FitOn Fitness App Raises $7 Million in Funding

Rachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

Peloton may not have killed spin classes, but there's a wave of tech-powered fitness companies trying to lure Americans away from the gym.

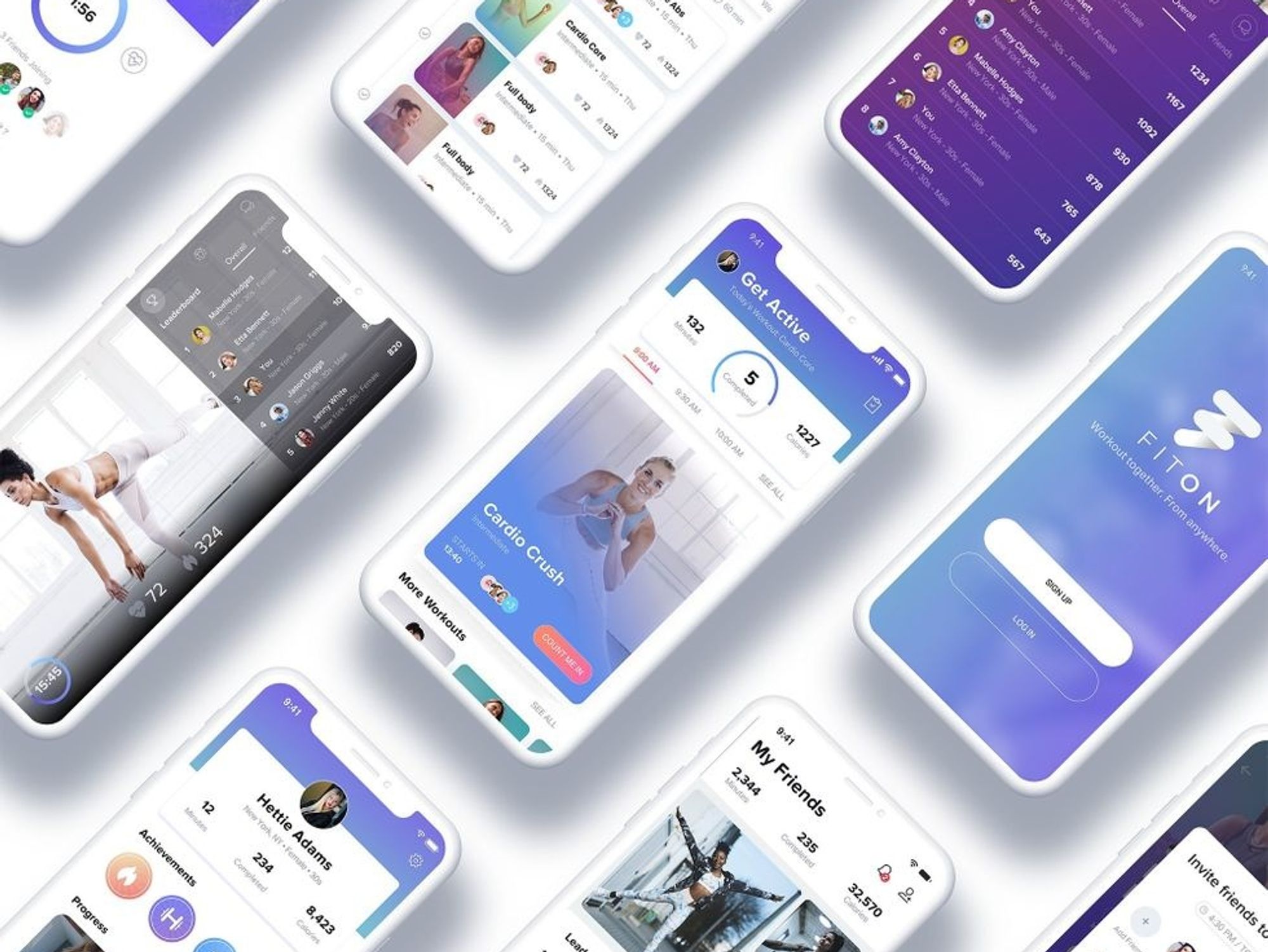

One of the latest, Century City-based FitOn, is betting that making sought-after celebrity trainers accessible through an at-home fitness program can convince the time-stretched and coach potatoes to sweat.

Last month, the startup raised nearly $7 million in funding, according to Securities and Exchange Commission filings.

It follows a swath of new venture-backed fitness tech companies that come on the heels of Peloton and are challenging brick-and-mortar models with streaming workout classes and fitness machines. There's San Francisco-based Tonal Systems, maker of a pricey weight-lifting machine that offers personalized training powered by a "Coach A.I." or New York startup Mirror, which sells an LCD screen that doubles for a mirror and streams fitness classes into your home.

FitOn sheds the pricey equipment. Co-founded by a former FItBit executive Lindsay Cook in 2018, FitOn tries to distinguish itself from the crowded field of on-demand fitness programs by partnering with celebrities like Gabrielle Union and influencer trainers. The service provides a menu of fitness programs including yoga, pilates and dance that are different time lengths.

As a working mother, Cook was inspired to make exercise options high quality yet practical. The platform is billed as a more affordable antidote to Peloton, the fitness bicycle that runs north of $2,000. On Wednesday, the venture-backed Peloton, which went public last year, saw its shares fall after it reported a $55.4 million loss for their last quarter and slow revenue growth.

But that hasn't soured investor optimism.

"We will see the fitness market expand as it becomes more convenient and accessible for consumers," said Gautam Gupta, a partner at M13, an early-stage consumer technology venture capital firm, in an email. The firm is an early investor in Tonal, another venture-backed fitness system that's been dubbed the weight-training version of Peloton.

According to SEC filings, this was FitOn's second funding round bringing the total raised to about $11.6 million since its founding.

There's no doubt Americans love the burn. Even as venture capitalist have poured money into making at-home fitness the next big thing, gym memberships have steadily risen.

About one in five Americans have a gym membership and the U.S. leads all international markets in gym membership according to the International Health, Racquet & Sportsclub Association with $32.3 billion in revenue during 2018.

That's an all time high for memberships. And, it came at a time when gyms like OrangeTherapy and SoulCycle fueled growth. But, the wave of fitness startups have challenged this reign.

Its unclear how much the at-home fitness cut into membership but there' s indications that gyms are trying to compete outside of their brick-and-mortar locations. Last year, Equinox Group, the parent of SoulCycle announced it would offer up their own at home equipment.

"Given consumer interest in wellness, I see no slow down to funding in this space," Gupta said.

Rachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

Image Source: Skyryse

Image Source: Skyryse

Image Source: Northwood Space

Image Source: Northwood Space