Get in the KNOW

on LA Startups & Tech

XThe Lithium Race Takes Shape in the Salton Sea

David Shultz

David Shultz reports on clean technology and electric vehicles, among other industries, for dot.LA. His writing has appeared in The Atlantic, Outside, Nautilus and many other publications.

Located roughly a hundred miles east of San Diego, the Salton Sea is California’s largest landlocked body of water, for now.

Measuring 5 miles across and 35 miles long in its current form, the lake was created by diverting water from the Colorado River into the region for agricultural purposes. Once a vacation destination renowned for its wildlife and wetlands, a series of environmental mishaps and mismanagement have left the lake toxically salty, shrinking and often malodorous. Conditions have gotten so bad that Palm Springs Life Magazine called the region’s transformation “the biggest environmental disaster in California history” in March of 2020.

But against this unlikely backdrop, new life—or at least new industry—is scrambling to set up shop in the region. The Salton Sea, it turns out, is rich with lithium, an element that has taken center stage in the world’s transition to clean energy and its ever-growing demand for batteries. From smartphones to electric vehicles, there’s a pretty good chance that the last battery you used had lithium ions inside. Prices for the metal reached an all time high in September, and futures are up more than 400% since the start of 2021. With Biden’s new economic policy outlined in the Inflation Reduction Act, there are strong financial incentives to move battery production back to North America.

If that’s going to happen the Salton Sea could very well become the lithium capital of North America, or to paraphrase Governor Gavin Newsom, the region could become the “Saudi Arabia of lithium,” and the players are already starting to assemble.

Currently, there are three companies attempting to set up plants in the Salton Sea for direct lithium extraction: EnergySource Minerals, Controlled Thermal Resources and BHE Renewables, a branch of Berkshire Hathaway. All three companies have similar business strategies from a high level, all of which involve geothermal power plants. These plants, which are common in many parts of the world, draw hot, salty water from deep in the ground to create steam which drives a turbine to produce electricity. What makes the Salton Sea so special is that its geothermal brines just happen to contain lithium.

In a 2017 study, researchers from the U.S. DOE Office of Energy Efficiency and Renewable Energy analyzed more than 2,000 samples of geothermal fluid from U.S. sources and found that only 1% had significant lithium concentration. This rare confluence of geothermal activity and lithium presence provides an opportunity for companies to generate electricity and mine lithium simultaneously.

Beyond their marriage of geothermal energy and lithium extraction, the three companies begin to diverge.

According to former dot.LA engagement editor Luis Gomez — whose newsletter Lithium Valle, is essential reading on this topic — EnergySource seems to be out in front early.

“They claim to have the technology that’s patented, they claim to have done the research, they claim to have the funding, and they claim they're ready to go and start production,” says Gomez. “They are kind of considered the canary in the coal mine.”

According to a report from the United States Department of Energy, EnergySource plans to eventually scale production up to over 20,000 metric tons of lithium hydroxide per year using its proprietary Integrated Lithium Adsorption Desorption technology.

Construction on the plant was slated to start earlier this year, but has been delayed. EnergySource has said publicly that lithium production might begin in the second quarter of 2024, but it’s unclear whether this date will also be pushed back. The company has a long history of operating in the region, having run the John L. Featherstone geothermal plant since 2012. The new venture into lithium would leverage that same plant, but without more details about how their proprietary technology works, there’s not much to do but wait and see.

One potential problem facing all three lithium extraction companies is that the Salton Sea geothermal brines are not the same as the brines in evaporation ponds similar to those in Argentina, Chile and Bolivia, where more than half of the world’s lithium is produced. Specifically, the deep geothermal brines in the Salton Sea contain more silica and transition elements, which may complicate the chemistry of purifying the lithium. Still, many researchers are extremely bullish on the prospect of tapping into these reserves. Alex Grant, The Principal at Jade Cove, a research organization focusing on direct lithium extraction technologies, says that much of the skepticism surrounding the technology can be attributed to competing financial interests that are trying to squash the nascent tech’s potential in favor of an established method.

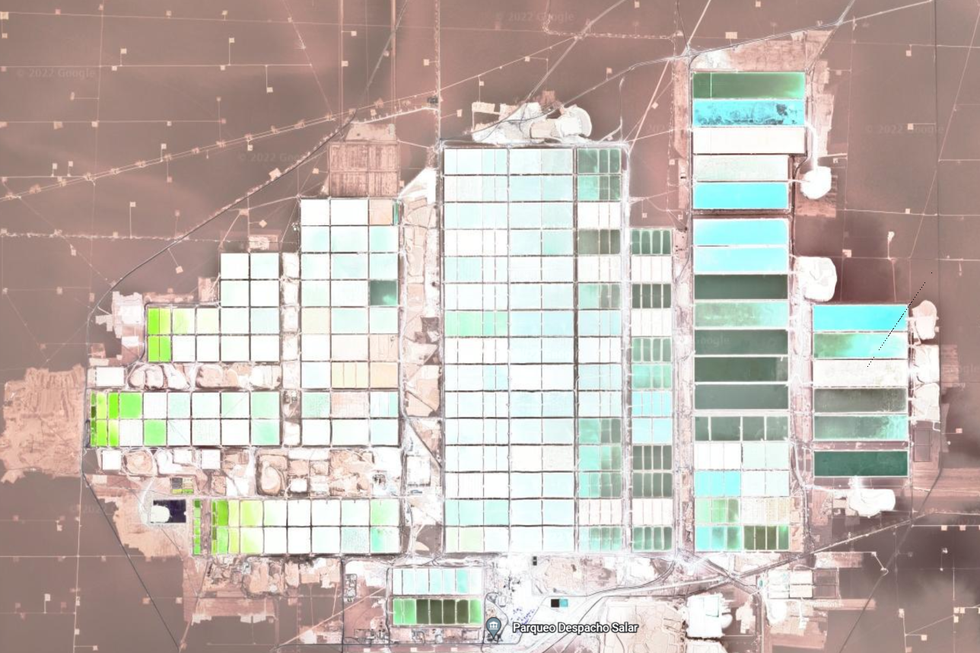

Lithium Mines in the Atacama Salt Flats, Chile from an altitude of 15km via Google Earth. The facility is about 10km wide.

Google Earth

For its part, BHE Renewables, operating as CalEnergy, runs a fleet of 10 geothermal plants in the Imperial Valley. The company had previously announced its intent to set up a direct lithium extraction demonstration plant sometime before the end of 2022 to assess the viability of lithium extraction. If that pilot program goes well, the company could build a commercial-scale facility as early as 2026 with a projected annual capacity of 90,000 metric tons of lithium.

Obviously, having the backing of Berkshire Hathaway comes with advantages and capital. Add into the equation another $15 million in DoE grant money obtained last winter, and BHE appears to be well positioned as a major player in the long term.

Finally, there’s Controlled Thermal Resources. As the only company not already operating a geothermal business in the region, CTR is something of an outsider and dark horse. By 2024, the company hopes to build both a geothermal energy plant and a direct lithium extraction plant to operate in parallel, projecting a capacity to extract 300,000 metric tons of lithium carbonate equivalent annually by 2030. As dot.LA previously reported, Controlled Thermal Resources has partnered with Statevolt, a company that intends to build a $4 billion gigafactory nearby that will run on power from CTR’s geothermal plant and make batteries from the lithium it extracts. It’s a beautiful closed-loop business model. But again, all of this relies on the direct lithium extraction technology, and details are scant.

According to Gomez, despite the typically cut-throat nature of the energy industry, the relationship between the three upstarts in the Salton Sea is often surprisingly cooperative at the moment.

“They want the others to succeed because it kind of gives them the confidence that their technology is also eventually going to succeed,” he says. “It gives confidence to investors.”

Which is all to say, there may well be space for all three companies if the technology is as solid as they claim. If that’s the case, the Salton Sea and its surrounding region may have yet another miraculous transformation up its sleeve.

From Your Site Articles

- EV Battery Maker Statevolt Is Embracing a 'Buy Local' Ethos - dot.LA ›

- EV Battery Maker's Plans Gigafactory in Imperial Valley - dot.LA ›

- Statevolt Joins Lithium Race In Salton Sea - dot.LA ›

- The US Needs A lot More Lithium Before The Switch to EVs - dot.LA ›

- Why Are Lithium Prices Falling? - dot.LA ›

Related Articles Around the Web

David Shultz

David Shultz reports on clean technology and electric vehicles, among other industries, for dot.LA. His writing has appeared in The Atlantic, Outside, Nautilus and many other publications.

JetZero Just Raised $175M to Rewrite How We Fly

07:06 AM | January 16, 2026

🔦 Spotlight

Happy Friday, Los Angeles ✈️

While everyone in tech is still busy arguing about the next AI model, one startup based out of Long Beach just raised a whole lot of money to change the shape of the airplane itself.

JetZero closed a $175 million Series B to build its blended wing body “all-wing” airliner, with B Capital leading the round alongside United Airlines Ventures, Northrop Grumman, 3M Ventures, Trucks VC and RTX Ventures. The company is working toward a full-scale Demonstrator aircraft that targets at least 30% better fuel efficiency than today’s tube-and-wing jets, with a first flight planned for 2027 and a commercial Z4 airliner to follow in the early 2030s.

This is not a small bet. JetZero’s pitch is that airlines and regulators need a way to hit climate targets without waiting on sci-fi batteries or hydrogen infrastructure, and that a radically more efficient airframe is the most realistic path. It is also very much an LA story: deep aerospace talent, strategic money at the table, and a product that looks like a mashup of climate tech, defense tech and old-school manufacturing rather than another SaaS dashboard.

There is still a long way to go. The next few years are about turning simulations and wind-tunnel charts into flight data, working with regulators and proving that a manta-ray-shaped jet can slot into a world built for Boeings and Airbuses. But if JetZero gets anywhere close, it will mean that one of the most ambitious hardware bets in commercial aviation is being engineered out of Long Beach.

Scroll on for the latest LA venture rounds, fund news and acquisitions.

🤝 Venture Deals

LA Companies

- No Agent List secured $10M in private investment to launch its AI powered real estate platform ahead of a planned Spring 2026 debut. The Los Angeles based company aims to put “agent level” tools directly in the hands of buyers, sellers and vendors, offering direct access to off market properties, FSBOs, distressed assets, foreclosures, tax liens and auctions that have traditionally been gated by agents and insiders. The funding will support product development and rollout of the platform, which promises more control over transactions while using AI to surface opportunities and streamline the deal process. - learn more

- Hadrian, the Los Angeles based advanced manufacturing startup, announced new capital led by accounts advised by T. Rowe Price Associates to accelerate its push to “reindustrialize” American manufacturing. The financing, which also includes Altimeter Capital, D1 Capital Partners, StepStone Group, 1789 Capital, Founders Fund, Lux Capital, a16z, Construct Capital and others, values the company at $1.6B and will be used to expand its high-throughput factories, grow its workforce and deploy more AI, software and automation across its “factories-as-a-service” platform for aerospace, defense and critical infrastructure customers.- learn more

LA Venture Funds

- Blue Bear Capital joined Hydrosat’s $60M Series B, backing the thermal infrared satellite data company alongside lead investors Hartree Partners, Subutai Capital Partners and Space 4 Earth. The funding will help Hydrosat expand its constellation beyond its two current satellites, ramp global coverage and deepen its AI-powered “thermal intelligence” products for water resource management, agriculture, civil government and defense customers worldwide. - learn more

- Elysian Park Ventures led a $12M growth round for Diamond Kinetics, backing the Pittsburgh-based baseball tech company as it doubles down on youth development. The new capital will help Diamond Kinetics scale sidelineHD, its AI-powered youth baseball and softball live streaming and highlights platform, and expand its broader suite of training tools as MLB’s Trusted Youth Development Platform. - learn more

- MANTIS Ventures participated in Depthfirst’s $40M Series A round, backing the San Francisco based applied AI lab alongside lead investor Accel, Alt Capital, BoxGroup, Liquid 2 Ventures and SV Angel. Depthfirst is building an AI-native “General Security Intelligence” platform that uses autonomous agents to detect, triage and remediate software vulnerabilities across code and infrastructure, aiming to outpace a new wave of AI-powered cyberattacks. The fresh capital will fund R&D, go-to-market efforts and hiring as the company scales its security platform for enterprise customers. - learn more

- Cedars-Sinai Health Ventures participated in Vista AI’s $29.5M Series B, joining a slate of leading health systems backing the company’s automated MRI scanning software. The Palo Alto-based startup will use the funding to expand its FDA-cleared cardiac MRI platform to additional anatomies like brain, prostate and spine, and to roll out remote scanning services that let hospitals without in-house MRI expertise offer advanced imaging while easing backlogs and technologist shortages - learn more

- Fourward Ventures is leading a new strategic growth investment in Mermaid Gin, backing the Isle of Wight–based premium spirits brand as it accelerates expansion in the U.S. market. The round brings Fourward’s founder Will Ward onto the board as lead investor and is paired with a national distribution partnership with Southern Glazer’s Wine & Spirits, plus the appointment of longtime Moët Hennessy veteran Jim Clerkin as CEO for the U.S. push. The capital and partnership are aimed at scaling Mermaid Gin in the fast-growing U.S. super-premium gin segment while preserving its sustainability-focused, Isle of Wight roots. - learn more

- Hyperion Capital joined Haiqu’s $11M seed round, backing the quantum software startup alongside Primary Venture Partners, Collaborative Fund, Alumni Ventures, Qudit Ventures, Silicon Roundabout Ventures, Harlow Capital, Toyota Ventures and MaC Venture Capital. Haiqu is building a hardware-aware quantum operating system and middleware layer that boosts the performance of today’s noisy quantum hardware, with the new funding going toward productizing its platform and enabling near-term commercial use cases in areas like finance, cybersecurity and scientific computing. - learn more

- Sound Ventures led WitnessAI’s $58M strategic funding round, backing the Mountain View based AI security and governance platform alongside investors including Fin Capital, Qualcomm Ventures, Samsung Ventures and Forgepoint Capital Partners. The company will use the capital to accelerate global go-to-market efforts and expand its platform, which secures AI agents and models by monitoring agent activity, linking human and agent actions, and blocking prompt injection and other attacks in real time. WitnessAI also unveiled new agentic AI governance tools that give enterprises deeper observability and policy control as they scale AI agents across their operations. - learn more

- Alexandria Venture Investments joined Proxima’s oversubscribed $80M seed financing, backing the newly rebranded AI-native biotech (formerly VantAI) alongside lead investor DCVC, NVentures (NVIDIA’s venture arm), Braidwell, Roivant and others. Proxima is building a generative AI driven platform for “proximity-based medicines” that modulate protein protein interactions, including molecular glues and PROTACs, to go after historically undruggable targets in oncology, immunology and beyond. The new capital will accelerate its NeoLink structural proteomics and Neo AI model stack, and advance a pipeline of first-in-class proximity-modulating therapeutics toward the clinic. - learn more

- Clocktower Technology Ventures participated in WeatherPromise’s oversubscribed $12.8M Series A, backing the weather-guarantee startup alongside lead investor Maveron, 1Sharpe, Lerer Hippeau, Commerce Ventures, MS Transverse, Start Ventures, 1Flourish and others. WeatherPromise partners with major travel brands like Marriott, Expedia and JetBlue to offer “weather guarantees” that automatically refund trips when conditions are worse than promised, driving demand for travel, events and outdoor experiences. The new capital will accelerate product development, expand strategic partnerships and scale the platform across more consumer categories. - learn more

- MANTIS Ventures participated in Sandstone’s $10M seed round, backing the AI-native legal tech startup alongside lead investor Sequoia Capital and others. Sandstone is building an operating system for in-house legal teams that uses AI agents to route requests, draft and review contracts, and surface answers directly inside tools like email, Slack and Salesforce, turning institutional legal knowledge into reusable workflows. The new capital will help the Brooklyn-based company scale its product and grow its customer base of corporate legal departments. - learn more

- Strong Ventures participated in Hupo’s $10M Series A round, backing the Singapore-based AI sales coaching startup alongside lead investor DST Global Partners, Collaborative Fund, January Capital and Goodwater Capital. Hupo’s platform uses AI to coach frontline banking, insurance and financial services sales teams in real time, helping them ramp faster and close more deals across highly regulated markets in APAC and Europe. The new funding will support product development, expansion of its coaching features and scaling enterprise deployments as the company eyes broader international growth. - learn more

- Freeflow Ventures joined Vivere Oncotherapies’ more than $10M funding round, backing the UC Berkeley spinout alongside YK Bioventures, Pillar, Berkeley Frontier Fund and the National Cancer Institute. Vivere is developing targeted immunotherapies for “cold” solid tumors like colorectal and ovarian cancers, aiming to activate the immune system against tumors that typically evade detection and resist existing treatments. The new capital will support advancement of its proprietary bioengineering platform and pipeline of therapies for patients with few effective options today. - learn more

- Alexandria Venture Investments joined Precede Biosciences’ $63.5M Series B equity round, part of an $83.5M total financing package that also includes a $20M strategic, non-dilutive credit facility. The Boston based precision diagnostics and data company is scaling its blood-based platform, which measures target expression and pathway activity to support next-generation cancer therapies like drug, radio and immune conjugates. The new capital will help Precede meet growing demand from biopharma partners developing these precision medicines and accelerate commercialization and health system adoption. - learn more

- Alexandria Venture Investments participated in Recludix Pharma’s new equity financing round alongside Access Biotechnology, NEA and Westlake BioPartners, with additional strategic investment from Eli Lilly. The San Diego based, clinical-stage biotech will use the $123M in total equity raised to advance clinical development of its novel SH2 domain inhibitor pipeline for inflammatory diseases and to tap Lilly’s TuneLab AI/ML platform to accelerate discovery across its broader SH2 domain program. - learn more

- BOLD Capital Partners participated in MagicCube’s $10M funding round, backing the Cupertino-based software security company alongside strategic investor Verifone and other existing backers. MagicCube plans to use the capital to expand beyond its core tap-to-phone payments offering into biometrics, identity verification and AI-driven device security, while scaling its Software Defined Trust platform that delivers hardware-grade protection through software on standard mobile and IoT devices.- learn more

LA Exits

- Webalo is being acquired by Prometheus Group, which is folding the Los Angeles based “no-code for the frontline” platform into its enterprise asset management software suite. The deal will combine Webalo’s mobile, real-time workflows for frontline workers with Prometheus Group’s planning and scheduling tools, aiming to create a closed-loop digital execution platform that connects shopfloor actions directly back into systems of record like SAP and Oracle. - learn more

Read moreShow less

Brex’s $5.15B Deal With Capital One Marks A New Era For Fintech

11:18 AM | January 23, 2026

🔦 Spotlight

Happy Friday, Los Angeles. 💳

The first big fintech plot twist of 2026 is here. Capital One is buying Brex in a cash and stock deal valued at about $5.15 billion, in what the companies are calling the largest bank - fintech deal in history.

From college dropouts to a multibillion exit

Brex launched in 2017, when Brazilian founders Henrique Dubugras and Pedro Franceschi, then in their early 20s after dropping out of Stanford, set out to fix the “startup card” problem. That project turned into an AI-native finance platform that now serves tens of thousands of companies, from early-stage startups to hundreds of public enterprises.

A few years into that journey, both founders moved to Los Angeles and continued running Brex from here as the company embraced a fully remote model. Now that same LA-based duo is steering a multibillion-dollar acquisition that will plug their software directly into one of the biggest banks in the country. Pedro will stay on as CEO of Brex inside Capital One, with the brand and product continuing rather than disappearing into a rebrand.

Why this looks like a win

“Big bank buys fintech” can sound like the end of the startup story, but here it reads more like an expansion pack. Capital One gets Brex’s cloud-based spend stack, AI-powered controls and roughly $13 billion in commercial deposits. Brex gets a massive balance sheet, a regulated rails partner and access to the mainstream business market it has been edging toward for years.

For founders and operators here, it is also quiet validation that building hard fintech infrastructure still pays off. Brex spent years doing the unglamorous work of licenses, compliance, underwriting and integrations. The outcome isn’t a hype cycle spike; it is a classic, real-money exit for a very modern stack.

What it signals for LA’s ecosystem

LA is not getting a new headquarters out of this. Brex has embraced a “no HQ” model. What the city does have is a pair of founders who chose to build their lives here and just proved that you can run a global finance platform from Los Angeles and end up selling it to a top-six U.S. bank.

It also fits a broader pattern our ecosystem is leaning into. Whether it is fintech, defense tech or climate, the most interesting LA stories right now are not about front-end apps. They are about deep, regulated infrastructure that incumbents eventually need more than startups need them.

For Brex, this is the start of a new chapter inside Capital One. For LA, it is one more data point that the city’s founders can build products the rest of the financial system has to buy.

Scroll on for the latest LA venture rounds, fund news and acquisitions.

🤝 Venture Deals

LA Companies

- L-Nutra secured a new $36.5M investment from Mubadala, bringing its total Series D proceeds to $83.5M. The company, which develops longevity-focused and medical nutrition therapies, plans to use the funding to accelerate global expansion, advance clinical research, and scale adoption of its nutrition programs across healthcare providers and consumers. - learn more

- RiskFront AI raised $3.3M in pre-seed funding to make financial crime and compliance work far less manual. The US-based startup uses “agentic AI” to automate time-consuming tasks like research, data analysis and documentation, with its Airos platform handling much of the day-to-day workload so human analysts can focus on higher-value judgment calls. The new capital will help expand engineering and product teams and deepen integrations with banks and fintechs already piloting the system. - learn more

- Balance Homes relaunched with a $30M investment led by Falco Group to scale its equity-sharing model for homeowners who are “house rich but cash and credit constrained.” The company buys a co-ownership stake in a home to free up trapped equity so owners can pay down mortgages and high-interest debt while staying in their homes, instead of being forced to sell. After stabilizing its existing portfolio following EasyKnock’s shutdown, Balance Homes is now resuming originations in six states, with plans to expand as affordability and household debt pressures intensify. - learn more

LA Venture Funds

- Distributed Global co-led Superstate’s $82.5M Series B, backing the Robert Leshner - founded tokenization platform as it builds regulated, on-chain capital markets infrastructure. The round, alongside Bain Capital Crypto and other institutional investors, will help Superstate expand beyond its existing tokenized U.S. Treasury funds to a full issuance layer for SEC-registered equities on Ethereum and Solana. The company, which already manages over $1.1B in tokenized assets, plans to scale its Opening Bell platform and transfer agent stack so public companies can issue and manage compliant on-chain shares directly. - learn more

- Krew Capital participated in GIGR (Playad.ai)’s $5.4M pre-seed round, backing the San Francisco based startup as it builds multi-agent AI workflows for marketing teams. GIGR’s Playad platform starts with interactive ads, using AI agents to help marketers create, test and iterate on playable and other ad formats much faster while turning performance data into continuous creative improvement. The new funding will support product development, expansion of its AI-native creative workflow and scaling to more customers looking to cut production costs and tighten the loop between ad performance and creative decisions. - learn more

- Trousdale Ventures participated in AheadComputing’s additional $30M Seed2 round, backing the Portland-based chip startup as it reimagines CPU architecture for the AI era. AheadComputing is developing high-performance RISC-V based CPUs and breakthrough microarchitecture aimed at handling the growing wave of AI data center, workstation and embedded workloads where CPU performance has become a bottleneck. The new funding, which brings total capital raised to $53M, will support R&D, software innovation and test chip development as the company races to deliver next-generation general purpose processors. - learn more

- Untapped Ventures participated in Nexxa.ai’s $9M seed round, backing the Sunnyvale-based startup as it scales specialized AI agents for heavy-industry workflows. Nexxa’s Nitro platform layers multi-agent automation on top of existing tools used in sectors like rail, construction, manufacturing and critical infrastructure, helping engineers plan and execute complex projects without ripping out legacy systems. The new funding brings Nexxa.ai’s total capital raised to $14M and will go toward expanding deployments, forward-deployed engineering teams and support for more industrial customers. - learn more

- UP.Partners participated in Zanskar’s $115M Series C, backing the Salt Lake City based geothermal startup as it uses AI to uncover overlooked conventional geothermal resources across the Western U.S. The company has already validated several high-potential sites and plans to use the funding to expand its discovery platform and begin developing multiple greenfield power plants, with a goal of bringing significant new clean baseload capacity to the grid before 2030. - learn more

- Smash Capital participated in Stream’s $90M Series D, backing the UK based workplace finance startup as it ramps expansion into the U.S. market. Formerly known as Wagestream, Stream partners with employers to offer workers tools like earned wage access, savings, budgeting and pensions in a single app, targeting financial stress for lower and middle income employees. The new funding, led by Sofina, brings total capital raised to about $228M and will help Stream scale its multi-product platform across more brands and workers globally. - learn more

- Fika Ventures participated in Ivo’s $55M funding round, backing the San Francisco based legal AI startup alongside lead investor Blackbird and others. Ivo builds contract intelligence tools for in-house legal teams and enterprises, using a highly structured approach that breaks reviews into hundreds of smaller AI tasks to boost accuracy and reduce hallucinations. The new capital, which reportedly values the company at around $355M, will go toward accelerating product development and hiring more sales and go-to-market talent to meet growing demand. - learn more

- Amplify.LA participated in Overworld’s latest funding round, backing the AI startup as it unveils a real-time diffusion world model for playable, AI-native worlds. Overworld’s system runs locally and generates persistent, interactive environments on the fly, aiming to become core infrastructure for next-generation games, simulations and creative tools built around world models rather than static assets. The new capital will support further development of its Waypoint 1 research preview and help the team expand its platform for researchers, engineers and builders working on interactive AI experiences. - learn more

- Dangerous Ventures participated in Carbogenics’ $3M investment and grant funding round, backing the Edinburgh-based bio-carbon startup as it scales its carbon removal technology. Carbogenics turns difficult-to-recycle organic waste into CreChar, a biochar product that boosts biogas production, supports wastewater treatment and locks away carbon. The new funding will help the company expand manufacturing in the US, grow its centralized UK operations and deploy its biocarbon products across the UK, Europe and North America. - learn more

LA Exits

- Farcaster is being acquired by Neynar, the infrastructure company that already powers much of the Farcaster ecosystem, in a full-stack handoff from Merkle Manufactory. Neynar will assume control of the decentralized social protocol’s smart contracts, code repositories, official app and Clanker client, while Farcaster co-founders Dan Romero and Varun Srinivasan step back from day-to-day operations after five years. The deal keeps the network running without disruption and sets Neynar up to roll out a new, builder-focused roadmap for on-chain social. - learn more

- ScribbleVet has been acquired by Instinct Science, which is folding the veterinary AI-scribing startup into its Instinct EMR platform to create what it calls an “intelligent-native” practice management system. The combined offering aims to move traditional PIMS beyond record-keeping by embedding AI scribing, workflow automation and clinical decision support in one system, reducing documentation burden and helping veterinary teams focus more on patient care. ScribbleVet’s team is joining Instinct, with founder and CEO Rohan Relan taking on a key role leading product strategy for intelligence features across the platform. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS