Here Are the Largest Raises in Los Angeles in 2021

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

Move over Silicon Valley, Los Angeles is increasingly becoming a tech player. This year proved a banner year for venture investment with the top 10 biggest raises so far this year drawing in $2.5 billion, according to Pitchbook.

Topping the list of big raises was Orca Security, a cloud security company that has offices in Los Angeles and Tel Aviv. But there are a wide variety of industries also represented from gaming to NFTs and even salad chain Sweetgreen, a list that represented both the moment and the future of tech.

The top 10 biggest raises in Los Angeles as of Dec. 15 total fell by $2.8 billion from last year’s top 10, which included a huge $1.9 billion raise for Elon Musk’s SpaceX.

This year, Orca Security had two of the largest raises this year, including the largest of all the local LA companies and it landed on the top 10 twice.

The company raised a $150 million growth round in July, just three months before its Series C. In October the company raised a whopping $550 million Series C round in Oct. that valued the company at $1.8 billion.

Orca’s growth is in part because of a rise in data breaches, and companies scrambling to safeguard their assets from hackers – especially as more and more of commerce and transactions move online. According to a December report from the Identity Theft Resource Center, this year saw a record-breaking number of data breaches, about 1,291 worldwide. Orca is backed by investors including Temasek, Redpoint Ventures, ICONIQ Capital, and Silicon Valley CISO Investments.

ReCharge Payments, a software company that lets online sellers manage subscription payments and recurring billing, was fifth on the list this year, having raised a $227 million round in May led by Bain Capital Ventures.

The latest addition to the list was AvantStay, a home rental startup that raised a $160 million Series B Dec. 15 and was the fifth largest raise so far this year.

Sherman Oaks-based Mythical Games, which is developing video games that run on a play-to-earn platform, an increasingly popular way of bringing NFTs into gaming, also made the list. Gaming exploded during the pandemic and its popularity helped the company raise $75 million in June and another $150 million in November to expand its Mythical Platform, a place where players can trade and buy NFTs gained in-game.

Venture capital is racing to snatch up potentially valuable NFT investments to avoid missing their shot at the next Bored Ape Yacht Club or CryptoKitties.

Mythical has a star-studded investor sheet, ranging from institutional tech investors like Andreessen Horowitz and RedBird Capital to OneRepublic lead singer Ryan Tedder and sports celebrities including agent Curtis Polk and Boston Red Sox director Michael Gordon. Binance and FTX, two crypto exchange operators, also invested.

Other companies to make it on the list is blockchain company BlockDameon, which raised $155 million in September and Kim Kardashian West’s Skims, which raised $154 million in April -- following the deal Skims was worth $1.6 billion, and it cemented Kardashian West’s status as a billionaire.

The only public firm on this year’s list was Sweetgreen, the Culver City-based salad chain that debuted on NASDAQ Nov. 18.

The company raised $156 million in January, the sixth-largest this year. Its IPO in November raised a further $364 million for the company, which has claimed profitability since 2018 but in reality has recorded losses since 2014. Still, post-IPO, Sweetgreen was valued at about $3.4 billion.

Interestingly, Sweetgreen co-founder Johnathan Neman told dot.LA last year that Sweetgreen is not a tech company -- but it still made the list because of its recent supersized funding rounds.

Beyond the top ten were some other notable raises.

Culver City-based esports team owner and apparel seller 100 Thieves raised a $60 million Series C Dec. 2, bringing it to a $460 million valuation and cinching the 23rd spot on the list this year.

100 Thieves co-founder Matthew “Nadeshot” Haag told investors the plan is to use the funding to acquire more companies that make hardware and merch it can brand and sell. The company picked up custom keyboard maker Higround in October, and the two are already collaborating on a merch capsule that includes a gaming keyboard, hoodie and bags.

Genies, a gaming-adjacent company that’s working to create digital avatars that people can take with them across the internet, was no. 18 on the list. Its $64.5 million Series B raised in May valued the company at $330 million. Genies is stacking its corporate ladder with ex-Snapchat employees, including George Tu, a former senior engineer at Snap who joined Genies as its director of engineering in September.

Check out more of the top raises in LA County this year below.

(Full disclosure: Universal Hydrogen is backed by dot.LA co-founder and chairman Spencer Rascoff through his 75 and Sunny venture firm).

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

Image Source: Perelel

Image Source: Perelel

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

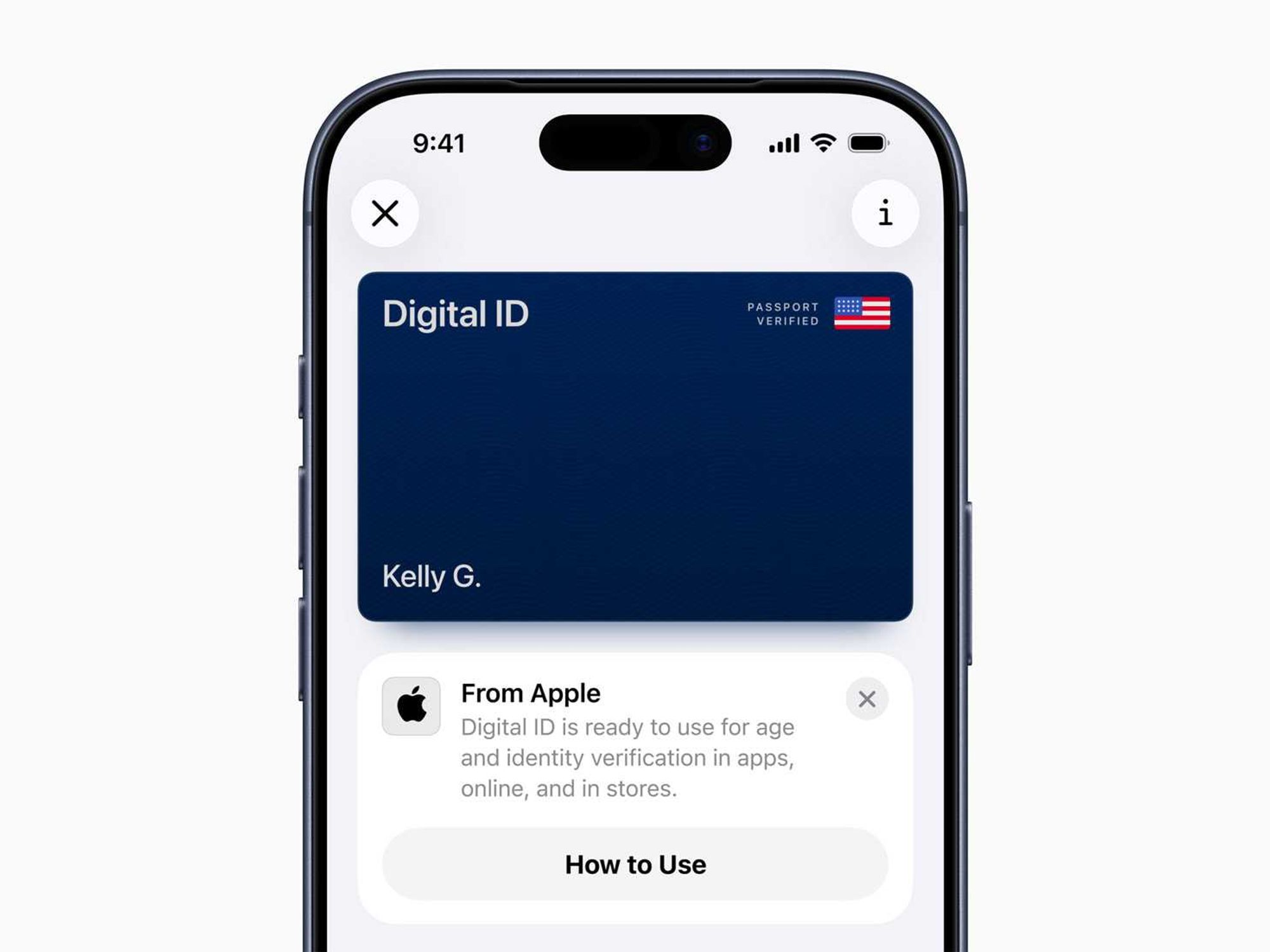

Image Source: Waymo Image Source: Apple

Image Source: Apple