CurbWaste Raises $6M to Help Waste Haulers Streamline Operations

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

CurbWaste, a new software platform from Curbside Technologies that helps trash haulers manage their routes and operations, raised $6 million to continue developing its technology and acquire new customers.

Curbside Technologies is a software development company founded by CEO Michael Marmo in 2020. Marmo told dot.LA he comes from a family of waste haulers. He said that though he originally began his career in entertainment and advertising (with stints at Yelp and as a media buyer at ad agency Mindshare), he went to work at his family’s transfer station and the job stuck.

Marmo said he began experimenting with software to streamline his family’s business, using what would eventually become CurbWaste’s platform to “basically solve the things I hated doing” in waste management.

Originally based in New York City, Marmo said the company is “bicoastal” with roughly 50% of its staff in New York and 50% in Los Angeles. Marmo divides his time between the east coast and Los Angeles, where the bulk of CurbWaste’s investors are based – including Manhattan Beach’s B Capital Group, which co-led the seed round with Santa Monica-based Mucker Capital.

B Capital invested in CurbWaste as part of its early-stage Ascent Fund 2. CurbWaste has raised $7.2 million since its launch two years ago following this round, Marmo said.

CurbWaste founder and CEO Michael Marmo

Courtesy of Curbside Technologies

“We love to see [the] acceleration of tech adoption in these online industries that will create massive software opportunities over the next decade,” B Capital General Partner Gabe Greenbaum told dot.LA. “Mike's this fourth-generation waste management operator with deep industry relationships, and we love backing insiders that have unfair insights and the problems that they're solving, which really helps drive empathy and trust with customers.”

To fuel its growth plans, CurbWaste hired ServiceTitan’s former head of international strategy and operations Vach Hovsepyan to serve as chief operating officer. Marmo said Hovsepyan joined the company earlier this month.

Marmo told dot.LA CurbWaste is in the process of closing a deal with its first Los Angeles client “in the near future.” He wouldn’t disclose the name of the company but said he expected the deal to be closed by this fall.

Los Angeles operates on a commercial franchise model for garbage removal, where private companies handle waste disposal through contracts with various cities. This can lead to disparate results for property owners, but it’s a great deal for Marmo. It means each individual franchise owner is a potential new buyer of CurbWaste’s software.

B Capital’s Gabe Greenbaum told dot.LA he expects more mom-and-pop waste removal companies will begin to embrace B2B software like CurbWaste’s platform as younger professionals take over businesses, similar to Marmo’s trajectory.

“What you're seeing is that there's a massive transformation in this particular industry to start to buy software,” Greenbaum said. “There's over 15,000 small and medium and mid-market waste management companies in the U.S. that are still running their business on internet 1.0 tech or paper and pad,” he added, noting B Capital discovered this during diligence research before investing in CurbWaste.

Marmo said there are pros and cons to the franchise model of removing trash. One hurdle is that it leaves logistics management up to the individual owners. Challenges include differences in routes, traffic and the regulations detailing how each type of waste has to be disposed of in certain areas, plus ever-evolving environmental guidelines.

B Capital Group general partner Gabe Greenbaum

Courtesy of B Capital Group

“The industry as a whole is way more complex than I think most people understand,” Marmo told dot.LA. “There's a lot of moving parts. Logistically, it's very complex. It's very labor intensive [and] capital intensive,” Marmo said, adding that Americans generate about 292 million tons of trash every year, and that number is only expected to grow.

“What the software is able to do is compartmentalize all the different moving parts, and then allow you to analyze the business and come up with optimal solutions to bring efficiency to what you're doing,” Marmo added. “Data basically breeds transparency.”

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

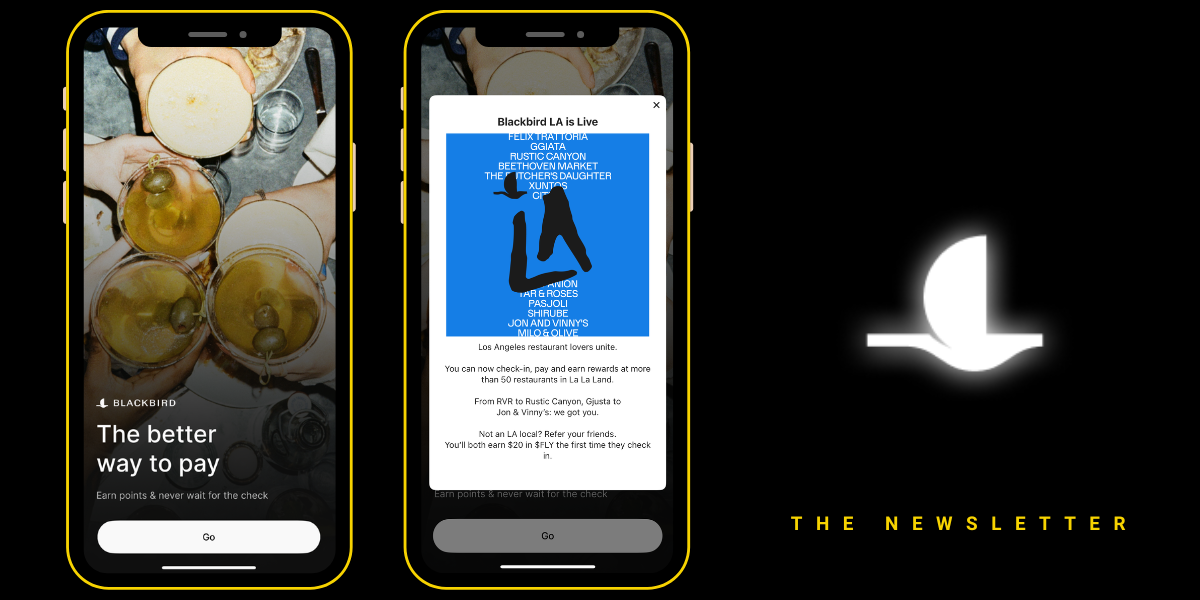

Image Source: Blackbird

Image Source: Blackbird