Mobile Choose-Your-Own-Adventure Movie App Whatifi is Looking For Scripts

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

The movie ends with the mother's severed head in the refrigerator. And it's in there because of the choices you made.

But you can return to the beginning, make new choices along the way and produce a different ending on Whatifi, a new, choose-your-own-adventure storytelling mobile app.

Mobile-first storytelling isn't exactly new. Nor is choose-your-own-adventure. But Whatifi founder Jaanus Juss believes his game plan to combine quality content, interactivity and socialization will make his app a hit, particularly with younger crowds.

"It's a new entertainment category that defines how the next generation will entertain themselves," he says.

Following a $10 million funding round led by Andreessen Horowitz, this L.A. and Estonia-based startup launched on iOS last week with two "branching story" titles. Adding the app to Android is one part of a "long product roadmap," the founders say.

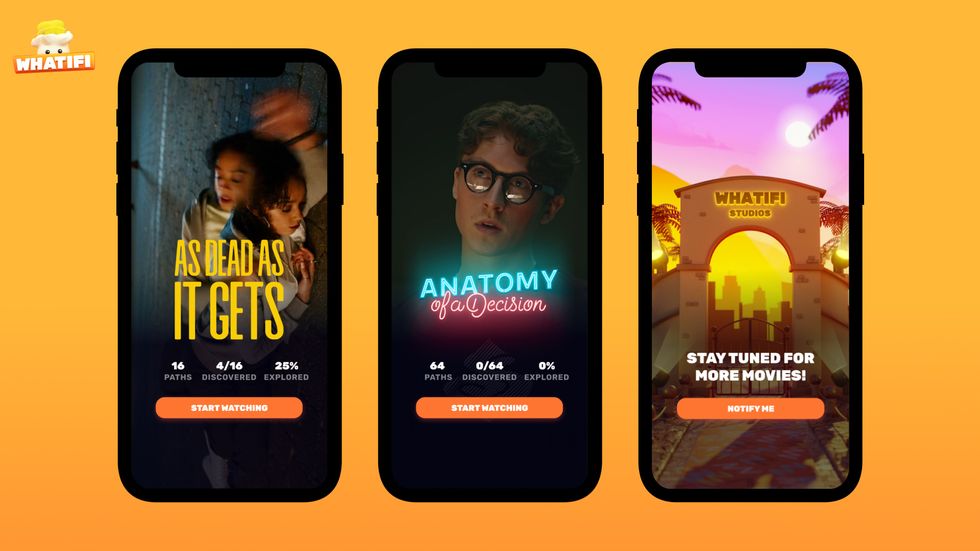

"Anatomy of a Decision" follows 30 years of a man's life, starting with his parents' visit to a fertility clinic, and proceeds along 64 possible story permutations based on the seven different decisions viewers make along the way.

In "As Dead as it Gets," viewers make four decisions to determine which of 16 fates will befall the main character, who is on the verge of death and wants to return to the land of the living.

Although Whatifi's founders think these 80 storylines will keep their viewers busy for the time being, they are calling for writers and directors to help them build out their content library.

What If I Want to Watch?

Juss' background puts him and his team in a strong position to provide advice to creators.

As chief executive and founder of Creator City, an Estonian creative network, Juss and some experimental colleagues began exploring how to introduce interactive storytelling into live theater. At first the crowds were too shy.

"Estonians are introverted," he explains. "Then we gave them shots a half-hour before the show, and it worked great, but that obviously wasn't a sustainable model. So we injected technology."

The idea took off. Juss and his team ran over 1,000 interactive shows. Around the time he and his eventual co-founder Hardi Meybaum began discussing the possibility of bringing the format to film, Netflix released Bandersnatch, a choose-your-own-adventure format from the creators of Black Mirror. That was enough validation for Meybaum, who'd formerly been an entrepreneur, to leave his venture capital gig in Silicon Valley and join in on the Whatifi journey about a year ago.

"I thought this was a unique opportunity to build a large consumer company," he says.

While testing the product in New Zealand, Singapore and Sweden, the team watched to see whether users who finished one storyline would return to the beginning to try another route.

"If they don't do that then the whole premise of branching stories isn't successful," Juss says.

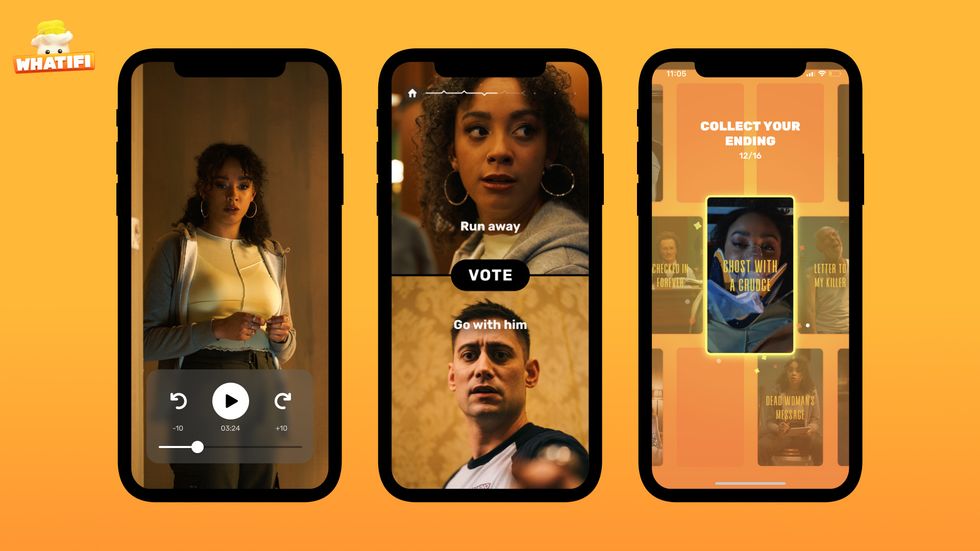

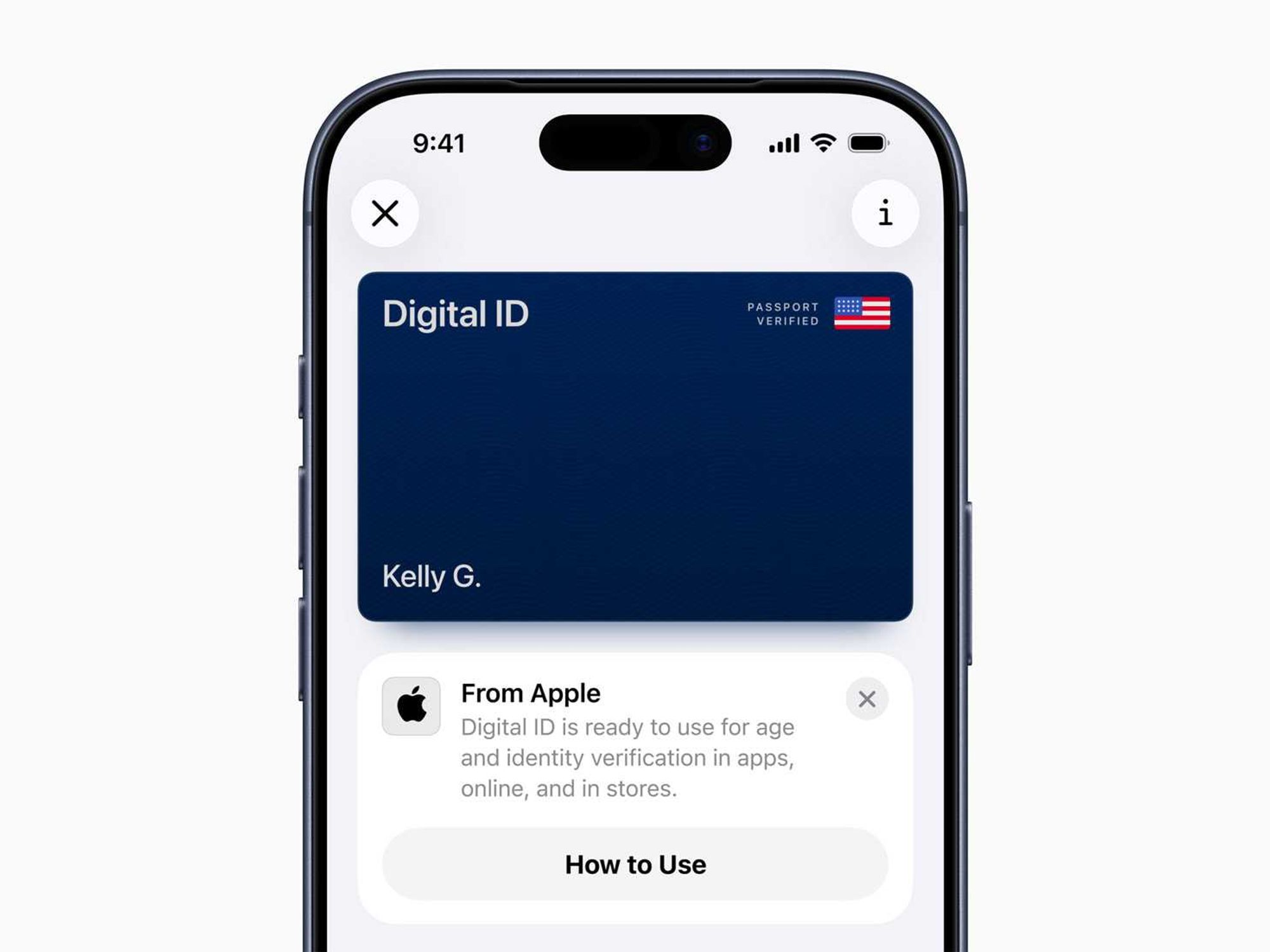

One decision point of "Anatomy of a Decision"

Courtesy of Whatifi

In those test markets they saw that 90% of users went back for another go, the founders say. And in the first week since launching in the U.S., that number has risen even higher.

Whatifi is targeted at a younger audience. They are more "native" to mobile, Juss says, and they were the audience segment who seemed to most enjoy the experience back in the live-theater version.

In addition to providing unique stories, Whatifi incorporates a social element. When users boot up the app, they enter a waiting room, where they can invite friends to join them in a viewing party. As the stories reach decision points, the movies pause and all the friends must vote. The story only continues if there's a consensus. Until then, friends must deliberate on which path to choose.

A key learning Juss took from the theater experiments was that the deliberation was often the part that was most fun.

And there's plenty more to explore.

"What we have so far is the simplest version that we've done in the theater," Juss says. "We can go much more complicated for telling the stories, but we'll ease into that."

Meybaum is enthralled by the possibilities.

"What makes Whatifi so cool and rewarding to work on is that, for us, there's content, social, the platform – it's all tightly coupled," he says. "When we are talking about the changes to come, they involve how to create content, the user experience, and also the social elements. It's the whole experience."

What if I Want to Participate?

July 7th is the pitch deadline. The company expects to receive applications primarily from "young and upcoming" screenwriters and directors, but Meybaum tells dot.LA that anyone can apply.

"You never know where the best ideas come from. We're excited to make it public," he says.

The contest has two parallel tracks: one for scripts only, and one for full productions. To help applicants get started, Whatifi provides a sample pitch, a story-mapping tool and a script template.

Up to 20 applicants will win $2,000 and qualify for the final round, for which they'll need to submit a full script – with a helping hand from Whatifi and its team of advisors.

Five winners of the full-production prize will receive $200,000 to turn their submissions into films for the Whatifi platform. Winners of the script-only prize will each receive $35,000, and the possibility that Whatifi will find a director to make the movie. The new films are scheduled to be completed by October 15.

Juss highlights one advantage the format provides to filmmakers: They need not suffer the pressures of having to make every decision themselves. That can be outsourced to the audience.

"Many writers probably wonder where their stories might have led, had they taken a different turn at a crucial point," says Johannes Veski, writer and director of "Anatomy of a Decision."

"The chance to see where all those potential paths lead should whet the appetites of screenwriters and filmmakers across genres."

Juss acknowledges that writing a script with multiple permutations can be a challenge. Veski agrees.

"Maintaining coherence is hard enough when writing one story," Veski says. "I aimed at 64 paths and outcomes that all begin at a single point. I had to make sure they'd all logically lead back to the beginning and still make sense in relation to each other. It felt like like building a house of cards and changing the laws of physics on the way."

But both Juss and Veski think the learning curve isn't too steep.

"We've seen that filmmakers can really get their heads around it," Juss says. "And once it's written it's not that different from a filming standpoint."

"Life is a single track of guesswork, projection, regret, and relief," Veski adds. "I'm intrigued by life as not one, but many possible paths. I see 'Anatomy of a Decision' as a mere mortal's chance to trick fate and try on all the couldas and shouldas."

---

Sam Blake primarily covers media and entertainment for dot.LA. Find him on Twitter @hisamblake and email him at samblake@dot.LA

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

Image Source: Perelel

Image Source: Perelel

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

Image Source: Waymo Image Source: Apple

Image Source: Apple