Add a Coke Can to Your Viral Video? The Next Gen of Product Placement Is Here

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

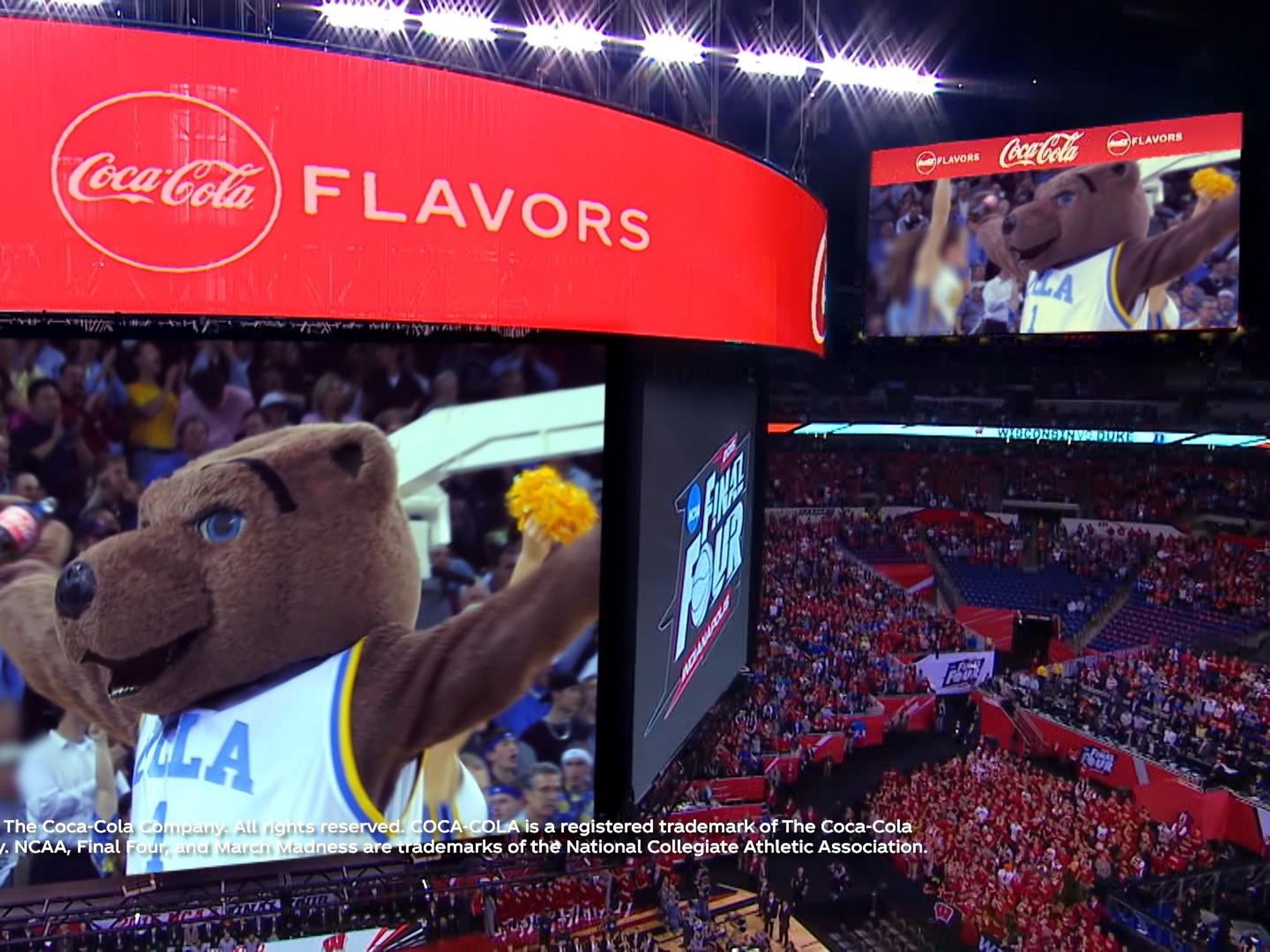

If you watched this year's NCAA basketball tournament, you may have unknowingly witnessed an early milestone from a company aiming to upend video advertising.

Ryff, a stealthy L.A.-based startup founded in 2018, helped Coca-Cola insert images of Coke bottles and banners into classic footage from past tournaments, like UCLA's 2006 finals run and North Carolina State's improbable championship in 1983.

We are delighted to share our work in support of the 2021 NCAA March Madness event together with UMWW, Warner Media… https://t.co/iGTgCtnWej— RYFF Inc (@RYFF Inc) 1616445098

Ryff's ambitions are much grander than clever, nostalgic ads: chief executive and co-founder Roy Taylor wants to introduce on-demand digitized product placement across the entire entertainment industry.

Traditional product placement often requires complex upfront negotiations between brands and content producers, or using post-production techniques that can be costly and clunky. Ryff uses technology common in video games, where on-screen items can be swapped in and out at the push of a button, to quickly insert branded images into completed scenes. This approach distinguishes the L.A.-based startup, but could raise questions from creators who never set out to be brand ambassadors and viewers who will be unwittingly exposed to ads.

Taylor himself is reluctant to seek out too much publicity for fear of a backlash.

"We're in a slightly unusual position because we want all the publicity we can get, but only B2B," he said, meaning he wants brands and content-owners to hear about Ryff, but not necessarily viewers.

"We believe the general public, if they have a preference, veer towards being less comfortable with digital anything right now," Taylor said. He is adamant, however, that Ryff does not create "deep fakes."

"We do not change an original truth; I think that's wrong," he said. "I would never allow our technology to be used in a way which is nefarious."

In addition to its Coke campaign, Ryff has done a test campaign with Diageo, for which it inserted Baileys bottles into three Lifetime movies, as well as a handful of other brands and firms including Intel, Perfectamundo tequila and Dutch production company Endemol Shine. The startup has raised $8.6 million.

As linear TV viewership has declined, advertising dollars on the medium have stagnated. They have "proven relatively resilient, despite cord cutting," said media analyst Tony Lenoir of Kagan, because advertisers like being able to reach the customers that have stuck with cable, who tend to be relatively wealthy.

But TV ads have been in steady decline as a share of overall advertising spend. From 2015 to 2020 the share of TV ad-spend in the U.S. fell from 42% to 33%, with a further decline to 20% expected by 2025, according to MoffettNathanson, an independent research company focused on media and communications. Online advertising, which includes streaming, has picked up the slack, growing from a 27% share in 2015 to 52% in 2020, with an expected rise to 73% by 2025. Relatedly, eMarketer predicts that by 2024, there will be more households without a traditional pay-TV service than with it.

Taylor's investors think he and his 30-person team, split between L.A. and Cambridge in his native U.K., are well positioned to ride these trends.

"I think streaming platforms, because there's so many of them now, will need to identify new ways of generating revenue outside of growing the subscriber base," said Marlon Nichols, whose MaC Ventures participated in Ryff's $5 million fundraise in 2019, its most recent.

Ryff's biggest competitor is London-based Mirriad, which Taylor says uses technology that is less scalable. That could change, however.

"There is no such thing today as a product which cannot be replicated," he said.

Like any multi-sided platform — think Uber, Airbnb, etc. — Ryff will need to onboard users on both the supply and demand sides of the ad market. In other words, to achieve its ambitions of ushering in a new paradigm of advertising, Taylor needs to lure in more brands on the one side, and streaming platforms, studios and UGC video services on the other.

How Ryff Works

To demonstrate his technology, Taylor pulls up a scene from a film he cannot disclose, of two men sitting on stools outside a restaurant, at a small table holding two empty glasses.

Using a combination of computer visioning and artificial intelligence, Ryff's "Placer" technology has scanned the entire film to identify opportunities like this for product placement. The tool, Taylor said, is trained to recommend product types that fit scenes contextually, culturally and creatively.

In the restaurant scene, that means the technology should know not only that a beverage bottle could fit, but also that it must be a brand that could be found in whichever country the scene is taking place. The product also must fit with the story's narrative; if both characters are teetotalers, the technology could suggest a soda brand, but not a beer.

"I took the notion that you could treat a frame of film or TV as a backdrop, like in a traditional theater," Taylor said. "You could take a 3D model and render it — that is, apply light and shade to it — and make it look as though it appeared in the backdrop; you could get them to match."

Ryff's automated suggestions are uploaded into a searchable database that brands can screen for myriad factors, including the time of day the scene takes place, specific actors in it and whether it contains certain activities like sports.

Taylor drew on his background at NVIDIA to create Ryff. The Silicon Valley company makes chips and graphic processing units. In the 1990s, he helped launch its European offices.

Will Advertisers and Content-Creators Riff on Ryff?

Analysts at PQ Media have pegged the brand-placement market at $20 billion worldwide, and forecast it to climb 9.8% per year through 2024, with the fastest growth occurring on digital platforms.

"It's a concept that was not possible in years past, just because the technology was not there to do this kind of scene analysis and to place in everyday objects in a realistic way," said Paul Erickson of market research firm Parks Associates.

Consumers today are less tolerant of ads than they once were, he points out. "People's tastes have changed."

As cable continues its decline and streaming picks up the slack, Taylor thinks that aversion will only grow.

"I don't believe in AVOD," he said, referring to streaming's ad-based monetization model.

But plenty of streaming companies are betting that traditional, interruptive advertising still has a place. HBO Max has announced plans to launch a lower-priced, ad-based tier later this year. ViacomCBS and NBCUniversal have both embraced multi-pronged streaming strategies that include monetization models ranging from free and ad-based to premium subscription-based.

As to whether pure-play subscription-based services might entertain Ryff's "placement-based" revenue opportunity, media analyst Dan Rayburn is skeptical.

"Based on the projections they've given Wall Street, these services think they can be profitable without ads," he said, adding that companies like Netflix have shunned advertising revenues, presumably based on their analysis that the benefits would be outweighed by the cost of turning off customers.

Rayburn also said that based on his research, streaming companies may bridle at serving viewers product placements that could feel inauthentic and thus devalue their content.

"Disney's not saying, 'Hey, we'll stick a Pepsi behind Disney content'," he said. "That's not a business model they want or a trend they want to start."

Taylor said content rights holders may yet be won over because they have the final say as to what goes in their scenes.

"They always have control–always," he said.

Even if customers and content creators are okay with what Ryff provides, it will still need to bring on more brands to grow. For its business model, the company charges brands a fee or takes a percentage of their payments to the content owners. Ryff would not disclose its revenue figures.

"Advertisers don't throw a lot of money around ideas where they don't know how to measure the ROI," said Rayburn, noting this may make it challenging for Ryff to bring on brands.

A report commissioned by Ryff about its Baileys campaign, done by third-party research firm Radicle, indicated that, from start to finish, the placement took three weeks, and that Diageo was pleased with the results.

Taylor thinks brands will warm to Ryff once they better understand its customer-targeting capabilities, saying he can help to ensure "we no longer promote meat products to vegetarians."

Ryff's Vision of the Future

In addition to tapping streamers and studios to feed its content database, Taylor is also intrigued by Ryff's opportunities in the vast and growing world of user-generated content that ends up on platforms like YouTube and TikTok. He points to renowned investor Marc Andreessen's thesis of a "third wave" of the internet, monetized by direct-to-creator spend rather than through third-party ads. The success of platforms like Cameo, Substack and Only Fans are early signs of this evolution.

"This is where I think this is going," Taylor said. "Real-time ingestion, real-time placement and real-time auctions."

Even as the means by which viewers access content evolves, and the monetization models change apace, Taylor is sure at least one thing will endure.

"Ultimately, great content needs budgets," he said, hopeful that such a need can be fulfilled by Ryff, even if it is, like much of advertising, a necessary evil.

- AdQuick Billboard Advertiser Raises $6 Million - dot.LA ›

- Marlon Nichols Of MaC Ventures On Finding Trends First - dot.LA ›

- Ryff Wants to Bring Product Placement to the Creator Economy - dot.LA ›

- Trust Ecommerce Advertising Platform Raises $9 Million - dot.LA ›

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

e.l.f. Beauty Chairman and CEO Tarang Amin and Rhode Founder Hailey BieberImage Source: e.l.f. Beauty

e.l.f. Beauty Chairman and CEO Tarang Amin and Rhode Founder Hailey BieberImage Source: e.l.f. Beauty

Image Source: Archer

Image Source: Archer