Microsoft’s $68.7 Billion Deal to Acquire Activision Blizzard Will Create a New Gaming Behemoth

Microsoft is aiming to vault itself into the upper echelon of video games with its $68.7 billion deal to acquire Activision Blizzard, the gaming giant behind such franchises as Warcraft Diablo, Overwatch, Call of Duty and Candy Crush.

Announced Tuesday morning, it would be the largest acquisition in the Redmond company’s history, eclipsing its $26 billion purchase of LinkedIn in 2017. Adding to its existing Windows PC and Xbox gaming businesses, Microsoft says it will become the third-largest gaming company by revenue, behind Tencent and Sony.

“Today, we face strong global competition from companies that generate more revenue from game distribution than we do from our share of games sales and subscriptions,” said Microsoft CEO Satya Nadella on a call with investors and analysts Tuesday morning. “We need more innovation and investment in content creation and fewer constraints on distribution.”

Activision Blizzard, based in Santa Monica, Calif., will bring Microsoft some of the most iconic franchises in modern gaming, 10,000 employees, and a recent spate of revelations of sexual harassment and other workplace misconduct.

Bobby Kotick, Activision Blizzard CEO, will continue to serve in that role, Microsoft said. After the deal closes, Activision Blizzard will report to Phil Spencer, who will have the new title of CEO of Microsoft Gaming.

Update: A Microsoft representative clarified that the statement referring to Kotick continuing to serve as CEO was a reference to the period from now until the deal closes, in which Microsoft and Activision Blizzard will continue to operate separately. The company isn’t commenting on leadership plans beyond that.

Under the all-cash deal, Microsoft will pay $95 per share of Activision stock, a 45% premium to Activision Blizzard’s Jan. 14 share price. Microsoft says it expects the deal to close in its 2023 fiscal year, which begins in July of this calendar year.

Activision Blizzard was on track for $8.7 billion in net revenue for 2021 as of November, up from $8.1 billion in 2020.

Microsoft’s gaming revenue rose 33% to $15.4 billion in its 2021 fiscal year, which ended in June.

Consumer spending on video games reached a record $60.4 billion last year, up 8% from 2020, according to data published today by the NPD Group research firm. Activision Blizzard’s Call of Duty: Vanguard and Call of Duty: Black Ops: Cold War were the top-selling video games in the U.S. last year.

The announcement comes a week after Take-Two Interactive announced a $12.7 billion deal to acquire mobile game maker Zynga, promising to combine the companies behind Grand Theft Auto and FarmVille.

“Mobile is the biggest category of gaming, and it’s an area where we’ve not had a major presence before this transaction,” Spencer said. Activision acquired King, the Candy Crush maker, for $5.9 billion in 2015.

The addition of Activision Blizzard also promises to bolster Microsoft’s Game Pass subscription service. After the deal is completed, Microsoft “will offer as many Activision Blizzard games as we can within Game Pass,” including new titles and games from the company’s back catalog, Spencer said.

Microsoft’s deal to acquire Activision Blizzard comes about a year after Microsoft’s $7.5 billion acquisition of ZeniMax Media, the Maryland-based holding company for the video game publisher Bethesda Softworks, the company behind such games as Doom, Fallout, Elder Scrolls, and the Wolfenstein series.

On the call Tuesday morning, Nadella also addressed Activision’s challenges with misconduct, saying that creating a healthy corporate culture is his top priority, requiring a mindset of continuous improvement.

“This is hard work,” Nadella said. “It requires consistency, commitment, and leadership that not only talks the talk but walks the walk. That’s why we believe it’s critical for Activision Blizzard to drive forward on its renewed cultural commitments.”

Activision Blizzard reached a consent decree with the U.S. Equal Opportunity Employment Division in November 2021.

Just last week, Microsoft’s board hired an outside law firm to review the company’s own sexual harassment and gender discrimination policies and practices, including its handling of past allegations against Microsoft co-founder Bill Gates, in response to a shareholder resolution that passed overwhelmingly in the fall.

Among the big U.S. tech companies, Microsoft may be in a unique position to make major acquisitions such as this right now.

“From a regulatory perspective, MSFT is not under the same level of scrutiny as other tech stalwarts (Amazon, Apple, Facebook, Google) and ultimately Nadella saw a window to make a major bet on consumer while others are caught in the regulatory spotlight and could not go after an asset like this,” said Wedbush analyst Dan Ives in a note on the deal.

Microsoft had more than $130 billion in cash and short-term investments as of Sept. 30. Its market value is about $2.3 trillion. Microsoft stock was down slightly, less than 1%, to about $308 per share in early trading Tuesday morning, following the announcement of the Activision Blizzard deal.

Activision Blizzard is scheduled to report its fourth quarter and year-end results on Feb. 3. Microsoft reports its fiscal second quarter results next week, on Jan. 25.

This story first appeared on GeekWire. GeekWire’s Taylor Soper and John Cook contributed to this report.

- Everything You Need to Know About the Activision Blizzard Walkout ›

- Analysis: Microsoft's massive $68.7B acquisition of Activision ... ›

- Read Activision Blizzard Employees' Letter to CEO Kotick - dot.LA ›

- A Look at Activision Blizzard's Workplace Harassment Lawsuit - dot.LA ›

- Microsoft Buying Activision Blizzard is a Mixed Bag - dot.LA ›

- Antitrust Concerns Won’t Block Microsoft’s Activision Deal - dot.LA ›

- Activision Shareholders Approve Microsoft Merger - dot.LA ›

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

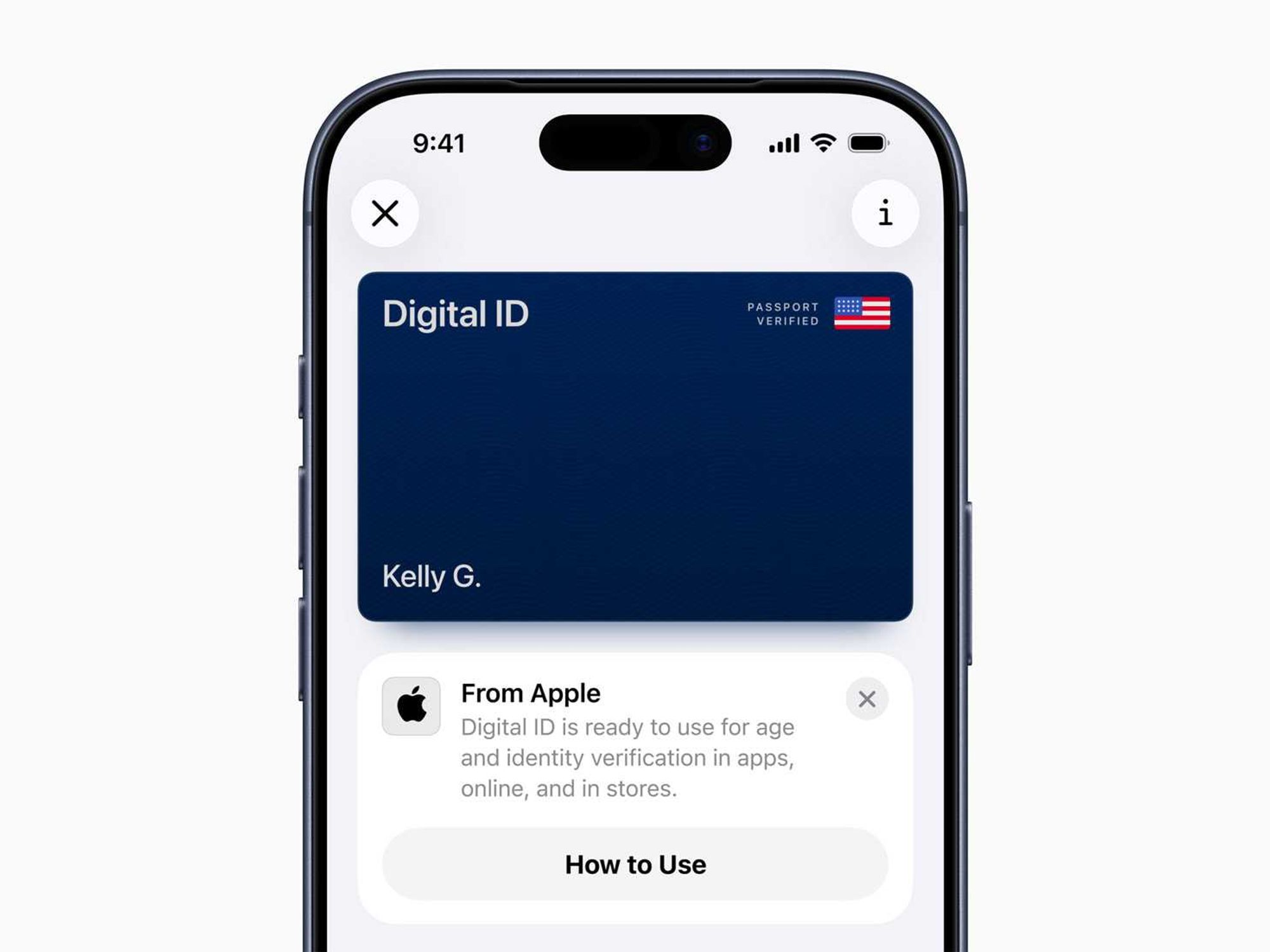

Image Source: Waymo Image Source: Apple

Image Source: Apple