🔦 Spotlight

Happy Friday, Los Angeles! As we wrap up another busy week in LA’s tech scene, there’s big news on the leadership front. PledgeLA has a new chair, and it’s someone who knows what it takes to break barriers and build lasting impact. Noramay Cadena, a San Fernando High grad turned triple-degree MIT engineer, has spent her career defying expectations. She started in aerospace engineering, leading operations before pivoting to venture capital, where she’s invested in 90+ companies across industries. She co-founded Latinas in STEM in 2013 and later launched MiLA Capital, a seed-stage VC firm investing in hardware and manufacturing innovations. As Managing Partner of Supply Change Capital, she has focused on technology transforming the food system, raising a $40M fund and deploying over $20M into 23 companies, including eight in California. Stepping into her new role as chair of PledgeLA, she’s setting her sights on an even bigger challenge: making LA’s tech and VC ecosystem more inclusive, accessible, and globally competitive.

She follows in the footsteps of Anna Barber of M13, whose leadership transformed PledgeLA into a driving force for change, launching the VC Fellowship to elevate diverse investors and spearheading the GP + LP Connections Series, which facilitated over 80 investor meetings last year. She also played a key role in the Venture Capital Data Report with UCLA Luskin and introduced the PledgeLA Catalyst Awards, honoring leaders driving capital access and innovation.

Now as Chair Emerita, Barber will continue supporting PledgeLA as it enters its next phase under Cadena’s leadership.

Cadena recognizes the strength of the foundation she’s inheriting. “Anna has been instrumental in making PledgeLA a force for inclusion in LA tech and venture. I’m honored to build on that work as we take the next big leap forward,” she said. “We’re at a critical moment for LA tech. We’ve built momentum, but now is the time to turn that into real, lasting change. I’m focused on forging new partnerships, increasing capital access, and ensuring that LA’s innovation economy works for everyone—not just the few.”

Her first priorities? Expanding PledgeLA’s VC Fellowship to create more pathways into venture, strengthening connections between emerging fund managers and investors, and doubling down on community-driven initiatives. Earlier this year, PledgeLA members, including Wonder Ventures, raised $1.1M for wildfire relief efforts—a testament to the power of LA’s tech community when it mobilizes.

With Cadena at the helm, PledgeLA isn’t just continuing its mission—it’s accelerating it. Thanks to Barber’s legacy and Cadena’s vision, the future of LA tech is poised for even greater impact. For more details on the transition and what’s ahead, read the official announcement here.

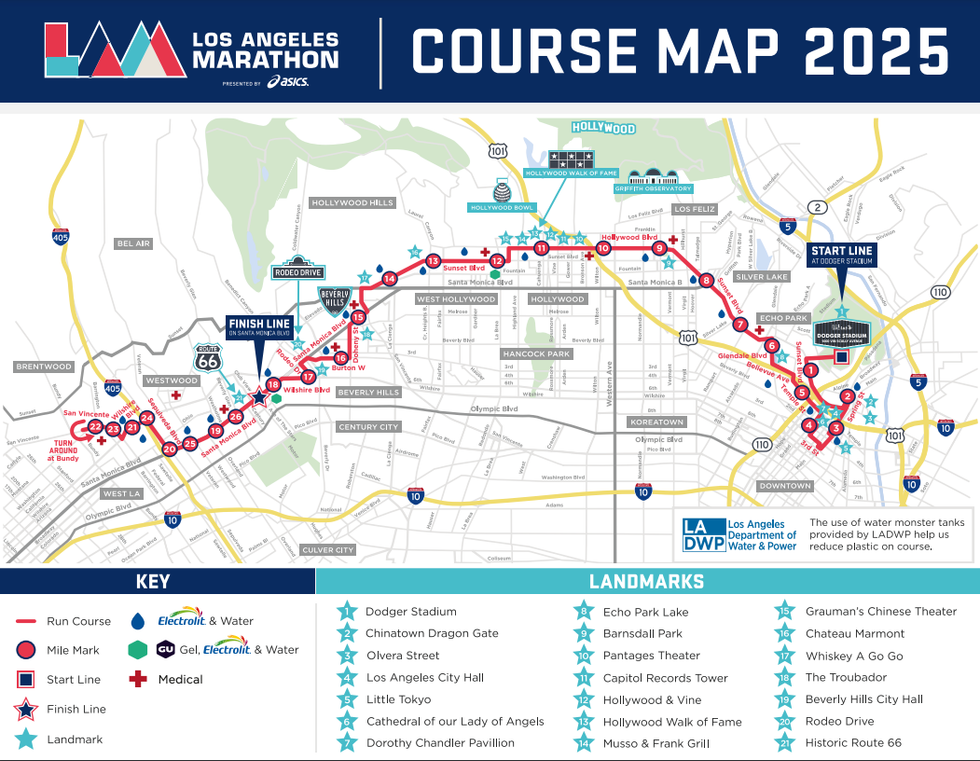

And speaking of momentum, if you’re heading out this weekend, be sure to check for road closures—the LA Marathon is set to take over the streets this Sunday! Whether you’re running, cheering, or just navigating around town, it’s another reminder that LA is always on the move.

🤝 Venture Deals

LA Companies

- Scrunch AI, a Los Angeles-based platform that helps businesses optimize their presence in AI-driven search results, has raised a $4M Seed funding round led by Mayfield. The company plans to use the funds to accelerate product development and expand its market reach, aiming to ensure brands remain visible and competitive as AI search becomes more prevalent. - learn more

- Wolf Games, a Los Angeles-based generative gaming startup, has secured $4M in seed funding. The investment round includes prominent figures such as television producer Dick Wolf, music industry pioneer Jimmy Iovine, and Paul Wachter, Founder and CEO of Main Street Advisors. Wolf Games specializes in creating generative cinematic games that adapt to individual player choices, offering immersive and personalized storytelling experiences. The company plans to use the funds to develop its inaugural game, "Public Eye," set to launch in Summer 2025. "Public Eye" is a crime procedural game where players assist in solving murder investigations, guided by an AI-powered assistant that tailors the experience to each user's play style. - learn more

- Fixated, a digital entertainment platform, has secured $12.8M in funding, led by Eldridge Industries. Fixated specializes in transforming creator representation and monetization, providing infrastructure, strategy, and expertise to help digital creators scale their content and diversify revenue streams. The investment will be used to expand Fixated's influence across talent management, content creation, gaming, and digital entertainment, aiming to empower creators and set higher industry standards. - learn more

- Liminal, a user-generated content (UGC) gaming startup, has secured $5.8M in seed funding. The investment round included BITKRAFT Ventures, Riot Games, and OTK Media Group, with participation from angel investors including Marc Merrill, co-founder of Riot Games. Liminal is developing a platform that enables players to create immersive role-playing game (RPG) adventures without coding knowledge, aiming to make storytelling through gaming more accessible and engaging. The funds will be used to advance the development of this platform, with plans to launch publicly playable content in the coming year. - learn more

- FCTRY LAb, an independent footwear prototyping lab and emerging brand, raised $8M in an oversubscribed Series A round, bringing its total funding to over $15M. The round was co-led by Level One Fund and Fog City Capital, with participation from Elysian Park Ventures, Slauson & Co., and Time Zero Capital. The funds will be used to expand operations, accelerate product innovation, and scale its creator-focused business model. - learn more

- Pragma, a Los Angeles-based backend game engine developer, has secured $12.75M in strategic funding, bringing its total raised to over $50M. The investment round included participation from Square Enix, Upfront Ventures, Greylock Partners, and Insight Partners. Pragma specializes in providing scalable backend solutions for live-service games, powering features like matchmaking, analytics, and monetization. The new funds will be used to enhance their suite of live-service tools, support strategic acquisitions, and strengthen partnerships within the gaming industry. - learn more

- Tetrous, a Sherman Oaks-based biotech company focused on bone-to-tendon healing, raised $6.5M in an oversubscribed Series A round. The funds will be used to expand market reach, generate clinical data, and broaden surgical applications of its technology. - learn more

- Uthana, a generative AI company specializing in 3D character animation, has raised a $4.3M funding round led by IA Ventures. The company plans to use the funds to expand operations and development efforts, aiming to revolutionize the animation and game development industry by enabling real-time, lifelike animations that adapt dynamically to gameplay, thereby enhancing immersion and realism. - learn more

- LiquidTrust, a Los Angeles-based fintech company, has raised a $4M Seed funding round led by Anthemis Female Innovators Lab Fund, Resolute Ventures, and Motivate Ventures. The company specializes in secure payment solutions for small and medium-sized businesses (SMBs) and has introduced Micro Escrow Pay, an instant escrow payment solution designed to embed trust directly into payment flows. The funds will be used to expand operations and development efforts, aiming to protect SMBs from fraud and nonpayment risks. - learn more

- B Capital participated in a $4.5M funding round for Bizongo, a Mumbai-based B2B e-commerce platform focused on raw material procurement and distribution, bringing the company's valuation to $980M. The funds will be used to scale operations threefold by December, expand product categories, and position Bizongo for profitability by the last quarter of FY26. - learn more

- UP.Partners led a $4M Seed funding round for SaySo, a New York City-based retail technology company that provides an interactive shopping platform designed to turn excess inventory into profit-driven opportunities. SaySo plans to use the funds to expand its partnerships and bring its interactive clearance platform to a broader retail audience. - learn more

- March Capital participated in a $200M Seed funding round for Lila Sciences, a company developing an AI platform combined with autonomous laboratories to accelerate scientific discovery across life, chemical, and materials sciences. The funds will be used to further develop Lila's AI platform, build the first AI-driven science factories, and scale operations to enhance scientific research capabilities. - learn more

- Animal Capital led a $1.6M pre-seed funding round for Platter, a New York-based ecommerce technology startup. Platter specializes in helping Shopify brands create high-converting storefronts that maximize profit. The funds will be used to further consolidate disparate tools into a unified product suite, empowering Shopify brands to build more profitable storefronts. - learn more

LA Exits

- Tastemade, a media company known for its food, travel, and home design content, has been acquired by food delivery startup Wonder for $90M. The acquisition aims to integrate Tastemade’s content with Wonder’s services, including takeout, delivery, and meal kits, to create a comprehensive "mealtime super app." The deal is also expected to enhance Wonder’s advertising business and offer seamless access to meals featured on Tastemade’s platforms. - learn more

- Jumpcut Media, a provider of AI-driven intellectual property management and audience analysis tools, has been acquired by Cinelytic, an AI-powered content intelligence platform. Jumpcut's platforms, such as ScriptSense and SocialSense, offer real-time insights into content development and market alignment, enhancing decision-making across the content lifecycle. This acquisition aims to integrate Jumpcut's capabilities into Cinelytic's services, optimizing decision-making in the entertainment industry. - learn more

- FatTail, a Calabasas, California-based advertising technology company specializing in direct advertising solutions, has been acquired by Chartbeat, a media operations software platform backed by Cuadrilla Capital. This acquisition aims to integrate FatTail's advertising revenue management capabilities with Chartbeat's content analytics services, providing media companies with a unified platform to enhance both audience engagement and revenue generation. - learn more

- Deep 6 AI, an AI-driven precision research platform specializing in accelerating patient recruitment for clinical trials, has been acquired by Tempus, a leader in AI-powered precision medicine. Deep 6 AI's platform analyzes both structured and unstructured electronic medical record (EMR) data to match patients with clinical trials, serving over 750 provider sites and encompassing more than 30 million patients. This acquisition aims to enhance Tempus' capabilities in clinical trial matching and real-world evidence generation, furthering its mission to advance precision medicine and patient care. - learn more

Image Source: Skyryse

Image Source: Skyryse