowledge that we did this to ourselves.

- You'll Soon Be Able to Get a Cheaper, Ad-Supported Version of HBO Max ›

- WB Discovery Wants to End the 'All-Streaming' Era ›

- HBO Max and Discovery Plus to Merge Into Single Streaming Juggernaut ›

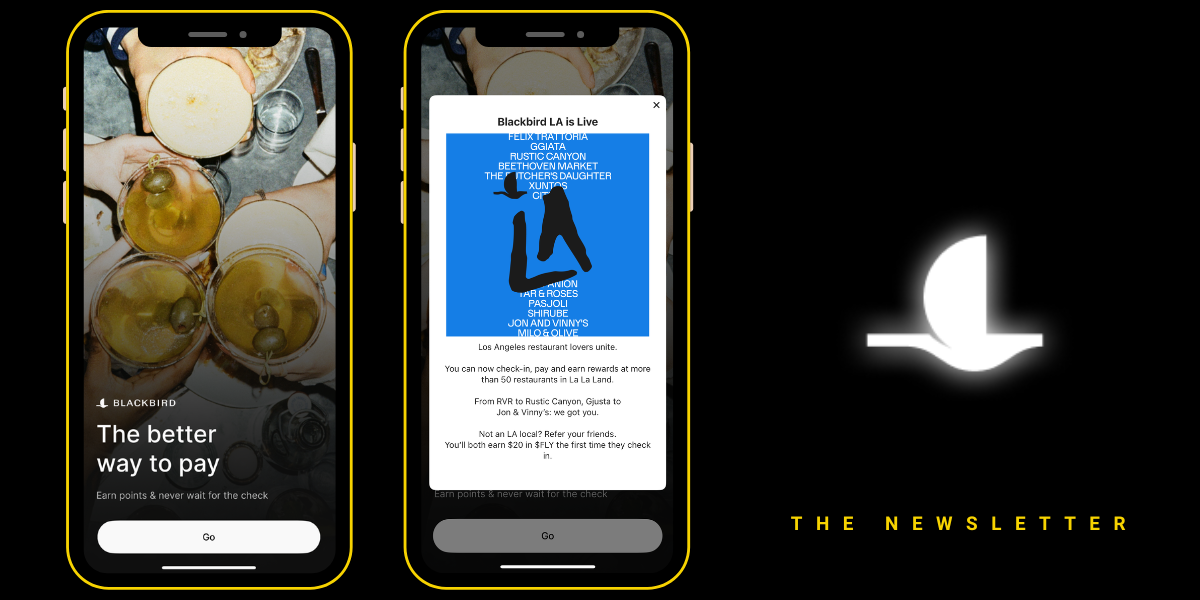

Image Source: Blackbird

Image Source: Blackbird