Get in the KNOW

on LA Startups & Tech

XMeet the Startup That Wants To Deliver Ketamine to Your Door

David Shultz

David Shultz reports on clean technology and electric vehicles, among other industries, for dot.LA. His writing has appeared in The Atlantic, Outside, Nautilus and many other publications.

Ketamine is on the come up in the pharmaceutical world. Once confined to nightclubs and operating rooms, the drug is quickly gaining recognition as a valuable tool for treating mental health disorders including depression and anxiety.

Amid these rising tides, Wondermed has emerged, offering telehealth consultations and, potentially, the ability to deliver the drug right to your doorstep—all while building out a virtual platform and collecting data on how to use the molecule more effectively.

At the moment, the company provides a mail order service for courses of ketamine lozenges to those who’ve been prescribed the drug along with a telehealth software bridge between doctor and patient. Wondermed currently operates in five states — California, Texas, Florida, New York and Connecticut, though it plans to expand to another eight to 10 states in the next two weeks.

In the long run however, its plans are much bigger than being a link between doctors and patients.

“We generate more than 3,000 data points on every patient that comes into the funnel, and actually receives the medication,” says co-founder & Managing Director Jose Aycart.

His company is building out its online platform to collect and analyze patient data and provide mental health support services that may be useful, regardless of whether or not a patient is taking ketamine.

These data show in granular detail how ketamine therapies work. Does the route of administration matter? Does time of day matter? What types of patients are most likely to experience positive outcomes? It’s this data that represents the biggest business opportunity for Wondermed. The specifics of the monetization are still being worked out, but Aycart says it will never sell anonymized patient data to other companies.

Wondermed is in the midst of a seed funding round, targeting $7 million by the end of the month; It’s raised $5.6 million so far.

The company makes a bit of revenue by charging patients for consultations, but in the event that a patient doesn’t wind up using Wondermed’s platform, the consultation fee is refunded. For patients who are prescribed ketamine, the company charges only as much as the drugs cost them ($249 per month, which includes four doses), so neither Wondermed nor the physicians in its employ are incentivized to over-prescribe.

The drugs themselves are supplied by Tailor Made Compounding, a pharmacy in Nicholasville, Kentucky, and Wondermed is working on additional contracts in the pipeline with several other suppliers.

. Wondermed’s transformation comes as ketamine, which has typically been restricted to use as a general anesthetic, is quickly gaining recognition as a valuable tool for treating mental health disorders like depression and anxiety.

“What I’ve found interesting is how rapidly this field has emerged,” says Steven Grant, a drug and addiction researcher who spent 25 years at the National Institute on Drug Abuse and is now retired.

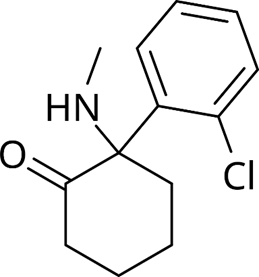

Ketamine is a simple organic molecule that first gained clinical popularity in the 1960s as an anesthetic. It produces a dissociative state in patients and dulls pain. Once in the bloodstream, the molecule travels to the brain where it binds to a protein called NMDA on the surface of neurons. NMDA has a variety of jobs, but it’s best-known for its role in learning, memory, and neuroplasticity—or the brain’s ability to form new pathways between neurons.

While the research into why ketamine is such an effective treatment for depression and anxiety is ongoing, the consensus so far is that the molecule’s power comes from this ability to rewrite or rewire the brain’s circuitry. If you’ve ever had an anxiety attack or a depressive episode, it can often feel like you’re stuck in a mental loop. Ketamine, it seems, offers a way to break that loop.

“It was this idea that you're increasing your neurological connections in the brain,” says Aycart. “You have the opportunity now to spark new forms of thought, new forms of emotion, or even new ideas.”

Unlike selective serotonin reuptake inhibitors (SSRIs) and other traditional drugs used to treat depression, ketamine’s effects are fast-acting—often appearing within minutes or hours of administration—and don’t require taking the drug daily.

“It really is revolutionary, and that’s why now more than ever, people are starting to get access to it, and companies like ourselves are really trying to bring it to people as an alternative form of medicine,” says Aycart.

Grant says the rise of ketamine clinics and telehealth services like Wondermed are likely a net positive because they increase patient access to drugs patients need, but he also has reservations about how the therapies are being applied.

Many of these psychoactive drugs—especially ketamine—are intended to be used in tandem with therapy, or at least under the supervision of a trained professional. Increasing the brain’s plasticity is a valuable tool for breaking out of depressive loops, but unless a professional is there to help the patient settle into a healthier mental pattern, the full benefits may be left on the table.

Wondermed offers a variety of supplementary support and strategies along with the drugs themselves, but taking advantage of these tools is left to the patient’s discretion. Grant would like to see a larger focus on extending and expanding that auxiliary support.

The company says it’s focused on building out the platform’s nonmedicinal mental health strategies—things like breathwork, meditation, music therapy—and adding them to an app. If they can get enough people on board, the eventual plan could be to sell health insights back to patients through a subscription model or something similar. They may even patent their own psychedelic molecules in the future. But all of this is likely quite a ways out.

“What we're trying to do is very new, and the landscape yet hasn't been built out,” says Aycart.

Clarification: This story has been updated to clarify Wondermed's monthly rate for ketamine lozenges.

From Your Site Articles

- Psychedelic Therapies Are Gaining Steam as Attitudes Change - dot ... ›

- Ketamine for Depression Is Now Available by Injection - dot.LA ›

- Ketamine Clinics Are Opening Across Los Angeles - dot.LA ›

- Pasithea Opens a Chic Clinic in Beverly Hills to Administer Ketamine - dot.LA ›

- New Pasithea Ketamine Clinic In Beverly Hills - dot.LA ›

- Pasithea Opens a Ketamine Clinic In Beverly Hills - dot.LA ›

Related Articles Around the Web

David Shultz

David Shultz reports on clean technology and electric vehicles, among other industries, for dot.LA. His writing has appeared in The Atlantic, Outside, Nautilus and many other publications.

How Jordan Fudge Raised One of the Largest Funds in LA History

06:30 AM | December 14, 2020

Jordan Fudge – Black, openly gay, and only 28-years old – recently closed one of the largest venture funds in Los Angeles history, which he runs out of a lavish Bel Air mansion. He has raised nearly a billion dollars in dry powder from a reclusive billionaire in Germany, who he got connected to through his personal trainer.

In a notoriously clubby and homogenous industry with few people of color, Sinai Capital Partners Managing Partner Fudge sees standing out from the pack as a major edge.

"We can be ourselves and leverage our youth in a way that makes founders feel excited to share their ideas with us and feel like they won't be rejected for having something that comes out of left field," Fudge said. "We understand certain concepts a little bit more quickly because typically the market they're trying to address is people like us."

Sinai Capital Partners has raised $600 million, $500 million of which will go towards the tech-focused Sinai Ventures and the rest to fund movies and television shows at New Slate Ventures. All told, Sinai will now have $800 million in assets under management, vaulting it into the upper echelon of L.A. venture funds.

The news touting the raise as the largest in Los Angeles history was announced in a terse press release last month but received scant attention, perhaps because Fudge does not travel in the usual VC circles or because he says he has deliberately avoided the spotlight.

"We preferred to stay under the radar until we had some real results and a track record," Fudge said.

In something unheard of in the tech world, Fudge does not have a LinkedIn profile.

"To me, LinkedIn encourages a rather shallow, artificial type of networking," he said.

But Fudge is hardly shy. He shares shirtless selfies in his home gym or pictures of yachts and sports cars to his nearly half a million followers on Instagram. Earlier this year, he co-hosted a tony fundraiser at his home for Democratic presidential candidate Pete Buttigieg with Empire writer/director Lee Daniels. He also serves on the board of the LGBTQ advocacy group, GLAAD, and was a young associate director at the Metropolitan Opera until last year.

Instead of the sleek corporate offices in Santa Monica most venture firms operated in before the pandemic, Fudge runs Sinai from a $9 million mansion tucked in the hills of Bel Air, furnished in all-white with a grand staircase and backyard pool.

"We chose it over an office because we don't like working in traditional office spaces," he explained. "We've had founders stay there when they're in L.A. for meetings and in better times hosted events and fundraisers."

What also makes Sinai unusual is that all of its capital comes from a single limited partner. Asked who that person is, Fudge said the individual prefers not to be named. "We don't comment on our LPs out of respect for their privacy," he said.

Then, he volunteered that the LP is a German billionaire who made his fortune as a founder of enterprise software conglomerate SAP and has a family office called Eagle Advisors.

A quick Google search reveals the billionaire is almost certainly Hans-Werner Hector, ranked as the 945th richest man in world by Forbes with an estimated $2.4 billion fortune.

The head of Eagle Advisors, Ekkehart Hassels-Weiler, has been known mostly for his lavish real estate purchases on both U.S. coasts. He bought four penthouses totaling $120 million in New York starting in the mid-2010s and last year reportedly purchased a Benedict Canyon spec mansion with his new husband for $43 million.

In 2015, after an uninspiring post-college stint at 21st Century Fox, Fudge met Hassels-Weiler through their personal trainers who happen to be brothers.

"We'd often see each other at the gym in L.A. near where the family office is based," Fudge remembers. "When I left Fox, I intentionally started scheduling sessions at the same time as him to get some face time and pick his brain. I finally asked him if he had hired anyone to look after tech, media, telecom and he hadn't due to their focus on energy and real estate."

Fudge pitched Hassels-Weiler on the graphics processing chip manufacturer NVIDIA Corporation and the timing turned out to be perfect. The stock more than tripled in a year, a return that led to Hassels-Weiler bringing Fudge on as an associate.

"I developed sort of an in-house private house venture capital fund for them, which was then spun out into what is now Sinai," Fudge said. "We started with them seeding us with one hundred million and did really well with that."

The biggest breakout from the 85 startups Sinai has invested in so far is Pinterest. The fund came in relatively late in Pinterest's 2017 Series H at a post-money valuation of $12.3 billion. The company went public in 2019 at a lower valuation of $10 billion, but Pinterest now has a market cap of more than $40 billion.

Sinai also got in on the real estate service Compass' Series D and the Series A of Ro, the parent company of Roman Health.

Eagle Advisors more than doubled its investment on Fund I, according to sources.

"We were able to use that credibility to continue to raise more capital from them and go later in the life cycle of some of these companies that we're interested in," Fudge said. "Specifically within Los Angeles, there really aren't many funds that are able to write those kinds of checks."

Fudge initially launched Sinai in the Bay Area, but he quickly soured on the tech scene there.

"I found San Francisco to be a monoculture and generally a soulless, unpleasant place to live," he said. "The VC crowd there has a tendency of being rather pompous and the deals we were seeing in the city seemed increasingly overpriced."

In 2018, the firm relocated to Los Angeles. Fudge and Zach White — the partner who helps oversee Sinai Ventures — both grew up here and say they want to invest in L.A. startups, but also companies anywhere that encapsulate the L.A. ethos of tech, entertainment and diversity.

"We're L.A. at our very core," White said. "And the sort of fiber and DNA of our fund is L.A. But we are going to be global in the way that we allocate capital."

Far from a hindrance, White says the fact that he and Fudge are young and Black has helped them get into highly competitive funding rounds. He points to Brud, an L.A company that uses artificial intelligence to create virtual popstars. It secured early funding from Sequoia but Fudge is friends with the founder, Trevor McFedries, and so they were able to get in on the Series A.

"He has no shortage of suitors trying to get into that company," White said. "But I think that us being able to view it from the perspective of someone who's a little bit closer in age and skin color to him really benefited us."

McFedries says he finds Fudge to be "super smart" and a great listener.

"He has a point of view that allows him to recognize opportunities others wouldn't," said McFedries. "And being in L.A. it's been great to have an investor close by."

An Entertainment Fund for Underrepresented Founders

After he graduated from Northwestern University, Fudge got what seemed like a plum gig in 2014, working on digital strategy under co-chairs Dana Walden – now a top executive at Disney – and Gary Newman. As he remembers it, the mandate of his group was figuring out how to make money licensing Fox's vast library of content to Netflix and Hulu without cannibalizing the studio's lucrative television and movie business.

"At the time, legacy studios like Fox were just beginning to recognize the legitimacy of subscription services as existential threats," Fudge said. "Part of the reason I left was I realized there wasn't much more runway for a company like that, a legacy media company owned by a family that sort of is trying to compete with these massive tech behemoths that have deeper pockets and a better understanding of the customer."

Six years later, every big media company is desperately trying to be the next Netflix and Fudge thinks he can use his entertainment and tech experience to both make a sizable return and elevate underrepresented filmmakers.

"There is a huge opportunity for artists that typically wouldn't fare very well within traditional studio structures to be able to make their films and create art that is authentic and resonates with this generation," Fudge said. "They can do that with us because we understand it as first-hand consumers of that content."

Fudge's New Slate Ventures wants to fund projects from underrepresented filmmakers. It has seen critical success backing "The Forty-Year-Old Version," a semi autobiographical comedy mostly shot in black and white from filmmaker Radha Blank that critics have hailed as "bringing a new voice to cinema." The film drew raves at Sundance and was picked up by Netflix.

New Slate is also developing a limited series on junk bond king turned philanthropist Michael Milken written by Terrence Winter of "The Sopranos" and "The Wolf of Wall Street" fame.

Aside from both being a sometimes glamorous yet risky investment, entertainment and tech would seem to have little in common. But Fudge maintains there have never been more similarities.

"The rules are being administered by the same companies and also being rewritten by similar types of people in terms of the founders who are coming to create new companies in a way that I think directors and producers are also looking to create new opportunities in media," Fudge said. "I have a very good understanding of how to make money in entertainment in this new sort of era that we're entering with the streaming wars being what they are."

The entertainment fund is being run by Jeremy Allen, who spent two years as an assistant to WME Chairman Patrick Whitesell.

"We understand how to read a script," Allen said. "We understand what makes a good movie. We understand how to produce something."

From Your Site Articles

- Jordan Fudge Raised One of the Largest Funds in LA History - dot.LA ›

- Ten Venture Capital Firms Commit to 'Diversity' Rider' - dot.LA ›

- Navigating the Venture Capital World as a Black Person - dot.LA ›

- Can Venture Capital Solve Its Whiteness Problem? - dot.LA ›

- Valence Funding Network Intends to Boost Black Startups - dot.LA ›

- Ranking LA’s Biggest VC Funds of 2020 - dot.LA ›

- Sinai Ventures' Zach White on Secondary Shares, LA's Future - dot.LA ›

- Sinai Ventures' Zach White on Secondary Shares, LA's Future - dot.LA ›

Related Articles Around the Web

Read moreShow less

jordan fudgesinai capital partnershans-werner hectorbrudnew slate venturesventure capitaldiversity in vcdiversity in tech

Ben Bergman

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

https://twitter.com/thebenbergman

ben@dot.la

Image by Joshua Letona

Starting today, Glendale’s most meme-able outdoor mall, The Americana at Brand, will be home to the Amazon Style store—the ecommerce giant’s first foray into brick-and-mortar apparel retail. We got an early sneak peak inside the new digs (located on the corner with Sprinkles Cupcakes, next to H&M and the Apple store) and were able to try out some of its tech-enabled features, which—as ever with Amazon—seek to make the act of shopping as easy as possible.

1. It’s Bigger Than It Looks—Even From the Inside

The floor is massive—laying out original products from Amazon’s own apparel lines alongside name brands like Theory, Adidas and Calvin Klein, as well as several other lines that have up until now only existed online. But the actual store is much larger than the two floors that most customers will only ever see.

Amazon Style is just the front—the homepage, if you will—behind which a large warehouse facility keeps a gigantic surplus of inventory. A floor-to-ceiling glass window on the main floor gives shoppers just a peak behind the scenes, as employees help load industrial-sized elevators with racks of goods to send upstairs to the dressing rooms.

2. Online Shopping IRL

When perusing the store’s bouquet of cottagecore maxi dresses, Kendall & Kylie blazers and, yes, a whole section dedicated to Y2K apparel, one doesn’t just pick an item off the rack and take it with you while you shop. Instead, each rack has a barcode that you can scan via the Amazon Shopping app, which has your sizes pre-loaded from previous purchases. (You can opt for a different size if you choose.) That cues an AI-enabled algorithm to start searching through the store’s warehoused catalog and zip the desired item over to the second floor, where the dressing room provides its own glimpse into the future of shopping.

The store also boasts a version of The Drop, an Amazon staple that allows online customers to shop entire influencer-curated collections for a 30-hour flash window.

3. Changing Stations of the Future—Today

Your phone also acts as your keycard to get into your personal dressing room. To prevent waiting, you are put in a virtual cue the moment you scan your first item; should the Amazon app prompt that your room is ready while you’re still shopping, a tap of your screen allows you to hold your spot in the queue while freeing up the room for someone else. (And if your phone dies while you’re waiting, Amazon says a Style employee on the floor will be happy to help you keep your place in line, or hook you up with a charge.)

The changing room is like its own parlor trick. Designed to look like a walk-in closet, one wall has a full-length mirror and a giant touchscreen while another has all the clothes you scanned in your style and size preference. Expect to see a few surprises in there, as Amazon’s algorithm picks out other stuff you might want to try on based on your picks. It would be spooky if it wasn’t so convenient—an IRL mashup of the online retailer’s “Recommended Based on Your Purchases” and “Frequently Bought Together” features.

If an item doesn’t fit quite right or you want to see how a skirt looks in blue instead of black, just tap the touchscreen to request a variant. Or an entirely new outfit, as the screen makes available everything in the facility. Then just bring it down to checkout—perhaps the wildest part of this ride.

4. Palming the Bucks

Checking out of Amazon Style’s flagship store is what really blew my mind—although apparently it’s because I haven’t been to one of the Amazon Go, Amazon Fresh or Whole Foods locations where cashless checkouts have been an option in select stores since 2020.

I assumed you could just walk out the door with your purchase, because I watch "Saturday Night Live" sketches for news. While the Go payment option isn't available at Amazon Style, there are several checkout options to keep the experience as frictionless and non-cumbersome as possible.

One way is to take the clothes you want out of the dressing room and go directly to Amazon’s palm-enabled checkout kiosks. That’s right: Register on the spot for an Amazon One account, and you need merely to wave your hand over a little black device that reads your palm and charges your on-file payment method. It’s super convenient for everyone except $10 boardwalk psychics, who just may be put out of business by such technology.

For the more traditional set, you still have the option of paying via credit card or cash.

5. Supply & Demand & Return

Amazon Style’s brick-and-mortar location opens up a variety of new ways to shop, return and exchange clothing. For instance, you can order a load of clothes online and pick them up in the store; anything you don’t want can be returned in the store without you ever having to print a shipping label.

See something you like but don’t have time to try it on? Just scan the barcode, pick it up at the front of the store and pay on your way out without ever going into a dressing room.

The Amazon Shopping app also boasts a Deals feature, which automatically sorts for the best price on items to help customers either save money (or believe they are).

While Glendale is home to the only Style store so far, Amazon isn’t ruling out more locations. With fewer retailers able to afford rents on America’s main strips and shopping malls, Amazon’s resources—and its unique position at the intersection of tech and retail—make it easy to envision more Style stores on the horizon.

From Your Site Articles

- Amazon To Add 2,500 Corporate and Tech Jobs in Expansion of ... ›

- Inside Amazon Fresh, Amazon's Ecommerce Grocery Store - dot.LA ›

- Amazon Unveils its New Go Grocery Stores - dot.LA ›

- Amazon Is Opening Its First Clothing Store in Glendale - dot.LA ›

- Amazon Launches $150 Million Diversity Fund - dot.LA ›

Related Articles Around the Web

Read moreShow less

Drew Grant

Drew Grant is dot.LA's Senior Editor. She's a media veteran with over 15-plus years covering entertainment and local journalism. During her tenure at The New York Observer, she founded one of their most popular verticals, tvDownload, and transitioned from generalist to Senior Editor of Entertainment and Culture, overseeing a freelance contributor network and ushering in the paper's redesign. More recently, she was Senior Editor of Special Projects at Collider, a writer for RottenTomatoes streaming series on Peacock and a consulting editor at RealClearLife, Ranker and GritDaily. You can find her across all social media platforms as @Videodrew and send tips to drew@dot.la.

RELATEDTRENDING

LA TECH JOBS