New Amplify Seed Report Shows Deals Fell 35% In the Second Half of 2022

As the tech industry reeled last year from a shaky macroeconomic environment, mass layoffs and poor stock performance, investors and venture capitalists began to tighten their purse strings. The proof is in the numbers: global venture funding slid from $681 billion to just $445 billion between 2021 and 2022, according to data from Crunchbase.

Seed funding in particular was the least impacted by the market downturn, according to the same report, but still didn’t escape the industry’s effects.

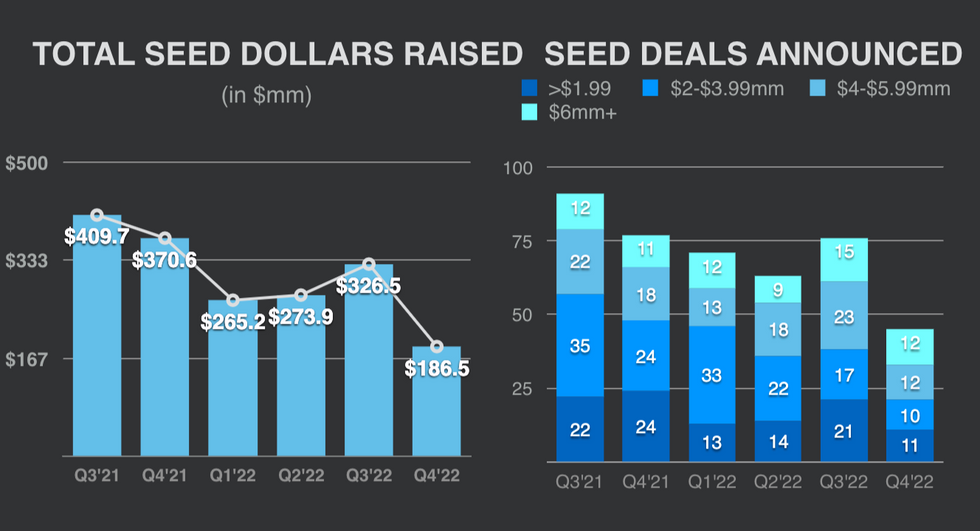

In Los Angeles, funding for seed deals in the second half of 2022 fell an astonishing 35% compared to the previous year, according to Amplify’s latest LA Seed Report. From a peak of $780 million dollars in the second half of 2021 to just north of $505 million a year later, along with the broader tech industry, seed funding for Los Angeles-based startups has dropped as well.

Besides a dip in overall funding, the size of seed rounds themselves have also shrunk.The average deal size in the second half of 2021 was $4.64 million compared to just $4.17 million in 2022, a decrease of about 10%, according to Amplify.

There were still bright spots for the LA seed market however.

Even against the backdrop of a challenging macroeconomic environment, the third quarter of 2022 had the highest number of deals over $6 million in more than a year and a half. That money went towards startups such as online fashion retailer Joopiter, Adidas-backed shoe company FCTRY Lab, and reusable satellite company Outpost, each of which raised more than $5 million each.

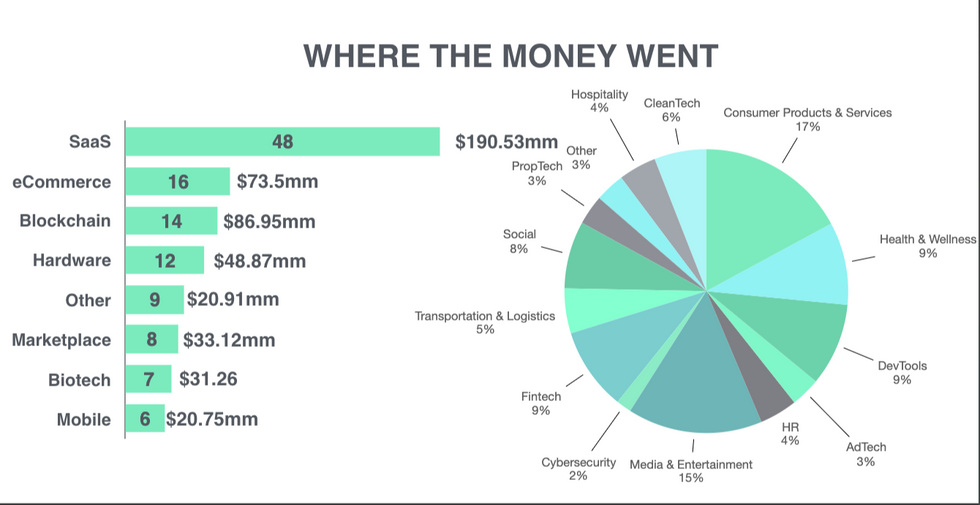

That said, the vast majority of funding in the second half of 2022 went towards SaaS startups, followed distantly by eCommerce and then blockchain.Together, those three categories constituted 78 of the 120 deals completed in the latter half of 2022.

But even amongst those top three categories, results were varied.

As the broader SaaS industry continued to grow last year, LA-based SaaS startups captured 38% of the capital deployed in the second half of 2022. The amount of funding also managed to remain relatively stable between 2022 and the year prior.

On the other hand, eCommerce startups struggled, as companies from Instacart to GoPuff to Shopify slashed valuations in response to lowered demand coming out of the pandemic. Subsequently, the number of deals for LA-based eCommerce startups dropped from 26 to 16, even though funding remained stable.

LA-based blockchain startups were also impacted by broader industry shifts. While increased consumer and investor interest in crypto likely drove more funding for blockchain startups, the crypto meltdown quickly changed the story. In the second half of 2022 investors poured 4% more capital into blockchain startups than they did the year prior. But as crypto exchanges began to collapse, seed stage blockchain deals dropped from 14 to 4 between the third and fourth quarters of 2022.

While overall seed deals were a bit insulated from shifts in the broader market, the impacts of a global decrease in venture capital funding still hit hard.

In a time of increased investor scrutiny and more stringent funding requirements, it’s not surprising that LA seed deals struggled, even if a bit less than others.

Image Source: Skyryse

Image Source: Skyryse

Image Source: Northwood Space

Image Source: Northwood Space