Can Cell-Cultured Seafood Help Stem Overfishing as Global Demand Increases?

In the fall of 2017, Lou Cooperhouse took the stage at the Hawaii Agricultural Foundation conference to talk about what he saw as the trend that would lead to the total transformation of our food supply: alternative proteins.

At the time, Cooperhouse — whose long career in food innovation includes founding and running Rutgers Food Innovation Center, an incubator for startups — was working with multiple companies making plant-based products. (Impossible Foods Inc., of Impossible Burger fame, was a client.) But the real transformative technology, in his view, was the use of cell culturing to make meat from animal cells — products that would have the look, feel, taste and nutritional content of real meat, because that's exactly what they are.

The first cell-cultured hamburger — a five-ounce patty that cost more than $300,000 to produce — was made in 2013, and a slew of beef and poultry-based products were under development. "I said to myself, that's amazing technology," Cooperhouse said, "but the real home run, the holy grail, would be seafood."

Chris Somogyi, an entrepreneur in the audience that day, agreed. Before the year was out, Somogyi and Cooperhouse had teamed up with Chris Dammann to launch BlueNalu, a seafood-focused cell culture company. Since its founding in 2017, the San Diego-based company has become the first to create stable cell lines from a variety of fin fish. (Both Somogyi and Dammann have since left the company.)

The cell-based protein industry is booming. Dozens of startups trying to grow food in labs have formed in the United States in recent years, and they raised more money in the first quarter of 2020 — some $189 million — than in all previous years combined, according to the Good Food Institute, a nonprofit that advocates for alternative meats.

So far, only one company has made it to market: the U.S.-based start-up Eat Just received regulatory approval to sell it's cell-cultured chicken at a restaurant in Singapore in late 2020. One of the major obstacles for many companies has been cost, and most are still working to bring down the price of the raw materials, scale-up production and gain regulatory approval. A few more are expected to hit the market this year. By one estimate, as much as 35% of meat will be cultured by 2040, buoyed by efforts to reduce carbon emissions, antibiotic use and the risk of disease.

But to Cooperhouse, seafood, more than any other industry, is in need of a transformation: Overfishing has pushed fisheries around the globe to the brink of collapse. Ocean acidification, heat waves, plastic pollution, and more threaten the stocks that are left. Research suggests that as many as 60% of the marine species humans fish are at a high risk for extinction in the coming years. Yet demand continues to rise since at least the mid-20th century. According to the United Nations's Food and Agriculture Organization, the rise in global fish consumption since 1961 has outpaced both population growth and increases in production of other meat products.

"Our global supply gap is only getting worse, our supply is increasingly compromised with mercury and environmental pollutants and plastics, and we just can't feed the world," Cooperhouse said. But in cell culture technology, he saw an opportunity to create a stable supply of one of the world's most sought-after protein sources, easing pressure on our oceans and feeding the world at the same time.

In January, the 40-person company announced it had raised $60 million in debt financing led by Rage Capital, bringing its total fundraising up to more than $84 million. BlueNalu's other significant investors include New Crop Capital, Lewis & Clark Agrifood, Siddhi Capital, and Rich Products Corp. The latest round of funding is expected to see the company through the next two phases of its development, according to Cooperhouse: FDA approval, and the initial launch of its products in select restaurants in San Diego.

It's too soon to say which restaurants those will be.

After market testing in restaurants, BlueNalu plans to scale up production with the construction of more factories, creating jobs and providing consumers with a third option to farmed or wild caught fish.

Already, the company is building out its facility in San Diego. By the end of the year, it will be capable of producing several hundred pounds of cell-cultured fish per week.

The Good Food Institute, which has called on the Biden administration to allocate some $2 billion toward research and research facilities for alternative proteins, believes that the production of plant-based and cell-cultured meats "will spark a renaissance in American manufacturing."

Critics of cell-cultured meat worry that the product could put farmers and fishermen out of work, but BlueNalu claims that it is carefully choosing its products with these issues in mind. Its first product to market will be mahi-mahi, a nod to the company's Hawaiian roots, and the most practical choice for a company that's trying not to compete with U.S. fisheries.

"We're specifically targeting seafood that are typically imported, that are high in mercury or other contaminants, or they can't be farm-raised at all," Cooperhouse said. A cell-cultured Bluefin tuna, a species that is both overfished and high in mercury, will follow. "The bottom line is there's a fundamental global supply chain gap. If we don't find another solution, we will be out of fish or it will be so high priced it will be unattainable."

The National Fisheries Institute, a nonprofit focused on seafood sustainability, is supportive of cell-cultured seafood as part of the solution. "As the global demand for seafood increases, so will the need for innovative solutions like cell-cultured products," an NFI spokesperson said by email.

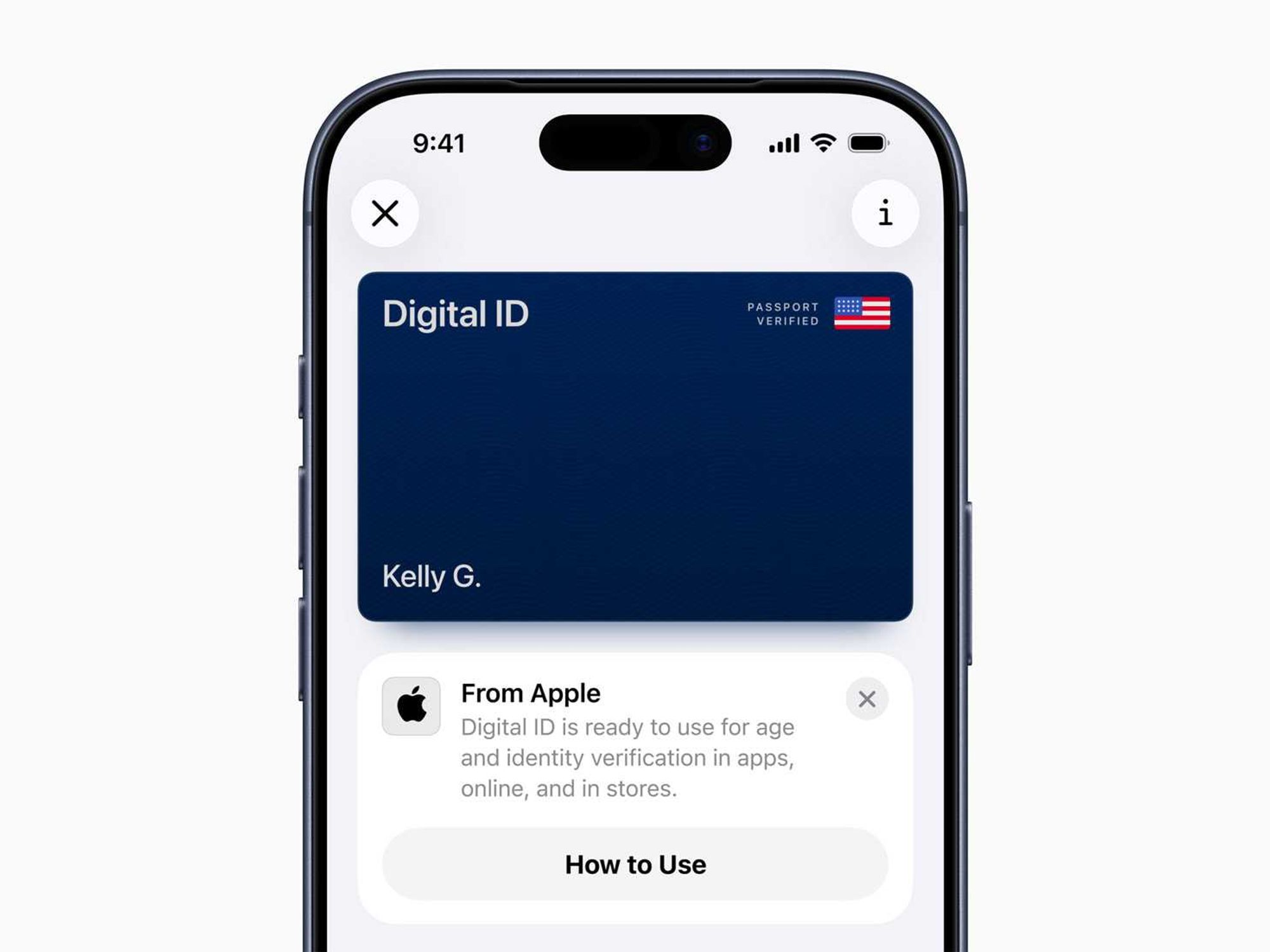

The final challenge for the first cell-based fish company is marketing. To prepare for direct-to-consumer sales, BlueNalu worked with the Alliance for Meat, Poultry and Seafood and the NFI to agree on a term that would allow the public to distinguish between wild-caught, farmed and fish grown from fish cells: cell-cultured. The term can be used more broadly to distinguish proteins from animals, and those made from animal cells.

As CEO, Cooperhouse has worked to distance BlueNalu from earlier cell-cultured products presented to the public as meat grown in petri dishes. BlueNalu's facility is a food factory, he says, not a lab.

"We are first and foremost a food company," he said. "BlueNalu is a culinary driven company. We are making great-tasting seafood products with all the sensory benefits, all that you love about seafood, but without the mercury, microplastics or pollutants."

Lead Image by Ian Hurley.

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

Image Source: Waymo Image Source: Apple

Image Source: Apple