Get in the KNOW

on LA Startups & Tech

X

Courtesy of Mercedes-Benz/Bosch

Mercedes-Benz Offers a Glimpse Into a Future Where Your Car Parks Itself

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

Sign up for dot.LA's daily newsletter for the latest news on Southern California's tech, startup and venture capital scene.

Angelenos famously hate parking, but soon their cars may be able to park themselves thanks to a collaboration between Mercedes-Benz and German engineering firm Bosch.

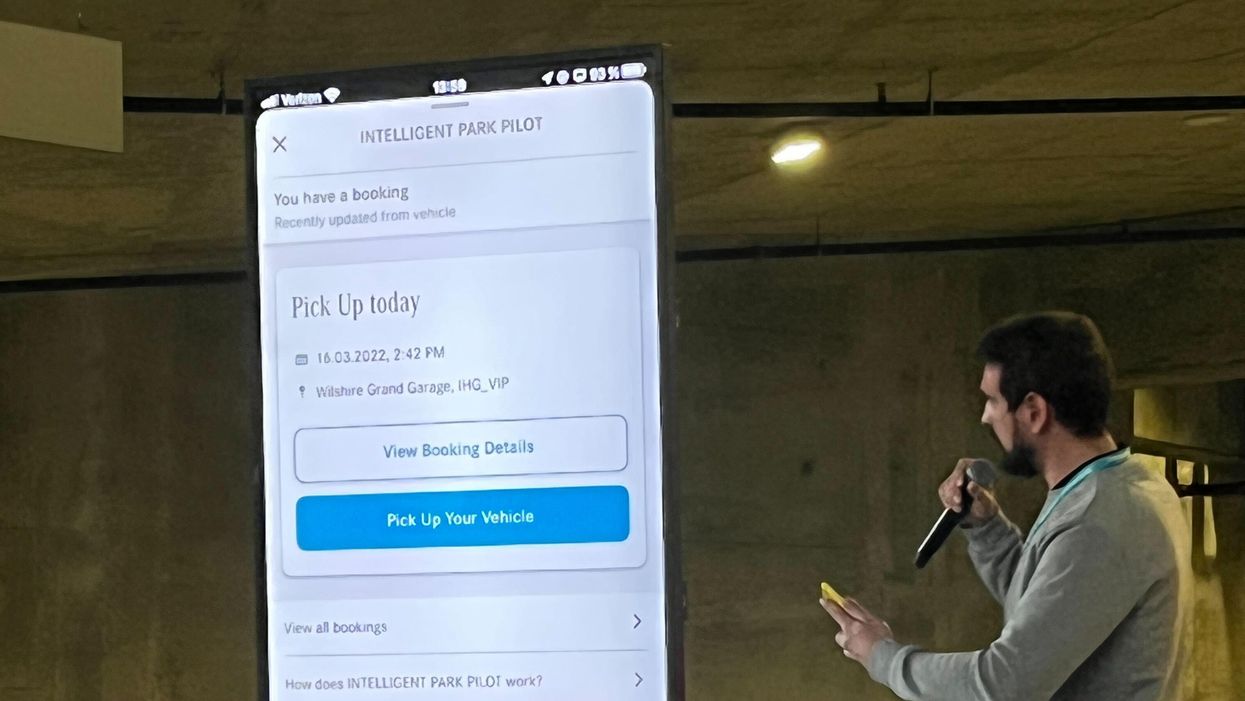

At a demonstration in Downtown Los Angeles on Wednesday, Mercedes and Bosch gave the first U.S. test run showcasing the fruits of their collaboration: an electric Mercedes-Benz 2022 EQS 580 luxury sedan capable of navigating itself into a parking spot.

Painted in bright teal stripes, the sedan first let its driver out at a designated spot. Then, a tap of a Mercedes-Benz phone app locked the vehicle and sent it, at a gradual pace, to the first available parking space. Later, a ping from the app woke up the car—which turned itself on, pulled out of the parking spot and slowly made its way to the driver’s pickup point.

A Bosch engineer stepped in front of the car several times as it was driving to demonstrate its safety features; if sensors detect a presence or any motion in front of the car, they’ll tell it to stop a safe distance away. (For extra security, a person walked alongside the car with an emergency shut-off button.)

Kay Stepper, Bosch’s senior vice president of automated driving for North America, noted that the self-parking technology relies on sensors and cameras built into its surrounding environment, which guide the car into its space. (The sensors are installed on the ground, while the cameras are mounted above.) He added that the technology could be applied to any type of car, so long as a manufacturer makes it compatible with its vehicle.

“The unique thing is really that we are not using any of the in-vehicle sensors—it’s a purely infrastructure-based solution,” Stepper told dot.LA.

Courtesy of Mercedes-Benz/Bosch

Using the MercedesMe app, a driver has access to their vehicles’s smart options.

The demo marked the first time that Mercedes and Bosch have tested the technology outside of Germany. In their home country, the driverless parking capability is already installed and ready to use at Stuttgart Airport pending final regulatory approval, according to Philipp Skogstad, Mercedes’ president and CEO of North American research and development.

A handful of other auto industry names are also investing in automated valets, including the Volkswagen Group-owned CARIAD, which demonstrated its technology at an industry summit in Munich last. Yet another competitor is Maryland-based STEER. Other companies focused on autonomous technology from more of a road-driving perspective are Google’s Waymo and, of course, Tesla.

Skogstad acknowledged the increasingly crowded playing field. “Automated driving is such a complex task requiring so many pieces to come together that nobody can do that alone,” he said. “No matter how much money you have, you need partners.”

Stepper noted that Bosch is “intensely” focused on finding collaborators in the “smart infrastructure” space who can help it implement a driverless parking network. The next step, he added, is to convince local parking operators to invest in the technology. Without human error (consider that driver in your apartment building’s garage who’s always double-parked), he estimated that a fully-automated parking lot could fit up to 20% more cars.

And what about the valet workers—such as those on hand at the demo, who were kind enough to park cars for the event’s attendees the old-fashioned way? A Bosch spokesperson noted that they wouldn’t exactly be put out of business, as self-parking garages would still need humans to operate and maintain their technology and act as a safeguard.

From Your Site Articles

- Autonomous Vehicle Companies Doubled Their Testing Miles - dot.LA ›

- Motional Expands Its Autonomous Vehicle Operations in LA - dot.LA ›

Related Articles Around the Web

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

https://twitter.com/samsonamore

samsonamore@dot.la

Swipe Less, Know More, Build Faster: LA’s AI Push

10:25 AM | November 07, 2025

🔦 Spotlight

Happy Friday LA!

This week was about AI moving from side feature to core product strategy. Tinder is testing an opt-in “Chemistry” flow that learns your interests with permission, including signals from your camera roll, to propose fewer, higher quality matches. Snap is wiring Perplexity’s conversational, source linked answers directly into Snapchat. And Rivian spun out Mind Robotics to take the industrial AI it built for its own lines to a broader market.

Tinder Bets on AI for Quality Over Quantity

Tinder is piloting Chemistry, an opt-in experience that starts with a short Q&A and, with permission, analyzes cues from your camera roll to build a richer picture of what you like. The aim is to cut through swipe fatigue by presenting a smaller set of high intent matches each day, first in New Zealand and Australia, as part of Match Group’s larger 2026 product overhaul. The pitch is relevance and control, with phased rollout and consent front and center; if engagement lifts, expect tighter loops between real world signals and match recommendations.

Snap Brings Perplexity Answers into Snapchat

Snap struck a deal with Perplexity to deliver conversational, source linked results inside Snapchat starting in early 2026, backed by a one year cash and equity package reportedly worth about 400 million dollars. Ask a question where you already spend time and get a cited answer without hopping to a mobile browser, with Snap emphasizing that Snapchat data will not train Perplexity’s models. The announcement landed alongside improving fundamentals, signaling Snap’s plan to make trustworthy answers feel native to social habits rather than a separate destination.

Rivian Spins Out Mind Robotics

Rivian formed Mind Robotics to productize the software and systems that coordinate its own manufacturing, raising roughly 110 to 115 million dollars led by Eclipse. The goal is to sell factory floor intelligence beyond vehicles, including adaptive quality control, smarter material handling, and autonomous workflows that reduce downtime. With Rivian’s headquarters in Irvine and a growing regional robotics talent base, this puts Southern California on the map for next generation industrial automation tied to the EV supply chain.

Bottom line

LA’s tech scene is pushing AI toward measurable outcomes: better match quality, faster answers with clear citations, and more efficient production. Keep an eye on the unsexy details, including privacy choices and user consent, data boundaries between partners, and how each team turns these features into monetization. That is where this week’s announcements will turn into lasting advantage.

🤝 Venture Deals

LA Companies

- Evotrex exited stealth with a $16M Pre-A round led by Xstar Capital, with Unity Ventures, Kylinhall Partners, Vision Plus Capital, and founders of Anker Innovations participating; the capital will expand engineering and speed commercialization of its first product. The California startup plans to debut what it calls the world’s first power-generating RV trailer at CES 2026, designed to provide off-grid power and help extend EV range while towing. - learn more

- Zest AI, which provides AI-driven credit underwriting and lending intelligence for banks and credit unions, closed an oversubscribed, customer-led financing round from SchoolsFirst, Members 1st, ORNL, and Truliant credit unions, with participation from Citi Ventures. The company says the round came at a higher valuation than its prior growth raise and will fund more automation across the borrower journey and a broader rollout of LuLu, its generative AI lending-intelligence platform. - learn more

- Estate Media, the social first real estate media startup co-founded by “Million Dollar Listing” star Josh Flagg, says it has surpassed $6M in revenue and closed a $1M seed round, bringing total funding to $2.65M. New investors include Tinder co-founder Justin Mateen and real estate and media figures such as Samir Mezrahi (“Zillow Gone Wild”), Tracy Tutor, and Hudson Advisory, which the company says positions it for profitability and further growth. - learn more

LA Venture Funds

- Cedars Sinai Ventures joined Amae Health’s $25M Series B, led by Altos Ventures with participation from Quiet Capital, Bling Capital, Healthier Capital, and 8VC. The company, which is building an AI enabled clinic model for severe mental illness, says the funding will accelerate nationwide clinic openings, advance its AI care platform, and support research into conditions like schizophrenia, bipolar disorder, and treatment resistant depression. Total funding now tops $50 million. - learn more

- Magnify Ventures participated in MiSalud Health’s new funding round led by IGNIA, alongside Ulu Ventures, Redwood Ventures, Amplifica Capital, and client investor Taylor Farms. MiSalud, which delivers bilingual virtual and on-site care for blue-collar workforces, says the capital will help it expand into 20 new states and add services typically offered only in person; reports peg total funding at about $18.3 million. - learn more

- Alexandria Venture Investments participated in Accipiter Biosciences’ $12.7M seed round, which was co-led by Takeda and Flying Fish Partners. The Seattle startup is developing AI-designed de novo protein therapeutics that can combine multiple mechanisms in a single molecule, and it also announced partnerships with Pfizer and Kite Pharma alongside the financing. The company says the funds will advance preclinical programs in immunology and oncology and further build out its computational design platform. - learn more

- Rebel Fund participated in Cactus’s $7M seed round alongside Wellington Management, Y Combinator, and Pelion Venture Partners. Cactus builds a 24/7 AI copilot for home service businesses that answers calls, qualifies leads, books jobs, and manages follow ups to capture after hours demand. The company says the funding will support product expansion and go to market growth in the United States. - learn more

- B Capital joined the angel round for Microtide Biotechnology (also known as Weitao Bio), which raised over RMB 100 million, led by Qiming Venture Partners. The Shanghai company, spun out from Sile Biomedicine’s in vivo CAR T platform, is developing targeted LNP delivered in vivo CAR T therapies for blood cancers and autoimmune diseases, and will use the funds to advance its first candidate and further develop its core platform. - learn more

- Patron co led Flint’s $15M Series A, with participation from the USC Viterbi School of Engineering alongside Basis Set Ventures, AME Cloud Ventures, Afore Capital, and Y Combinator. Flint builds an AI platform that helps teachers personalize K 12 learning, and the company says the funding will accelerate product development and scale the service to more schools. - learn more

- Rebel Fund participated in Freya’s $3.5M round alongside Y Combinator, 212 VC, N1 Tech, BD Partners, and others. Freya is building voice automation tools that let companies create and manage natural language voice workflows, aiming to replace brittle IVR systems with more flexible, AI powered voice agents. The company says the funding will accelerate product development and early go to market efforts. - learn more

- Regeneration.VC led Hullbot’s roughly $10.6M Series A, with participation from Climate Tech Partners, Katapult Ocean, Folklore, Trinity Ventures, Rypples, NewSouth Innovations, and Bandera Capital. The Australian startup builds autonomous hull-cleaning robots that remove biofouling to cut ship fuel use and emissions, and it plans to use the funding to ramp manufacturing, expand global service hubs, and develop larger robotic platforms. - learn more

- M13 led Teleskope’s $25M Series A, with continued participation from Primary Venture Partners and Lerer Hippeau. Teleskope builds an agentic data security platform for the AI era, and says the capital brings total funding to $32.2M to accelerate product development and scale go to market. - learn more

- SmartGateVC participated in Coherence Neuro’s $10M seed round led by Topology Ventures and Artesian, alongside Blackbird, Possible Ventures, XEIA, Jumpspace, Divergent, Spacewalk VC, and others. San Francisco based Coherence Neuro is developing a closed-loop, bi-directional neurotechnology platform to treat cancers like glioblastoma by decoding and modulating electrical signals; the funding will support its first human trials and further product development. - learn more

- Rebel Fund participated in Mecha Health’s $4.1M seed round led by Valia Ventures, alongside Y Combinator, Reach Capital, and Phosphor Capital. Mecha Health is an applied AI lab that builds foundation models for radiology which read medical images and generate fully structured reports, and the new capital supports continued development and deployment of these systems. - learn more

LA Exits

- Green Econome was acquired by VCA Green, the sustainability practice of VCA Consultants. The Los Angeles firm is known for lifecycle strategies, building performance reporting, and compliance services like ENERGY STAR, LEED, CALGreen, and Title 24; combining it with VCA Green’s energy modeling, project management, and field verification creates a single team serving both new construction and existing buildings. Marika Erdely, Green Econome’s founder, is joining VCA Green as a principal. - learn more

- InData Consulting was acquired by The 20 MSP as part of a three-company deal that also included Red Level Group and iStreet Solutions. The additions expand The 20 MSP’s footprint in California, Arizona, Michigan, and the Sacramento area, bringing its total to 44 acquisitions in about three years. The company says it sources targets from its peer group to speed integrations and reduce attrition. - learn more

- Caulipower was acquired by Urban Farmer, a Paine Schwartz Partners portfolio company, creating a vertically integrated “better for you” frozen foods platform that pairs Urban Farmer’s manufacturing with Caulipower’s nationwide brand and distribution. Caulipower will continue operating under its name, with founder Gail Becker joining Urban Farmer’s board; financial terms were not disclosed. - learn more

- StudyOS was acquired by Sitero, a technology-enabled CRO, which simultaneously launched SiteroAI to position itself as the industry’s first fully AI-powered CRO. StudyOS’s Ash clinical-trial agent will be integrated with Sitero’s Mentor eClinical suite, with Sitero projecting 20–30% efficiency gains across the trial lifecycle beginning in 2026; terms were not disclosed. - learn more

Read moreShow less

Resy Cofounder’s New App Lands in LA: A Loyalty Tool Restaurants Actually Want

10:08 AM | October 24, 2025

🔦 Spotlight

Hello LA,

Blackbird, the loyalty and payments startup from Resy and Eater co-founder Ben Leventhal, officially landed in LA this week. The product is simple in the wild: you check in, pay through the app, and earn rewards that restaurants can actually act on, helping them spot and serve regulars without guessing. The LA launch goes live with more than 50 partners centered on the Westside, including names like Gjelina and Felix, plus spots across groups such as Rustic Canyon and Citrin, with expansion planned beyond Venice and Santa Monica.

Under the hood, Blackbird has been building a national network and says it is live at more than 1,000 restaurants. The company raised fresh capital earlier this year to expand markets and roll out cross-restaurant rewards, positioning LA as a key beachhead for growth. If you dine out a lot, the appeal is that the app collapses discovery, payment, and loyalty into one flow. If you run a dining room, the promise is cleaner data on guests you actually see, instead of a generic points program that lives somewhere else.

For LA specifically, the draw is that this model fits how the city eats. We spread across neighborhoods, follow chefs, and rotate between a small set of favorites and a long list of next-ups. A networked loyalty layer that recognizes that pattern could move real dollars, particularly for independents that want to keep the relationship direct. We’ll be watching how quickly the footprint moves east from the coast and which operators lean into memberships and targeted rewards first.

Scroll for this week’s LA venture deals, funds, and acquisitions.

🤝 Venture Deals

LA Companies

- GammaTime, a Los Angeles based premium micro drama platform founded by former Miramax CEO Bill Block, raised $14M seed led by vgames and Pitango, with participation from Alexis Ohanian, Kris Jenner, Kim Kardashian, and Traverse Ventures. The app is live on iOS and Android, features more than 20 vertical phone native originals, and plans new series from “CSI” creator Anthony E. Zuiker as it scales a freemium model for U.S. audiences. - learn more

- Wolf Games, a generative-AI gaming startup backed by Dick Wolf, raised a $9M Series A led by Main Street Advisors. The company also inked a partnership with NBCUniversal to develop interactive games using NBCU IP, built on Wolf Games’ platform for creating “living, cinematic” game worlds. Notable participants include Maverick Carter, Tom Werner, and Rashid Johnson, alongside returning investors Jimmy Iovine, Paul Wachter, and Dick Wolf. - learn more

- Quantum Elements, a Los Angeles based startup, launched Constellation, an AI native platform that helps teams build quantum software and co design hardware using agentic AI, natural language prompts, and a large noisy qubit simulator. The company emerged from stealth with funding from QDNL Participations and support from USC Viterbi, and says Constellation can speed code generation, debugging, and testing for applications in pharma, energy, and finance. - learn more

- Arbor Energy raised a $55M Series A co-led by Lowercarbon Capital and Voyager Ventures, with Gigascale Capital and Marathon Petroleum Corporation participating, to accelerate deployment of its zero-emission, fuel-flexible turbines. The funding completes a 1 MW pilot called ATLAS and advances HALCYON, a 25 MW modular turbine that uses oxy-combustion with supercritical CO₂ for efficient, carbon-neutral baseload power aimed at data centers, utilities, and industrial customers. - learn more

- Dialogue AI raised a $6M seed led by Lightspeed Venture Partners to scale its AI-native research platform, which uses a live conversational AI interviewer to run real-time customer interviews and deliver insights faster. Participants include Seven Stars, Uncommon Projects, the Tornante Company, and notable angels, and the funds will accelerate product and go-to-market efforts with early customers such as Wayfair, Square, Nextdoor, and Suno. - learn more

LA Venture Funds

- March Capital participated in Uniphore’s $260M Series F, joining strategic investors NVIDIA, AMD, Snowflake, and Databricks. The funding will accelerate development and adoption of Uniphore’s Business AI Cloud and expand its partner ecosystem, alongside investors like NEA, BNF Capital, National Grid Partners, and Prosperity7 Ventures. - learn more

- Beast Ventures participated in Nutropy’s latest funding round to scale precision-fermented casein for next-gen dairy ingredients. The France-based startup will use the capital to ramp production and deliver larger samples of its “cheeseable milk” powder to food manufacturers as it targets a 2027 launch. - learn more

- Patron participated in Notch’s $8M seed financing round, alongside investors such as Wing, Samsung, and Balaji, to scale the company’s AI platform for generating performance ads. Notch has since launched a “URL-to-animated-ads” feature that turns a product link into ready-to-run animated creatives within minutes, supporting a faster workflow for marketers rolling out motion ads. - learn more

- B Capital participated in CurbWaste’s $28M Series B, which was led by Socium Ventures with Flourish Ventures, TTV Capital, and Squarepoint Capital also joining. The funding brings total capital to $50M and will accelerate product and go-to-market work on CurbWaste’s operating system for independent waste haulers, including AI-driven dispatch, reporting, and payments. - learn more

- Thin Line Capital participated in SenseNet’s $14M Series A to scale its AI wildfire-detection network in the United States. The round was led by Stormbreaker with Fusion Fund, Plaza Ventures, FOLD36 Capital, and B Current also joining; funds go toward new offices and installations as SenseNet fuses gas sensors, AI cameras, satellites, and weather data to spot fires before they are visible. The company says it already monitors about 130 million acres and can flag ignitions within minutes. - learn more

- MANTIS Venture Capital participated in Keycard’s $38M financing for its identity and access platform for AI agents. The combined seed and Series A were led by Andreessen Horowitz, Acrew Capital, and Boldstart Ventures, and coincide with Keycard’s early-access launch. Keycard says its system issues short-lived, auditable identity tokens to help developers govern agent actions and data across apps. - learn more

- WndrCo participated in Defakto’s $30.75M Series B, a round led by XYZ Venture Capital with The General Partnership and Bloomberg Beta also joining. Defakto, formerly SPIRL, builds a Non-Human Identity and Access Management platform that replaces static credentials with dynamic, auditable identities for services, pipelines, workloads, and AI agents across multi-cloud environments. The company will use the capital to accelerate product development and expand go-to-market efforts. - learn more

- CIV co led 1001’s $9M round alongside General Catalyst and Lux Capital to build an AI native operating system for decision making in critical industries. 1001 combines live data ingestion, operational mapping, AI driven decisioning, and governance to help operators act in real time, with early pilots in aviation, logistics, and large infrastructure projects. The raise also includes backers like Chris Ré and Amjad Masad and will fund early deployments and hiring in Dubai, London, and beyond. - learn more

- Brentwood Associates led Throne Labs’ $15M Series B initial close to expand the company’s smart restroom infrastructure across new and existing U.S. markets. Existing investors including Uncorrelated Ventures, DiPalo Ventures, Rabil Ventures, and Arpiné Capital participated as Throne scales its network of sensor-equipped, ADA-compliant restrooms and city partnerships. - learn more

- M13 led Estuary’s $17M Series A, with participation from FirstMark and Operator Partners, to scale the company’s “right-time data” platform. Estuary unifies change data capture, streaming, and batch into one managed system with BYOC deployment so enterprises can control latency and feed AI applications more reliably; funds will support product and go-to-market expansion. - learn more

- Strong Ventures provided follow-on funding in Unjeonseonsaeng’s ₩2.8B (~$2.0M) Series A, backing the driving-school comparison and booking platform as it scales nationwide. New investors Fast Ventures and Korea Credit Guarantee Fund joined the round, with proceeds going to expand the company’s SaaS tools for driving schools and enhance data-driven features like AI recommendations and advertising. The startup reports monthly GMV above ₩1B and its first profitable quarter in 2025. - learn more

- Interlagos led Adaptyx Biosciences’ $14M seed, with Hyperlink Ventures participating alongside Overwater Ventures, Starbloom Capital, Stanford University, the Chan Zuckerberg Biohub, and others. Adaptyx is developing a biowearable for continuous, multi-analyte molecular monitoring; the raise brings total funding to about $23M and supports R&D, clinical progress toward FDA clearance, and platform scaling. - learn more

- B Capital participated in Faeth Therapeutics’ new $25M financing, which brings the company’s total funding to $92M and supports a randomized Phase 2 trial of its PIKTOR regimen in endometrial cancer with the GOG Foundation. The raise, led by S2G Ventures with additional new and existing backers, follows Phase 1b data showing an 80% overall response rate and 11-month median PFS when PIKTOR was combined with paclitaxel. - learn more

- Btech Consortium participated in PortX’s strategic growth round, joining renewed backers alongside new investors Allied Solutions and the American Bankers Association. The funding extends PortX’s Series B and underscores industry support for its AI-powered data integration platform for banks and credit unions. - learn more

LA Exits

- Breez was acquired by JumpCloud to bolster JumpCloud’s identity threat detection and response capabilities and accelerate its security roadmap. The deal brings Breez’s ITDR technology and team into JumpCloud’s platform; terms were not disclosed. The Breez group is led by former Adobe executive Abhinav Srivastava. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS