Column: Five Reasons Why Space Matters (Hint: It's Not Tourism)

Last night, Rocket Lab made a big comeback from its failed launch last May. The Long Beach startup's Electron rocket launched a satellite for the U.S. Space Force, bringing their total to 105.

This capped a busy month for space, with Richard Branson and Jeff Bezos making their space dreams come true in the weeks prior. But with all the attention on the billionaire's exploits, are we missing the bigger picture?

The lack of coverage for Rocket Lab's rebound is just as telling as the fanfare around Virgin Galactic and Blue Origin's flights. Space tourism is distracting us from why we should actually care about space.

The Biggest Space News of the Year

While the public has debated the merits of this month's sub-orbital joyrides, the media missed the biggest aerospace event of the year a month ago, when Hawthorne-based SpaceX launched their Transporter‐2 mission on June 30.

What was so revolutionary about last month's launch? Nothing. And that's partly the point. Launches are becoming routine thanks to reusable launch vehicles.

But the Transporter‐2 mission was significant, because the rideshare mission launched 88 different satellites for customers into orbit, enabling innovation for scores of organizations.

The launch was the first for Santa Barbara startup Umbra, which has developed technology capable of seeing at night and through dense clouds; it has since been added to a joint $950M Air Force contract. The payload also included a competing satellite from Iceye, manufactured in Irvine, and two cubesats from San Diego-based General Atomics to test optical communications between satellites and from satellites to drones.

As a preeminent hub for aerospace, Southern California stands to gain greatly as launches become more frequent and the industry re-emerges from its post-'80s slumber. But other hubs are rapidly catching up.

As a venture capitalist and advisor to space—and other—startups, I've seen the sector evolve into something barely recognizable from the time I started my career as an engineer on the Space Shuttle Main Engine decades ago. Here are five reasons we should care.

1. Space Improves Our Quality of Life

If you looked at your phone this morning to get the weather forecast or check the route to your first meeting, you can thank satellites for the help.

"The blue dot on your phone is possible due to billions of dollars of space infrastructure," says Van Espahbodi, managing partner and co‐founder of Starburst, a company that catalyzes connections in the aerospace industry. "Sure it results in food delivery, dating apps and so many innovations in daily life, but none of this would be possible without the boundaries of exploration into space."

Space isn't just delivering convenience, it's democratizing access to data and technology, too.

"There are four billion people unconnected in this world," says Akash Systems CEO and founder Felix Ejeckam, who aims to expand global access to broadband. "Unless you're still going to run expensive fiber optic cables all over the Earth, you have no choice but to drop internet beams from space."

Programs like OneWeb and SpaceX's Starlink are bringing broadband connectivity to every corner of the globe, and Akash has developed advanced materials that will help reduce the cost and increase speeds of such Internet satellites, aiming to make these services more accessible and ubiquitous.

On the flip side—those times we claim we're "off the grid" from work for a week? Those days might be numbered.

2. Space Lets Us Understand Our World and Adapt to Climate Change

With all this talk of Mars missions as our "Plan B," you might ask, "Why not invest in the planet we have?" The aerospace industry is doing that, too.

Satellites are critical for sensing our world—tracking changes in infrastructure, weather and the environment over time. Satellites can measure the height of entire oceans within an accuracy of about an inch, and NASA's first TROPICS cubesat, launched on Transporter-2, will use microwaves to predict hurricanes.

"Our space endeavors have been instrumental to understanding the extent of climate change on Earth using satellite data from NASA and NOAA," says Jessica Rousset, Deputy director of the Arizona State University Interplanetary Initiative.

Government efforts are complemented by an ever‐expanding collection of private constellations with new capabilities. With these expanding capabilities we can sense new things—and sense them more often. Inexpensive infrared and hyperspectral imaging of crops can help farmers make better decisions and make agriculture more productive and resource‐ efficient. Soon, we'll even be able to see underground, thanks to companies like Lunasonde.

Granted, the carbon emissions from rocket launches can have their own negative impact on the environment. Fortunately, some launch services—including Blue Origin—are shifting to less‐ polluting fuels like hydrogen.

3. Space Enables Things We Could Never Do Before

The unique environment of space unlocks new opportunities in science and industry that would be worthy of science fiction movies.

Companies like Varda plan to set up self‐assembling, automated factories on orbit to manufacture things. Production of semiconductors, protein crystals, polymers, new drugs or optical fibers might benefit from the zero‐gravity, near‐vacuum conditions of space.

Some have proposed setting up 24/7 solar farms in space and beaming the energy down to Earth using lasers or microwaves.

And 21st‐century prospectors have set their sights skyward, with dreams of mining asteroids for precious materials. Last year, Japan hosted the first successful asteroid sample recovery mission, landing their loot in the Australian outback.

Not everyone believes space production will be practical anytime soon, but research in space has already led to discoveries in material science, plasma physics and biology.

The publicly‐funded International Space Station has been a productive early laboratory. Now, space infrastructure developer Axiom Space is working towards a 2024 launch of their initial components for the next generation commercial space station, partially funded by a $140M NASA grant.

4. Space Has Created a Burgeoning New Industry

Space has another very practical benefit; it has created an entirely new sector of the economy. Early governmental funding and discoveries has set the stage for an entirely new ecosystem of startups, suppliers and service companies sustained by private dollars. Morgan Stanley estimates that the global space industry—$350B as of 2016—will expand to over $1 trillion by 2040.

These companies are driving innovation, fueling economic growth, and creating new jobs in an industry where the United States still maintains a manufacturing edge.

Satellites in space means the need for infrastructure, being built now. Orbit Fab, the "Gas Stations in Space" company, launched the world's first satellite fuel tanker on Transporter‐2. They are building a materials supply chain to support a space economy that CEO Daniel Faber predicts will ultimately lead to permanent jobs in orbit. (Full disclosure: I'm an investor.)

"Fuel is now available for purchase and delivery in space," says Faber, "And we don't have to keep throwing away perfectly good satellites when they run out of fuel."

In the past NASA has justified their funding by pointing at thousands of technologies spun out of the space program—memory foam, cochlear implants, freeze dried food, CMOS image sensors and powdered lubricants — to name a few.

"But today, it's almost like the reverse is happening," says Jonathan Fentzke, the newest managing director of the Techstars Space accelerator. Space is driving demand for technology. "Unique challenges on orbit, like petabytes of image data streamed daily or the lack of heat dissipation in a vacuum, means the industry is always looking for new technologies and suppliers to solve their challenges." The June 30 launch of three SAR satellites alone will add 30-40 terabytes of data per day to the cloud.

Which is why his 2021 cohort includes startups like Pixspan, an image compression company with roots in Hollywood, and Thermexit, whose carbon nanomaterials were originally designed for supercomputers. These companies are finding a new thirst for their technologies thanks to the space industry.

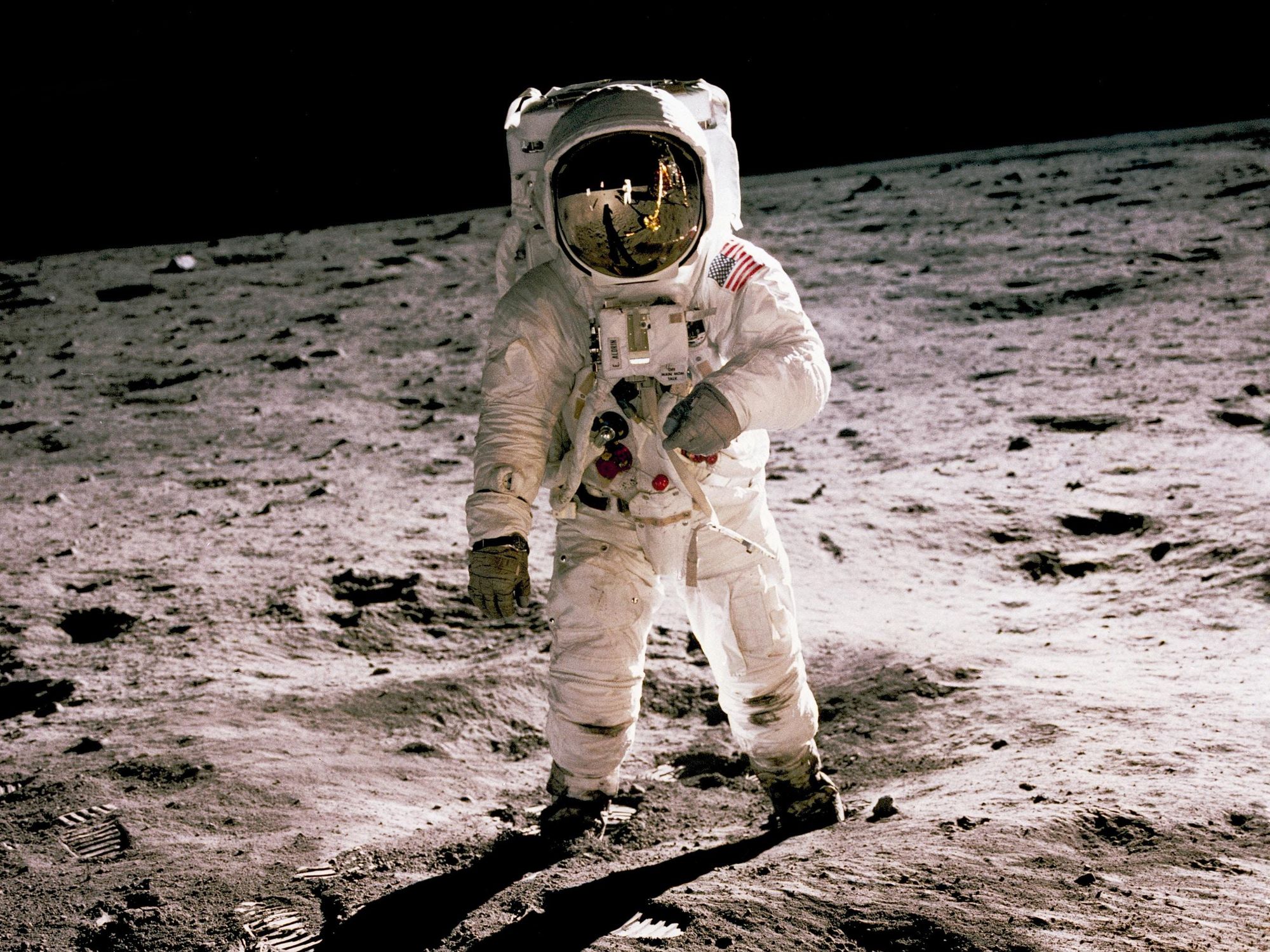

5. Space Inspires Discovery

And finally, space still holds a special place by being the final frontier. While there aren't many places left on Earth that haven't appeared in a selfie, endless discoveries await us beyond our atmosphere.

Southern California has a long history of space adventures, including Chuck Yeager's historic sound barrier-busting flight in 1947. From NASA-JPL's Curiosity and Perseverance rovers to SpaceX's dreams of colonizing Mars, we continue to be the epicenter of big-idea space exploration

And our discoveries aren't just for adventure, either. By exploring beyond our planet, we can prepare for interplanetary human settlement, learn about the origins of life or better understand the beginning of the universe.

In El Segundo, Northrop Grumman is assembling the much awaited James Webb Space Telescope, soon headed a million miles away to "L2," a cold, stable perch past the moon. From there it will peer deep into space, providing views of faraway exoplanets and glimpses of light from 13.6 billion years ago, when the earliest stars and galaxies were just forming in the universe.

Our Future in Space is Inevitable

Things have changed for the better in aerospace over the last decade.

Back when I was a young engineer working at Rocketdyne, my work was funded by NASA. I remember how we depended on the largess of government dollars and lived by the whims of public sentiment. Risk and new ideas weren't readily accepted, and failure wasn't an option.

Today, aerospace is more iterative, entrepreneurial, and largely driven by commercial interests. "There's so much money and interest out there, and there is more of a culture of innovation," says Carrie Hernandez, formerly of SpaceX and now CEO and Co‐Founder of Rebel Space Technologies in Long Beach.

And private space investments have never been higher. "In 2021, private capital will invest more money in the space industry than NASA will spend on everything," NASA-JPL physicist and local angel investor Shanti Rao quipped recently on Twitter.

And with a few exceptions, we're exploring at relatively bargain‐basement prices. Reusable rockets, space servicing, robotics and other technologies make space more affordable than ever.

"In the 60s, we went at great expense—often around 4% of GDP. But today, we're doing twenty times more at one‐tenth the price," says a colleague who asked to remain anonymous because he doesn't have permission to speak on behalf of his government employer. "And this time we're not just stopping by to say hello, we're setting up a permanent base."

Private industry is taking the lead, but Southern California needs to keep its eye on the ball. These days space companies can be almost anywhere, and Colorado, Texas and Northern California have become major hubs of space innovation, too.

NASA's Apollo and Space Shuttle programs were as much a PR effort as they were science expeditions. And those educational efforts have paid dividends by inspiring more public funding for research and development and a whole generation of kids to pursue science and math.

Will Blue Origin and Virgin Galactic succeed at filling this inspirational role? I hope so. But it's time for us to celebrate and support all the entrepreneurs exploring the boundaries of space.

Because it turns out, you don't need to be a billionaire to pursue your space dreams. And with or without public support, the space industry is now inevitable.

- Relativity Space to Launch 3-D Rocket Mission with TriSept - dot.LA ›

- Bezos, Branson and the Billionaire Space Race: What to Watch ... ›

- Systima Technologies Acquired By LA's Karman Missile & Space ›

- ICEYE Satellite Imaging Startup Raises $136 Million - dot.LA ›

- Relativity Space Inks New Deal with Satellite Maker OneWeb - dot.LA ›

Image Source: Revel

Image Source: Revel