What's the Future of Real Estate? Bigger Offices and Smaller Chains

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

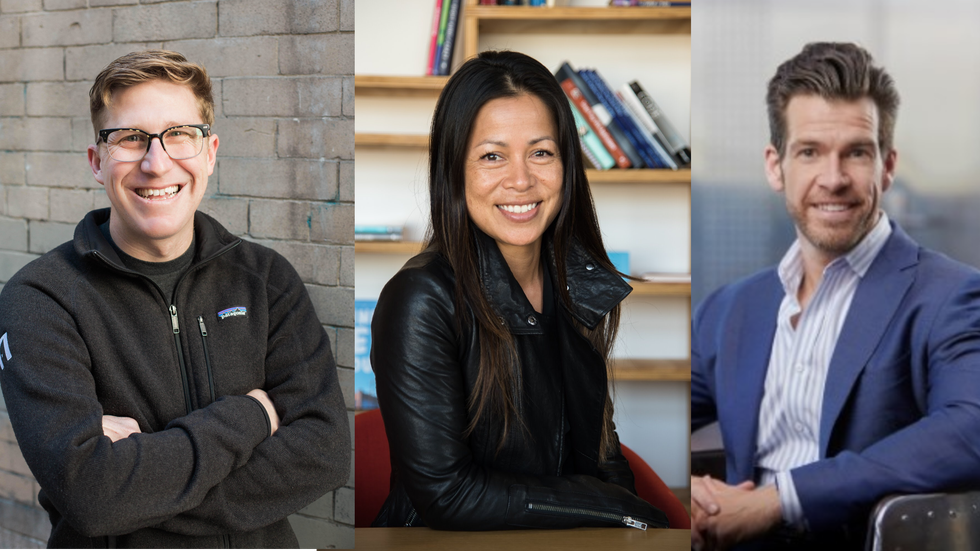

Offices will be bigger and oriented around creating a sense of community, omnichannel retail will be more important, brands will have dozens of stores instead of thousands, and cities will provide incentives to lure employees rather than companies. Those are some of the predictions about what will happen in the next few years as the world recovers from the coronavirus, according to Brendan Wallace, co-founder and managing partner at Fifth Wall, Justin Bedecarre, co-founder and CEO of HelloOffice and Jen Nguyen, founding partner of TEAMWERC.

Fifth Wall is the largest venture capital firm focused on real estate tech, known as proptech. It announced the close of its second real estate technology fund last year, with $503 million in dry powder, making it the largest VC fund in Los Angeles. HelloOffice is a technology-powered commercial real estate brokerage that started in the Bay Area and expanded to L.A. last year. TEAMWERC is a San Francisco-based commercial real estate consultancy.

Wallace, Bedecarre and Nguyen spoke to dot.LA in advance of an executive strategy session Tuesday at 11 am PST about the future of real estate after the novel coronavirus. Here are some excerpts from the conversation:

Retail shops have been opening in Los Angeles and elsewhere. How quickly do you think people will want to go shopping?

Wallace: I think there's probably two considerations. One is that you actually have some pent-up demand. So, I think you will see a surge, and I think you actually have seen that in cities like Phoenix. What I'm not clear on is if that's a false positive, and what we're likely to see going forward because we haven't seen the second peaks occurring in cities and how the public will react to that. We're in the very early innings of probably a surge in retail bankruptcies. As stores go dark that just drives down foot traffic, and I think alongside that you have this forced adoption of e-commerce that just occurred over the last 75 days. That experience is going to have a long-term effect and I think about it like we pulled the future forward. Whatever was going to happen in 2022 or 2023 is happening now in 2020, and the confounding variable on top of that is the uncertainty around COVID and the public response to it so the one thing I feel confident in saying is it is not going to go back to business as usual.

That sounds like a lot of uncertainty, which is understandable because no one really knows what's going to happen in terms of the health considerations. But as someone who has this big retail fund, what, how are you deploying that?

Wallace: Our retail fund is focused on brands that are omnichannel, so those are brands that are selling both online and offline. This crisis has underscored is that to really have resiliency in circumstances like this, a brand needs to be ubiquitous. You need to be able to reach consumers where they are and that can be on their computer, their phone or in a store. I think the more omnichannel a brand is, the more durable they are in a situation like this so we are still actively looking to invest in those brands. I think the other distinction about how we invest in retail versus how retail is traditionally conceptualized is that some of the brands that are out there today — like Old Navy and Gap — you're talking about hundreds in some cases thousands of stores. I don't think even the largest, most prolific omnichannel brand is ever going to have 1,000 stores. I think that era is over. What you're seeing is just smaller real estate footprints and a concentration of those footprints in higher-quality real estate assets. In many ways this crisis is hurting the weakest assets. The malls in the shopping centers that were already struggling are going to struggle more in this crisis and this could be a body blow. But I think the stronger assets, the assets that were always desirable, and the high streets in retail real estate that were always desirable to many brands are going to come back for no other reason then there's still going to be a street life in cities. I don't think that's going away.

Just looking at cities in general, there's this whole potential ripple effect from people not working as much in big cities. Do you see that actually happening, lots of tech workers moving out of San Francisco?

Wallace: I think you can generalize more broadly than tech workers and make it knowledge workers, who are less required to work in cities than they were in January of this year. The experience of many companies is that working remotely has been surprisingly productive. But the reason cities formed in the first place was to accommodate businesses and people and create a social dynamic which drove people together where you had to go to the market square to buy things. What's happened with technology – e-commerce being a prime example – is we virtualized much of that meaning. So, we've stripped away many of the commercial benefits of concentrating businesses and people together. And so what I think cities are left considering is because there's no longer the commercial magnetism of pulling everyone together it really has to come down to the social magnetism, that we like being around other people. I'm curious to see how much people want to go back to cities.

Justin, how much work do you see returning to the office once the threat from the pandemic subsides?

Bedecarre: Offices are really going to be built around what they're meant to be built around, which is collaboration. In the short term, square footage per person is going to go way up. The way that we're thinking about our spaces at HelloOffice is that we're going to be doing a phased-in approach to bring in key members and desks are going to be spread out significantly. Fewer people are going to be coming into the office at any given time. Whether it equals out for how many people are in the office versus how many square feet per person is is hard to predict with certainty. But square footage per person will trend upwards, not downward as it has been for over a decade.

Jen, are you seeing a similar trend?

Nyugen; Oh definitely. It's really typical for a lot of tech startups that we work with, their standard square foot per person is 100 square feet per person. But what we've seen in doing the six foot social distance studies is a lot of the companies we work with need extra space, so instead of 100-square-feet per person they're needing at least 300 square feet, at a minimum.

Are you hearing from clients that they want to go back to the office?

Nyugen: We're hearing more of we're going back to the office in some shape or form but in a phased approach.

Is there a specific timeline you're getting from most companies about when they want to come back?

Nyugen: The timelines are consistent with specific regions. For example, in San Francisco a lot are looking towards the end of Q3. A lot of them are also identifying within their own or organization which functions they deem critical.

Justin, it seems like there has been something specific about startups that they need to physically work together. Do you think that will change now?

Bedecarre: I do think overall, especially in the early stages, having everyone together working in one place has significant advantages. But it's not for everyone. Gitlab and WordPress have built some phenomenal companies being 100% remote, but that certainly isn't where most companies will end up.

- Is Working remotely Here to Stay And Is It For Everyone? - dot.LA ›

- How Will Offices Change After Coronavirus? - dot.LA ›

- Fifth Wall Venture Firm Is Now a B Corporation - dot.LA ›

- The Future of Commercial Real Estate - dot.LA ›

- The Future of Commercial Real Estate - dot.LA ›

- How the Pandemic Will Change Work - dot.LA ›

- Los Angeles Could Be What Real Estate Looks Like Post-COVID - dot.LA ›

- Los Angeles Could Be What Real Estate Looks Like Post-COVID - dot.LA ›

- Los Angeles Commercial Rents Are Higher Than Before COVID - dot.LA ›

- Trends To Watch As We Return to Work - dot.LA ›

- Top L.A. Proptech Companies in 2021 - dot.LA ›

- Fifth Wall Ventures' Dan Wenhold on Real Estate Tech - dot.LA ›

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Revel

Image Source: Revel