LA‘s Bus Stop Redemption

Last year, the city of Los Angeles approved a new bus shelter contract with Tranzito-Vector after a 20-year contract that shorted the city over 600 bus shelters and $70 million in advertising revenue. According to a 2012 audit by the city controller, the last contract failed because of a combination of NIMBYism and bureaucratic red tape.

Now, L.A. — the city that puts its cars and their drivers above all else— has an opportunity to prioritize bus riders, and by extension, promote racial and social equity. As the contract wends its way through city hall, delayed by bureaucracy once again, questions remain about whether the city can meet its goals.

Will L.A. bus riders finally get the bus stops (and shade) that they need?

New leadership may spell hope for bus riders

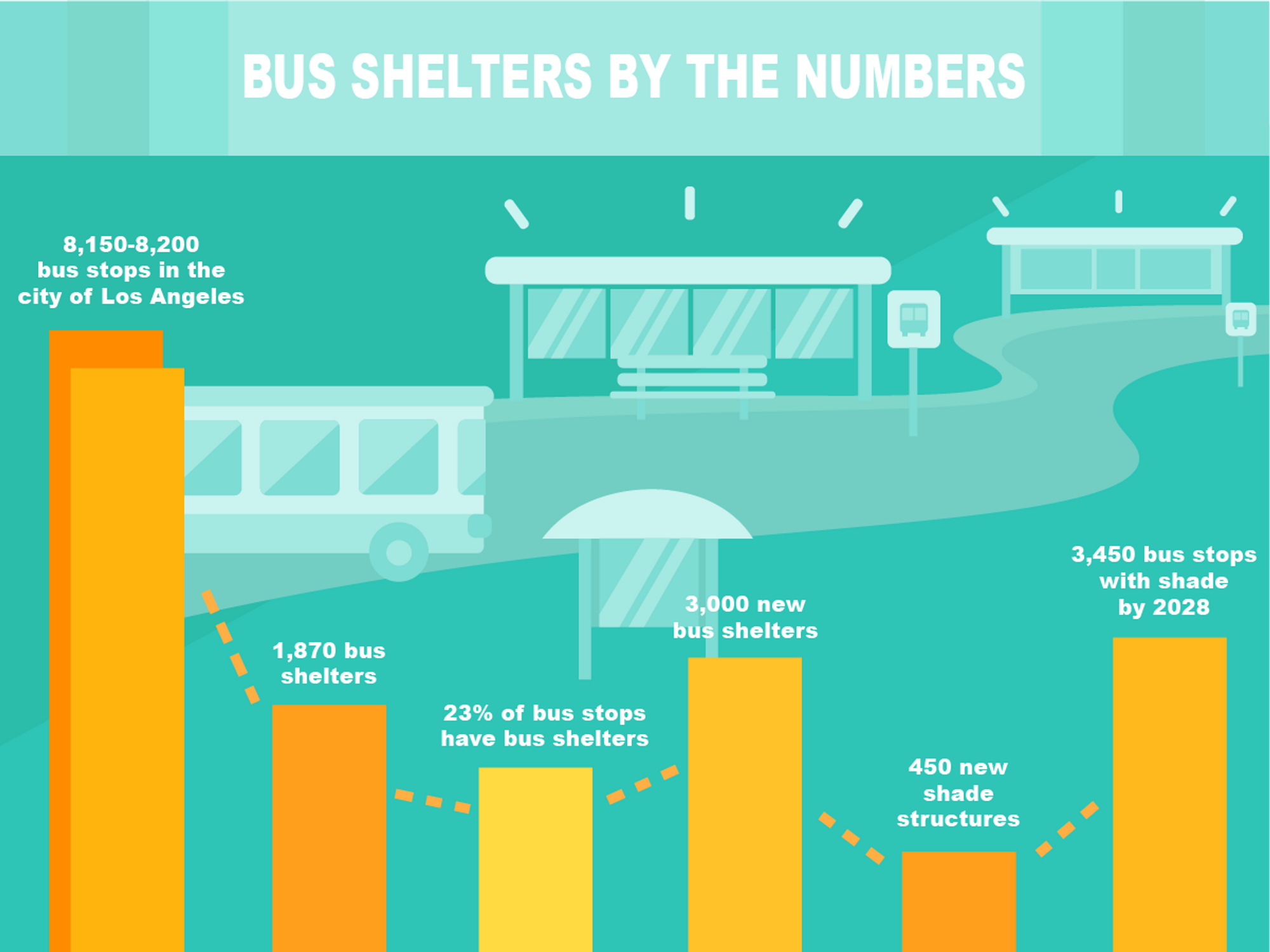

Less than 25% of bus stops in Los Angeles provide shade for bus riders, leaving a group composed primarily of low-income people of color vulnerable to extreme heat.

In L.A., bus stops are managed not by L.A. Metro or by the L.A. Department of Transportation, but by StreetsLA (formerly the bureau of street services), the division within the Department of Public Works that oversees sidewalks, street trees and medians.

Since the new contract was approved in September, things have changed at city hall. The city elected its first Black woman mayor, Karen Bass, former council president Nury Martinez was ousted after she made racist comments and four districts elected new councilmembers.

In the current landscape, bus shelters may have gained traction. In his first city council meeting in December, new Councilmember Hugo Soto-Martinez drafted a motion instructing StreetsLA to study how to place shelters at every bus stop in the 13th district.

If only it were that easy.

It’s One Bus Shelter, Michael -What Could It Cost?

The new contract, the Sidewalk and Transit Amenities Program (STAP) is projected to bring 3,000 new shelters and 450 shade structures to the city by 2028.

In the previous contract, L.A. did not foot the bill for the bus shelters — the capital costs and maintenance fell to the previous contractor in return for the right to place advertising in the public-right-of-way. But now, for a bigger share of the revenue — 60.5% versus 20% — the city is paying all capital expenses.

Currently, StreetsLA estimates that it will cost about $380 million total to implement STAP, up from the $237 million estimated in 2021. In five years (just in time for the 2028 Olympics), if things go according to plan, L.A. will have a total of 3,000 shelters versus the 1,870 it has today.

“At the end of the rollout period — which is going to extend into 2028, minimally — we hope that we’re going to have shade structures at least 3,450 locations,” said Lance Oishi, contract administrator for STAP.

It’s an ambitious goal. And it’s still unclear where the money will come from. In City Council’s February 8 public works committee meeting, Oishi said that STAP currently has $114 million in funds in place, including a $30 million loan from the public works trust fund and $53 million as part of L.A. Metro’s North San Fernando Valley BRT project.

The $30 million StreetsLA hopes to receive soon is enough to build 180 shelters and do site work for 240 additional shelters in the first year.

The first 180 shelters will replace existing shelters along transit corridors to drive ad revenue, while the 240 sites will be in locations without existing shelters. StreetsLA is using five criteria to determine prioritization of new shelter locations: transit ridership, heat exposure, equity-focused communities, job and school access and bus wait times.

It’s a big investment for a bigger payday. The city estimates that it will earn up to $500 million over the course of the contract — with the addition of new digital advertising — with $90 million guaranteed from Tranzito-Vector.

Where the curb meets red tape

While the new contract eliminates the bureaucratic red tape of the past — shelter locations go through a two-step versus 16-step approval process — new construction on L.A.’s crumbling sidewalks is its own challenge.

More than half of the cost of building bus shelters doesn’t come from the cost of materials or construction but from preparing the site.

“We know that 95% of our bus stop sidewalks are not ADA compliant,” said Oishi. “That means that we have to basically rip out the sidewalks, kind of re-engineer them so they meet ADA from a grading perspective.”

For 450 bus stop locations that can’t accommodate a shelter due to space requirements or a “perfect storm of tree wells, fire hydrants, streetlight poles [and] utility poles,” StreetsLA hopes to install shade structures, added Oishi.

Plan to flail

Advocates say that bus shelters are merely one example of a larger problem in L.A. — the lack of a multi-year capital infrastructure plan laying out how the city will spend its transportation and public works funds. Currently, eleven different city agencies work in the public right-of-way, managing everything from bus stops to street trees to sidewalks to bike lanes.

“It’s like doing a 500 piece puzzle when you don’t even have the cover image,” said Jessica Meaney, executive director of Investing in Place, a nonprofit advocating for greater policy and spending transparency in the public right-of-way.

Bus shelters are not paid for out of the city’s general fund, which means StreetsLA must cobble together multiple sources of federal, state and city funding.

Perhaps bus shelters will be the vanguard in the fight for greater oversight in how L.A. spends its public works dollars. In the committee meeting, Councilmember Nithya Raman called for StreetsLA to create a public-facing dashboard showing how shelters are prioritized to meet equity goals.

Using Bus Shelter Revenue to Pay for Bus Shelters

With the new focus on equity, there is a proposal in committee for funding shelters using money generated from STAP advertising revenue. Currently, the money generated is split 50-50 between L.A.’s general fund and 15 council offices. Under a new initiative, RAISE (Reinvestment in Accessibility, Infrastructure and Streetscape Enhancements), council offices will continue to receive the same share of revenue as in the past ($200,000 annually), but any additional revenue will go back into funding bus shelters, staffing for STAP and other transit improvements.

Bus shelters when?

Currently, StreetsLA and Tranzito-Vector are awaiting city approval of the $30 million public works trust fund loan to start fabrication of the shelters. To be approved, the City Administrative Officer (CAO) must first review an Executive Directive No. 3 (ED3) report (first instituted by Mayor Villaraigosa in 2005) submitted by StreetsLA, and then the report must be approved by Mayor Bass’ office.

“The ED3 report is currently in our [o]ffice under review,” said assistant city administrative officer Yolanda Chavez in an email. She added that the CAO’s office will draft a recommendation report to send to the mayor within a few weeks. Mayor Bass can waive the report but so far has not done so.

Meanwhile, the projected rollout for new shelters has been pushed from late July, to August, to currently, late fall, according to StreetsLA.

“I can understand that the scale of doing bus shelters given the number of stops is really daunting,” said Madeline Brozen, deputy director of the UCLA Lewis Center for Regional Policy Studies and co-author of a new study on the lack of shelters in L.A. County. “But bus shelters aren't just a ‘nice to have,’ this is really [about] protecting people's health and welfare and it’s important to think about the public health benefits as they're figuring out how to address the disparity.”

- Metro Is Launching a Universal Pass Experiment in South LA This Summer ›

- One Card to Rule Them All: LA Metro’s Experiment in a Universal Transit Wallet ›

- Launched During the Pandemic, Metro’s $1 Rideshare Experiment Is Expanding to the Westside ›

- Here's What LA's Proposed New 'High-Tech' Bus Shelters Will Include ›

- Who Will Be King of the Curb? LA's Rideshare Debate Heats Up - dot.LA ›

Image Source: Tinder

Image Source: Tinder Image Source: Apple

Image Source: Apple