Get in the KNOW

on LA Startups & Tech

X

Design, Bitches

Looking to Build a Granny Flat in Your Backyard? Meet the Firms and Designs Pre-Approved in LA

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Adding a backyard home in Los Angeles is now nearly as easy as buying a barbecue.

Homeowners who for years have wanted to build a granny flat in their backyard, but dreaded the red tape, can now choose from 20 pre-designed homes that the city has already approved for use.

The shift, made official last week, will speed up a weeks-long process and bring more badly needed units to an overpriced market. It also has the potential to elevate the 14 startups and firms building the next generation of homes.

The designs for the stand-alone residences range from a 200-square-foot studio to a 1,200-square foot, two-story, two-bedroom unit. And many of the homes are filled with design flourishes, reflecting the diverse architecture of the city, from a house in the silhouette of a flower to one with a spiral outdoor staircase leading to the roof.

It's no surprise. The program was spearheaded by Christopher Hawthorne, a former architecture critic at the Los Angeles Times and now the city's chief design officer.

The firms are primarily local and startup architecture and design firms, while others are well-known with a history of building granny flats, also know as accessory dwelling units, or ADUs.

The standard plans avoid the Los Angeles Department of Building and Safety's typical four-to six-week review process and can allow approvals to be completed in as quickly as one day.

Some aspects of the plans can be modified to fit a homeowner's preferences. Eight other designs are pending approval.

Mayor Eric Garcetti believes by adding more such units, the city can diversify its housing supply and tackle the housing crisis. Recent state legislation made it easier to build the small homes on the lot of single-family residences. Since then, ADUs have made up nearly a quarter of Los Angeles' newly permitted housing units.

Because construction costs are relatively low for the granny flats – the pre-approved homes start at $144,000 and can go beyond $300,000 – the housing is generally more affordable. The median home price in L.A. County in January was $690,000.

Here's a quick look at the designs approved so far:

Abodu

Abodu

Abodu, based in Redwood City in the Bay Area, exclusively designs backyard homes. In 2019, it worked with the city of San Jose on a program similar to the one Los Angeles is undertaking.

In October, it closed a seed funding round of $3.5 million led by Initialized Capital.

It has been approved for a one-story 340-square-foot studio, a one-story one-bedroom at 500 square feet, and a one-story, 610-square-foot two-bedroom.

The pricing for the studio is $189,900, while the one-bedroom costs $199,900 and the two-bedroom is $259,900.

Amunátegui Valdés Architects

Led by Cristobal Amunátegui and Alejandro Valdés, the firm was founded in 2011 and has offices in Los Angeles and Santiago, Chile. Amunátegui is an assistant professor at the Department of Architecture and Urban Design at UCLA.

The firm designs work in various scales and mediums, including buildings, furniture and exhibitions.

Its one-story, two-bedroom with a covered roof deck 934-square-foot unit is pending approval from the city.

Connect Homes

Connect Homes has a 100,000-square foot factory in San Bernardino and an architecture studio in Downtown L.A.

It specializes in glass and steel homes and has completed 80 homes in California. Its designs have an aesthetic of mid-century modern California residential architecture.

It has two one-bedroom models pre-approved by the city, one is 460 square feet, which costs $144,500 with a total average project cost of $205,000. The other is 640 square feet, which costs $195,200 with a total project cost of $280,000.

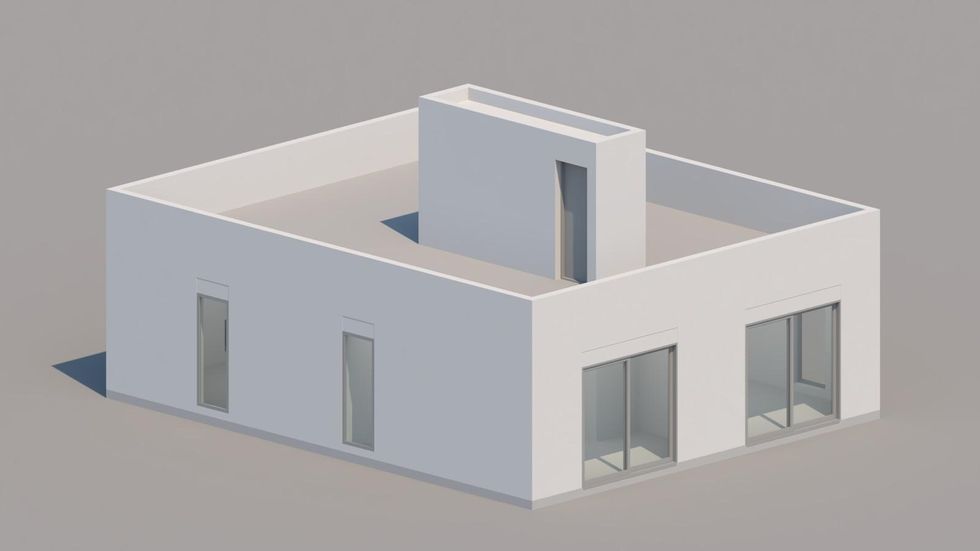

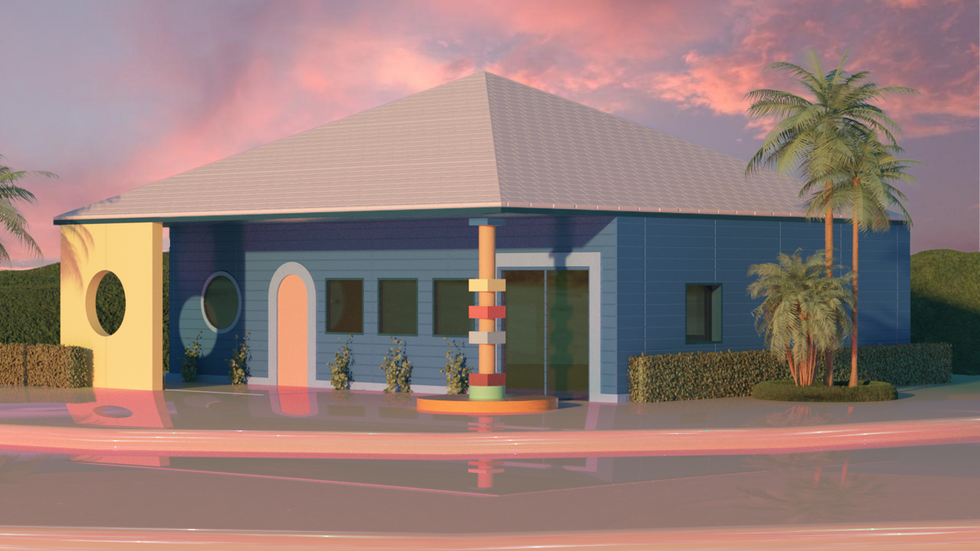

Design, Bitches

The Los Angeles-based architectural firm founded in 2010 describes itself as having a "bold and irreverent vision." Its projects include urban infill ground-up offices to single-family homes, adaptive re-use of derelict commercial buildings and renovations of historic landmarks.

Its pre-approved design, named "Midnight Room," is a guest house/ studio. Its bedroom can be left open for a loft feel or enclosed as a separate room. The design is a one-story, one-bedroom at 454 square feet.

Escher GuneWardena Architecture

Founded in Los Angeles in 1996, Escher GuneWardena Architecture has received international recognition and has collaborated with contemporary artists, worked on historical preservation projects and more.

The company has been approved for two different one-story, one- or two-bedroom units, one at 532 square feet with an estimated cost of $200,000 and another at 784 square feet with an estimated cost of $300,000. The firm noted the costs depend on site conditions and do not include soft costs. Those could add 10% to 12% to the total construction costs.

First Office

First Office is an architecture firm based in Downtown Los Angeles. Its approved ADUs will be built using prefabricated structural insulated panels, which allow for expedited construction schedules and high environmental ratings.

The interior finishes include concrete floors, stainless steel counters and an occasional element of conduit.

There are five options:

- A one-story studio, 309 to 589 square feet

- A one-story one-bedroom, 534 to 794 square feet

- And a one-story two-bedroom, 1,200 square feet

Fung + Blatt Architects

Fung + Blatt Architects is a Los Angeles-based firm founded in 1990.

The city has approved its 795-square-foot, one-story, one-bedroom unit with a roof deck. It estimates the construction cost to be $240,000 to $300,000, excluding landscape, site work and the solar array. Homeowners can also expect other additional costs.

Taalman Architecture/ IT House Inc.

The design team behind "IT House" is Los Angeles-based studio Taalman Architecture. Over the past 15 years, IT House has built more than 20 homes throughout California and the U.S.

The IT House ADU standard plans include the tower, bar, box, cube, pod and court.

The city has approved four options, including:

- A two-story including mechanical room, 660 square feet

- A two-story including mechanical room, 430 square feet

- A one-story studio, 200 square feet

- A one-story including mechanical room, 700 square feet

The firm also has another two projects pending approval: a 360-square-foot one-story studio and a one-story, three-bedroom at 1,149 square feet.

LA Más

LA Más is a nonprofit based in Northeast Los Angeles that designs and builds initiatives promoting neighborhood resilience and elevating the agency of working-class communities of color. Homeowners who are considering their design must commit to renting to Section 8 tenants.

The city has approved two of LA Más' designs: a one-story, one-bedroom, 528 square feet unit and a one-story, two-bedroom, 768 square feet unit. The firm has another design for a one-story studio pending approval. That design would be the first 3D-printed ADU design in the city's program.

Jennifer Bonner/MALL

Massachusetts-based Jennifer Bonner/MALL designed a "Lean-to ADU" project, reinterpreting the stucco box and exaggerated false front, both Los Angeles architectural mainstays.

The design has been approved for a 525-square-foot one-story, one-bedroom unit with a 125-square-foot roof deck.

sekou cooke STUDIO

New York-based sekou cooke STUDIO is the sole Black-owned architectural firm on the project.

"The twisted forms of this ADU recalls the spin and scratch of a DJ's records" from the early 90s, the firm said.

Its design, still pending approval, is for a 1,200-square-foot, two bedroom and two bathroom can be adapted to a smaller one-bedroom unit or to include an additional half bath.

SO-IL

New York-based SO-IL was founded in 2008. It has completed projects in Leon, Seoul, Lisbon and Brooklyn.

Its one-story, one-bedroom 693-square-foot unit is pending approval. It is estimated the construction cost will be between $200,000 and $250,000.

WELCOME PROJECTS

Los Angeles-based Welcome Projects has worked on projects ranging from buildings, houses and interiors to handbags, games and toys.

Its ADU is nicknamed The Breadbox "for its curved topped walls and slight resemblance to that vintage counter accessory."

It has been approved for a one-story, one-bedroom 560-square-foot unit.

wHY Architecture

Founded in 2004, wHY is based in Los Angeles and New York City. It has taken on a landmark affordable housing and historic renovation initiative in Watts.

Its one-story, one- or two-bedroom 480 to 800-square-foot unit is pending approval.

Firms that want to participate in the program can learn more here . Angelenos interested in building a standard ADU plan can learn more the approved projects here.

From Your Site Articles

- United Dwelling Raises $10M to Address the Housing Shortage ... ›

- Plant Prefab Raises An Additional $30 Million - dot.LA ›

- How 3D Printing Could Help Tackle Homelessness in LA - dot.LA ›

- New Bills, New Startups Address Housing in California - dot.LA ›

- LA's ADU Culture Still Faces Financial Barriers - dot.LA ›

- What Will Take To Make Modular Homes Mainstream? - dot.LA ›

Related Articles Around the Web

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Leonardo DiCaprio Backs New $45 Million Climate VC Fund

02:09 PM | March 28, 2022

UNclimatechange | Flickr

A new, early-stage venture capital firm targeting climate and sustainability-related investments announced its debut $45 million fund on Monday, with backing from the likes of Hollywood actor Leonardo DiCaprio and Silicon Valley’s Tribe Capital.

Beverly Hills-based Regeneration.VC said it aims to invest in “circular economy” consumer startups developing regenerative materials—an area it described as a “$4.5 trillion opportunity to ensure the prosperity of our species and planet” in a press release.

The circular economy involves reusing materials at the end of their life cycle to produce new goods, ideally eliminating waste and harmful emissions in the process. The fund’s portfolio companies include VitroLabs, which makes lab-grown leather, and Pangaia, a fashion brand that repurposes discarded textiles.

Regeneration.VC is co-led by general partners Dan Fishman, the former president of Los Angeles ice cream brand Coolhaus, and Michael Smith, a former touring DJ and co-founder of the L.A. real estate firm Creative Space. Alongside DiCaprio and Tribe Capital, the firm’s limited partners include Maryland-based investor ImpactAssets, Twist Bioscience co-founder Bill Peck and Depeche Mode guitarist Martin Gore.

“We need forward-thinking approaches that perform measurably better for our planet,” DiCaprio, who will also serve as a strategic advisor to the fund, said in a statement. “It’s time for people to feel good about their purchases and for businesses to meet that challenge—every bite of food, every t-shirt, every product counts.”

The Oscar-winning actor has previously backed Santa Monica-based seed-stage fund Struck Capital and eco-conscious digital bank Aspiration.

From Your Site Articles

- Aspiration Acquires Carbon Insights to Track Carbon Use - dot.LA ›

- Leonardo DiCaprio Joins LA Venture Fund Struck Capital - dot.LA ›

- Regeneration.VC’s Dan Fishman on Consumer Climate Startups - dot.LA ›

Related Articles Around the Web

Read moreShow less

clean techcleantechventure capitaltribe capitalregeneration.vcleonardo dicapriocreative spacestruck capitalaspiration

Harri Weber

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

LA Is Betting on Nukes, Netflix and Next-Gen Attention

11:30 AM | December 19, 2025

🔦 Spotlight

Hey Los Angeles.

If you were looking for a quiet week, this was not it. LA is backing a portable nuclear reactor, Netflix just took a big step closer to owning Warner Bros. Discovery’s future, and Snapchat is basically handing the city a mirror and saying, “Here is what you did with your attention all year.”

Let’s dive in.

Radiant’s microreactors and LA’s new nuclear moment

Radiant Nuclear raised more than $300M in a Series D round to build Kaleidos, a one megawatt portable nuclear microreactor that is designed to roll off a factory line, ship in a standard container and replace diesel generators at remote sites, military bases and disaster zones. The new capital will fund a full scale test at Idaho National Lab and the build out of Radiant’s R 50 factory in Oak Ridge, Tennessee, which aims to produce up to 50 reactors a year starting later this decade.

For LA’s climate and infrastructure ecosystem, this is a big tell. The city that got rich on pipelines of content is now funding pipelines of electrons, betting that small, modular nuclear can be part of the grid story that powers everything from data centers to defense. It is a very different flavor of LA tech, but the pattern is familiar: take a frontier technology, wrap it in product thinking and try to make it feel as boring and reliable as a utility bill.

Netflix and Warner Bros. Discovery: one step closer

On the media front, Netflix just received an official recommendation from Warner Bros. Discovery’s board to proceed with the planned acquisition of WBD’s studios and streaming business. The board reaffirmed that the Netflix deal, which would fold Warner Bros. film and TV, HBO and HBO Max into Netflix, is in the best interest of shareholders, even as competing ideas swirl around what to do with the company.

Practically, this does not mean the deal is done. It means the process has moved from “big idea in a press release” into the slower, more serious phase of shareholder approvals and regulatory review. For Los Angeles, every incremental step like this reinforces the likely end state: a world where a handful of global platforms control not just distribution but also the studios and libraries that defined Hollywood’s last century.

Snapchat’s 2025 Recap and the attention economy in our backyard

Then there is Snapchat, which used its 2025 Recap to show off what its mostly Gen Z and Gen Alpha users actually did on the app this year. The company is leaning into personalized “year in review” stories that highlight top chats, memories, maps moments and creator content, while quietly reminding brands and investors that Snap still owns a very specific slice of youth attention that is hard to find anywhere else.

For LA, Snapchat’s recap is more than a cute end of year product. It is a reminder that some of the most important social infrastructure for the next generation is being built and iterated a short drive from Santa Monica Boulevard. While the grown ups argue about nuclear reactors and studio mergers, Snap is training the next wave of consumers how to communicate, create and remember their lives on a platform that barely existed fifteen years ago.

Taken together, this week says a lot about what “LA tech” means in 2025. On one end, you have Radiant trying to change how we power the physical world. On the other, Netflix and Snapchat are fighting over how we package and monetize the stories that live in our heads. Somewhere in the middle are the founders, investors and operators here who see all of this as raw material.Now keep scrolling for this week’s LA venture deals, fund announcements and acquisitions.

🤝 Venture Deals

LA Companies

- Fixated secured a $50M strategic investment from Eldridge Industries to fuel what it calls the “next era of creator-led empires.” The company says the capital will help it expand its capabilities and partnerships that support creators in building and scaling their own brands and businesses beyond traditional sponsorship deals. - learn more

- Vital Lyfe raised $24M in financing, including more than $18M in seed funding, in a round led by Interlagos and General Catalyst with participation from Generational Partners, Cantos, Space.VC and Also Capital. The Hawthorne based startup, founded by former SpaceX engineers, will use the capital to ramp manufacturing of its portable, autonomous “water making” systems, expand early deployments with partners like maritime operators and NGOs, and prepare for its first consumer ready products in 2026. - learn more

- Molly Sims’ YSE Beauty closed a $15M Series A growth equity round led by Silas Capital, with participation from L Catterton and existing backers Willow Growth Partners and Halogen Ventures. The clinically tested skincare brand, which targets women 35+ and recently rolled out nationally at Sephora, will use the funding to fuel product development, expand across Sephora doors in the U.S., and grow its direct-to-consumer e-commerce business. - learn more

- Ember LifeSciences raised a $16.5M Series A led by Sea Court Capital, with participation from Cardinal Health, Carrier Ventures and other strategic investors including former U.S. Secretary of State Mike Pompeo. The Los Angeles based cold chain tech company will use the funding to launch its next generation Ember Cube 2 shipping system and expand globally, helping pharma and healthcare customers cut temperature related losses and waste in medicine distribution. - learn more

- Strada, a Los Angeles–based media collaboration startup, received a strategic investment from Other World Computing (OWC) to accelerate its product roadmap. The company’s peer-to-peer platform lets video pros access, share and review large files directly from local drives anywhere in the world, without uploading to the cloud. The partnership will also include co-marketing efforts, joint NAB 2026 presence, and bundled offerings that pair Strada’s software with OWC’s storage and workflow hardware. - learn more

LA Venture Funds

- Calibrate Ventures participated in Manifold’s Series B round, backing the company as it scales its AI technology platform. Manifold plans to use the new capital to accelerate product development, deepen its capabilities for enterprise customers, and grow its team to support broader commercial rollout. - learn more

- SmartGateVC participated in NeuraWorx’s oversubscribed seed round, which was led by Nexus NeuroTech to back the company’s neurotechnology based therapies for central nervous system (CNS) disorders. NeuraWorx plans to use the capital to advance its R&D and early clinical work, build out its technology and product pipeline, and expand its team as it moves toward bringing new CNS treatments to market. - learn more

- Kinship Ventures participated in Lovable’s $330M Series B, which values the Stockholm based “vibe coding” platform at $6.6B in a round co-led by CapitalG and Menlo Ventures’ Anthology fund. The company lets non developers build full stack software from natural language prompts, and says it will use the new capital to scale its AI native platform globally, deepen enterprise features and integrations, and support a fast growing base of business users building production apps on Lovable. - learn more

- B Capital participated in MoEngage’s $180M Series F follow-on, which brings the customer engagement platform’s total Series F raise to $280M. The round was led by ChrysCapital and Dragon Funds, with Schroders Capital and TR Capital also joining, and will be used to accelerate MoEngage’s Merlin AI product roadmap, expand go-to-market teams across North America and EMEA, and pursue strategic acquisitions while also funding an employee and early-investor liquidity program. - learn more

- O'Neil Strategic Capital led HEN Technologies’ $22M financing, which combines a $20M oversubscribed Series A with $2M in venture debt, to build what the company calls the industry’s first operating system for fire defense. The Hayward based startup will use the capital to scale its IoT enabled hardware and Fluid IQ predictive AI platform, capture a comprehensive operational fire dataset, and expand global deployments with distributors and agencies as it aims to make fire suppression faster, more efficient and data driven. - learn more

- Core Innovation Capital participated in Transparency Analytics’ second funding round, backing the company alongside lead investor Deciens Capital, Allianz Life Ventures, Mouro Capital, FJ Labs and SUM Ventures. Transparency Analytics, which provides quantitative, tech enabled credit ratings and benchmarking for private credit, will use the funding to scale its platform, refine go to market strategy and build out products like its private credit index as the asset class grows. - learn more

- Upfront Ventures participated in Nanit’s $50M growth round, which was led by Springcoast Partners with support from JVP. The company will use the funding to expand its AI powered Parenting Intelligence System and related tools that give parents real time, personalized insight into a baby’s sleep, health and development between pediatric visits. - learn more

- Integrity Growth Partners fully funded Fluency’s $40M Series A, coming in as the company’s first major institutional investor. Fluency, a “digital advertising operating system,” centralizes and automates paid media across Google, Meta, TikTok, programmatic and more, already powering nearly $3B in annual ad spend and over 250,000 monthly campaigns. The company plans to use the capital to enhance its automation and agentic AI capabilities, expand integrations with publishers and tech partners, and grow its team. - learn more

- JAM Fund joined Last Energy’s oversubscribed $100M+ Series C, backing the advanced nuclear startup as it pushes to commercialize its factory built microreactors. The round was led by Astera Institute with investors including Gigafund, The Haskell Company, AE Ventures, Ultranative, Galaxy Interactive and Woori Technology. Last Energy plans to use the capital to complete its PWR-5 pilot reactor under the U.S. DOE’s Reactor Pilot Program, ramp manufacturing in Texas, and advance its larger PWR-20 units toward commercial deployment in the U.S. and U.K. - learn more

LA Exits

- NextWave is being acquired by Pattern, bringing the TikTok-focused commerce agency under Pattern’s umbrella to strengthen its TikTok Shop and creator-led commerce capabilities. The deal folds NextWave’s expertise in TikTok Shop strategy, operations and creator partnerships into Pattern’s broader ecommerce platform, giving brands a single partner to manage marketplace, DTC and social shopping channels. - learn more

- Ubiquitous is being acquired by Humanz as part of Humanz’s broader push to build a next-gen, data driven creator economy platform alongside its recently announced $15M funding round. The deal folds Ubiquitous’ creator marketing and TikTok/native social expertise into Humanz’s influencer analytics and campaign tooling, giving brands a more end-to-end partner for strategy, creator management and performance measurement across major social channels. - learn more

- Silver Tribe Media is being acquired by TPG-backed Initial Group, which is folding the company into its broader sports and entertainment platform. The deal brings Silver Tribe’s storytelling, production and athlete brand work under Initial Group’s umbrella, giving it more capital and distribution while expanding Initial’s in-house content capabilities around teams, athletes and sponsors. - learn more

- Duffl, the YC-backed campus delivery startup, is being acquired by Rev Delivery, bringing its “10M campus delivery pioneer” operation under Rev’s umbrella. The acquisition folds Duffl’s college-focused, ultra-fast delivery network and playbook into Rev’s hyper-growth delivery operators, with the goal of scaling on-demand service across more campuses and strengthening Rev’s position in student-centered last-mile logistics. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS