Kobe Bryant Remembered for his Second Act: Venture Capitalist

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Kobe Bryant's precision as a shooting guard in a Lakers jersey was legendary. But, the NBA superstar's acumen in the boardroom was his future.

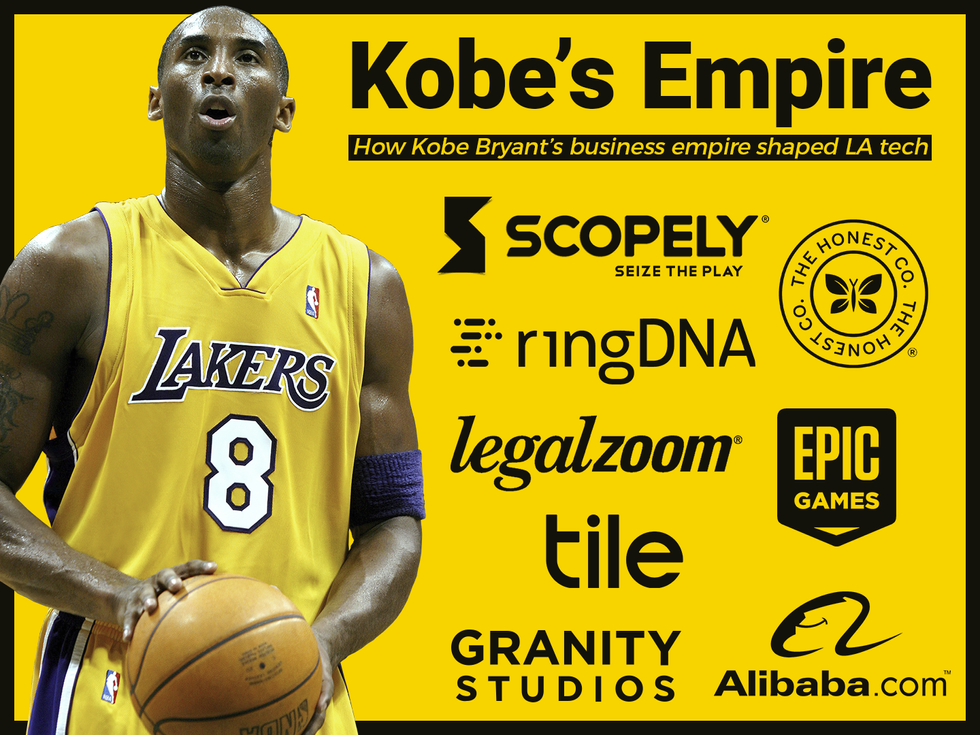

The basketball phenomenon was laying down the groundwork for the next part of his career years before he retired as a five-time NBA champion in 2016. Bryant partnered with entrepreneur Jeff Stibel, a scientist and former tech chief executive, to form a venture capital fund. He threw the gauntlet down on Hollywood, forming Granity Studios to front streaming and movie efforts, and Kobe Inc. for some of his personal investments.

He was determined to avoid the financial mistakes that have plagued so many athletes, applying the same drive and work ethic that won him five championships to a successful new phase as an investor. Like Earvin "Magic" Johnson, who exited the Lakers with his investment business tied to a string of movie theater chains and other ventures, Bryant was setting up the next stage of his life.

"Kobe was a legend on the court and just getting started in what would have been just as meaningful a second act," former President Barack Obama tweeted Sunday.

Bryant earned $680 million in salary and endorsements during his two decade career, the most ever for a team athlete during their playing career, according to Forbes. But Bryant was determined to be more than just a celebrity athlete; He wanted to be respected as a venture capitalist who mentored entrepreneurs.

"The most important thing I enjoy now is helping others be successful," Bryant said in 2016. "I enjoy doing that much, much more, that's something that lasts forever, and hope they do that for the next generation."

In 2013, while still wearing the Lakers uniform, Bryant teamed with Stibel, to form Bryant Stibel, which provided strategic, financial, and operational consulting to businesses. Three years later, the duo announced a $100 million venture capital fund – funded with their own money – to invest in tech, media, and data companies. The portfolio included the sports media website The Players Tribune, legal-services company LegalZoom, mobile game designer Scopely, Alibaba Group, home-juicing company called Juicero, and enterprise voice communications platform RingDNA.

"He didn't want to just write checks but he wanted to be in the boardroom," said Brian Hollins, co-founder of BLCK VC, a group advancing black venture capitalists, who worked with Bryant's firm during its deal to back RingDNA. "He wanted to participate and be thought of as someone that was going to add high value."

Bryant purchased a 10 percent share for $6 million in 2014 for the sports drink BodyArmor, a stake ESPN reported became worth $200 million four years later when the Coca-Cola Company acquired part of the company.

It is difficult to overstate how beloved Bryant was in Los Angeles. When he transitioned from basketball to investing there was hope he would also have an outsize impact on the city in his new role.

"When we learned his next acts would be venture capital we certainly sat up and took notice," said Cinny Kennard, executive director at Annenberg Foundation, which co-runs PledgeLA, an initiative to improve equity and inclusion in the venture capital and tech industry. "We said who could be a better role model, who could link arms with this new wealth and this new tech community - who could be better than that?"

Bryant said he tried to apply the same lessons he learned on the basketball court to business, including the value of patience.

"A lot of time through the course of a game, you may notice a gap in defense or something you can take advantage of offensively," he told USA Today last year. "If you attack all at once, you show your hand too early, Team sports does a great job in teaching that and how to trust others."

When asked whether he thought hitting the winning shot in the playoffs or finding a winning company was more exciting and satisfying, Bryant quickly answered: "It's finding that winning company as an investor. Because I always expected to hit a game-winning shot growing up."

Staff writers Rachel Uranga and Tami Abdollah contributed to this report.

- Jeff Stibel Writes Farewell to Kobe Bryant - dot.LA ›

- kobe-bryant - dot.LA ›

- Kobe Bryant Remembered as Venture Capitalist in L.A. - dot.LA ›

- Blck VC Group Launches 'We Won't Wait' Campaign - dot.LA ›

- What Is the Future of Sports After the Pandemic Subsides? - dot.LA ›

- What Is the Future of Sports After the Pandemic Subsides? - dot.LA ›

- Kobe Bryant’s Legacy Will Live On—In the Metaverse - dot.LA ›

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Revel

Image Source: Revel