🔦 Spotlight

Hello Los Angeles,

The future just got a flight plan, and it includes skipping traffic for the 2028 Olympics.

This week, Santa Clara-based Archer Aviation made headlines (and history) by being named the official air taxi provider for the LA28 Olympic and Paralympic Games and Team USA. Yes, that means electric vertical takeoff and landing (eVTOL) aircraft will be soaring above the gridlocked freeways, whisking athletes, officials, and perhaps a few lucky spectators through LA’s famously congested skies.

This isn’t just a flashy PR stunt (although, let’s be honest, it is peak LA). It’s a strategic move to redefine how we move around the city, especially during one of the largest global events ever to hit Southern California. In partnership with the LA28 Organizing Committee, Archer plans to deploy its Midnight aircraft, an all-electric air taxi that promises ultra-quiet, zero-emission rides from point A to point OMG-I’m-not-in-traffic.

While Archer is headquartered in Santa Clara, it has deep ties to the LA tech ecosystem. United Airlines, one of its major partners, has previously announced plans to establish eVTOL routes between downtown and LAX. Pair that with this new Olympic milestone and we’re looking at LA as ground zero for what could become the world’s first large-scale urban air mobility network.

Of course, there are still regulatory hurdles, infrastructure needs, and airspace coordination issues to iron out before we can book our sky ride to the Coliseum. But make no mistake, this announcement is a moonshot moment for LA tech, mobility, and the future of Olympic-scale transportation.

We’ll be keeping our feet on the ground (for now), but we’ll definitely be watching the skies.

Catch you next week ✈️✨

🤝 Venture Deals

LA Companies

- Akido, a Los Angeles-based health tech company, has raised $60M in Series B funding led by Oak HC/FT to expand the reach of its AI-powered clinical tool, ScopeAI. The platform assists physicians by generating clinical questions, documenting patient responses, and drafting care plans in real time. The funding will help Akido scale its technology across its provider network and expand into new markets like New York City. - learn more

- Reflect Orbital, a startup developing satellite-based sunlight delivery systems, has raised $20M in a Series A round led by Lux Capital. The company plans to use the funding to expand its team, scale operations, and prepare for its first satellite launch in Spring 2026. Reflect Orbital’s technology aims to reflect sunlight from space to Earth, enabling nighttime illumination for energy, remote operations, and civil infrastructure. - learn more

- Rolli, an AI-powered platform designed to support fact-based journalism, has received an investment from the NYU Impact Investment Fund (NIIF). This marks NIIF's first investment in a media company, underscoring its commitment to backing ventures that enhance democratic institutions through innovation. Rolli's platform connects journalists with a diverse range of vetted experts, aiming to streamline news production and promote equitable representation in media. The funding will help Rolli expand its reach and further develop tools that empower journalists to produce accurate and impactful reporting. - learn more

LA Venture Funds

- CIV and Wonder Ventures participated in The Nuclear Company’s $46.3M Series A round to support its plan to develop large-scale nuclear reactor sites across the U.S. CIV co-founder Patrick Maloney also co-founded the company, which is taking a “design-once, build-many” approach to modernize nuclear construction. The funding will help meet rising energy demands from sectors like AI and data centers. - learn more

- WndrCo participated in Cartwheel's recent $10M funding round. Cartwheel is an AI-driven 3D animation startup that enables creators to generate rigged animations from text prompts and videos. The funding will support Cartwheel's efforts to simplify and democratize 3D animation production. - learn more

- Crosscut Ventures participated in Solestial's $17M Series A funding round, which aims to scale the company's production of radiation-hardened, self-healing silicon solar panels for space applications. Solestial plans to increase its manufacturing capacity to 1 megawatt per year, matching the combined annual output of all U.S. and EU III-V space solar companies. This investment supports the growing demand for cost-effective, high-performance power systems in the expanding space industry. - learn more

- Upfront Ventures participated in Tern's $13M Series A funding round, adding to its earlier $4M seed investment in the travel tech startup. Tern offers an all-in-one platform for travel advisors, streamlining itinerary building, CRM, and commission tracking. The new funding will help Tern enhance its product offerings and expand support for its growing user base. - learn more

- Dangerous Ventures participated in Verdi's $6.5M seed funding round, supporting the Vancouver-based agtech startup's mission to modernize farm irrigation systems through AI-powered automation. Verdi's technology retrofits existing infrastructure, enabling precise, row-level control of irrigation, which helps farmers reduce water usage and labor costs. The investment aligns with Dangerous Ventures' focus on climate resilience and sustainable food systems. - learn more

- Pinegrove Capital Partners participated in Saildrone's recent $60M funding round, supporting the company's expansion of its autonomous maritime surveillance technology into Europe. The investment will aid in deploying Saildrone's uncrewed surface vehicles for enhanced maritime security and defense applications across European waters. - learn more

- Starburst Ventures participated in a €2 million seed funding round for French defense tech startup Alta Ares, which specializes in embedded AI and MLOps solutions for military applications. Alta Ares' technologies, including the Gamma platform for real-time video analysis and the Ulixes platform for managing operational data lifecycles, operate autonomously without the need for internet or cloud connectivity. This funding will support the industrialization of these solutions and expand their deployment across European armed forces and NATO allies. - learn more

- Nomad Ventures participated in Stackpack’s recent $6.3M seed funding round, supporting the company's mission to streamline vendor management for modern businesses. Stackpack offers an AI-driven platform that provides finance and IT teams with a centralized system to oversee third-party vendors, manage renewals, and mitigate compliance risks. The investment will enable Stackpack to expand its operations, enhance its platform, and introduce new features like the "Requests & Approvals" tool, aimed at simplifying vendor onboarding and procurement processes. - learn more

- Tachyon Ventures participated in Stylus Medicine's $85M Series A funding round, supporting the biotech company's development of in vivo genetic medicines. Stylus aims to simplify gene editing by enabling precise, durable CAR-T therapies delivered directly inside the body, potentially transforming treatment for various diseases. - learn more

- Up.Partners led a $28M Series A funding round for WakeCap, a construction tech startup that uses sensor-powered platforms to deliver real-time workforce visibility and site intelligence. WakeCap’s system tracks labor hours, safety, and productivity across large-scale projects, with over 150 million labor hours already monitored. The new funding will help the company expand globally, enhance product features, and grow its engineering and customer success teams. - learn more

LA Exits

- MediaPlatform, a leading provider of enterprise video solutions, has been acquired by Brandlive, a company renowned for bringing the magic of television to business communications. This strategic acquisition aims to enhance Brandlive's capabilities in delivering high-scale, reliable CEO town halls and global corporate broadcasts. By integrating MediaPlatform's robust infrastructure with Brandlive's creative video tools and production services, the combined entity seeks to offer more engaging and authentic internal content experiences for enterprise clients. - learn more

- RHQ Creative, a studio renowned for its competitive Fortnite training maps, has been acquired by JOGO, the game development company founded by popular creator Typical Gamer (Andre Rebelo). This acquisition aims to bolster JOGO's expansion into the competitive gaming arena by integrating RHQ's expertise in skill-building and training map design. RHQ Creative, co-founded by Fortnite pro Quinn Gannon (RichHomieQuinn) and Sean Lugo, has achieved over 20 million map visits and 200 million hours of playtime. The deal includes full ownership of RHQ's map catalog and the addition of its team to JOGO, enhancing the company's capabilities in developing high-quality, competitive gaming experiences. - learn more

Image Source: Perelel

Image Source: Perelel

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

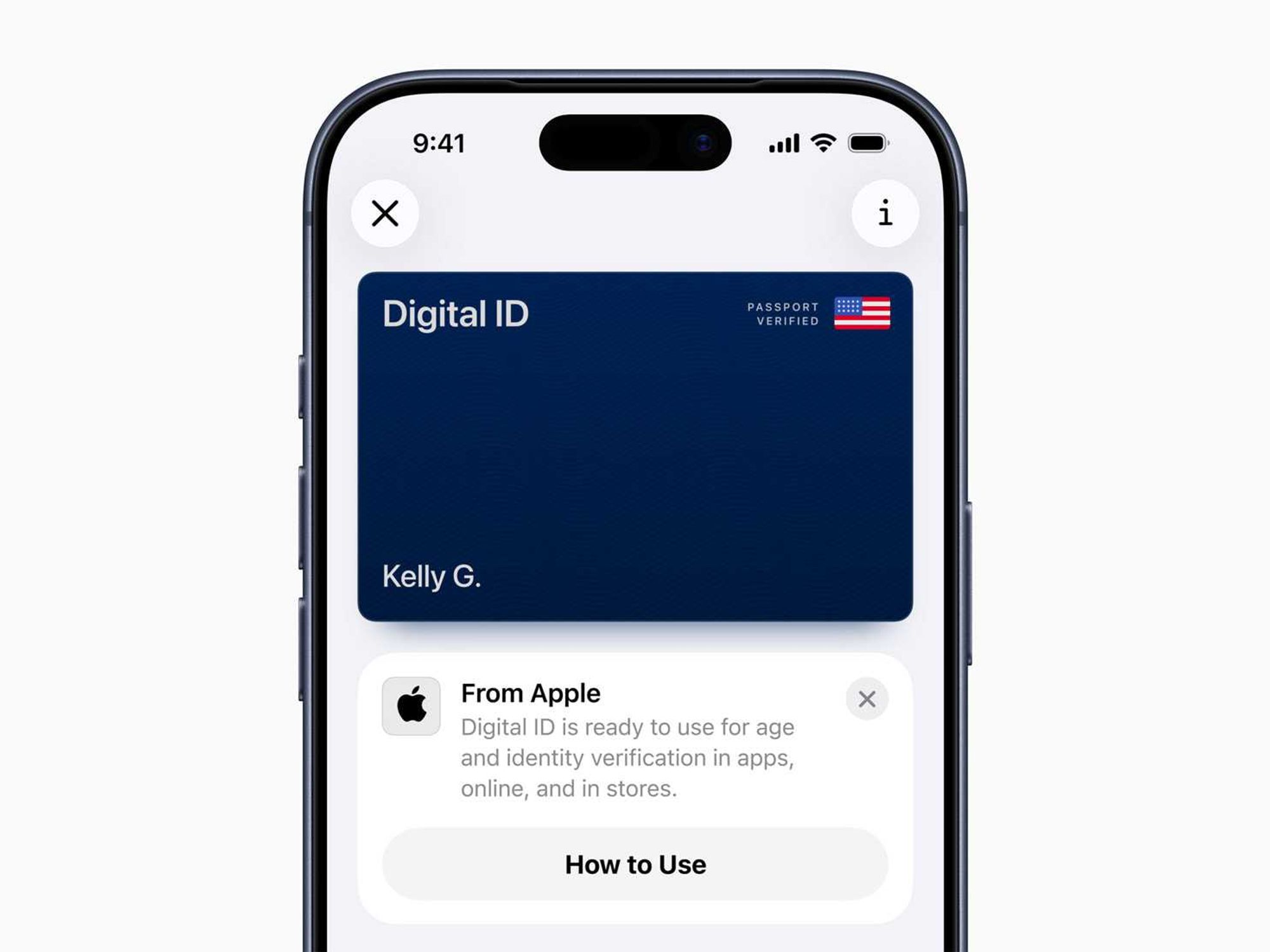

Image Source: Waymo Image Source: Apple

Image Source: Apple