Get in the KNOW

on LA Startups & Tech

X

commons.wikimedia.org

Meet the New Santa Barbara Venture Fund Eyeing Software Startups

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

A new venture fund based up the 101 isn’t letting the current market slowdown curb its appetite for new software startups.

Santa Barbara Venture Partners has officially closed its first, $11 million investment fund, the company told dot.LA, with the primary goal of backing software-as-a-service (SaaS) companies based predominantly in Southern California.

The Santa Barbara-based firm was founded in 2020 by former tech entrepreneur Dan Engel, who said that he looks to invest in companies that can weather the storms of tumultuous capital markets. SBVP claims a strict set of criteria for its portfolio companies; Engel said it won’t invest unless a startup can prove it’s already conquered product-market fit and is generating at least $3 million in annual revenue, with an emphasis on companies with subscription-based revenue models and annual growth rates of at least 75%.

“We invest at a stage when product-market fit has already been figured out,” Engel told dot.LA. “We don't want to take that risk, because too many times it doesn't end up getting figured out, and an investor ends up with a goose-egg zero.”

The firm plans to invest in startups that are anywhere from the seed stage up to their Series D round, and which have the potential to deliver a 3x-to-6x return in at least a seven-year time span, Engel added.

“We try to invest in businesses that are really hard to screw up,” Engel noted, half-jokingly.

So far, SBVP has backed nine companies out of its debut fund with an average check size of about $850,000, according to Engel. The fund recently saw its first exit via San Diego-based nonprofit fundraising platform Classy, which raised $118 million in a Series D round last year before being acquired by GoFundMe this January.

While he’s cautious about backing companies that don’t have a clear track record of growth, Engel did say he’s optimistic about the current state of the tech startup environment despite increasingly sluggish market conditions. He noted particular optimism about SBVP’s chosen software market.

“Every time SaaS is down, it comes roaring back up,” Engel asserted. “It's got real advantages to it as an investment—such as having the ability to weather storms that others can’t, [like] much more capital-intensive businesses that don't have predictable recurring revenue.”

Still, there is at least one company in the SBVP portfolio that’s been directly affected by stagnating IPO markets—with Classy originally planning to go public before opting to shelve its Nasdaq ambitions

“The M&A market I don't think is too different at the moment; maybe multiples are down a little bit. The IPO market is certainly on hold at the moment, and that affects us too,” said Engel, who worked in customer acquisition and marketing for the likes of Google before co-founding Santa Barbara-based fintech software startup FastSpring. He also served as FastSpring’s CEO prior to its 2013 acquisition by L.A.-based investment firm Pylon Capital.

Other recent SBVP investments include Hydrosat, a satellite thermal imaging company that graduated from Techstars’ aerospace accelerator in Los Angeles; and Berkeley-based Voltaiq, which makes software to analyze the efficiency of electric vehicle batteries. The remaining investments from the new fund include Bark Technologies, Specright, Nice Healthcare, Jackpocket, Rad AI and Curri. Engel said over 70% of the fund is already invested, including via sidecar deals.

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

https://twitter.com/samsonamore

samsonamore@dot.la

Smart Shoes for Kids? Skechers Thinks So 👟

08:16 AM | August 01, 2025

🔦 Spotlight

Happy Friday, LA!

This week, Skechers may have just kicked off a new trend that’s bound to have parents and tech lovers talking. They've unveiled the "Find My Skechers" line, kids’ sneakers that come with a hidden compartment to securely hold an Apple AirTag. For $52 to $58, parents can now track their child’s shoes in real-time using the Find My app, giving a whole new meaning to "keeping an eye on things." While these tech-savvy kicks are already gaining attention, will they become the new norm in kids' footwear? And who’s next? Will Nike or Adidas be jumping on the AirTag bandwagon, or is Skechers setting the stage for a whole new wave of tech-integrated fashion?

But it’s not all smooth sailing. This innovation raises some interesting questions about privacy and surveillance. Are we crossing a line when we start tracking our kids’ every move through their shoes? While Apple’s anti-stalking features are in place to prevent misuse, it will be intriguing to see how other brands and parents respond to this new blend of fashion and tech.

What do you think? Could this become a must-have feature in the next generation of kids' gear, or is it a step too far? Let us know your thoughts!

🤝 Venture Deals

LA Companies

- LakeFS, a provider of Git-like version control for data lakes, has secured $20M in a growth funding round led by Maor Investments. The funds will support the company's expansion efforts and product development aimed at enhancing data engineering and AI initiatives within enterprise and public sector environments. - learn more

LA Venture Funds

- Sound Ventures co-led the $16.1M Series A funding round for Knit, an AI-powered consumer research platform. The funds will be used to accelerate product development, enhance AI capabilities, and expand global research operations. This investment underscores the growing trend of combining AI with human expertise to deliver faster, cost-effective, and high-quality insights for enterprise research. - learn more

- Anthos Capital co-led a $60M Series A funding round for Good Job Games, a mobile game developer known for creating casual and hyper-casual games. The investment, co-led by Menlo Ventures, will support the company's growth, enabling the expansion of its game portfolio and enhancing user engagement through innovative gameplay features. This funding marks a significant step in scaling Good Job Games’ operations and solidifying its position in the competitive mobile gaming market. - learn more

- Pinegrove Capital Partners participated in Ramp's $500M Series E-2 funding round, which values the company at $22.5 billion. The funds will be used to accelerate Ramp's AI-driven financial tools, aiming to enhance automation and efficiency in corporate finance operations. - learn more

- Riot Ventures participated in Oxide Computer Company's $100M Series B funding round, led by the U.S. Innovative Technology Fund (USIT). This investment will enable Oxide to scale its manufacturing capabilities, enhance customer support, and accelerate product delivery to meet the growing demand for on-premises cloud computing solutions. - learn more

- Rebel Fund participated in a $3.2M seed funding round for Caseflood.ai, a San Francisco-based legal tech startup offering AI-powered client intake solutions for law firms. The funds will support the development of Caseflood's advanced voice agent, Luna, which autonomously handles client interactions, including consultations and retainer signings, aiming to enhance conversion rates and operational efficiency for law firms. - learn more

- Smash Capital participated in Ambience Healthcare's $243M Series C funding round, co-led by Oak HC/FT and Andreessen Horowitz (a16z). The investment will support Ambience's expansion of its ambient AI platform, which automates clinical documentation, coding, and workflow tasks across over 200 specialties. The platform integrates directly with electronic health records, enhancing efficiency and compliance in healthcare settings. - learn more

- ARTBIO, a clinical-stage radiopharmaceutical company developing alpha radioligand therapies for cancer treatment, has secured $132M in a Series B funding round. The round was co-led by Sofinnova Investments and B Capital, with participation from Alexandria Venture Investments and other investors. The funds will support the advancement of ARTBIO's lead program, AB001, through Phase II clinical trials, and facilitate the expansion of its manufacturing and supply chain infrastructure. - learn more

- Rebel Fund participated in OffDeal's $12M Series A funding round, led by Radical Ventures, to support the company's mission of building the world's first AI-native investment bank. OffDeal aims to democratize access to high-quality M&A advisory services for small and mid-sized businesses by automating analyst tasks with AI, enabling efficient sell-side transactions. The funds will help scale OffDeal's technology-driven, advisor-led approach to facilitate successful exits for entrepreneurs. - learn more

- Sandbox Studios participated in a $3M seed funding round for Sarelly Sarelly, a Mexican cosmetics brand, with backing from U.S. investors like Wollef, Morgan Creek Capital Management, and Hyve Ventures. The funds will support Sarelly Sarelly's expansion into the U.S. market, including retail launches at Ulta Beauty and growth on digital platforms like TikTok Shop. - learn more

LA Exits

- NEOGOV, an El Segundo-based provider of HR and compliance software for U.S. public sector agencies, has been acquired by EQT and CPP Investments in a deal valued at over $3 billion. The acquisition will help NEOGOV expand its product offerings and grow its presence across North America. - learn more

Read moreShow less

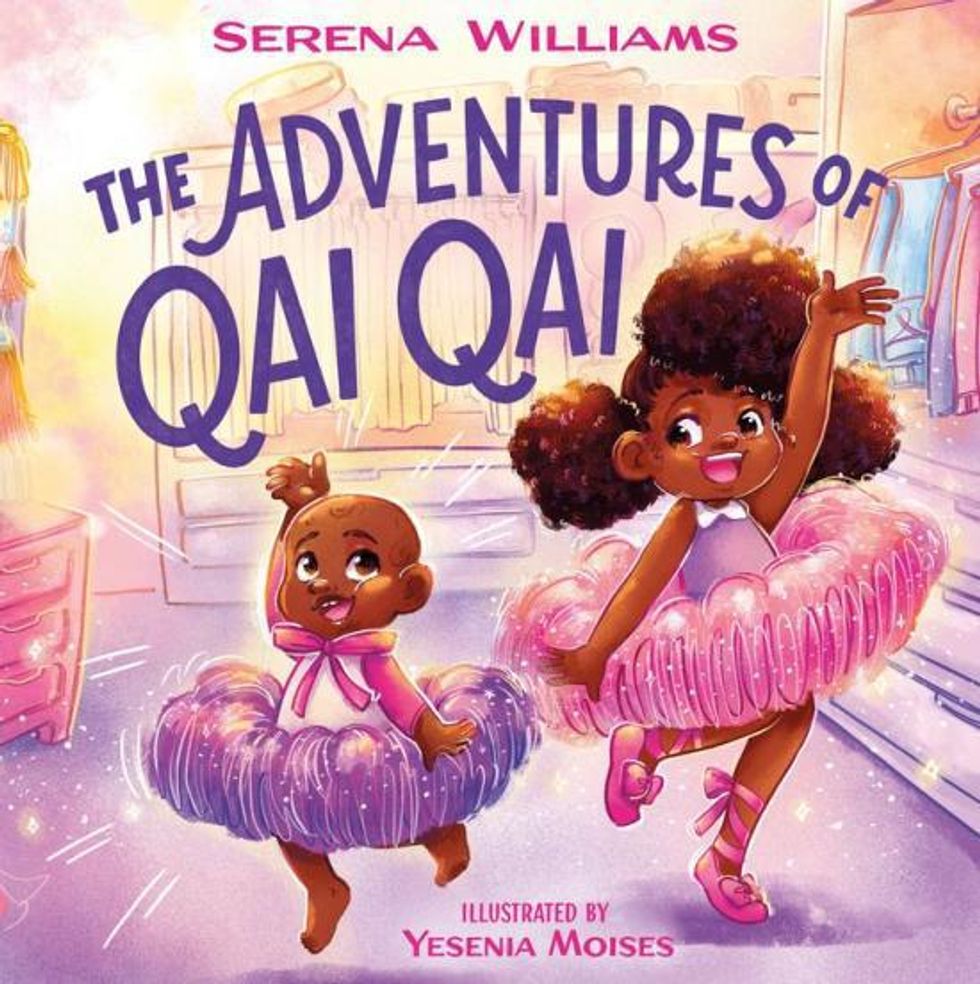

Serena Williams' Debut as an Author Is an Invisible Universe-Inspired Book for Children

04:01 PM | December 03, 2021

Qai Qai the baby doll made her debut on social media in August 2018. Dressed in a tutu, the doll is pictured courtside cheering at Serena Williams’ tennis matches, taking calls in a car with Gayle King, and reading Beyonce’s book “Lemonade” -- and she has over 350,000 followers on Instagram.

Now, Olympic gold medalist and the best female tennis player in the world Serena Williams has written a children’s book about her.

“The Adventures of Qai Qai” is a kid’s book written by Williams, published by Macmillan and co-created with Invisible Universe, a Los Angeles-based startup that’s looking to create the next hit cartoon character on social media and become “the Pixar of the internet.”

Qai Qai is a digital character based on a doll owned by Williams and Reddit co-founder Alexis Ohanians’ four-year old daughter, Alexis Olympia Ohanian Jr. But the digital avatar was created by Invisible Universe.

To go along with Qai Qai’s debut in the tangible world (the book is set to be released in September 2022), the company also helped Williams create a doll that will be sold on Amazon.

Invisible Universe is one relatively new entrant into the rapidly crowding field of digital avatars and virtual influencers like Qai Qai.

Dapper Collectives (formerly known as Brud) runs social accounts for Lil’ Miquela, a virtual influencer with 3.1 million followers and is said at dot.LA’s recent fall Summit it’s looking to expand her reach into TV and other forms of interactive storytelling. Another similar company is Genies, which is making digital avatars for celebrities that can follow them across different social media platforms.

“Our belief is that the power of incubating IP on social media allows us to test things and build an audience and community,” said Invisible Universe CEO Tricia Biggio “But from there, our mission is absolutely to extend that (intellectual property) and other forms of publishing.”

She said part of that is selling the doll on Amazon and eventually creating long-form scripted content.

Biggio was a TV development executive at VH1, Snap and MGM, and she was Invisible Universe’s chief creative officer for a year before taking the CEO helm in June.

She believes that creating strong characters that can transcend the boundaries of their scripted content and live online as their own digital personas is the key to getting people to stay engaged with new stories. But unlike studios focused on box offices or streaming, Biggio wants Invisible Universe’s content to be on social media first where fans can interact with it all the time.

Biggio said that her co-founder and former Snap executive John Brennan was friends with Williams and Ohanian and developed the idea to create content based on the Qai Qai doll before Invisible Universe even started. They then tapped writers with experience at Hollywood studios to bring the vision to life.

“We've assembled a team of writers, Hollywood writers, who we've convinced to come and do this really experimental thing with us,” Biggio said.

Other digital creations by Invisible Universe include the fictional long-lost toys of Dixie D’Amelio’s family called Squeaky and Roy and robots for Karli Kloss called Kayda and Kai. The creators are involved in the creation of their digital characters, and Invisible Universe is working on another to-be-announced project with “Friends” star Jennifer Aniston.

Biggio said the company has raised $9 million since its launch.

dot.LA co-founder Spencer Rascoff is an investor in Invisible Universe, alongside Williams and Aniston, who also acts as an advisor. Actor Will Smith is an investor through his venture fund Dreamers VC, as is the Cassius Family, Seven Seven Six and Initialized Capital.

Correction: An earlier version referred to John Brennan as Johnathan and incorrectly identified Dixie D'Amelio as Charli D'Amelio. An earlier version also stated Biggio wanted to create the "Pixar of social media," she in fact said "Pixar of the Internet."

From Your Site Articles

- dot.LA Summit: Grid110 Wins Social Justice Award - dot.LA ›

- Invisible Universe's Plan to Bring Animation to Social Media - dot.LA ›

- Invisible Universe’s Tricia Biggio on Animation for Social Media - dot.LA ›

- Invisible Universe, the 'Pixar of the internet,' raises $12M - dot.LA ›

Related Articles Around the Web

Read moreShow less

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

https://twitter.com/samsonamore

samsonamore@dot.la

RELATEDTRENDING

LA TECH JOBS