Ficto's Plan to Test its Way Toward a Mobile Streaming Content Strategy

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

Fiction Riot, the L.A.-based entertainment company behind mobile streaming app Ficto, raised $250,000 this week. Chief executive Mike Esola says the company has intentionally grown slowly, eschewing venture capital in favor of incremental fundraising from family offices, institutions and friends and family.

In total, the company has raised $3.5 million, according to an internal document.

Ficto is free to download on iOS and Android, but is currently in a testing phase, says Esola, a former agent at WME and UTA. He and his team – which includes Jeff Mayo (employee #80 at YouTube and #300 at LinkedIn) and Nick Mitchell (former head of engineering at Technicolor) – plan to launch the fully fledged service in Q4 of this year. That will receive a boost from distribution partnerships that will guarantee them 1.3 million automatic downloads of the Ficto app, according to Esola and the document.

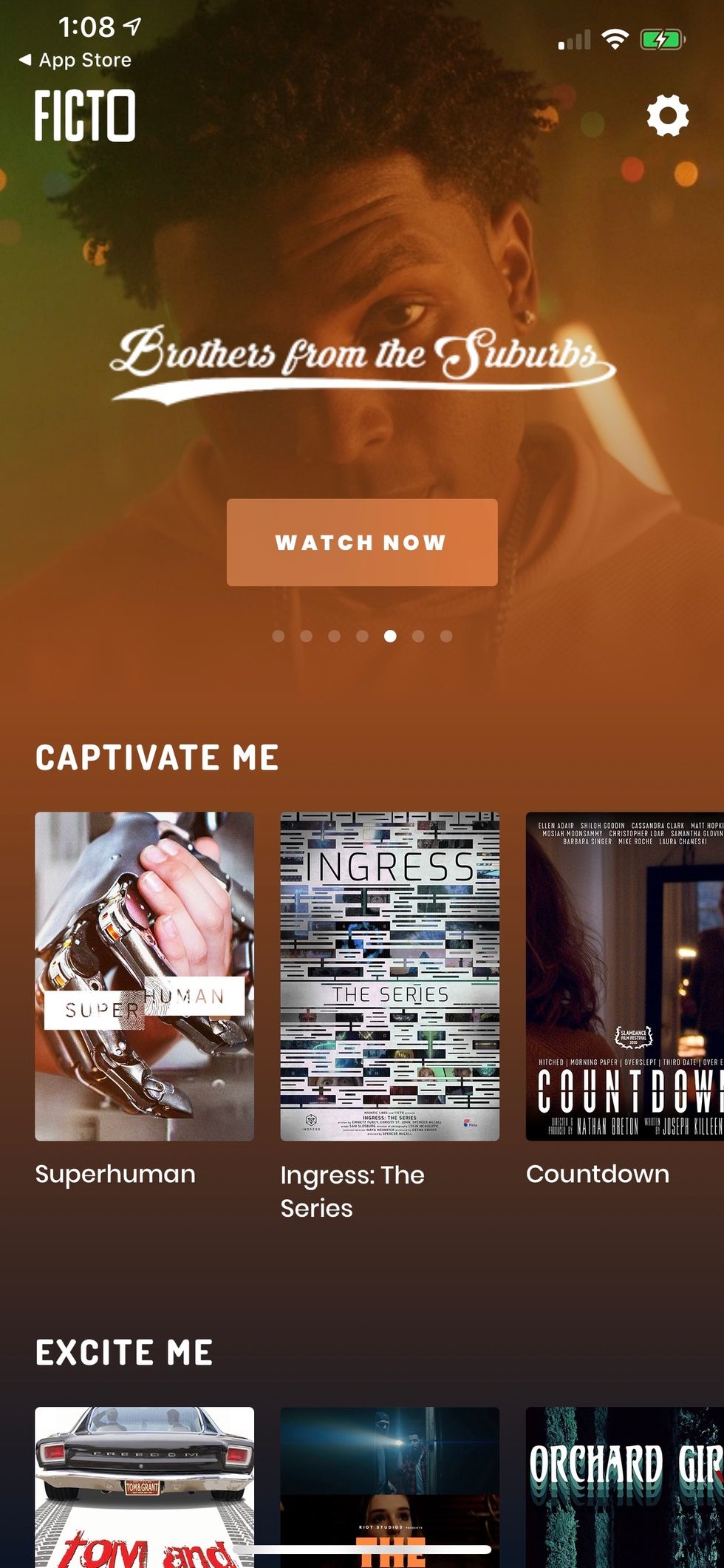

Courtesy Ficto

Courtesy FictoThe company's business model is based on advertising and providing white label streaming technology to third parties such as festivals, conferences and broadcasters, Esola says.

Ficto aims to leverage mobile-oriented tech to offer a unique user experience. In the future its shows will include features like interactive choice-based storytelling; content that is unlocked if a user goes to a specific location; and real-time chats. The tech stack is also built to provide unique opportunities to advertisers and financial transparency to creators.

dot.LA caught up with Esola to talk about his plans for the Q4 launch, what short-form video competitor Quibi got wrong, and how Ficto will do it differently.

How did Ficto come about?

It started out as one primary thing but it has evolved. The original focus was on backend compensation for artists. I was an agent for about 16 years and I made 95% of my revenue on 5% of my deals; it's the same with most artists. And most of the time that comes from the backend.

But when streaming came along it eradicated the backend. Everything's going to streaming. Consumers love it, but like many tech companies they don't reveal their metrics – it's inherent in the tech culture.

I was really impressed with Netflix; they basically invented streaming, and production is up because of them. But I love this industry and I didn't like what I was seeing for the creators. If you take away content performance metrics, it changes everything. So that was my inspiration. I couldn't sit around.

Mike Esola is Fiction Riot's CEO

Where is Ficto headed from here?

Q4 will be significant for us. The last couple months have been a beta period; we're testing, not spending money on marketing. We'll have 10 original shows coming in Q4, but we can't premier those now because we can't shoot them.

The filming moratorium looks like it'll lift soon and we'll go back into production. These shows will give users more empowerment and engagement than the shows that are on our beta version.

Those are good shows, too, and there's an element of empowerment there, since we accepted several of them through a submission portal; and also some engagement, with micro-donations from viewers. But we'll take all of that to the next level. To be able to do that how we want, you have to bake it in from the start.

We also have a number of great distribution deals coming in Q4, which will come with automatic pre-downloads that will allow us to exceed the downloads that Quibi got.

What will you do with the money you've just raised?

That was almost all convertible debt, and it will go to content, marketing, and operating expenses – which includes technology development.

We're not opposed to VC money but it's got to be the right moment and the right value proposition for them. We don't want to rush the valuation. And it seems lately there's been a bit of a reckoning in VC because of overvaluations and a have-or-have not mentality. VCs are really smart but like everyone they spread themselves thin. These are generalizations but I think there needs to be a more diverse approach to how VCs invest.

What do you think Quibi got wrong?

It's very simple: their value proposition is not correct. What problem are they trying to solve? They're aware there's an amazing amount of people, especially young people, watching on mobile. But content on mobile and content on normal streaming is not apples to apples, and they didn't adequately adjust their approach to production or programming. You've got to do the other things that people expect on mobile, and the way we think about that is it's all about empowerment and engagement.

Quibi raised and spent all this capital and assumed people would adopt their product, without hardly testing it – they just went straight into a big launch. If you do that in any industry the odds are against you. Every other app is built how we've built, but Quibi didn't care about history. (They figured) this is what people will accept — that they'll like what we make. It's not the first time this has happened to (Quibi chairman and founder Jeffrey) Katzenberg. Look at pop.com – it didn't launch. Dreamworks' live-action business sold for pennies on the dollar.

Quibi also disregarded the importance to young people of a free service. It's not easy to get someone to pay for a service with no established brand or content, especially young people.

The people making decisions at streaming services are focused on a mature, established market — long-form, primarily over-the-top, in front of the TV. They're missing this explosion, this cultural gap of mobile viewing. Quibi caught onto that, but it's not just about the length of the content. That's where Quibi got it wrong — it's about empowerment and engagement.

It's a different type of offering and different type of expectation that comes along with the internet, with mobile, with social and lots of things that aren't necessarily obvious. But people have a different value proposition in mind when they pick up their mobile phones. With any offering, whether you're talking about movies or Dropbox, you've got to deliver to consumers' expectations; and if you're lucky, you've got to exceed them. So if you're going to create content for mobile you have to meet those mobile expectations.

What exactly do you mean by engagement and empowerment?

Engagement is a fancy word for interactivity. It's about making people feel like they're part of something. It could be a choice-based show, or a location-based show that you unlock based on your location. It could be livestream; livestream is the longest anyone spends on average on mobile by far – you know why? Because with livestream, you feel like you're part of something, since it's happening in real time. You can do live-chat functionality, commentary, opinion, social integration — it's easy to do that for our shows. Quibi completely cut all that out.

And empowerment is basically about allowing people to submit content or opinions. Polling is its most basic form, or clicking to donate. Beyond that you see people submitting a video to be a part of something – TikTok is the most successful at that. We haven't premiered it yet but we have an interactive dating show that will empower viewers to win a date with a celebrity. And we'll do other competitive shows where people will have to submit a 10-second video to win a prize.

Most of the services are focused on long-form content and they're ignoring the twenty-somethings and teens because they don't understand it. They scratch their heads at why Quibi doesn't work and why TikTok does, and they dismiss TikTok as crap user-generated content. But it doesn't have to be that. It can be a hybrid. And that's where we see ourselves.

This interview has been edited for brevity and clarity.

- ficto - dot.LA ›

- Ficto Tests its Way Toward a Mobile Content Strategy - dot.LA ›

- Whatifi is Looking For Scripts - dot.LA ›

- Can a Niche Streaming Service Survive the Streaming Wars? - dot.LA ›

- Ficto Partners with LG on Shows Designed For Its LG Wing - dot.LA ›

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

Image Source: Skyryse

Image Source: Skyryse

Image Source: Northwood Space

Image Source: Northwood Space