Get in the KNOW

on LA Startups & Tech

XImage by Candice Navi

Here Are LA's Top VCs, According to Their Peers

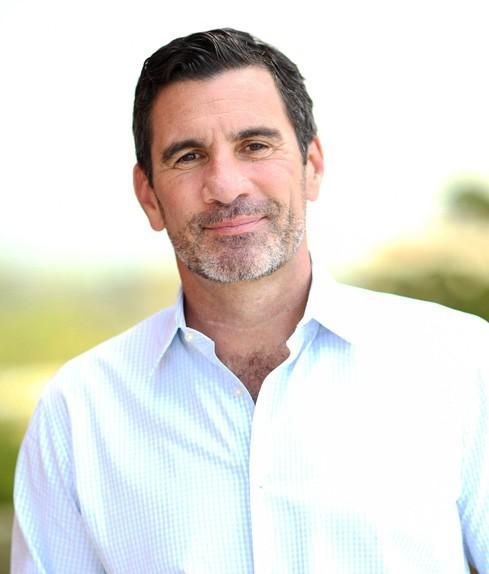

Ben Bergman

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Though Silicon Valley is still very much the capital of venture capital, Los Angeles is home to plenty of VCs who have made their mark – investing in successful startups early and reaping colossal returns for their limited partners.

Who stands out? We thought there may be no better judge than their peers, so we asked 28 of L.A.'s top VCs who impresses them the most.

The list includes many familiar names. Dana Settle, founding partner of Greycroft, and Mark Mullen, founding partner of Bonfire Ventures, garnered the most votes.

Settle manages West Coast operations for Greycroft, a New York firm with $1.8 billion in assets under management. She is one of only nine of the top 100 VCs nationally who are women, according to CB Insights.

Mullen is a founding partner of Bonfire Ventures, which closed a $100 million second fund in September to continue funding seed stage business-to-business (B2B) software startups. Mullen has also been an angel investor and is an LP in other funds focusing on other sectors, including MaC VC and BAM Ventures.

Below is the list of the top ranked investors by how many votes each received from their peers. When there was a tie, they appear in alphabetical order according to their last name:

Mark Mullen, Bonfire Ventures

Mark Mullen is a founding partner of Bonfire Ventures. He is also founder and the largest investor in Mull Capital and Double M Partners, LP I and II. A common theme in these funds is a focus on business-to-business media and communications infrastructures.

In the past, Mullen has served as the chief operating officer at the city of Los Angeles' Economic Office and a senior advisor to former Mayor Villaraigosa, overseeing several of the city's assets including Los Angeles International Airport and the Los Angeles Convention Center. Prior to that, he was a partner at Daniels & Associates, a senior banker when the firm sold to RBC Capital Markets in 2007.

Dana Settle, Greycroft

Dana Settle is a founding partner of Greycroft, heading the West Coast office in Los Angeles. She currently manages the firm's stakes in Anine Bing, AppAnnie, Bird, Clique, Comparably, Goop, Happiest Baby, Seed, Thrive Market, Versed and WideOrbit, and is known for backing female-founded companies.

"The real change takes place when female founders build bigger, independent companies, like Stitchfix, TheRealReal," she said this time last year in an interview with Business Insider. "They're creating more wealth across their cap tables and the cap tables tend to be more diverse, so that gives more people opportunity to become an angel investor." Prior to founding Greycroft, she was a venture capitalist and startup advisor in the Bay Area.

Erik Rannala, Mucker Capital

Erik Rannala is a founding partner at Mucker Capital, which he created with William Hsu in 2011. Before founding Mucker, Rannala was vice president of global product strategy and development at TripAdvisor and a group manager at eBay, overseeing its premium features business.

"As an investor, I root for startups. It pains me to see great teams and ideas collapse under the pressure that sometimes follows fundraising. If you've raised money and you're not sure what comes next, that's fine – I don't always know either," Rannala wrote in a blog post for Mucker.

Mucker has a portfolio of 61 companies, including Los Angeles-based Honey and Santa Monica-based HMBradley.

William Hsu, Mucker Capital

William Hsu is a founding partner at the Santa Monica-based fund Mucker Capital. He started his career as a founder, creating BuildPoint, a provider of workflow management solutions for the commercial construction industry not long after graduating from Stanford.

In an interview with Fast Company, he shared what he learned in the years following, as he led product teams at eBay, Green Dot and Spot Runner, eventually becoming the SVP and Chief Product Officer of At&T Interactive: "Building a company is about hiring correctly, adhering to a timeline, and rigorously valuing opportunity. It's turning something from inspiration and creative movement into process and rigor."

These are the values he looks for in founders in addition to creativity. "I like to see the possibility of each and every idea, and being imaginative makes me a passionate investor."

Jim Andelman, Bonfire Ventures

Jim Andelman is a founding partner of Bonfire Ventures, a fund that focuses on seed rounds for business software founders. Andelman has been in venture capital for 20 years, previously founding Rincon Venture Partners and leading software investing at Broadview Capital Partners.

He's no stranger to enterprise software — he also was a member of the Technology Investment Banking Group at Alex. Brown & Sons and worked at Symmetrix, a consulting firm focusing on technology application for businesses.

In a podcast with LA Venture's Minnie Ingersoll earlier this year, he spoke on the hesitations people have about choosing to start a company.

"It's two very different things: Should I coach someone to be a VC or should I coach someone to enter the startup ecosystem? On the latter question, my answer is 'hell yeah!'"

Josh Diamond, Walkabout Ventures

Josh Diamond founded Walkabout Ventures, a seed fund that primarily focuses on financial service startups. The firm raised a $10 million fund in 2019 and is preparing for its second fund. Among its 19 portfolio companies is HMBradley, which Diamond helped seed and recently raised $18 in a Series A round.

"The whole reason I started this is that I saw there was a gap in the funding for early stage, financial service startups," he said. As consumers demand more digital access and transparency, he said the market for financial services is transforming — and Los Angeles is quickly becoming a hub for fintech companies. Before founding Walkabout, he was a principal for Clocktower Technology Ventures, another Los Angeles-based fund with a similar focus.

Kara Nortman, Upfront Ventures

Kara Nortman was recently promoted to managing partner at Upfront Ventures, making her one of the few women – along with Settle – to ascend to the highest ranks of a major VC firm.

Though Upfront had attempted to recruit her before she joined in 2014, she had declined in order to start her own company, Moonfrye, a children's ecommerce company that rebranded to P.S. XO and merged with Seedling. Upfront invested in the combination, and shortly after, Nortman joined the Upfront team.

Before founding Moonfrye, she was the SVP and General Manager of Urbanspoon and Citysearch at IAC after co-heading IAC's M&A group.

In an interview with dot.LA earlier this year, she spoke on how a focus for her as a VC is to continue to open doors for founders and funders of diverse backgrounds.

"Once you're a woman or a person of color in a VC firm, it is making sure other talented people like you get hired, but also hiring people who are not totally like you. You have to make room for different kinds of people. And how do you empower those people?"

Brett Brewer, Crosscut Ventures

Brett Brewer is a co-founder and managing director of Crosscut Ventures. He has a long history in entrepreneurship, starting a "pencil selling business in 4th grade." In 1998, he co-founded Intermix Media. Under their umbrella were online businesses like Myspace.com and Skilljam.com. After selling Intermix in 2005, he became president of Adknowledge.com.

Brewer founded Santa Monica-based Crosscut in 2008 alongside Rick Smith and Brian Garrett. His advice to founders on Crosscut's website reflects his experience: "Founders have to be prepared to pivot, restart, expect the unexpected, and make tough choices quickly... all in the same week! It's not for the faint of heart, but after doing this for 20 years, you can spot the fire (and desire) from a mile away (or not)."

Eva Ho, Fika Ventures

Eva Ho is a founding partner of Fika Ventures, a boutique seed fund, which focuses on data and artificial intelligence-enabled technologies. Prior to founding Fika, she was a founding partner at San Francisco-based Susa Ventures, another seed-stage fund with a similar focus. She is also a serial entrepreneur, most recently co-founding an L.A. location data provider, Factual. She also co-founded Navigating Cancer, a health startup, and is a founding member of All Raise, a nonprofit that supports and provides resources to female founders and funders.

In an interview with John Livesay shortly before founding Fika, Ho spoke to how her experience at Factual helped focus what she looks for in founders. "I always look for the why. A lot of people have the skills and the confidence and the experience, but they can't convince me that they're truly passionate about this. That's the hard part — you can't fake passion."

Brian Lee, BAM Ventures

Brian Lee is a co-founder and managing director of BAM Ventures, an early-stage consumer-focused fund. In an interview with dot.LA earlier this year, Lee shared that he ended up being the first investor in Honey, which was bought by PayPal for $4 billion, through investing in founders and understanding their "vibe."

"There's certain criteria that we look for in founders, a proprietary kind of checklist that we go through to determine whether or not these are the founders that we want to back…. [Honey's founders] knew exactly what they were building, and how they were going to get there."

His eye for the right vibe in a founder is one gleaned from experience. Lee is a serial entrepreneur, founding LegalZoom.com, ShoeDazzle.com and The Honest Company.

Alex Rubalcava, Stage Venture Partners

Alex Rubalcava is a founding partner of Stage Venture Partners, a seed venture capital firm that invests in emerging software technology for B2B markets. Prior to joining, he was an analyst at Santa Monica-based Anthem Venture Partners, an investor in early stage technology companies. It was his first job after graduating from Harvard, and during his time at Anthem the fund was part of Series A in companies like MySpace, TrueCar and Android.

He has served as a board member in several Los Angeles nonprofits and organizations like KIPP LA Schools and South Central Scholars.

"Warren Buffett says that he's a better businessman because he's an investor, and he's a better investor because he's a businessman. I feel the same way about VC and value investing. Being good at value investing can make you good at venture capital, and vice versa," Rubalcava said in an interview with Shai Dardashti of MOI Global.

Mark Suster, Upfront Ventures

Mark Suster, managing partner at Upfront Ventures, is arguably L.A.'s most visible VC, frequently posting on Twitter and on his blog, not only about investing but also more personal topics like weight loss. In more normal years, he presides over LA's biggest gathering of tech titans, the Upfront Summit. Before Upfront, he was the founder and chief executive officer of two software companies, BuildOnline and Koral, which was acquired by Salesforce. Upfront backed both of his companies, and eventually he joined their team in 2007.

In a piece for his blog, "Both Sides of the Table," Suster wrote about the importance of passion — not just for entrepreneurs and their businesses, but for the VCs that fund them as well.

"On reflection of the role that I want to play as a VC it is clearly in the camp of passion. I really want to start my journeys only with people with whom I want to work closely with for the next 5–7 years or more. I only want to work on projects in which I believe can produce truly amazing change in an industry or in the world."

Lead art by Candice Navi.

From Your Site Articles

- Here Are Los Angeles' Top Venture Capitalists - dot.LA ›

- Ten Venture Capital Firms Commit to 'Diversity' Rider' - dot.LA ›

- Navigating the Venture Capital World as a Black Person - dot.LA ›

- The Largest Venture Capital Raises in Los Angeles in 2020 - dot.LA ›

- Los Angeles Venture Funds Grow, but Spend Less in LA - dot.LA ›

- dot.LA's Venture Capital Survey for Q1 2021 - dot.LA ›

- Meet Scott Lenet, Co-Founder, President and Educator - dot.LA ›

- LA VC's Hosted Their First Party in 14 Months - dot.LA ›

- Los Angeles’ Top Investors Under 30 According to Their Peers - dot.LA ›

- TX Zhuo is Behind Fika Ventures' $77 million Fund ›

- Los Angeles Notches Record Levels of VC Investment in Q2 - dot.LA ›

- VCs See Valuations Reach Record Highs as Optimism Stays High - dot.LA ›

- Top LA Angel Investors 2021: McInerney, Rascoff and Lee - dot.LA ›

- LA Venture: Chirag Chotalia on Threshold Ventures - dot.LA ›

- CrossCut Ventures' Rick Smith on Coming to Venture Capital - dot.LA ›

- Event: Investors & Entrepreneurs Networking in Los Angeles - dot.LA ›

- Los Angeles Startups Closed a Record Number of Deals in Q3 - dot.LA ›

- Southern California Venture Capitalists See a Tech Bubble - dot.LA ›

- Pear VC’s Pejman Nozad on Early-Stage VC - dot.LA ›

- Bonfire Ventures Is Raising a $165 Million For Its Third Fund - dot.LA ›

- 5 Highlights From a Record-Smashing 2021 for SoCal Startups and VCs - dot.LA ›

- Los Angeles Venture Capital Activity Was Up in Q3 - dot.LA ›

- LA Is The Third-Largest Startup Ecosystem in the U.S. - dot.LA ›

- LA's Top Venture Capitalists of 2022 - dot.LA ›

- Crosscut’s Brett Brewer on Starting Intermix Media and Myspace - dot.LA ›

- Venture Deals in LA Are Slowing Down - dot.LA ›

- Venture Deals Fall in LA Amid Economic Worries - dot.LA ›

- LA Seed Deals Hold Steady Despite Despite Economic Worries - dot.LA ›

- PitchBook Reports Fewer Tech Investments - dot.LA ›

- LA Venture Investments to Women & Founders of Color Dropped - dot.LA ›

- GoFreight Raises $23 Million, Valcre Secures $12.7M - dot.LA ›

- Here Are The Top Venture Capitalists In 2023 - dot.LA ›

- Pagos Secures $34M, Champions Round Picks Up $7M - dot.LA ›

- Toba Capital's Patrick Mathieson On How to Support Founders - dot.LA ›

- B Capital's Howard Morgan On Key To Early Stage Investing - dot.LA ›

Related Articles Around the Web

Ben Bergman

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

https://twitter.com/thebenbergman

ben@dot.la

TikTok Timeline Update: The Rise and Pause of a Social Video Giant

03:07 PM | July 08, 2022

TikTok | Solen Feyissa | Flickr

See our timeline below for key developments TikTok's story over the last 10 years, starting with the founding of ByteDance and moving through the app's rise to popularity and the mounting concerns about data privacy and security.

March 2012: Internet entrepreneur Zhang Yiming founds ByteDance in Beijing.

August 2012: ByteDance launches its first product, Toutiao, an AI-powered news aggregator.

July 2014: Alex Zhu launches Musical.ly, an app that enables users to create short-form lipsync music videos; Musical.ly is headquartered in Shanghai with an office in Santa Monica.

July 2015: Musical.ly hits #1 in Apple app store.

September 2016: ByteDance launches Douyin, an app with similar functionality as Musical.ly; within a year, the Chinese app achieves 100 million users and 1 billion views per day.

September 2017: ByteDance brings Douyin outside of China's Great Firewall under the name of TikTok; the app does well in numerous Asian markets.

November 2017: ByteDance acquires Musical.ly for $1 billion; the company starts operating Musical.ly in the US, Douyin in China and TikTok in other markets.

August 2018: ByteDance merges Musical.ly with TikTok and migrates all user profiles to TikTok; Alex Zhu becomes TikTok senior vice president, saying, "Combining Musical.ly and TikTok is a natural fit given the shared mission of both experiences – to create a community where everyone can be a creator."

October 2018: ByteDance achieves a record $75 billion valuation, making it the world's biggest privately backed startup.

February 2019: Lil Nas X releases "Old Town Road" on TikTok, catalyzing a viral sensation that ultimately reaches #1 on Billboard's charts.

February 2019: TikTok is fined $5.7 million for child data privacy violations.

September 2019:Washington Post reports that TikTok may be censoring protests in Hong Kong.

September 2019: Leaked documents show TikTok instructs its moderators to censor videos that mention various subjects deemed offensive by the Chinese government and Communist Party, The Guardian reports.

October 2019: U.S. Senator Marco Rubio calls on the U.S. government to investigate the national security implications of ByteDance's acquisition of Musical.ly, citing concerns over the Chinese government and Communist Party's use of TikTok to censor content and silence open discussion.

October 2019: U.S. Senators Chuck Schumer and Tom Cotton ask U.S. Acting Director of National Intelligence to assess the national security risks from TikTok and other Chinese-owned apps, and request a congressional briefing on the findings.

October 2019: Alex Zhu begins reporting directly to ByteDance head Zhang Yiming; he had previously reported to the head of Douyin.

November 2019: The U.S. government launches an investigation into ByteDance's acquisition of Musical.ly on the grounds that ByteDance did not seek clearance when it acquired Musical.ly.

TikTok reportedly has 26.5 million monthly active users in the U.S. at this time.

December 2019: The U.S. Defense Department's Defense Information Systems Agency issues a recommendation that military personnel delete TikTok from all smartphones.

Q4 2019: TikTok becomes the most downloaded app in the world and second in the U.S.

January 2020: Several U.S. military branches ban TikTok on government-issued smartphones.

March 2020: U.S. officials reach out to TikTok to discuss political disinformation.

April 2020: TikTok surpasses 2 billion downloads and sets the record for quarterly downloads.

May 2020: Various child privacy groups file a complaint with the U.S. Federal Trade Commission that TikTok is violating the Children's Online Privacy Protection Act (COPPA) and flouting terms agreed to following its February 2019 settlement.

A TikTok spokesperson says the company "takes the issue of safety seriously for all our users, and we continue to further strengthen our safeguards and introduce new measures to protect young people on the app."

May 2020: ByteDance hires former Disney executive Kevin Mayer as chief operating officer and TikTok chief executive officer.

June 2020: Teens organize on TikTok to fool Trump administration into anticipating high attendance for the President's Tulsa, Oklahoma campaign rally.

June 2020: India bans 59 Chinese apps including TikTok, citing national security and data privacy concerns; the move comes amid ongoing skirmishes between the two countries on the China-India border.

July 2020: Australia Prime Minister Scott Morrison launches an investigation into TikTok surrounding data concerns.

July 2020: U.S. Secretary of State Mike Pompeo confirms the U.S. is looking into banning TikTok over concerns the app is sharing data with China; the next day, President Trump says he is considering a ban, framing it as a potential retaliation tactic against China for its handling of the coronavirus pandemic.

Aug. 2, 2020: Microsoft issues a blog post citing a conversation between chief executive Satya Nadella and President Trump around the company's potential acquisition of TikTok.

Aug. 4, 2020: Australia Prime Minister Scott Morrisson says there is not sufficient evidence to suggest a TikTok ban is necessary.

Aug. 6, 2020: President Trump issues an executive order banning American companies from transacting with ByteDance or its subsidiaries, namely TikTok; the U.S. Secretary of Commerce is to identify specific prohibited "transactions" 45 days after the order is issued.

Aug. 14, 2020: Trump issues another executive order demanding ByteDance "divest all interests and rights" in its assets and property that enable TikTok's U.S. operations, and data collected via TikTok in the U.S., within 90 days. The order says the U.S. investigation into ByteDance's acquisition of Musical.ly presented "credible evidence" that ByteDance "might take action that threatens to impair the national security of the United States."

Aug. 17, 2020: Oracle enters the discussion as a reported TikTok suitor.

Aug. 18, 2020: President Trump says he would support Oracle buying TikTok. Oracle's cofounder and CTO Larry Ellison had previously said he supports Trump and had fundraised for him in February 2020.

Aug. 24, 2020: TikTok announces it is suing the Trump administration over the ban for failure to protect due process. Separately, a U.S.-based TikTok employee also sues the administration, stating, "I am a patriot"

Aug. 26, 2020:Kevin Mayer steps down from ByteDance and TikTok, citing a diminished role in a letter to colleagues. Rumors swirl that he was left out of ByteDance's negotiations with potential acquirers

Aug. 27, 2020: Walmart issues a statement that it is interested in partnering with Microsoft to acquire TikTok.

Aug. 28, 2020: L.A.-based Triller, a TikTok upstart competitor, is reported to have issued a bid for TikTok along with investment firm Centricus.

Aug. 29, 2020:The Chinese government issues new export rules that complicate the exportation of TikTok's underlying technology – namely its "For You" algorithm – to any foreign buyer.

Aug. 31, 2020:CNBC reports TikTok has chosen a buyer, with an expected sale price of $20 billion - $30 billion.

Sept. 3, 2020: With uncertainty over whether a buyer will be able to acquire TikTok's algorithm, and debate mounting over how that affects the value of the company, numerous outlets negotiations are likely to slow as the Chinese government increases its involvement.

Sept. 13, 2020: Microsoft says in a blog post that "ByteDance let us know today they would not be selling TikTok's US operations to Microsoft." The company says it would have made "significant changes" to ensure security, privacy, online safety and combatting disinformation.

Sept. 14, 2020: Oracle confirms that it has been selected by ByteDance to become a "trusted technology provider" with TikTok. The company says the proposal was submitted by ByteDance to the Treasury Department over the weekend. Treasury Secretary Steven Mnuchin says on CNBC that the proposal includes making TikTok-global a U.S. headquartered company with 20,000 new jobs.

Mnuchin adds that the Committee on Foreign Investment in the United States is reviewing the proposal this week for national security implications, and will make a recommendation to the president, who will then review the proposal.

Sept. 19, 2020: President Trump tells reporters he approved the deal in concept between Oracle and TikTok's parent company ByteDance, in which Oracle and Walmart would partner with the app in the U.S. The U.S. government postpones a planned ban on TikTok for one week.

Sept. 27, 2020: A federal judge in Washington temporarily blocks President Trump’s order banning TikTok, granting the social media firm a reprieve just hours before it was to be removed from mobile app stores. The judge says Trump’s order was “largely a unilateral decision with very little opportunity for plaintiffs to be heard,” according to the Washington Post.

Oct. 30, 2020: TikTok averts a U.S. ban again after a federal judge in Pennsylvania temporarily blocks restrictions set to take place on Nov. 12—the Trump administration's deadline for ByteDance to close a deal in the U.S.

Nov. 7, 2020: Democrat Joe Biden defeats President Trump in the presidential election, the Associated Press and other media outlets confirm. A few days later, an advisor to President-elect Biden says it is “too early to say” Biden’s thoughts on TikTok.

Nov. 11, 2020: TikTok asks a judge to extend the deadline for its sale by 30 days. The company says it hasn’t heard an update from the administration in weeks.

Nov. 12, 2020: The U.S. Commerce Department says it won’t enforce the sale deadline imposed by Trump’s order "pending further legal developments." The department cites the Pennsylvania ruling from October that found the TikTok crackdown exceeded the government’s power.

Nov. 13, 2020: The U.S. government extends its deadline by 15 days, giving TikTok until Nov. 27 to strike a deal that allays the government’s national security concerns.

Nov. 26, 2020: ByteDance gets another week to sell off TikTok’s U.S. business. A spokesperson for the Treasury Department tells CNBC that the government granted the extension until Dec. 4 “to allow time to review a revised submission” that it recently received.

Dec. 4, 2020: The latest deadline passes without an approved deal to sell TikTok. The Treasury Department says it won’t extend the deadline again, but there are “no plans to enforce anything,” a source tells The Washington Post.

Dec. 14, 2020: The Federal Trade Commission orders TikTok—along with Snap, YouTube, Twitter and other social media and streaming sites—to turn over information about how they collect and use information about users.

Feb. 10, 2021: Newly-inaugurated President Joe Biden slams the brakes on forcing a TikTok sale. In court papers, Biden administration lawyers file a motion to postpone the cases related to a potential ban of the popular social media app.

June 9, 2021: President Biden revokes Trump’s executive order that sought to ban TikTok and replaces it with one that calls for a broader review of foreign-controlled apps that may pose national security risks.

June 25, 2021: CNBC reports TikTok is tightly controlled by Chinese parent company ByteDance. Insiders tell the news outlet that ByteDance has access to TikTok’s American user data and is closely involved in the Culver City company’s decision-making.

July 20, 2021: Pakistan bans TikTok for the fourth time, citing “inappropriate content.” The country lifts the latest ban a few months later.

Sept 27, 2021: TikTok announces that it has surpassed 1 billion monthly active users as the app continues to rapidly rise in popularity.

Oct. 26, 2021: During a public hearing, U.S. lawmakers press Michael Beckerman, TikTok’s head of public policy for the Americas, on whether TikTok’s Chinese ownership could expose consumer data to Beijing. Beckerman says “access controls for our data is done by our U.S. teams,” adding that the data that TikTok collects is “not of a national security importance,” according to the New York Times.

Dec. 17 2021: A Wall Street Journal investigation shows that TikTok’s recommendation algorithm is flooding teens’ video feeds with eating disorder content.

December 2021: TikTok overtakes Google as the most-visited website on the internet.

Feb. 8, 2022: Facing criticism over hosting harmful content, TikTok announces new rules aimed at preventing viral hoaxes, shielding the LGBTQ community from harassment and removing videos promoting unhealthy eating.

February 2022: As Russia invades Ukraine, TikTok is awash in raw footage from the battlefield and false and misleading clips. The war raises fresh concerns about TikTok’s handling of misinformation on its platform.

March 2, 2022: A bipartisan group of state attorneys general launch an investigation into TikTok, examining whether the social media giant is harming children and young adults through the content on its platform.

March 11, 2022:Reuters reports that TikTok is close to a deal to store all of the video-sharing app’s U.S. user data with American software giant Oracle. The partnership is aimed at resolving the U.S. government’s national security concerns.

March 15, 2022: California lawmakers unveil a first-of-its-kind bill to let parents sue social media platforms like TikTok for allegedly addicting children to their apps.

March 31, 2022: Attorneys general from 44 U.S. states and territories urge TikTok and Santa Monica-based Snap to strengthen parental controls on their platforms, telling the social media giants that they must do more to protect kids online.

April 3, 2022: “The Unofficial Bridgerton Musical” wins a Grammy for Best Musical Theater Album. It’s the first Grammy-winning album to originate on TikTok, solidifying the app’s growing influence over the music industry.

April 15, 2022: The Department of Homeland Security and the Department of Justice launch probes into TikTok’s moderation of content depicting child sexual abuse, according to the Financial Times.

April 2022: TikTok is the most-downloaded app in the world during the first quarter of 2022, according to a study from digital analytics firm Sensor Tower.

May 12, 2022: The mother of a 10-year-old girl who died after allegedly trying a dangerous “Blackout Challenge” sues TikTok. The case is one of several to claim the app’s algorithm showed kids and teens videos of people choking themselves until they pass out.

June 17, 2022: BuzzFeed News publishes a bombshell report that TikTok’s data on U.S. users was repeatedly accessed in China by employees of parent company ByteDance. The report raises fresh privacy and security concerns about the Chinese-owned social media app.

The same day, TikTok announces that it migrated all of its U.S. user traffic to servers operated by American software giant Oracle, an effort to assuage concerns that American data could fall into the hands of the Chinese government.

June 28, 2022: In the wake of the BuzzFeed report, Federal Communications Commissioner Brendan Carr urges Apple and Google to remove TikTok from its app stores. Nine Republican U.S. senators send a letter to TikTok with questions about the company’s handling of American data.

June 30, 2022: TikTok responds to Republican lawmakers by detailing its plans on keeping U.S. data out of the hands of Chinese parent company ByteDance. The company’s letter confirms that ByteDance employees in China can access TikTok data, but only when “subject to a series of robust cybersecurity controls” and approvals overseen by its U.S.-based security team.

July 5, 2022: Leaders of the U.S. Senate Intelligence Committee ask the Federal Trade Commission to investigate whether TikTok deceived the public about whether people in China could access American user data.July 29, 2022: Bloomberg reports the Chinese government requested TikTok host stealth, propaganda accounts—a move that TikTok executives denied due to their growing efforts to distance the platform from its Chinese origins.

August 5, 2022: The flood of information coming from within the organization leads TikTok to hire roles meant to prevent internal leaks.

August 11, 2022: A Forbes review of TikTok and ByteDance employees’ LinkedIn profiles reveals that 300 current employees previously worked for Chinese state media publications. Fifteen employees apparently were employed by both at the same time.

August 16, 2022: Oracle begins its audit of TikTok’s algorithm and content moderation process to determine if the Chinese government has interfered with the platform.

August 18, 2022: Developer Felix Krause finds that the app monitors all keyboard inputs and tags, which could record private data like passwords and credit card information. TikTok denies these claims.

September 14, 2022: TikTok Chief Operating Officer Vanessa Pappas appears before the Senate Homeland Security Committee and says its ongoing negotiations with the U.S. government “will satisfy all national security concerns.” Notably, Pappas would not fully commit to cutting off U.S. data flow to China.

September 21, 2022: Former TikTok executives claim they were instructed to follow directions from ByteDance and had limited power to make internal decisions as people question TikTok CEO Shou Zi Chew’s influence.

September 24, 2022: British regulators from the Information Commissioner’s Office (ICO) send TikTok a warning over how the company handles children’s data—a warning that could lead to a $29 million fine.

September 26, 2022: The Justice Department reaches a “preliminary agreement” with TikTok over national security concerns, though details are still being negotiated.

October 12, 2022: A BBC report finds that TikTok profited from refugees collecting donations via the app’s live streaming feature, with some claiming the platform took up to 70% of the profits.

October 20, 2022: A Forbes report reveals that ByteDance intended to use TikTok to monitor the location of American citizens as a method of surveillance. TikTok denies these claims.

October 27, 2022: Even as the government places increasing pressure on TikTok, the Biden administration invites eight TikTok stars to the White House in an effort to reach Gen Z voters.

That same day, A Philadelphia judge rules that TikTok is immune in a lawsuit claiming the app was responsible for the death of a child participating in the “blackout challenge.”

From Your Site Articles

- TikTok, Influencer Panic and the Celebrity Economy - dot.LA ›

- Biden Ends Ban on TikTok, WeChat - dot.LA ›

- TikTok is The Most Downloaded App - dot.LA ›

- TikTok’s Chinese Ownership Is Still Causing Concerns - dot.LA ›

- A Breakdown of the Data TikTok Collects on American Users - dot.LA ›

- A Breakdown of the Data TikTok Collects on American Users - dot.LA ›

- Report: TikTok Is Hiring to Help Crack Down on Leaks - dot.LA ›

- TikTok Keylogging Controversy and Update - dot.LA ›

- Top 10 TikTok Gadgets To Buy This Holiday Season - dot.LA ›

- What Happens When Every App Tries to Be TikTok? - dot.LA ›

- The Weird Wacky World of TikTok Sludge Content - dot.LA ›

Related Articles Around the Web

Read moreShow less

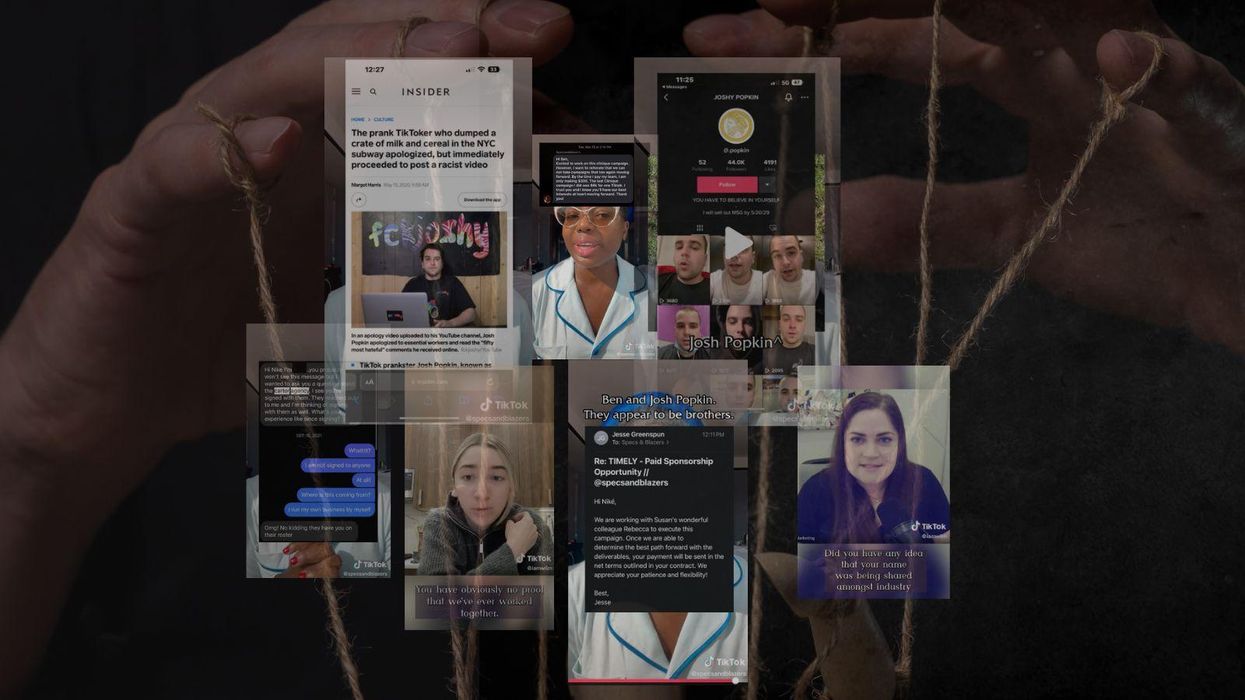

PR Firm Carter Agency Allegedly Scammed Hundreds of Influencers Out of Brand Deals

08:00 AM | December 01, 2022

Andria Moore

Influencer Niké Ojekunle was surprised when a young content creator reached out to ask her about her experience working with The Carter Agency. The content creator had apparently seen Ojekunle’s name on the agency’s roster and wanted to know how helpful they’d been in helping her navigate brand deals.

The problem was, Ojekunle, who has nearly half a million followers on TikTok, had never heard of The Carter Agency, let alone worked with them. So she sent them an email inquiring about why the agency had listed her name as one of their influencers.

She received a response from a person by the name of Ben Popkin who claimed to be the CEO of The Carter Agency that lists Netflix, Amazon, Disney and Prada as just a few of their “strategic partners.”

In the email, Popkin explained to Ojekunle that he had previously worked with her through a different PR agency and apologized for the mix-up. Then he pivoted to a new proposition: he could help her get two $5,000 brand partnership deals. Ojekunle agreed to the details of the agreement and completed two campaigns with Popkin as the middleman. A few weeks later, Popkin reached out again. This time it was with an offer from Clinique—a skincare brand Ojekunle had worked with in the past.

“In June, he wrote me and said Clinique offered me two campaigns for $1,900,” Ojekunle says. “I’ve been with Clinique for six years. Clinique knows not to put anything in front of me for less than $6,000.”

Not interested in lowering her standard rate for a product campaign, Ojekunle declined the deal and informed Popkin she no longer needed his assistance.

In subsequent months, however, Ojekunle noticed something was wrong: similar to the situation with Clinique, brands that had previously offered her campaigns worth thousands of dollars were offering her campaigns at significantly lower rates.

One of those brands was Naturiu, a skincare company run by Susan Yara, a friend of Ojekunle. When Ojekunle reached out to learn more about why the offer had been significantly lower than their past partnership deals, Yara informed Ojekunle, she too had never spoken to Popkin and was unaware any such offer had been issued.

The malpractice of influencer agencies has, of late, been well reported. In 2020, talent management firm Influences, came under fire over claims the company did not pay its clients. According to the New York Times, the firm owed dozens of creators thousands of dollars from brand deals. One of those influencers claimed the company withheld $23,683.82 from her. Influences' former owner is currently suing the New York Times over defamation.

In July, influencer Liv Reese called out Creative Culture Agency for not paying her after she made a video for one of the company’s advertising campaigns. According to its private Instagram page, Creative Culture Agency is “no longer available.”

And in 2020, 13 influencers paid talent management firm IQ Advantage a $299 deposit when they first signed with the company. But when IQ Advantage failed to secure them brand deals, the deposit was never returned and eight months later, once all the money had been collected, IQ Advantage conveniently shut down.

But Ojekunle’s experience with The Carter Agency shows signs of a different offense. “He’s [Popkin] telling the brand that he’s representing me, then he’s telling me he’s representing the brands,” Ojekunle says. “It's a very violating feeling and a very vulnerable feeling. You ask yourself, ‘how was I so stupid’ over and over.”

According to OpenCorporates.com, The Carter Agency LLC is registered to a person by the name of Josh Popkin — a former social media star who faced public backlash in 2020 after pouring cereal in a New York City subway as part of a prank. Ojekunle suspects Popkin took on a fake name (Ben Popkin) when reaching out to her in order to distance himself from his controversial reputation. The Carter Agency has not responded to multiple requests for comment.

Like so many influencers who find themselves victims of unethical behavior, Ojekunle took her allegations straight to TikTok. In the first of five videos, the influencer claims that Popkin was not only pretending to be her manager, but had also been operating under a pseudonym.

@specsandblazers Ben Carter = Ben Popkin = Josh Popkin. Carter Agency = Malibu Marketing Group = Jesse GreenSpun. A Complete Scam! #carteragency #benpopkin #joshpopkin #scammers

Jessy Grossman, co-founder of Women In Influencer Marketing, wasn’t surprised when people shared Ojekunle’s video in the company’s private Facebook group. She says reports of the Carter Agency’s misconduct had begun circling among the members as early as February—Ojekunle’s video was further evidence.

Soon after, Grossman began connecting with other influencers who were impacted by the company. And in recent weeks, ever since Ojekunle posted her videos, many brand managers have reached out to Grossman with claims that, despite Carter’s previous push to hire his influencers, he has since ceased all contact.

Grossman believes The Carter Agency is specifically targeting TikTokers not only because of the platform’s success but also because many of them are teens.

“Some are young and think that having management is the path to ‘making it,’” Grossman says. “You have to know the right questions to ask and industry standards, otherwise anyone can claim to be legitimate since there’s no regulatory body.”

Looking back on the low offers she had been accepting from brands, Ojekunle now believes Popkin was attempting to pocket the difference after sending only a portion of what the brands were really offering her.

“It was a predatory and well-calculated thing that he did,” Ojekunle says.

In total, The Carter Agency’s actions have affected more than 130 influencers, including those signed to Popkin’s company and those who he falsely claimed to represent. Ojekunle also claims The Carter Agency has potentially jeopardized nearly $60,000 in brand deals by pretending to represent her. She’s currently pursuing a civil lawsuit and has opened up a criminal investigation into the company.

“I have been doing this for 10 years, and I have built a name for myself,” Ojekunle says. “I'm not scared of him.”

From Your Site Articles

- How LA’s Beauty Brands Found Positive LoopHoles in an Imperfect Recycling System ›

- Talent Agency Endeavor Reprises Its IPO, with a Role for Elon Musk ›

- Brands Are Reevaluating Influencer Deals Following Kanye West’s Fallout ›

- Celebrities Are Facing Legal Ramifications From NFT Endorsements ›

- How To Protect Yourself From the Latest Venmo Transaction Scam ›

- The Stats Are Clear — Gen Z Swears By Influencer Marketing - dot.LA ›

- Brands Love 'Synthetic Influencers' But Do Audiences Care? - dot.LA ›

Related Articles Around the Web

Read moreShow less

Kristin Snyder

Kristin Snyder is dot.LA's 2022/23 Editorial Fellow. She previously interned with Tiger Oak Media and led the arts section for UCLA's Daily Bruin.

https://twitter.com/ksnyder_db

RELATEDTRENDING

LA TECH JOBS