Valuations are dropping substantially, pessimism about the economy is growing, and most VCs remain skeptical about investing in fully remote companies. Those are some of the sobering findings of a new survey released Tuesday of 141 VCs and 461 seed and series-A founders by NFX, an early-stage firm based in San Francisco.

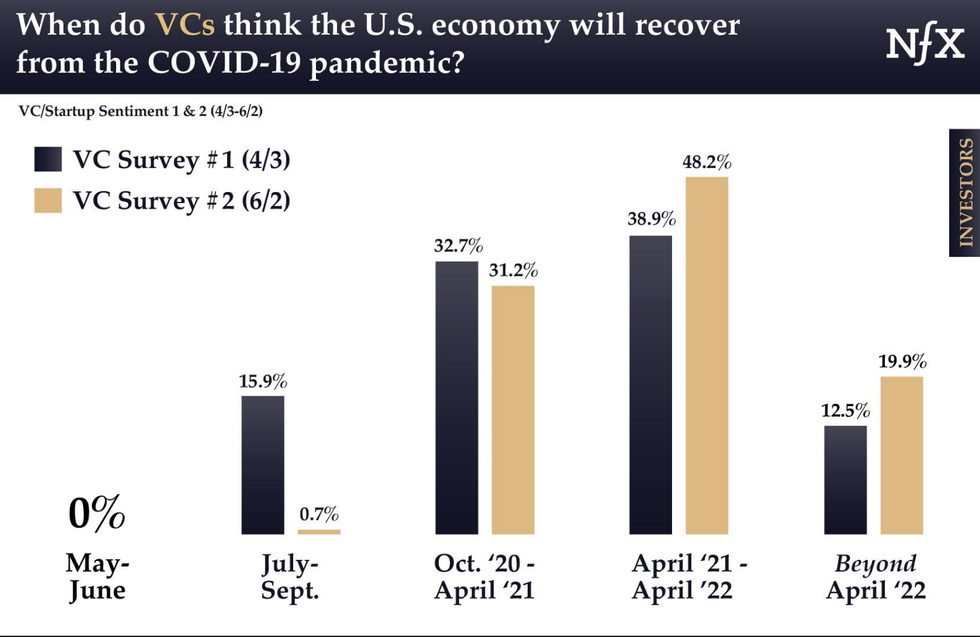

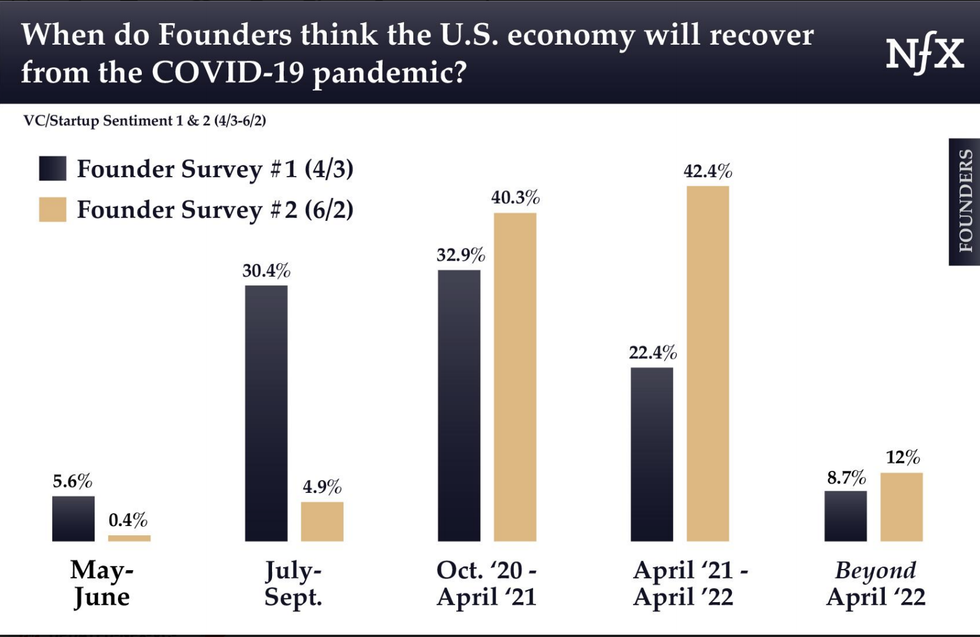

The firm first performed the survey in early April – during the relatively early days of the coronavirus pandemic – and decided to follow up last week to see how sentiments have changed. It found that over that time, founders and investors have become more pessimistic about how long it will take the economy to recover. Perhaps not surprisingly, founders remain more optimistic than VCs. Wall Street has also been far more hopeful of a quick recovery, though this survey was conducted June 3rd, before May's shockingly positive jobs numbers were released.

Fundraising is a mixed bag, with about half of founders saying they are moving up their raises and the other half saying they will delay or stop raising money.

Here are some of the key findings:

- 60% of VCs have seen valuations drop by 20-30% so far as a result of COVID-19 and they predict additional declines over the next year.

- Though 74% of founders plan to move to majority or fully remote work, nearly 60% of VCs say that remote teams are less attractive as investments. Only 9% say remote teams make them more likely to invest.

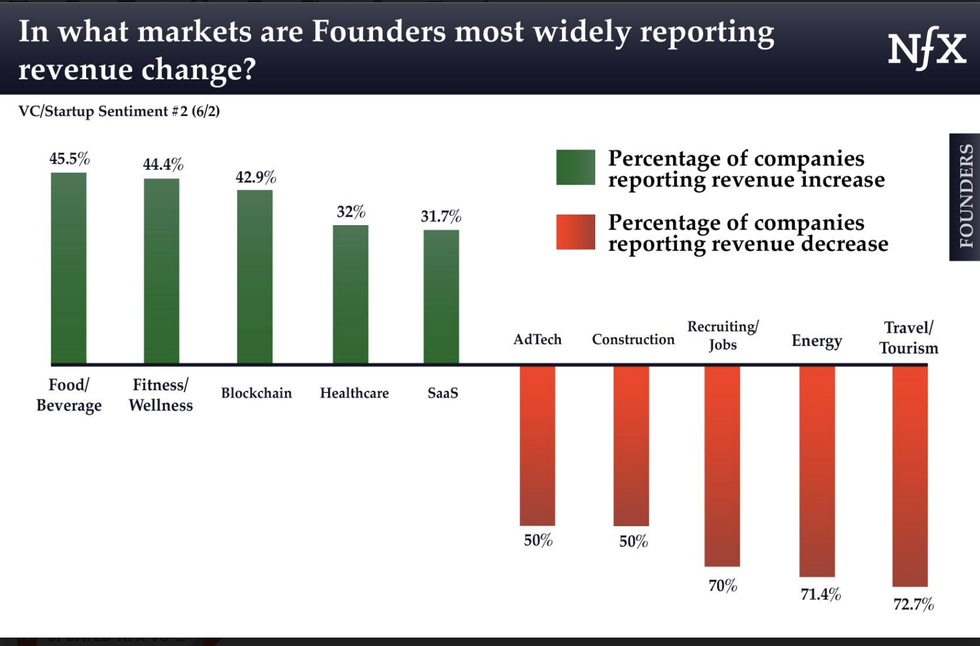

- 40% of tech founders have reported no change to revenue while 20% have reported an increase in revenue.

- 60% of founders are still hiring, but half of those say they're offering lower salaries.

- 60% of founders give the federal government's handling of the COVID-19 pandemic a D or F failing grade.

- Will Remote Work Outlast the Pandemic? Survey Says... ›

- U.S. Has Entered Recession, UCLA Economists Predict - dot.LA ›

- Founders and Investors Do Not Share Wall Street's Optimism - dot.LA ›

- Wall Street's Perspective on Tech - dot.LA ›

- Tech Markets Boom While Economy Reels - dot.LA ›