Four Tech Execs Charged in $150M Fraud Scheme Against San Diego Tech Giant

The Department of Justice (DOJ) charged four people last week, alleging that they deceived a prominent San Diego technology firm in 2015 when the firm invested $150 million in the defendants’ startup Abreezio, which purported to offer innovative new microchip technology based on inventions by a Canadian grad student.

Defendants Karim Arabi and Ali Akbar Shokouhi were taken into custody in San Diego, and authorities arrested Sanjiv Taneja in the Northern District of California. The fourth defendant, Sheida Alan, was taken into custody in Canada. Authorities will seek her extradition to the United States for prosecution.

The DOJ indictment alleges that Arabi and Shokouhi used their positions with the buyer to create a fake multimillion-dollar sale. The defendants allegedly falsified business records and lied to company representatives about the startup’s value. While the DOJ didn’t name the defrauded company in its press release, Karim Arabi’s LinkedIn profile showed he was San Diego-based Qualcomm’s vice president for research and development between 2013 and 2016, and intelligence and sales engagement platform Apollo.io indicates Qualcomm acquired Abreezio in 2015.

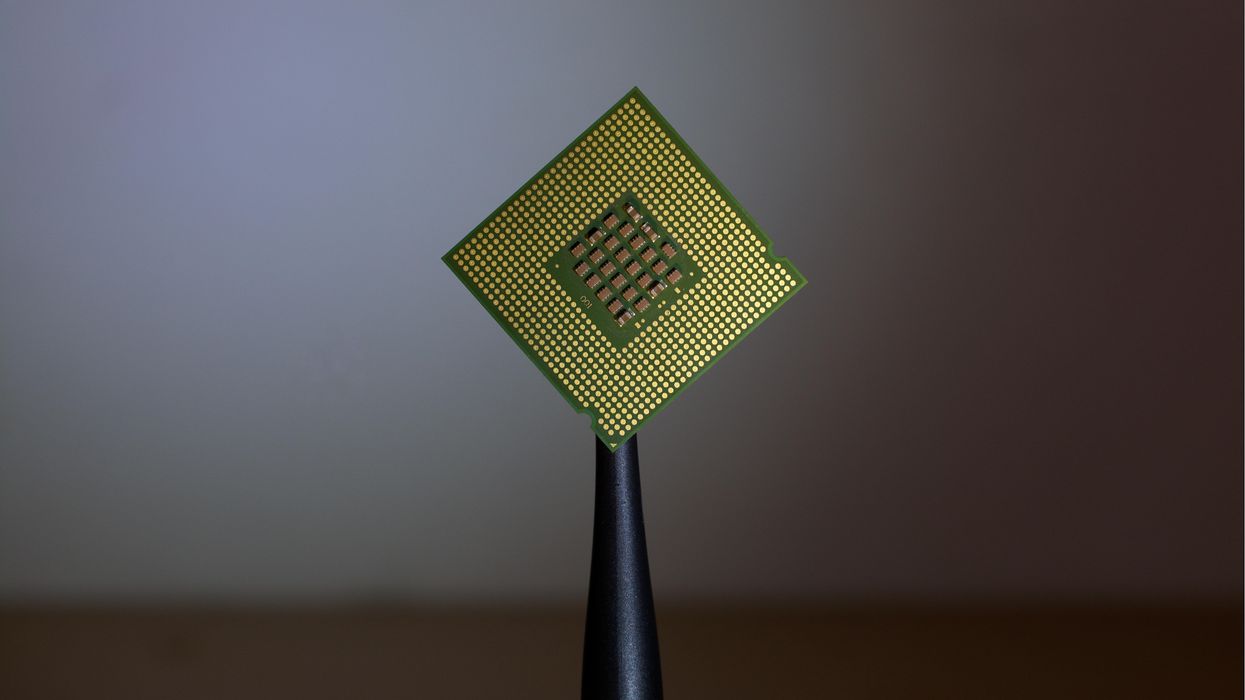

A look at Abreezio’s website as archived in 2016 revealed a basic set of pages and just two team members—CEO Sanjiv Taneja and a CTO not named here because he was not included in the indictment. The home page advertised “groundbreaking TRUSENS technology to improve PPA [power, performance, and area] of SoCs [systems on a chip] providing one technology node advantage” and beneath that, in red letters, “Acquired by Qualcomm.”

But what did Qualcomm acquire when it purchased the startup? According to an indictment filed in the Southern California U.S. District Court, the semiconductor and wireless telecommunications products company paid $150 million to acquire Abreezio and proprietary technology—tech actually developed by Qualcomm employees taking advantage of their inside knowledge of the company.

The indictment alleges that Karim Arabi, who was vice president of research and development at the time at Qualcomm, took part in the creation of a new kind of microprocessor while at the same time another Qualcomm VP, Akbar Shokouhi, was funding Abreezio, filtering money through shadow companies.

According to the indictment, Arabi’s employment contract with Qualcomm stated that the company owned any “intellectual property he created” while employed there. So what Abreezio presented as “new” tech developed in part by Sheida Alan (a.k.a. Sheida Arabi), a grad student based in Canada, was already legally Qualcomm property.

The possibility that there was simply some misunderstanding between Qualcomm and Arabi or Shokouhi is quickly eliminated in reading the indictment, which alleges an elaborate coverup to conceal the true provenance of Abreezio’s technology. The scheme described in the court papers involved fake email accounts, Arabi allegedly filing patents using Alan’s name—he stated she was his sister—and money laundering through a combination of real estate transactions and loans. The indictment also alleges that Arabi colluded with Sanjiv Taneja by giving him Qualcomm’s “sensitive internal information about” the tech that Abreezio’s product would replace “in order to fine-tune Abreezio's marketing pitch.”

The defendants all cleaned up when Qualcomm bought Abreezio. Alan and Arabi received almost $92 million, Taneja $10 million and Shokouhi a total of $24 million.

The indictment enumerates a laundry list of financial crimes, including wire fraud, conspiracy to launder “monetary instruments,” and engaging in monetary transactions in property derived from specified unlawful activity. If convicted, the defendants face hundreds of thousands of dollars in fines and the possibility of 20 years in prison.

In response to dot.LA’s request for comment, a Qualcomm spokesperson said, “Protecting intellectual property is a cornerstone of innovation. We thank the U.S. Department of Justice for its work in this case.”

Image Source: Revel

Image Source: Revel